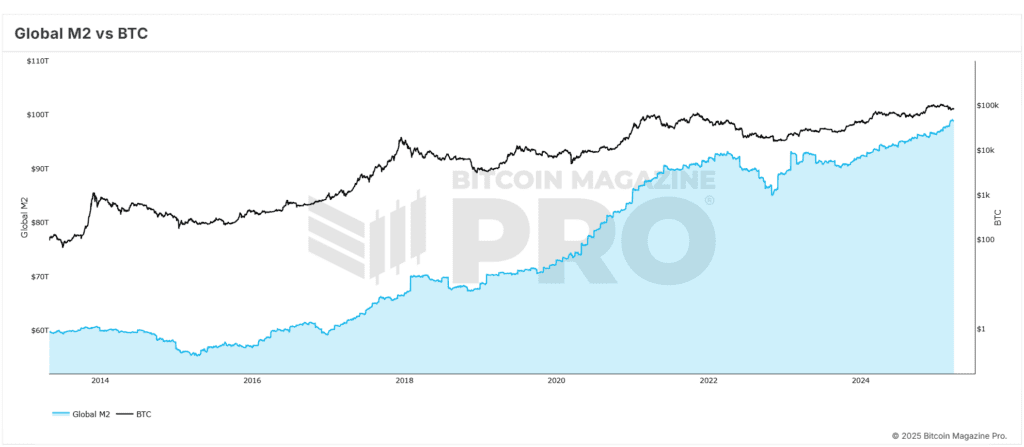

The trajectory of Bitcoin’s prices is again capturing the titles and this time the catalyst seems to be the global liquidity tendencies that reshape the feeling of investors. In a recent complete break, Matt Crosby, head analyst of Bitcoin Pro magazine, presents convincing evidence that binds the renewed ups and closet of the digital resource to the expansion of the offer of expanding M2 money. Its intuitions not only illuminate the future of the price of Bitcoin, but also anchor its macroeconomic relevance in a wider financial context.

Bitcoin price and global liquidity: a high impact correlation

Crosby highlights a remarkable and coherent correlation, often higher than 84%, among the global M2 liquidity levels and M2 liquidity levels. As the liquidity increases throughout the global economy, the Bitcoin price generally responds with the movement upwards, although with a considerable delay. Historical data support the observation of a delay of 56-60 days between monetary expansion and increases in Bitcoin prices.

This intuition has recently proved accurate, since the Bitcoin price has bounced from minimums of $ 75,000 to over $ 85,000. This trend aligns closely to the expected recovery that Crosby and its team had outlined on the basis of macro indicators, validating the strength and reliability of the correlation that guides the price of Bitcoin upwards.

Because the 2 -month delay affects the price of Bitcoin

The two -month delay in the response to the market is a critical observation to understand the movements of Bitcoin’s prices. Crosby underlines that monetary policy and liquidity injections do not immediately affect speculative activities such as BTC. Instead, there is a period of incubation, generally about two months, during which liquidity filters through financial systems and begins to influence the price of Bitcoin.

Crosby has optimized this correlation through various backtes, regulating times and offsets. Their results indicate that a 60 -day delay produces the most predictive accuracy both in the action of the historical price of short -term Bitcoin (at 1 year) and 4 years). This delay offers a strategic advantage for investors who monitor macro trends to anticipate Bitcoin prices extensions.

S&P 500 and its influence on Bitcoin price trends

By adding further credibility to the thesis, Crosby extends its analysis to traditional equity markets. The S&P 500 has a correlation of all times even stronger than about 92% with global liquidity. This correlation strengthens the topic that monetary expansion is a significant pilot not only for the price of Bitcoin, but also for the wider classes of activities.

By comparing liquidity tendencies with multiple indexes, Crosby shows that the price of bitcoin is not an anomaly but part of a wider systemic model. When liquidity increases, digital actions and activities tend to benefit, making the M2 to provide an essential indicator for timing the movements of Bitcoin’s prices.

Bitcoin price forecast at $ 108,000 by June 2025

To build a far -sighted perspective, Crosby uses historical friars from previous bull markets to project future movements of Bitcoin prices. When these models are superimposed on the current Macro data, the model indicates a scenario in which the price of the bitcoins could repeat the test and potentially pass its maximums of all time, aiming at $ 108,000 by 2025.

This optimistic projection for Bitcoin prices depends on the assumption that global liquidity continues its trajectory upwards. The recent declarations of the Federal Reserve suggest that a further monetary stimulus could be implemented if the stability of the market falters, another tail wind for the growth of Bitcoin prices.

The expansion rate affects the price of Bitcoin

While the increase in liquidity levels is significant, Crosby underlines the importance of monitoring the liquidity expansion rate to predict Bitcoin’s prices trends. The growth rate M2 year on year offers a more nuanced vision of the macroeconomic moment. Although the liquidity has generally increased, the rhythm of expansion was temporarily slowed down before resuming a trend upwards in recent months.

This trend is surprisingly similar to the conditions observed at the beginning of 2017, just before the price of Bitcoin entered an exponential growth phase. Parallelisms strengthen Crosby’s bullish perspective on the price of Bitcoin and underline the importance of the dynamic macro analysis rather than static.

Final thoughts: prepare for the next phase of the Bitcoin price

While potential risks such as a global recession or a significant correction of the stock market persist, the current Macro indicators indicate a favorable environment at the price of Bitcoin. The approach based on Crosby data offers investors a strategic lens to interpret and browse the market.

For those who wish to make informed decisions in a volatile environment, these intuitions provide an impossible intelligence based on the economic foundations to capitalize on the price opportunities of Bitcoin.

For further immersion searches, technical indicators, real -time market notices and access to a growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.