Block, Inc., founded by Jack Dorsey, the co-founder and former Twitter CEO, is a financial technology company with a full-stack in-depth connection with the Bitcoin industry through its branches. Its companies embrace the apps of payments and commercial tools with Bitcoin integration, development of mining bitcoin hardware, open source software development, a decentralized financial protocol for peer-to-peer markets and even a self-aware hardware wallet.

Previously called Square and founded in 2009, the company began to integrate Bitcoin into its technological offer already in 2014 through the cash app – its most famous branch – allowing traders to accept bitcoin payments through the app. In 2021, Square Inc officially renounced Block Inc, doubling his commitment to Bitcoin and affirming his vision of the future as the one in which Blockchain Bitcoin would have played a fundamental role. Square has become a Block inc inc and now mainly deals with the technology of the payment terminal. Today Block has 8,584 BTC in its balance of almost $ 1 billion, with an average purchase price of $ 30,405 dollars per bitcoin.

Block branches and investments, most have explicit connections with bitcoin or blockchain systems such as the cash app, bitkey, proto, spiral, TBD and Tidal. Everyone is making Bitcoin’s adoption at various levels in the sector and have a growing influence and gratitude from the Bitcoin community. Jack Dorsey was a prominent donor of various non-profit organizations and efforts of the Bitcoin community, including Opensatits, which finances the development of Bitcoin Open Source and through which a large amount of nostr-a protocol of Native Bitcoin social network was started.

In an exclusive interview with the Bitcoin magazine, Mile Setter, the protagonist of Block shared insights on their vision for the future and the ideal role of Bitcoin in it, saying that “we think that Bitcoin reaches his latest fate when they are used as daily money. To maintain the fundamental properties that make a single bitcoin and in the end he will make him win in the long term.”

Below you will find short panoramic views of some of the companies related to Block Bitcoin, in particular those that serve retail, with exclusive citations of Setter on how critical roles are needed in the path towards hyperbitization.

Square

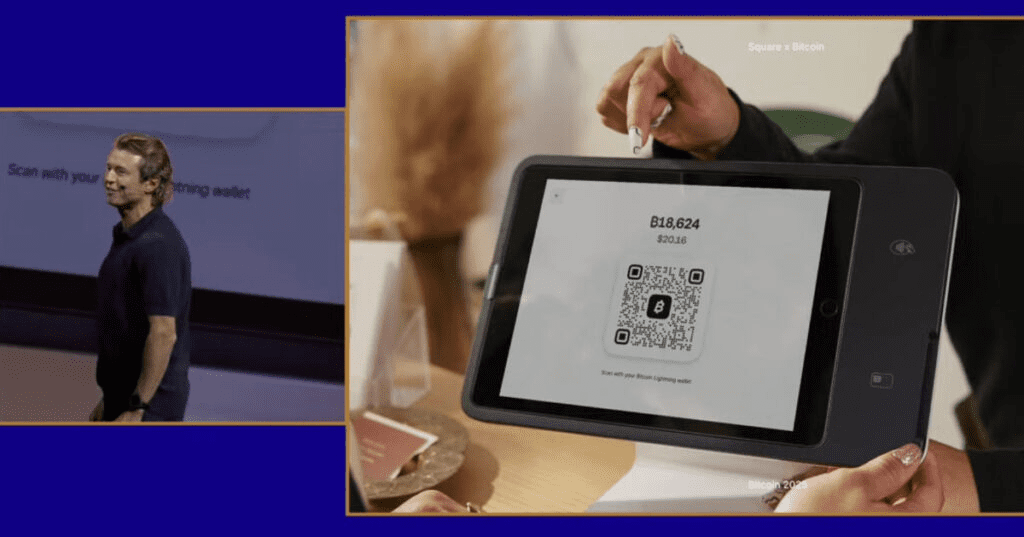

Launched in 2009, Square is a (POS) store system that allows traders to accept payments for card and manage operations such as inventory, paychecks and business loans. Using four million vendors and elaborating $ 241 billion per year starting from 2024, Square announced that he started launching Bitcoin payments for traders at the Bitcoin Vegas conference in 2025, allowing them to accept Bitcoin seamlessly through its Hardware Pos.

The move marks a large milestone in the integration of Bitcoin with retail payment systems, establishing a missing pillar until now in the business tool kit necessary to use really bitcoins as a means of exchange. “On the square side, we have over 4 million traders in the United States with a suite complete with stores, inventory, taxes, relationships, such as the best of the company in terms of processing traditional payments. This initiative goes beyond Bitcoin payments,” said Setter.

With Bitcoin Full Stack Accounting Integration, traders who wanted to accept the digital currency but could not because of the lack of tools now wide open from the door. But the vision is greater than that. “And we will offer a Bitcoin Banking Suite specially designed for small businesses,” added Setter, leaning on the growing trend of Bitcoin Treasury companies and the strategies that dominates Bitcoin today.

Companies will soon have all the tools to accept Bitcoin payments and put them directly in the corporate treasure rather than instantly sell Bitcoin for dollars. If they need liquidity, they are already able to put that bitcoin as a guarantee and obtain loans called in dollars directly on their bank account through companies such as Unchained, although, without a doubt, Block is also moving in that direction for their customers. Setter added that “one thing I love of this full-stack Bitcoin bank suite is that we are democratizing access to the Treasury Treasury tools that were previously available only for large companies. I believe that keeping Bitcoin on your budget should not be just a luxury of Wall Street.”

Cash app

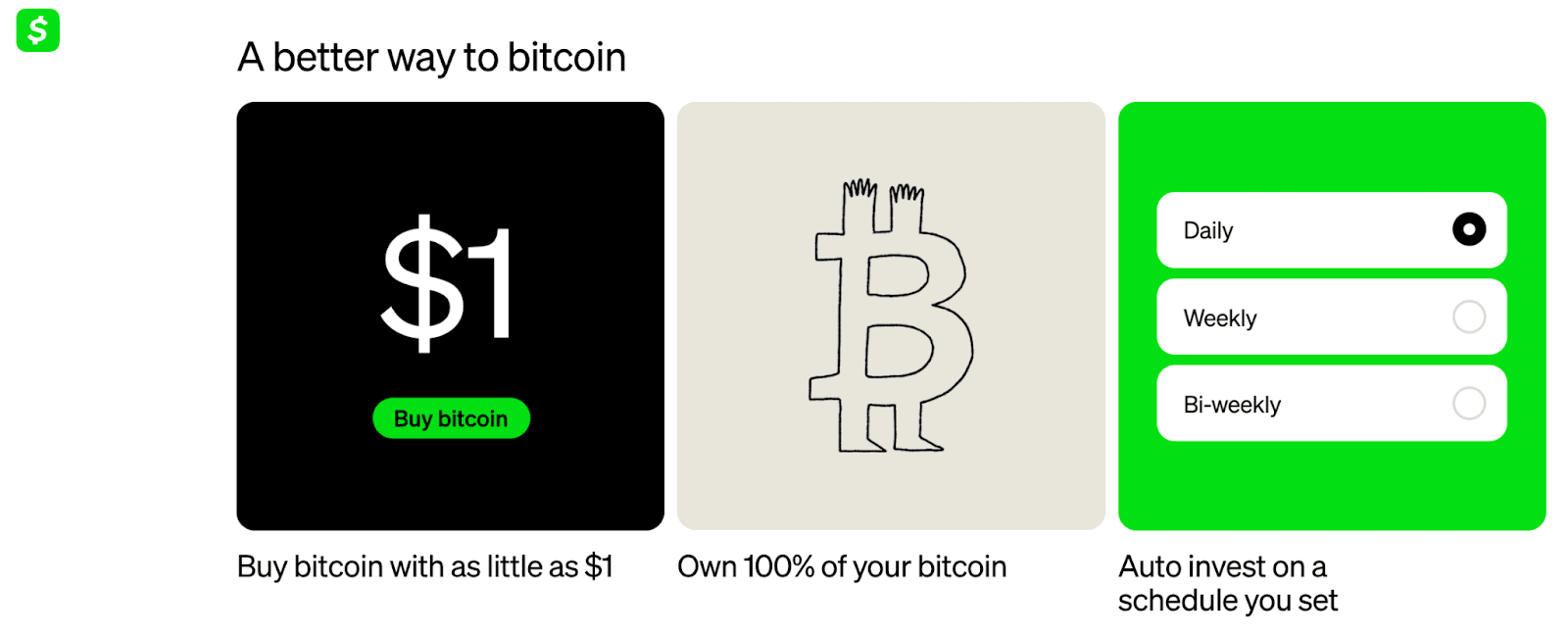

The cash app, perhaps the most famous brand inside the block wallet, completes the side of the retail payments of the block of the hyperbitization engine that is building. Introduced in 2013, the cash app is a digital portfolio focused on the consumer with 57 million active users reported in 2024, which offers payments from person to person, debit cards, titles and Bitcoin negotiation and tax deposit. The cash app recorded $ 10 billion in Bitcoin origin in 2024, representing 62% of the total, charged ~ 2% per trade.

The cash app could also be the first app for traditional payments to integrate Lightning, the Bitcoin payments network. It is at the forefront of the sector, producing the most public disseminated revenues and denominated Bitcoin but manages the Lightning network when 9.7%. This is not a strange performance of cryptographic magic and can only be reached by ensuring that Bitcoin’s payments are incredibly efficient and reliable. Suitable has observed that “for me, it is proof that Bitcoin is already a working network functioning, not digital gold. It is more than this. And I don’t want to enter too much in the weeds here, but I can say safely that we have the most talented series of lightning engineers in the world who work on these problems.”

Exalted for the success of Bitcoin’s integration of the cash app, Setter added that “we are very enthusiastic about Lightning’s role in making daily money Bitcoin because it is really, from the point of view of Block Inc.

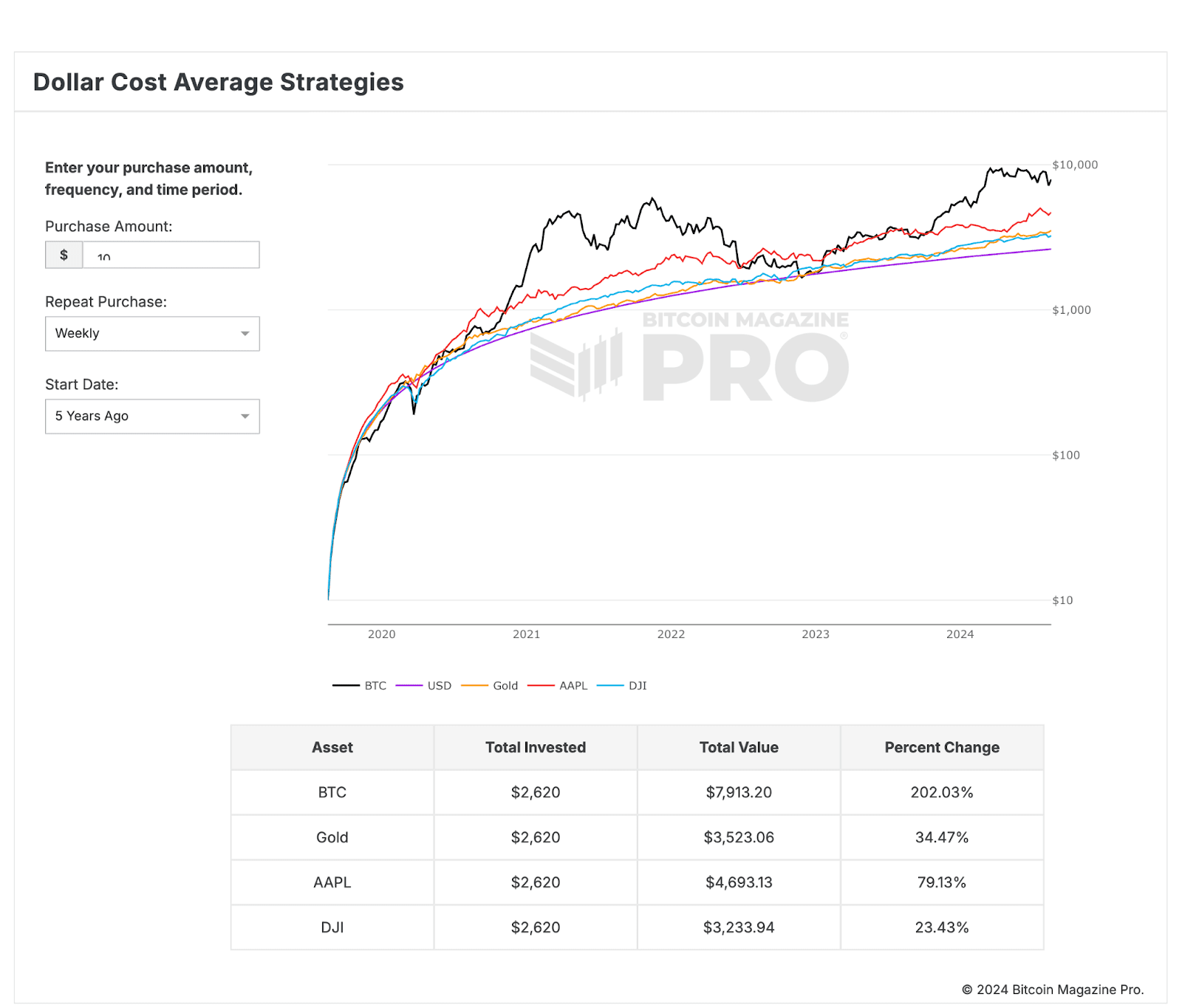

Consumers cannot simply buy and easily send Bitcoin through the cash app, but also to automate purchases, an investment strategy known as the media of DCA or dollars costs, which has been mathematically demonstrated one of the best investment strategies in Bitcoin.

The combination of apps and Square unlocks what technological people call a “flight wheel”, a term used to describe the self-relevance loops of consumer behavior and business that can push a company to new peaks and that usually is not possible if there is no element in that corporate logic. Perhaps with these two important additions, Bitcoin’s vision of payments has dreamed of the first users for over a decade, which have not worked very well until now, can finally become reality.

Bitkey

Anchored in the proposal of fundamental value of Bitcoin – censorship resistance through individual freedom and self -custody – Block has launched a new hardware portfolio product called Bitkey. The device is designed specifically for Bitcoin safety, using a popular technology called multisignature, which decentralizes passwords – private keys – necessary to move bitcoins on three different devices: the Bitkey hardware, a key stored for recovery in Block servers and a third encrypted key with the user’s credentials and archived on the report of the Giro di Google chosen. by the user.

The bitkey, launched globally in 2024, makes various design choices that move away from the way other hardware wallets in the function of the sector – The most primary and controversial difference is that it never shows private key material to the user. Unlike any other hardware portfolio and most of the bitcoin and cryptody apps, Bitkey hides the key material almost entirely by the user, instead giving them various well -designed tools to protect, recover and inherit their bitcoin firmly to their loved ones. Setter observed that “we built Bitkey to expand those who can be safely self-aware. Noi-Bitcoiner-Scherza on the fact that you should aboard your grandmother to self-possess, but I feel countless stories of what is true and the people who stretched because onboarding was so fluid.”

The device seems and looks like an alien technology, each unit with a single mixed stone motif and that lights up to the touch, as if it were alive. It is a profound rethinking of self -custody, born from a profound criticism of the user experience of the traditional bitcoin seed backup approach. While the design has been on the market for just one year and there have been no public data on sales numbers, it will be interesting to see if new lands in the adoption of the hardware wallet – a historically scarce metric for a sector so culturally defined by self -custody.