The latest FOMC news indicates a clear dovish tilt among US Federal Reserve officials, with newly released meeting minutes showing that additional interest rate cuts are likely before the end of the year. Most participants felt that it would be “appropriate to ease policy further during the remainder of 2025,” representing a marked shift from the cautious tone that dominated most of the year.

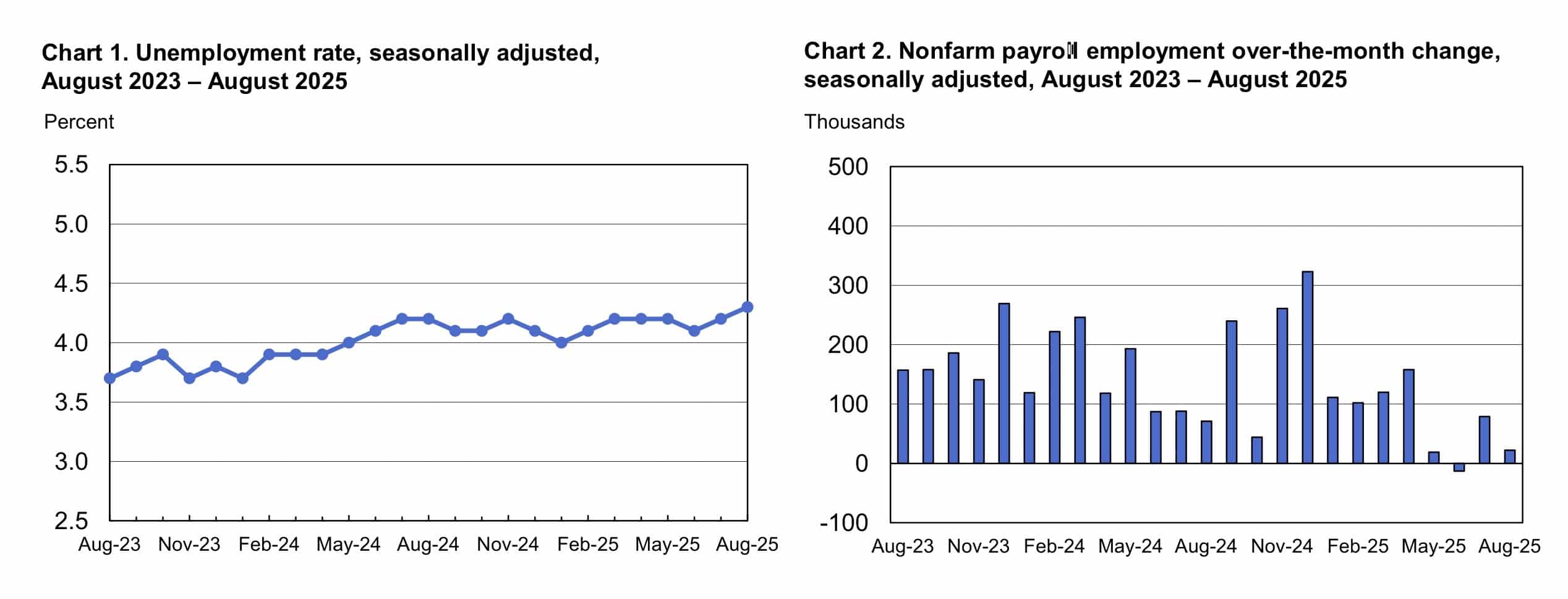

While the central bank remains officially committed to its 2% inflation target, the tone of the September meeting minutes suggests the Fed has become more concerned about a hiring slowdown than persistent inflation. The first rate cut in September – by 25 basis points – was driven by signs of a weak labor market, with job gains slowing and the unemployment rate rising.

Explore: 15+ Upcoming Coinbase Listings to Watch in 2025

FOMC News: Two additional interest rate cuts are expected in 2025

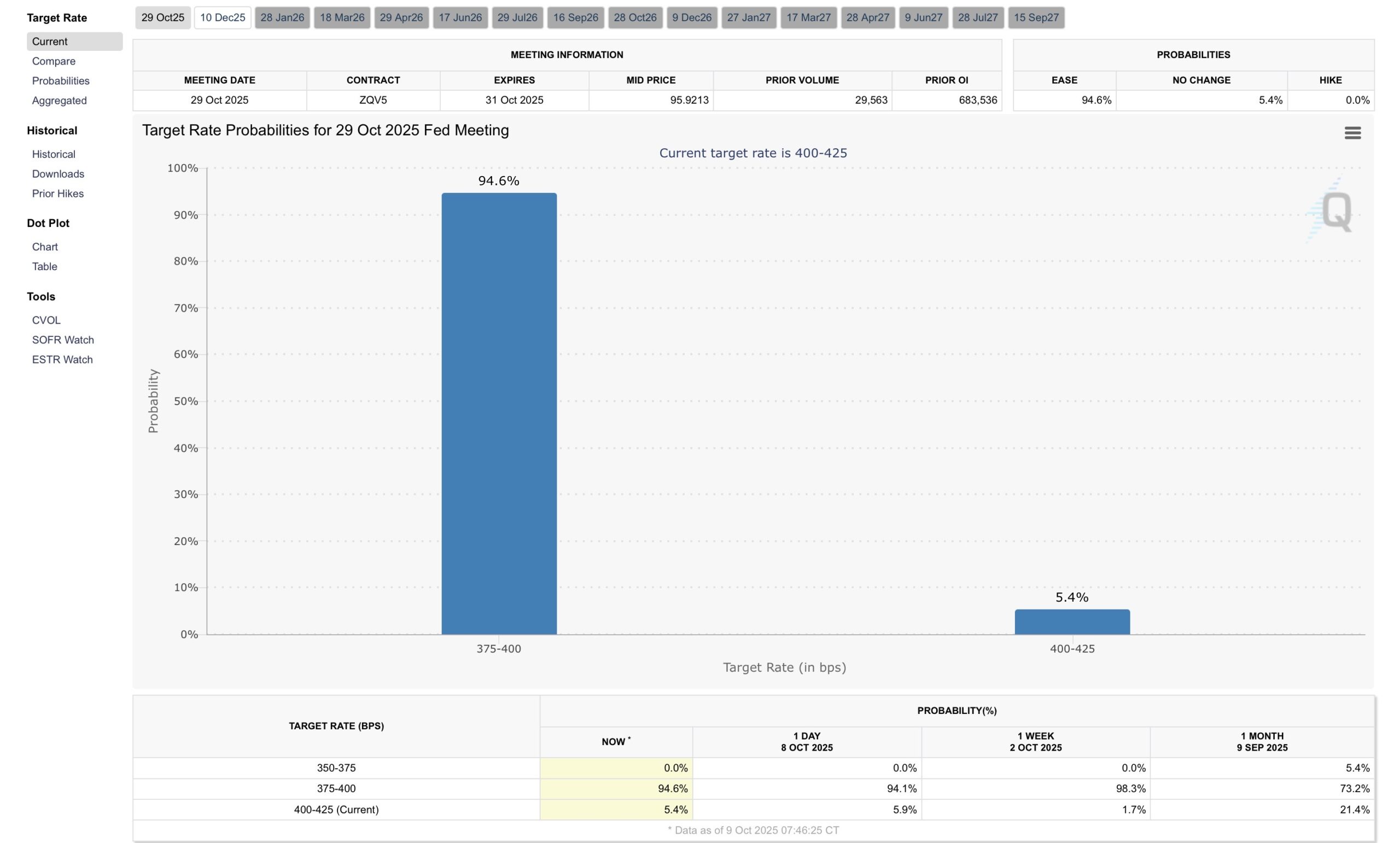

According to the Fed’s median estimate, two additional 25 basis point cuts are expected before the end of the year, most likely at the FOMC meetings in October and December. Market expectations are largely consistent with this view. CME FedWatch data currently shows a 92.5% probability of a 25 basis point cut at the October 29 meeting.

The softer tone had an immediate impact on risky assets. Bitcoin rose after the minutes were released, briefly topping $124,000 before settling at $123,500. The broader cryptocurrency market cap remains above $4.19 trillion.

Cryptocurrency traders often view lower interest rates as bullish, as easier monetary policy tends to increase liquidity and risk appetite across traditional and digital asset markets. Thus, the expectation of further easing has boosted sentiment in cryptocurrencies, especially after months of mixed signals from the Federal Reserve.

Find Out: Gold Price Hits $4K ATH, Leaves Nasdaq in the Dust – Are We Toast for a Bull Cycle?

Employment versus inflation debate

The FOMC’s dual mandate of maximizing jobs and maintaining price stability is once again a balancing act. The minutes showed that members were divided on whether to prioritize addressing downside risks to employment or continuing to pressure inflation.

Most participants agreed that the policy stance should move toward a more neutral level in light of recent labor data. They noted that inflation risks “have either diminished or not increased,” although many members remained cautious, arguing that easing too quickly could reignite price pressures.

Kansas City Fed President Jeffrey Schmid emphasized that inflation remains “very high” and said he favors a more measured pace of monetary policy easing. In contrast, newly appointed Governor Stephen Meeran, the only official to object in favor of a deeper 50 basis point cut in September, said he was “optimistic on the inflation outlook” and supports a more aggressive approach to easing.

This split highlights a key uncertainty: whether the current price level remains constrained. Some members felt that the real policy stance may no longer be quite so hawkish, while others believed that the economy could benefit from further easing to compensate for the weak labor market.

Discover: 16+ new and upcoming Binance listings in 2025

Implications for Bitcoin and Cryptocurrencies

For cryptocurrency markets, the Fed’s shift toward easier policy reinforces a familiar narrative: that bitcoin and other decentralized assets thrive when real yields fall and liquidity expands. Former hedge fund manager James Lavish noted that while the Fed “remains concerned about rising inflation,” its willingness to cut interest rates anyway highlights why “sound money like Bitcoin is more important than ever.”

Traders reacted quickly to the FOMC news, with Bitcoin jumping above $124,000 before settling near $123,500. In previous cycles, easing phases often coincided with renewed uptrends in risk assets, including cryptocurrencies. However, traders remain cautious after post-FOMC volatility in September, when Powell’s comments briefly sparked a sell-off despite a rate cut.

With the next Fed meeting looming and the release of economic data delayed due to the ongoing government shutdown, Powell’s upcoming speech will serve as the only major policy signal this week. Both Wall Street and cryptocurrency markets are bracing for potential volatility.

Discover: 16+ new and upcoming Binance listings in 2025

Join the 99Bitcoins News Discord here to get the latest market updates

Key takeaways

-

FOMC news underscores the Fed’s softer stance, with two additional rate cuts expected in 2025.

-

Easy policy from the Federal Reserve has lifted Bitcoin above $124,000, boosting optimism across the broader cryptocurrency market.

FOMC News: Members Will Ease Policy Further This Year – What Does This Mean for Cryptocurrencies? appeared first on 99Bitcoins.