Jerome Powell is clarifying him: there will be no digital dollar or a digital currency supported by Us Central (CBDC) under his leadership.

Taking testing in front of the Senate Banking Committee on February 11, Powell stressed that no digital dollar is in progress and confirmed that the approval of the congress would be mandatory for this move.

Powell was pressed by Senator Bernie Moreno (R-Oh) for the commitment to block a CBDC, but Powell did not chop the words. His response of a single word- “yes” -non do space for the debate.

We already have a digital dollar, is WTF Powell?

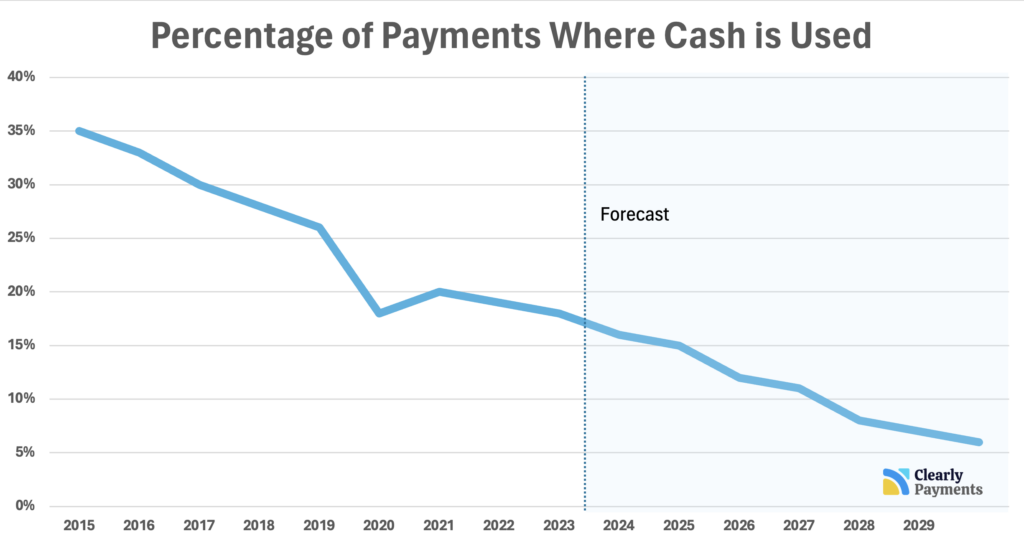

Despite Powell’s observations, a move is taking place towards the CBDC and 99.9% of people are Honneal.

The transition to a CBDC is happening through Stablecoins, especially because they are supported by anything.

Currently, we see the Stablecoins supported by gold or other concrete goods, but El Salvador could pin his mega prison production to his Stablecoin or China to the exports of minerals of rare lands. It will continue until everyone stops using monopolistic money. The system has already been exaggerated; Therefore, we are witnessing a push for a paradigm that they can exploit.

Online people are advertising victory, with government bodies such as US Republicans and Jerome Powell stating that they will never create CBDC. These people do not realize that the CBDC already exists in the form of Stablecoin.

People do not read because they would not understand the management of perception if they did.

We are so cooked, it’s not even funny

Legislative Pushback against CBDCS

Fortunately, the anti-cbdc forces at the congress are intensifying the struggle. The No CBDC Act, presented both in the Chamber and in the Senate, tries to block the Federal Reserve to issue a digital dollar without the blessing of legislators.

Supporters argue that such a currency could break financial privacy and give the government the uncontrolled power to supervise citizens.

The deputy Tom Emmer, sponsor of the Enteantellance State Act, did not chop the words. “An US CBDC could allow the federal government to monitor and control the spending habits of individual Americans,” he said. Opponents indicate Chinese digital yuan as a caution story, claiming that the critics of the tools allow financial overcoming and eroded freedoms.

Global Momentum in the development of the CBDC: Will Stablecoins win?

The United States can hesitate, but the world is moving at full speed on the CBDCs. According to the Atlantic Council, 134 countries, which cover 98% of the global economy, explore digital currencies. Of these, 66 perform advanced pilots or completely distribute CBDC.

The Chinese digital Yuan is at the center of the scene with rehearsals expanded in the main cities, showing how governments could redo the financial systems. Europe is increasing efforts with its digital euro and plants such as India, Brazil and Russia are not unrelated to the development of the CBDC.

The United States remain focused on promoting the blockchain without venturing into the CBDC territory. But we will see if the CBDC project becomes a trojan horse sent through Stablecoins. It seems likely.

Explore: Dogecoin Discoupling with a bitcoin price? While market drops the investors flock to dogeverse

Join 99 bitcoins news discord here for the latest market updates

The post Fed chair is and says “no” to the digital dollar during its mandate appeared first out of 99 bitcoins.