Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

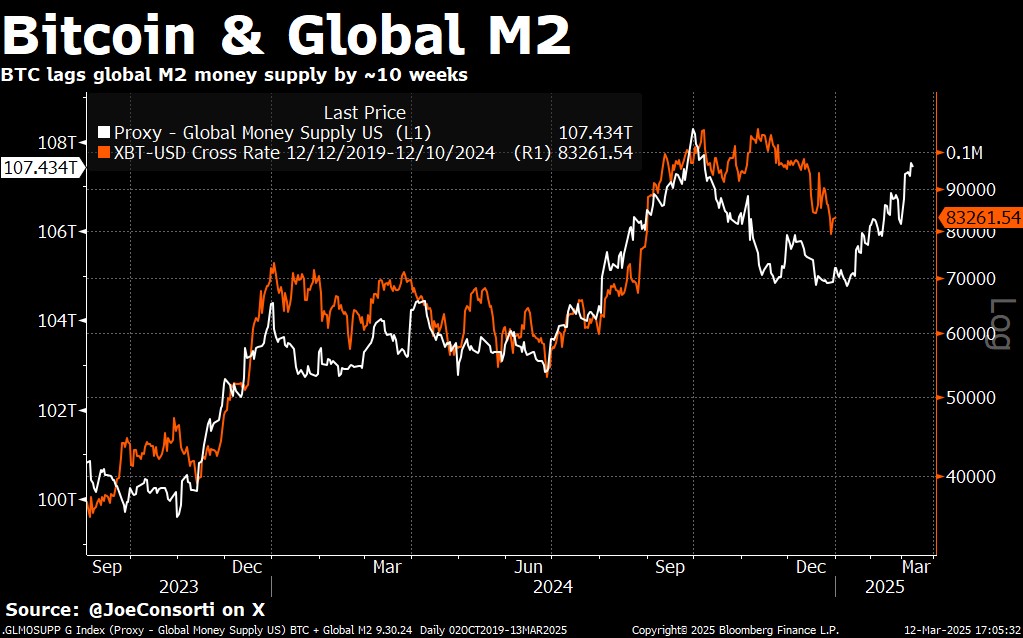

The close correlation of Bitcoin with Global M2 has returned to the spotlight, suggesting that the wider monetary conditions remain a key force behind the trajectory of the cryptocurrency market. Recent prices of the prices show that Bitcoin converges with the drift downwards of M2, which Mirro late 70 days late. This cyclic movement highlights Bitcoin’s continuous reactivity to liquidity fluctuations, although other fundamental factors, such as the new Bitcoin Reserve (SBR) of the United States, continue to capture the titles.

M2 global correlation and inefficiency of the Bitcoin market

In his last research note, the analyst Joe Consorti underlines that “Bitcoin’s directional correlation with Global M2 has reinforced again”, indicating that the price remains strongly influenced by the trends of the coin offer. After a few months of divergence, fueled in part by a strong US dollar, Bitcoin went down to $ 78,000, reaching within $ 8,000 from the expected route of M2.

The global M2 index has softened, partly reflecting the robust dollar performance. Despite that resistance, Bitcoin seems to follow the general liquidity project that has tracked down during this cycle, suggesting that the Bitcoin price still depends on the main macro forces such as expansions and contractions of the central bank. “Although this relationship is not a mechanism of cause and direct effect, it continues to provide a useful macro framework,” writes Consorti.

He added: “Takeaway? Bitcoin remains the last monetary activity in a world where the offer of money, the ability of the budget and the credit are perpetually expanding. As the offer of global money expands, Bitcoin tends to follow him, at least directionally. But this cycle is seeing further variables that make M2 a less reliable self -employed indicator, such as the dollar uses historically strong, creating a global report called in USD and more accurate measures of the coin and liquidity offer that enter the scene. “

Reading Reading

Although the macro conditions are exercising a family pressure, the market reaction to the SBR announcement has been disconcerting. After the President of the United States Donald Trump has formally declared plans to accumulate Bitcoin through a “neutral from the budget” mechanism, the price collapsed by 8.5% in just under a week. Consorti described the Sell-Off as “an irrational reaction that highlights serious inefficiencies in the price of the geopolitical importance of Bitcoin”.

Executive order 14233 imposes on treasury and trade officials to increase American BTC participations, in current at 198,109 BTC, without the new cost of taxpayers or the supervision of the congress. This is a clear contrast with the previous adoptions in terms of government, such as El Salvador’s legal move, which coincided with an increase in the Bitcoin price. Consorti attributes the disparity to the intake of short-term profits and a “Sell-The-News” mentality, adding that “the extent of the serum indicates a complete failure of the price in the long-term implications”.

Despite the SBR related Dip, the technical signals of Bitcoin suggest a possible local background formation. The cryptocurrency dropped to $ 77,000 before bouncing, filling a low volume gap in the $ 76,000 – $ 86,000 interval. The buyers seized the retracement, creating two hammer candelabra on the weekly chart.

Reading Reading

The hammer candelabra generally indicate an inversion, especially when they appear to support levels for the outflow of the cycle. According to Consorti, “the historian previously suggests that Bitcoin forms these schemes in the turning point of the cycle … The last time we saw this exact price structure was during the end of the consolidation of the summer of Bitcoin, two months before it came from $ 57,000 to $ 108,000”.

A remarkable trend between these price fluctuations is the growing domain of Bitcoin, even during periods of market contraction. The Eth/BTC has recently sank at 0.0227, its lowest since May 2020 – the indentation of the intensification of skepticism towards the altcoin. In the meantime, the institutional demand for Ethereum has also collapsed, as highlighted by a drop of 56.8% of the ratio of activities subject to management (AUM) for Ethereum vs. Bitcoin.

“This cycle belongs to Bitcoin and all future cycles will cease only this reality,” says Consorti. He suggests that Altcoin is fighting an uphill battle while the narratives focused on Bitcoin get a global traction.

At the time of the press, BTC exchanged $ 82,875.

First floor image created with Dall.e, graphic designer by tradingview.com