Speaking at World World 2025 today, Chris Koyber, Videlity Vice -President, challenged companies to reconsider how they think about risks and allocate capital and long -term financial health. “Bitcoin has surpassed every chapter of major origins over the past ten years,” said Koyber. “If you are a company sitting on money or low yields, you are behind the knees.”

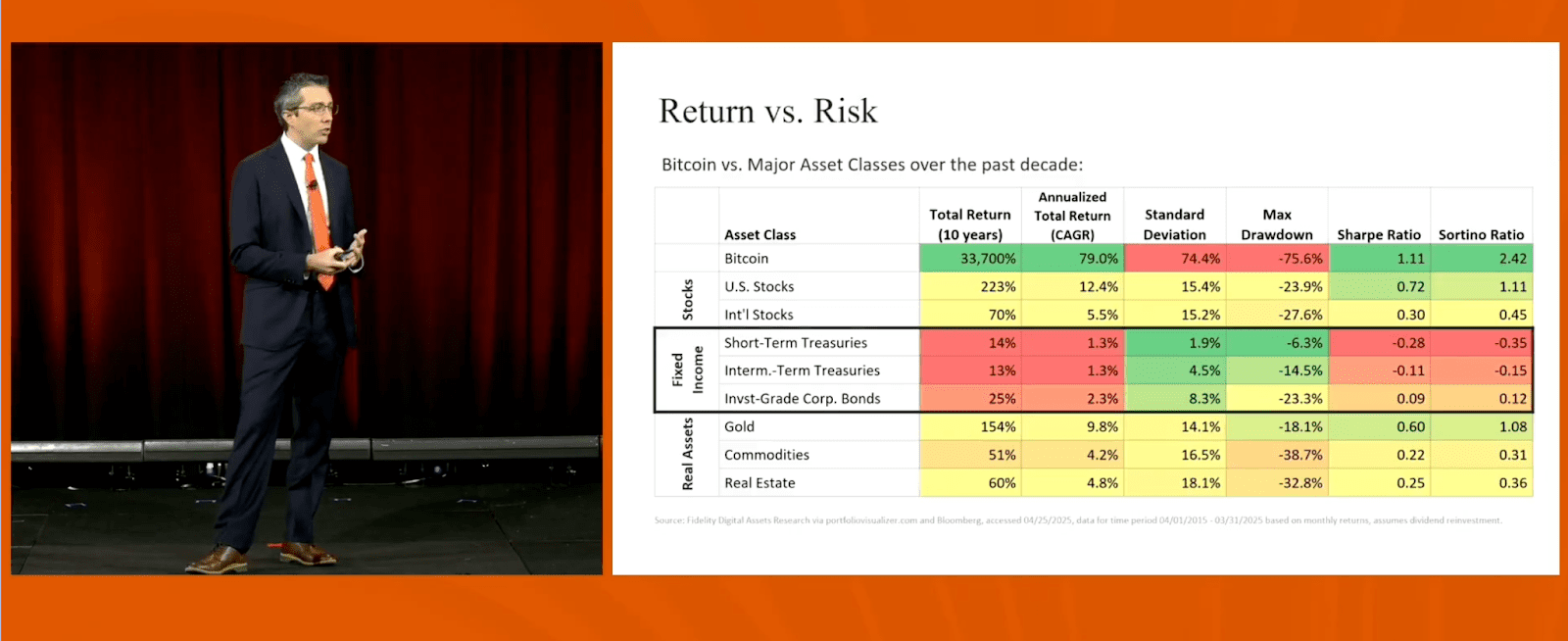

With more than a decade of data, Kuper presented the case that Bitcoin is not just speculative assets – it’s a superior strategic reserve. The numbers were in the foreground and the center: Bitcoin has achieved an annual growth rate of 79 % over the past decade and 65 % over the past five years. On the other hand, Keper showed that investment bonds have returned only 1.3 % during the same period.

“Companies often focus on fluctuation. But fluctuations are not a risk – permanent capital loss,” Koyber explained. He pointed to inflation and currency currency as the real threats facing public budgets today, which shows how traditional safe havens such as American treasury bonds have suffered real negative returns over time.

To address concerns about Bitcoin fluctuations, Kuper presented two strategies: limiting positions and long -term thinking. He said: “Bitcoin should not be everything or nothing.” “It is not a key – it’s a tablet.” Even allocating 1-5 %, he said, can significantly improve the return of the modified company with risks with reducing exposure to inflammation.

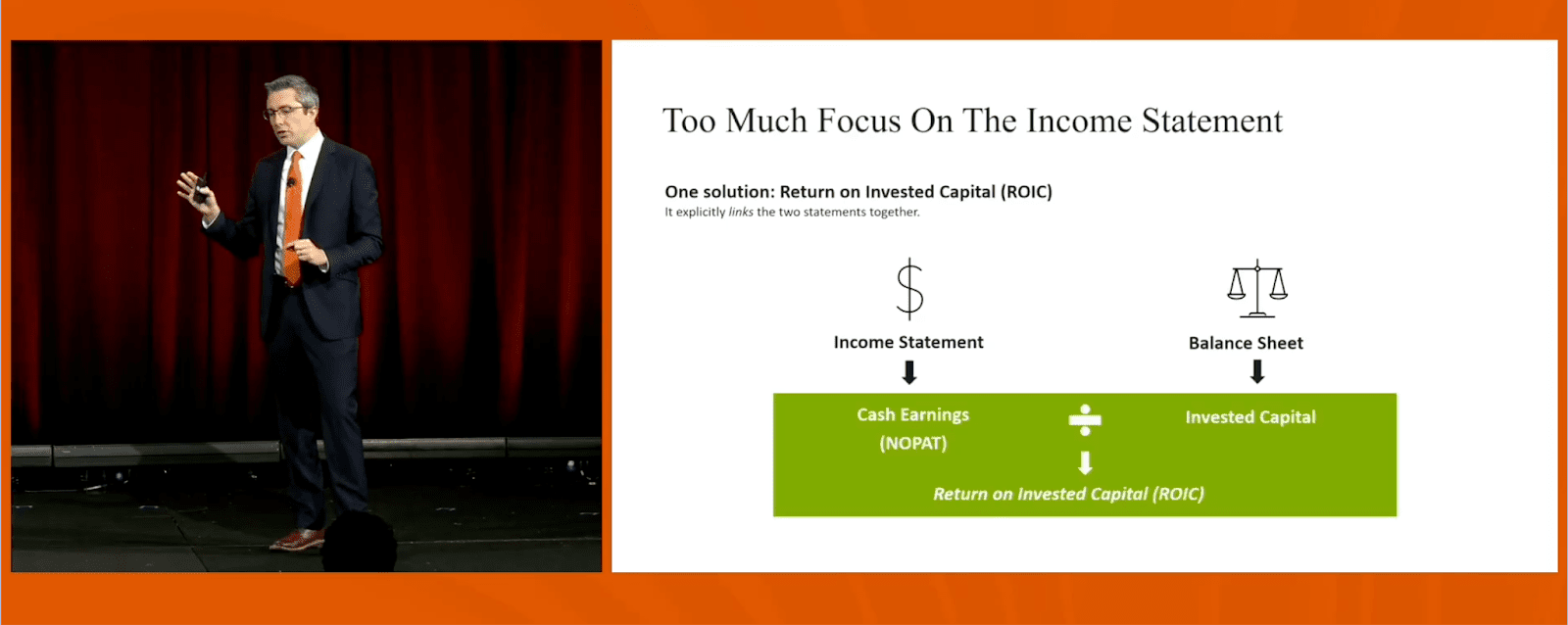

Then the presentation turned into the basics of companies. Koyber stressed the importance of the return on the invested capital (ROIC) on the main profits, and called for the inconvenience of sitting on the money. For example, he indicated that ROIC from Microsoft decreases from 49 % to 29 % when included in excess cash – handover of inactive capital clouds.

“Companies focus on the laser on income data, but it is the public budget that tells the true story,” said Koyber. “Criticism is part of that story – Bitcoin can be converted from dead weight to fruitful origin.”

He closed with a direct question for CEO: “What is your opportunity – and do you think that these opportunities can outperform Bitcoin?”

From the viewpoint of Keper, the answer is increasingly clear.

Source: https://bitcoinmagazine.com/news/fidelitys-chris-kuper-presents-the-