While the Bitcoin market has been threatened with the negative side in recent weeks, a summer of explosive activity from the cabinet bonds in Bitcoin, as well as the increasing hopes of reducing the long -awaited Federal Reserve, leads the continuous demand at the top of the atom. But how realistic is Bitcoin in September?

Bitcoin BTC 0.46 % The noise remained high throughout the summer. But how long can you continue? As long as the BTC USD price moves up, it looks!

Traders and investors reserve the hope to see the reduced prices in the United States in September. The chances of this happening are the highest ever, despite the recent disturbances of the Jackson Hall conference.

This is a great possible catalyst for BTC USD growth because it pumps new liquidity in the markets in a huge indication of the risks.

$ BTC – It can be predicted at this stage. Everyone has a collapse for a day when clear support occurs. But this literally when giving bids. Even Squiggles predicts obligatory collapse, and fake without support. pic.twitter.com/17mp3q7f5e

– Incomesharks (Incomesharks) August 27, 2025

Another injector is the latest global launch of Liberty Financial – Trump’s encrypted company. Will these two events be sufficient to fulfill the hope of Bitcoin in September? Incomeshark analysis is very simple and easy to understand – support now. In fact, CT (Crypto Twitter) was recently calm around Bitcoin, even somewhat afraid. People are loudly late, after great moves.

Discover: The best new encrypted currencies for investment in 2025

September Bitco ATH: What do the plans say?

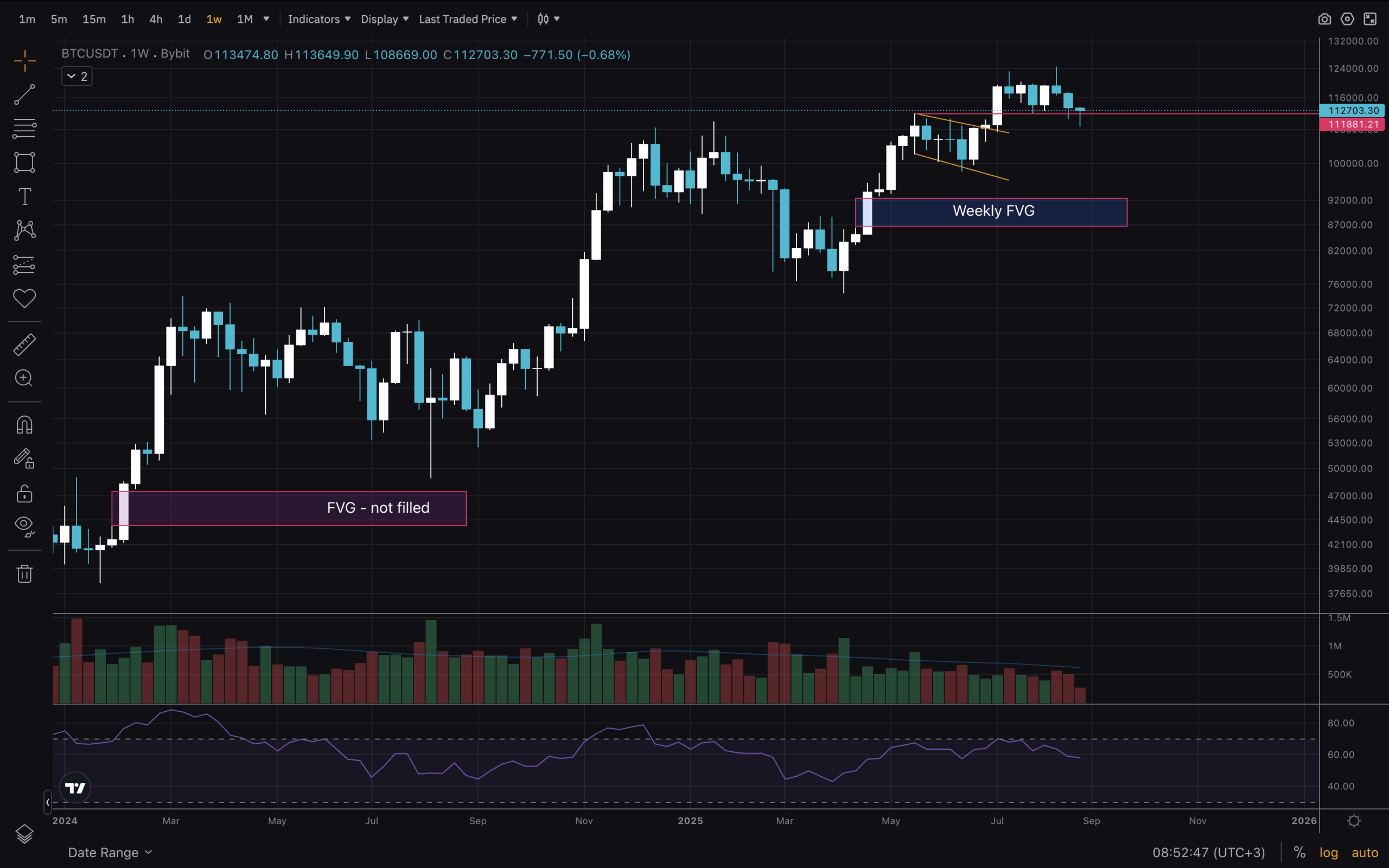

(BTCUSD)

The start of our analysis with the weekly timetable, we see the FVG gap from early 2024 is still not full. From this spring, 2025, we have another weekly FVG that has not yet been filled. As the date appears, some gaps are filled, while others do not.

The upscale scenario here is that this person remains unintended, especially given the big liquidation event early this week, when $ 1 billion of people’s accounts were eliminated.

Discover: 20+ Cracking the next explosion in 2025

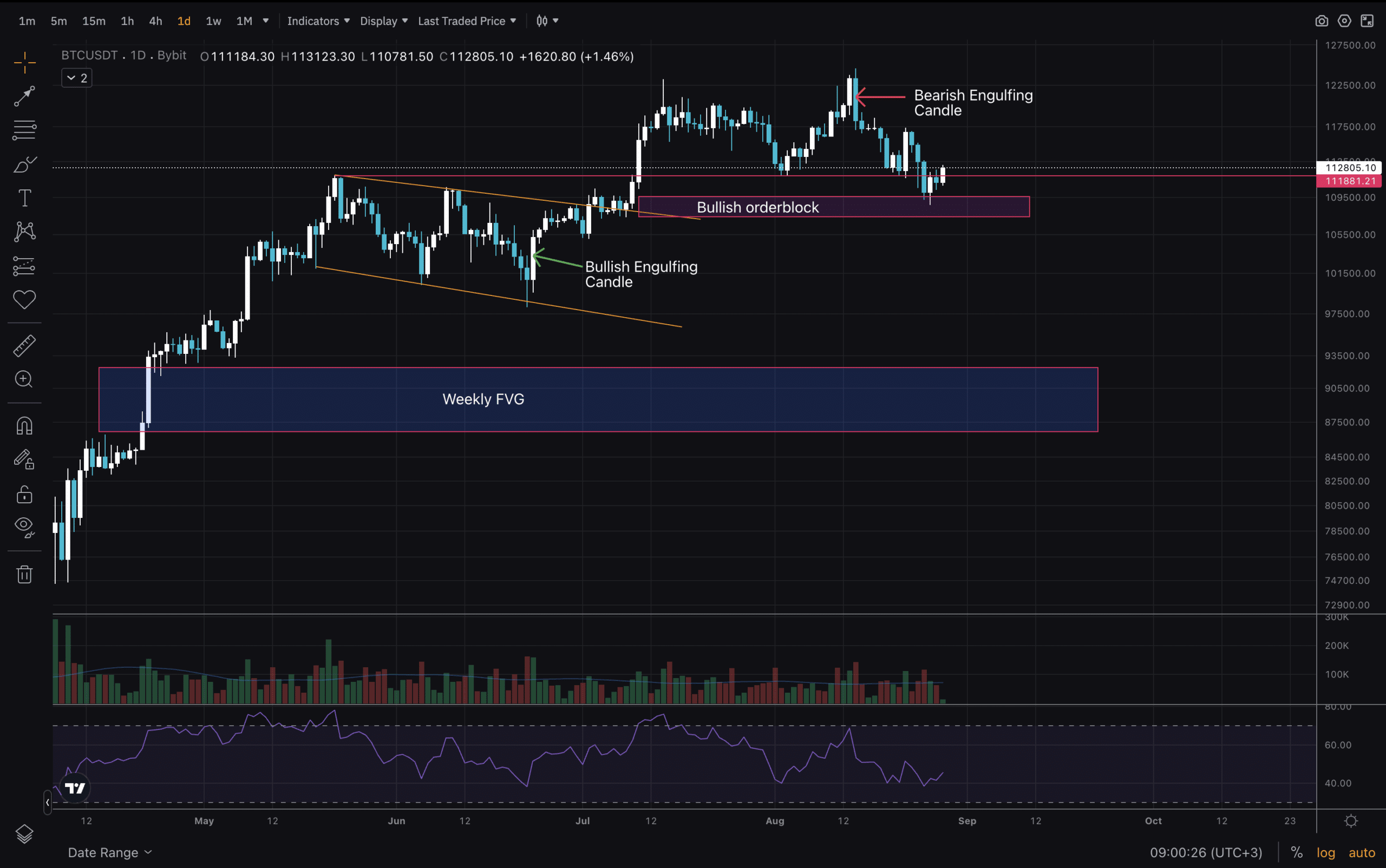

(BTCUSD)

As our analysis on the 1D graph continues, we can see the upper deviation candle that started July. After that, we have a fabric of $ 123,000 and on August 14, a fuse at $ 124,000, followed by rejection and large sale candles.

This is our dumping candle, which indicates that sellers control. This week, the price of the upscale demand block. Let’s make more details.

Discover: 9+ best high -risk encryption, highly bonus for purchase in 2025

Final ideas on BTC USD: bullish or declining work?

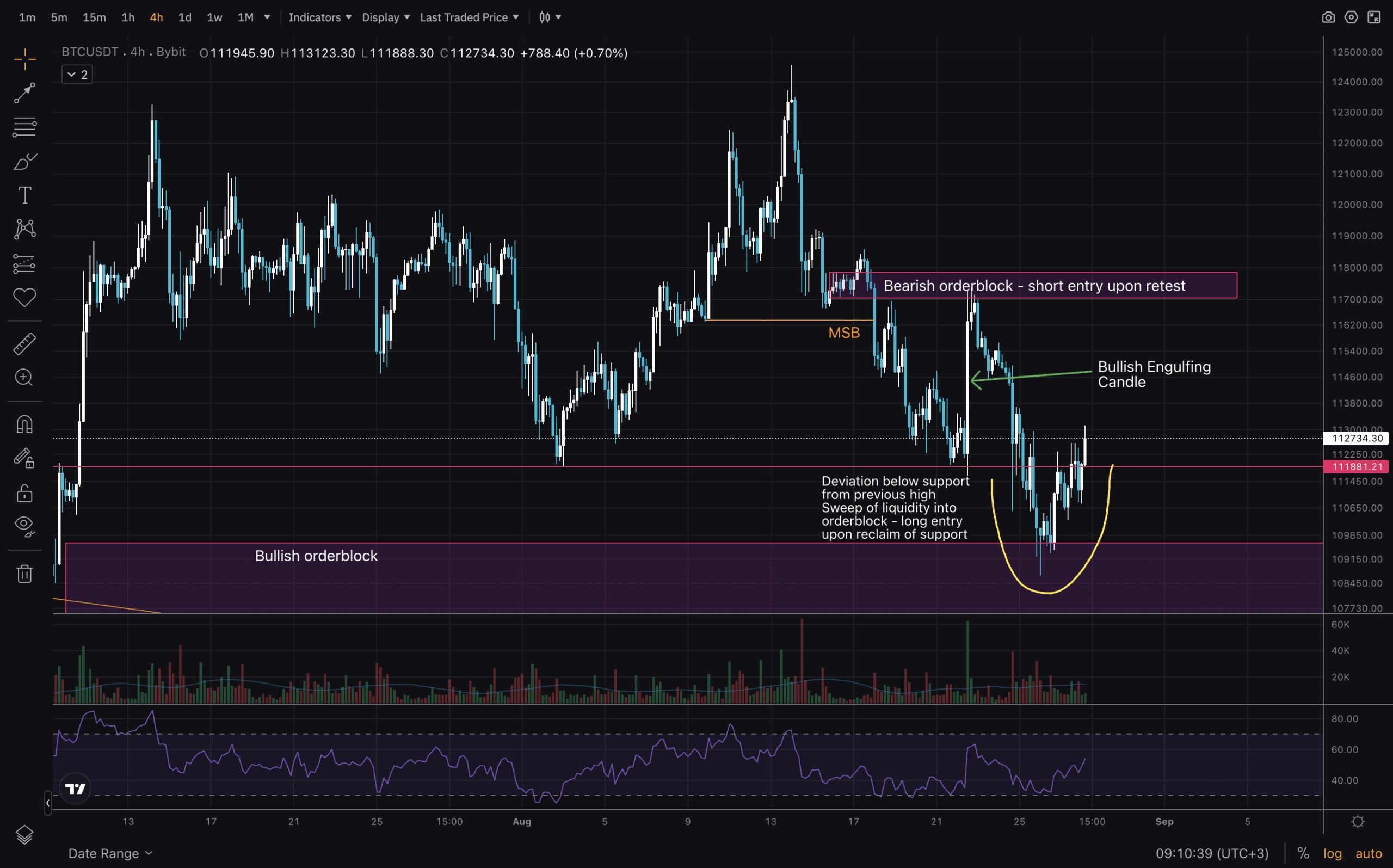

(BTCUSD)

(BTCUSD)

In the low time frame – 4H – we can dissect the BTC USD action more accurate. The fuse can be considered at $ 124,000 SFP, followed by a break in the market structure. The apostasy from the top of the previous high is a tough candle, directly in the mass of the landfill, which was a perfect short entry.

Next, the BTC price moved to the support of support below, collect liquidity from Bullish Orderblock below, and restore support. This restoration is actually essential – the rejection was anxious to the bulls. Currently, during this time frame, the basic procedure is optimistic. There are chances of Bitcoin AR there.

Habboudia issue: SFP, the hidden declining difference on the relative strength index, and the dumping candle on the 1D graph are factors that must be taken into account. It can cause deeper withdrawal. This is a landline scenario, especially if prices are already reduced or failed to achieve them.

Join Discord 99bitcoins News here to get the latest market updates

BTC Price Expectations: A technical look at the possibility of A ATH ATH

-

The main level to be kept is $ 110,000 – $ 112,000

-

The 1D graph shows vibrant factors, however the structure remains optimistic

-

Expect the price to be intermittent about the monthly closure

-

Everyone is waiting for the declaration of lower prices

Experts say about how ATH ATR in September Bitcoin: BTC USD price analysis first appeared on 99bitcoins.