The price of Hyperliquid has been standing in the background on social media and the media lately. Is this the top of the HYPE or is it building up to the next one? Technical analysis reveals fundamental insights when it comes to price and risk. Investors may be a bit on edge, as competition from Aster has been fierce lately. But which project will last?

Hyperliquid has been consolidated in this range for more than 135 days.

At that time, the aid fund purchased more than $347 million worth of HYPE.

We all know that HYPE is undervalued by at least 2x.

But I think it is undervalued even when looking at short-term flows.

1. There will be… pic.twitter.com/zbtZS5qaBh

– Arthur.HL (@ArthuronHL) October 8, 2025

One of the correct methods for HYPE price is this bullish channel/consolidation. I’m going to move the upper border to match all three of the higher highs, making it a widening wedge. Either way, Arthur explained his point well enough.

Discover: 20+ Upcoming Cryptocurrencies That Will Explode in 2025

Excessive liquidity price: technical analysis reveals key levels

(Source – Tradingview, HYPEUSD)

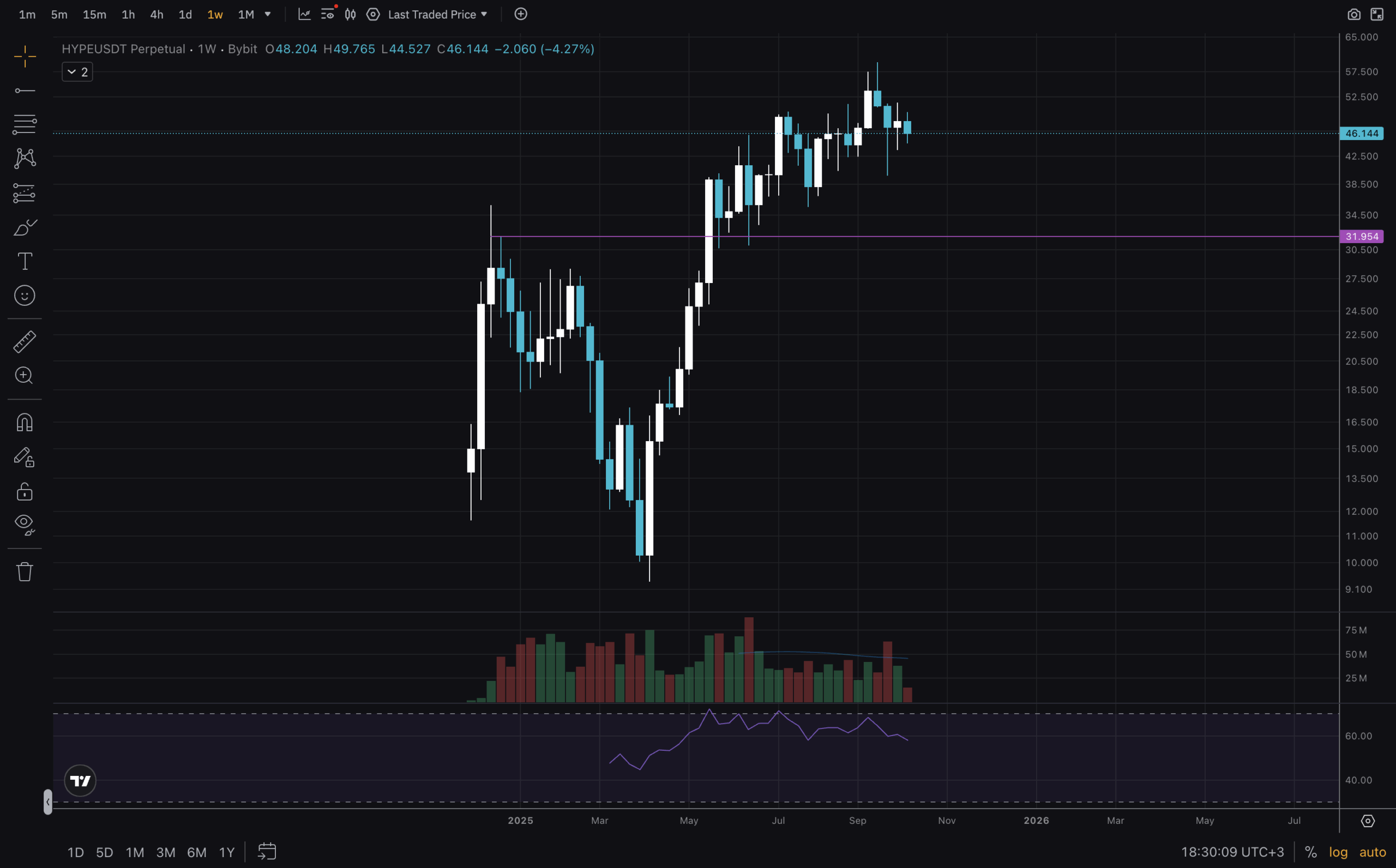

Let’s start today’s analysis with the weekly time frame chart. Hyperliquid is still a fairly new project. It performed surprisingly well and is still generating $10 million to $20 million in revenue each week (see more at DeFi Llama). Considering he has a team of 4 people, those are big numbers! For this chart, we don’t have much price history, although there is a $30-32 level from the previous high. This is HTF support. The RSI shows a hidden bearish divergence!

Discover: 9+ Best High-Risk-Reward Cryptocurrencies to Buy in 2025

(Source – Tradingview, HYPEUSD)

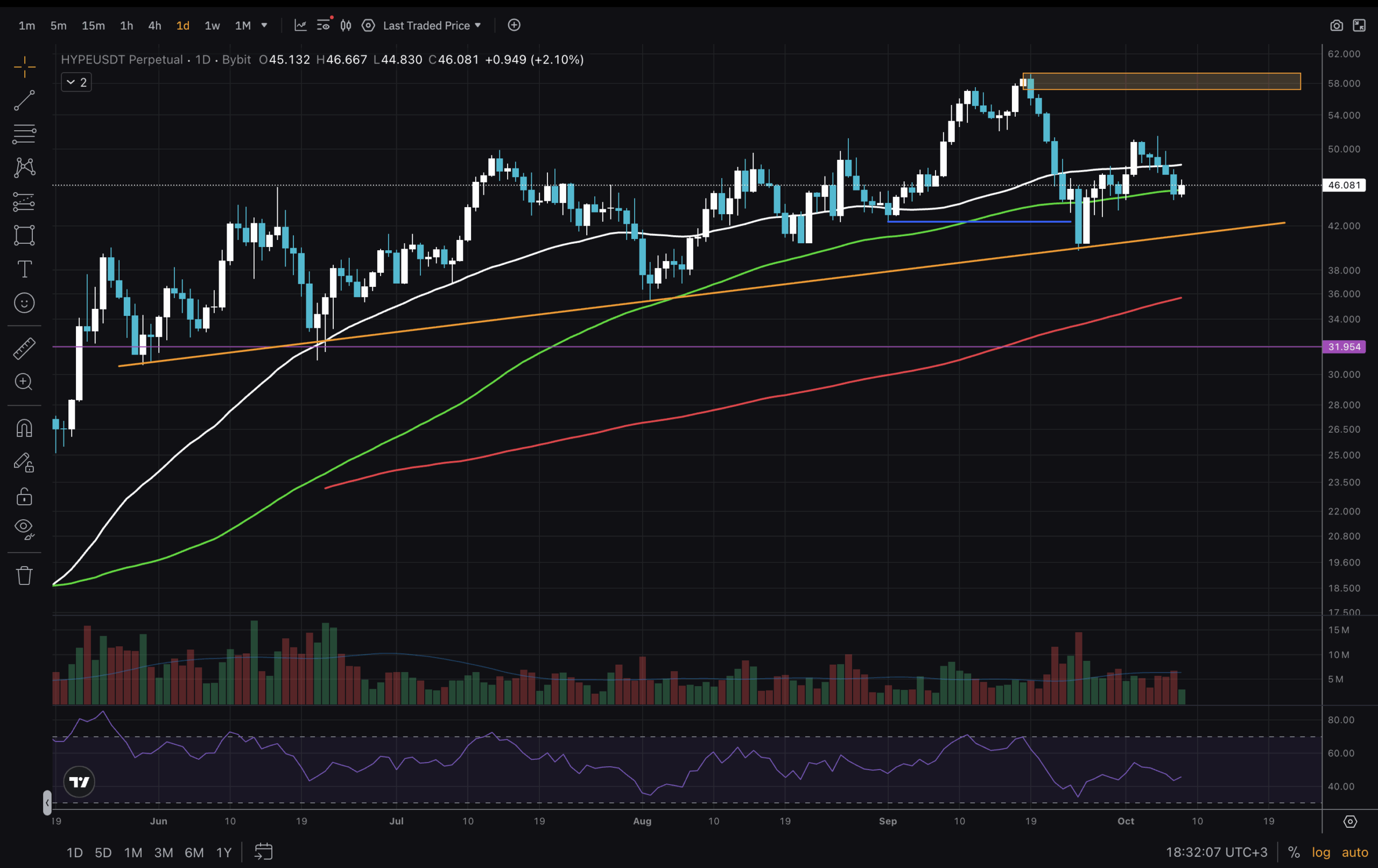

Next to take a look at is the 2D chart of Hyperliquid price. We have more pricing history to unpack here. The Relative Strength Index (RSI) has reset and is in the lower half of its range. The price is near the MA100, which recently broke below the MA50. Looking back, the MA50 wasn’t really respected from August onwards. The moving average order is still bullish, as is the market structure. We have a clear rising support level. And with the possibility of the blue line appearing on MSB.

Discover: 9+ Best Memecoin to Buy in 2025

HYPE: Expected next moves

(Source – Tradingview, HYPEUSD)

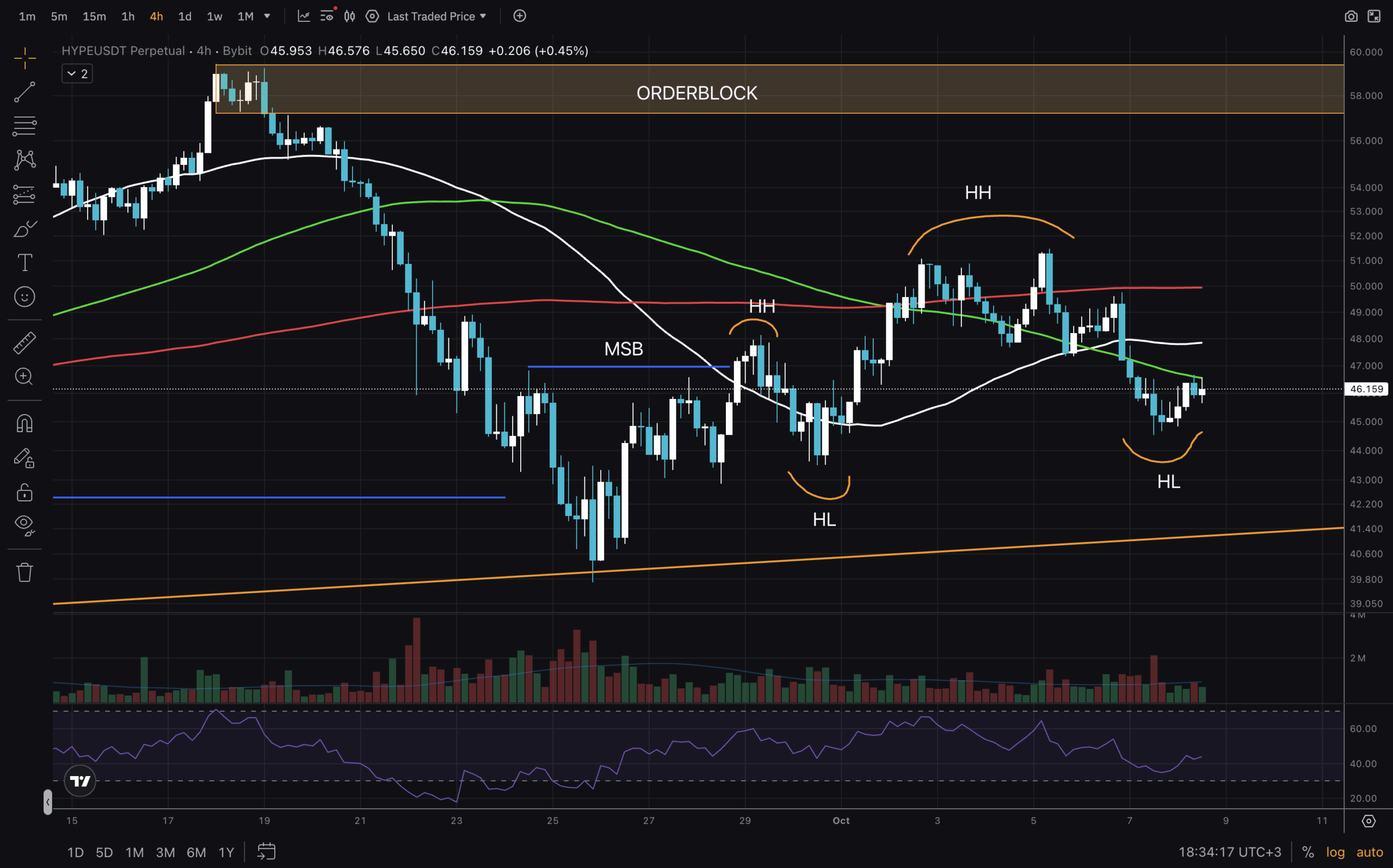

Finally, we will look at the 4-hour chart and see what we can expect in the near future. The blue line likely indicates an MSB on the 1D from the left side on this time frame. We can see that the price bounced from the support level with two bullish candles, indicating strength. Also, in this LTF, there is an MSB followed by a pair of higher highs and higher lows. Bulls want to reclaim the moving averages and order block of $57 to $59, support around $40 to hold.

That’s all for today. Stay safe out there!

Discover: 16+ new and upcoming Binance listings in 2025

Join the 99Bitcoins News Discord here to get the latest market update

Excessive liquid is still at $40: is this a quiet accumulation or distribution?

-

Hyperliquid’s price range is in the $40 to $55 range for over a month.

-

The RSI at 1W hides a bearish divergence

-

The bearish demand block between $57 and $59 should be broken

-

A breakout on either side of the channel could be decisive

Super Liquid remains steady at $40: is this quiet accumulation or distribution? appeared first on 99Bitcoins.