Bitcoin prices movements have always been the subject of debates between investors and analysts. With recent market retacings, many wonder if Bitcoin has already reached its peak in this bull cycle. This article examines the data and chain metrics to evaluate the market position of Bitcoin and potential future movements.

For a complete in -depth analysis, has reference to the original has already reached the price of Bitcoin? Full video presentation available on the YouTube channel of Bitcoin Magazine Pro.

The current performance of the Bitcoin market

Bitcoin recently faced a 10% portrayal from its historic maximum, leading to concerns for the end of the bull market. However, historical trends suggest that these corrections are normal in a bull cycle. Generally, Bitcoin experiences Pullback from 20% to 40% several times before reaching its final cycle peak.

Analysis of chain metrics

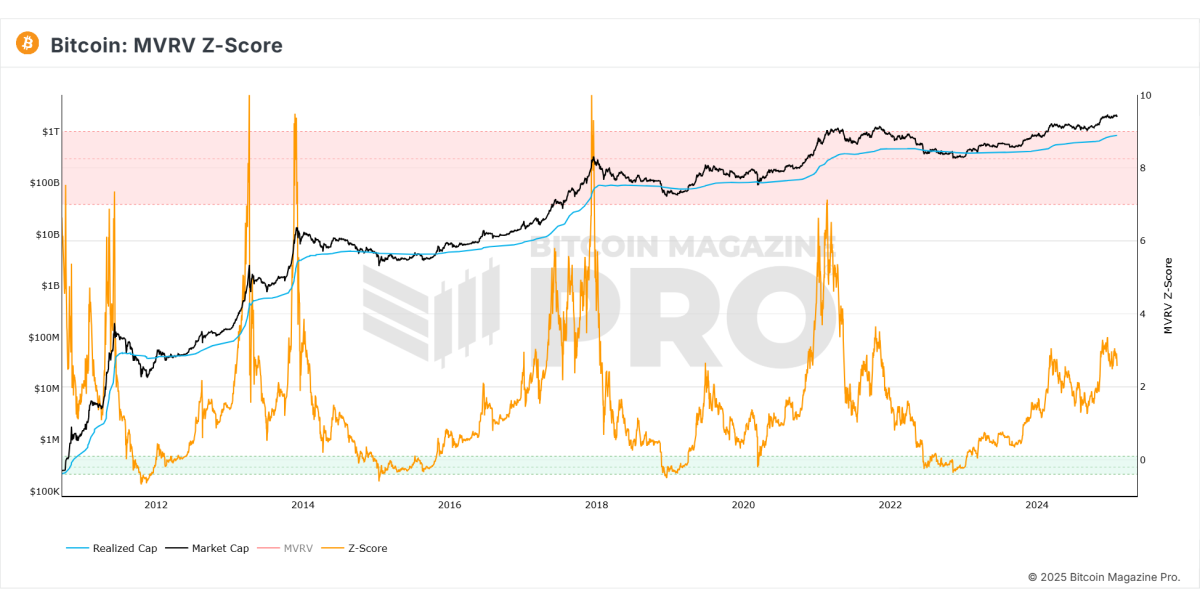

Mvrv z-score

The Izz MVRV score, which measures the market value to the value made, currently indicates that Bitcoin still has a considerable raised potential. Historically, the peaks of the Bitcoin cycle occur when this metric enters the overheated red area, which is currently not the case.

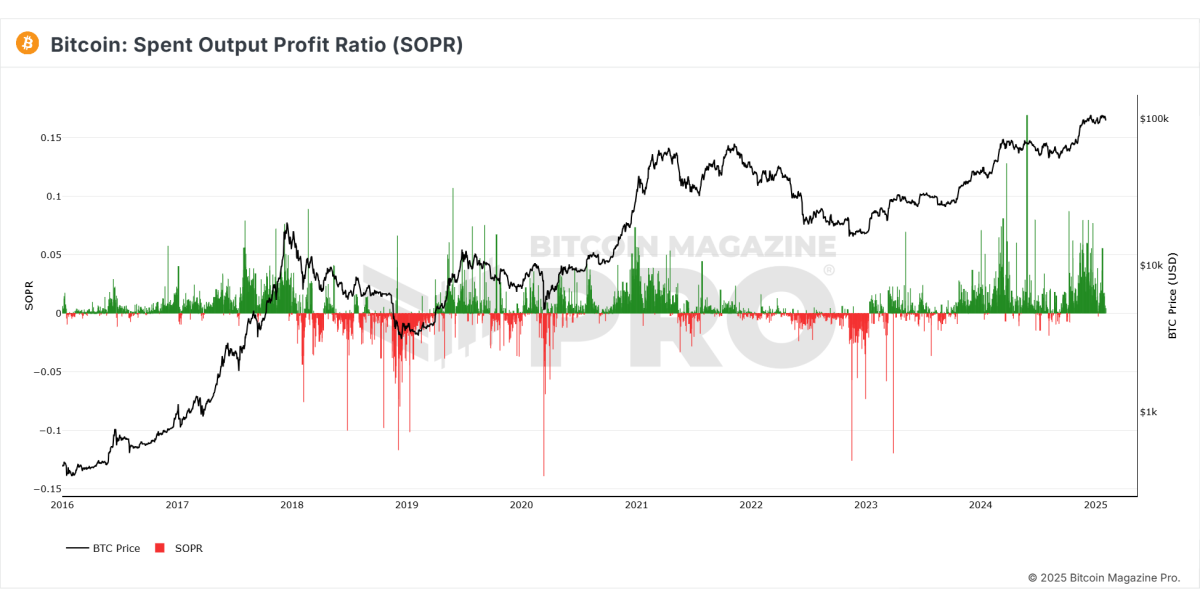

Spered production report (SOP)

This metric reveals the percentage of results spent in profit. Recently, the sop has shown to reduce the profits made, suggesting that fewer investors are selling their participations, strengthening market stability.

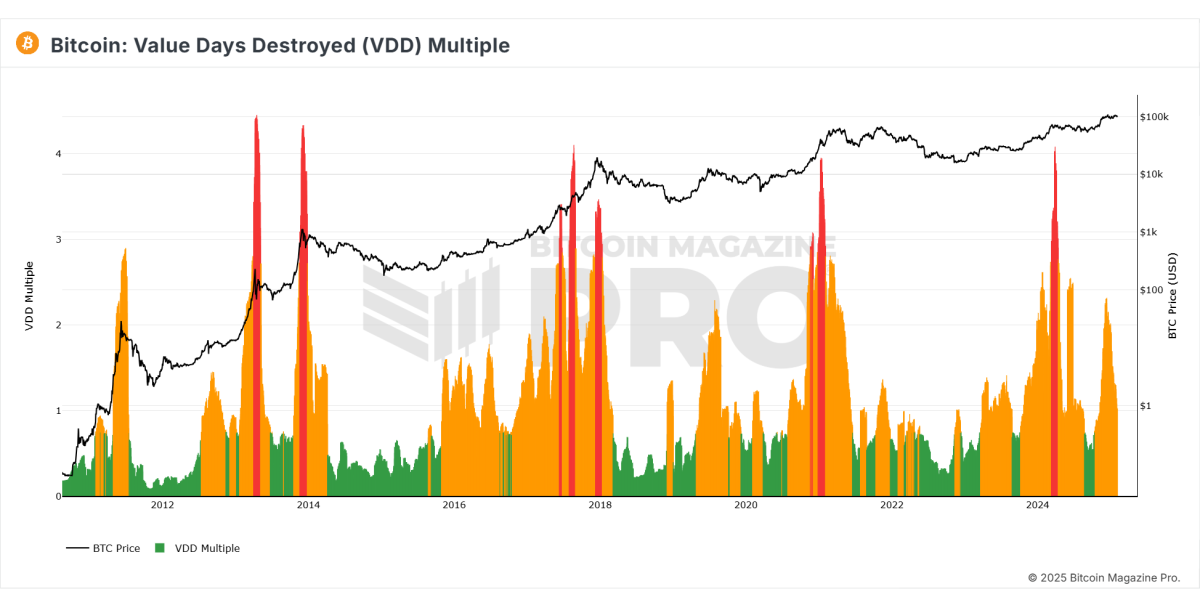

Destroyed days of value (VDD)

VDD indicates Sell-off of long-term owners. The metric showed a decline in the sales pressure, suggesting that Bitcoin is stabilizing at high levels rather than going to a prolonged reduction trend.

Institutional and market sentiment

- Institutional investors such as microstrategy continue to accumulate Bitcoin, reporting trust in its long -term value.

- The feeling of the derivative market has become negative, historically indicating a potential short -term price price since the overvalued traders that bet against Bitcoin can be liquidated.

Macroeconomic factors

- Quantitative window: The central banks have reduced liquidity, contributing to the temporary drop in Bitcoin prices.

- M2 global money offer: A contraction in the coin offer has influenced risk activities, including bitcoin.

- Federal Reserve policy: There are indications from the main financial institutions, including JP Morgan, which quantitative eraping could return by mid 2025, which would probably increase the value of Bitcoin.

Related: are $ 200,000 a realistic bitcoin price lens for this cycle?

Future perspectives

- The action of Bitcoin prices is showing signs to enter a consolidation phase before another potential gathering.

- Chain data suggest that there is still significant space for growth before reaching the cycle peaks observed in the previous bull markets.

- If Bitcoin further experiences Pullback up to the $ 92,000 range, this could present a strong accumulation opportunity for long -term investors.

Conclusion

While Bitcoin has experienced a temporary retracement, chain metrics and historical data suggest that the bull cycle is not over yet. The institutional interest remains strong and the macroeconomic conditions could move in favor of Bitcoin. As always, investors should carefully analyze data and consider long -term trends before making any investment decision.

If you are interested in a more in -depth analysis and given in real time, take into consideration the possibility of taking a look at Bitcoin Magazine Pro for precious insights on the Bitcoin market.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.