Bitcoin prices fluctuations are often evaluated using chain metrics, technical indicators and macroeconomic trends. However, one of the most underestimated but significant factors in the action of Bitcoin prices is global liquidity. Many investors could undergo this metric or even misunderstand the way in which it affects the cyclical trends of BTC.

Impact on bitcoin

With growing discussions on platforms such as Twitter (X) and analysts who analyze liquidity graphics, the understanding of the relationship between global liquidity and bitcoin has become crucial for both operators and long -term investors. However, recent divergences suggest that traditional interpretations could require a more nuanced approach.

The global offer of M2 currency refers to the total offer of liquid currency, including cash, controlled deposits and almost convertible activities. Traditionally, when Global M2 expands, capital seeks higher performance activities, including Bitcoin, actions and goods. On the contrary, when M2 contracts, risk activities often decrease in value due to closer liquidity conditions.

View the Live Graph 🔍

Historically, we saw the price of Bitcoin follow the global expansion of M2, increasing when liquidity increases and suffering during contractions. However, in this cycle, we saw a detour: despite a constant increase in global M2, the action of Bitcoin prices showed inconsistencies.

Change of year to year

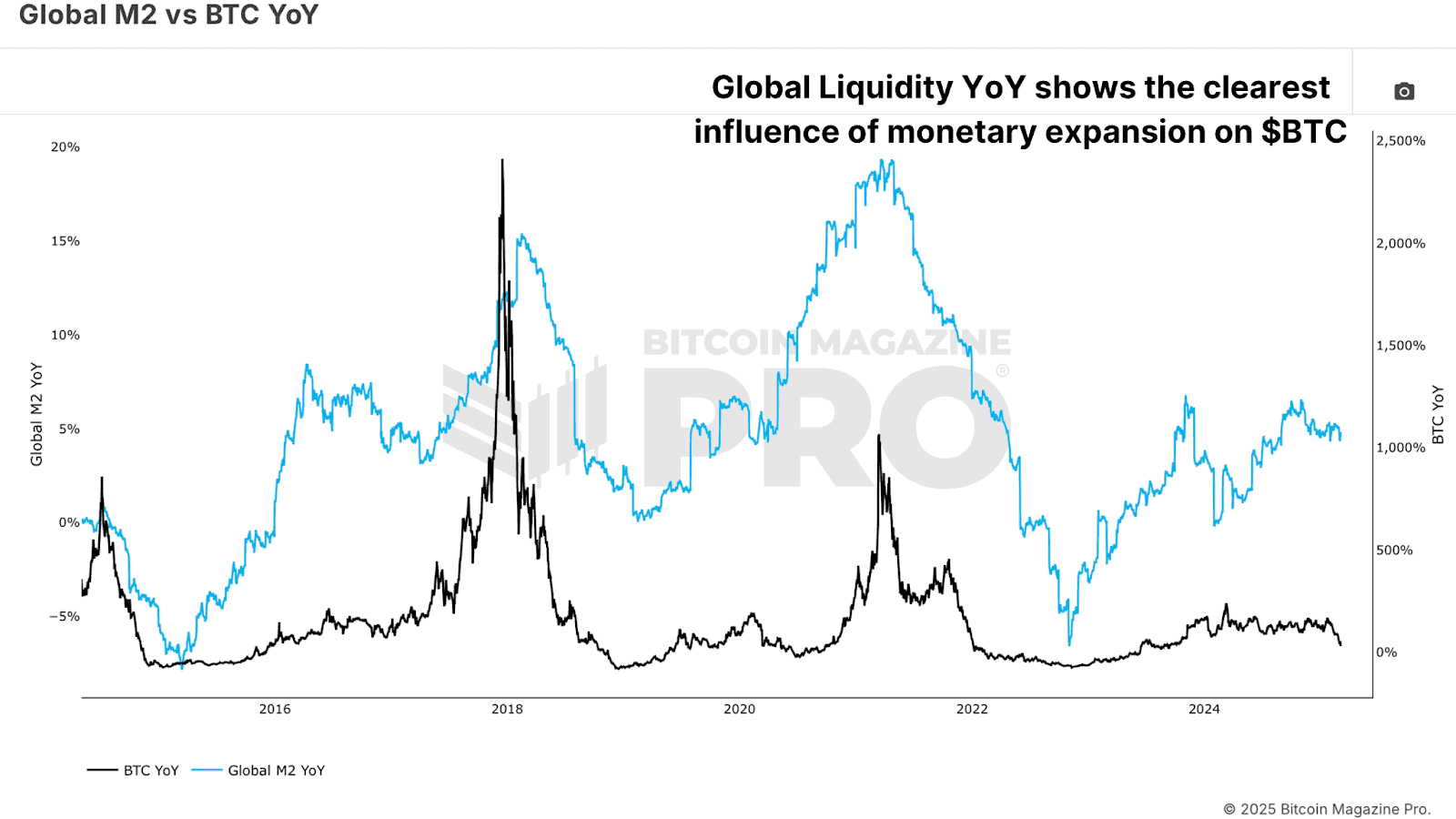

Rather than simply monitor the absolute value of global M2, a more in -depth approach is to analyze its variation rate year on year. This method represents the speed of expansion or contraction of liquidity, revealing a clearer correlation with Bitcoin performance.

When we compare Bitcoin’s return on an annual basis (Yoy) with the global change of Yoy M2, a much stronger relationship emerges. The strongest bitcoin bull aligns the periods of rapid expansion of liquidity, while the contractions precede the drop in prices or the prolonged consolidation phases.

View the Live Graph 🔍

For example, during the Bitcoin consolidation phase in early 2025, Global M2 was constantly increasing, but its change rate was flat. Only when the expansion of M2 accelerates considerably can bitcoin breaks out towards new maximums.

Liquidity lag

Another key observation is that global liquidity does not immediately affect Bitcoin. Research suggests that bitcoin is late compared to global liquidity variations of about 10 weeks. By moving the 10 -week global liquidity indicator, the correlation with Bitcoin is strengthened significantly. However, further optimization suggests that the most accurate delay is about 56 to 60 days or about two months.

Bitcoin Outlook

For most of 2025, global liquidity was in a flattening phase following a significant expansion at the end of 2024 which pushed Bitcoin to new maximums. This flattening coincided with the consolidation of Bitcoin and the retracement of about $ 80,000. However, if historical tendencies hold, a recent rebirth in liquidity growth should translate into another paw for BTC by the end of March.

Conclusion

The monitoring of global liquidity is an essential macro indicator to anticipate the trajectory of Bitcoin. However, rather than relying on the M2 static data, focusing on its change rate and the understanding of the two -month lag effect offers a much more precise predictive framework.

As the global economic conditions evolve and the central banks adapt their monetary policies, the action of Bitcoin prices will continue to be influenced by liquidity trends. The next few weeks will be fundamental; Bitcoin could be ready for an important move if global liquidity continues its renewed acceleration.

Did you have fun? Explore more on the price shifts of Bitcoin and on the market cycles in our recent guide to the mastery of data in Bitcoin chain.

Explore Live data, graphics, indicators and in -depth searches to keep up with the action of Bitcoin prices at Bitcoin Magazine Pro.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.