The Altcoin Etf race is heating since Pyth Crypto could be the next one following the revelation of Greecale on a Pyth Trust, which could precede the ETF.

Grayscale Investments has returned to the spotlight with the debut of its Pyth Crypto Trust.

Dedicated to the Pyth network on Solana, the latter addition to the range of cryptographic funds by Grayscal Signals by increasing the demand for activities based on blockchain and cement the position of Pyth as emerging power defi.

What is the Grayscale Pyth Trust?

Grayscale Investments has launched Pyth Trust, aimed at offering exposure to the token governance of the Pyth network led by Solana. This fund continues the grayscale series to focus on single asset products and now approaches investors suitable for Solana’s ecosystem through daily subscriptions.

Built as a decentralized oracle, the Pyth network integrates data from the real world such as resources prices in Blockchain systems, creating crucial backand tools for Defi. Manage 95% of Solana’s applications, Pyth remains indispensable for the functions of the network.

This move demonstrates the understanding of the grayscale for the decentralized infrastructure for a long time. With Pyth’s precise data feeds from merchants and market makers, trust draws on an essential level that feeds Defi’s architecture.

Grayscale is Altcoin’s shepherd: because the Pyth Trust counts

The launch funds just released in parity with the performance of Dogecoin and Crypto Mining, Grayscale is doubled the demand for investors for Blockchain niche games.

This explosion of interest follows the approval of the Etf Bitcoin Spot approval at the beginning of 2024, which triggered billions of inflows through cryptographic funds. Products focused on Ethereum have also increased, creating the perfect storm for Grayscale to expand its encryption arsenal.

Is the Solana ecosystem collapsing?

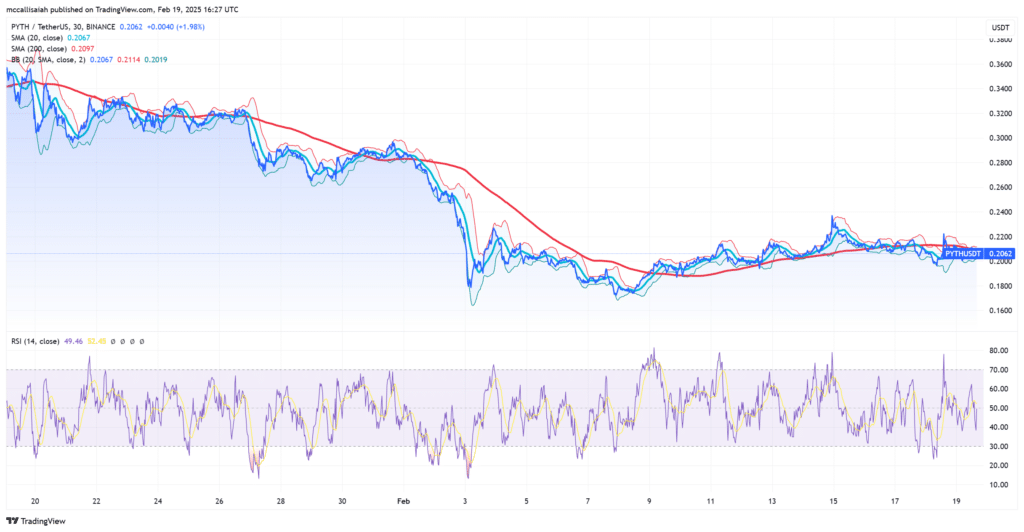

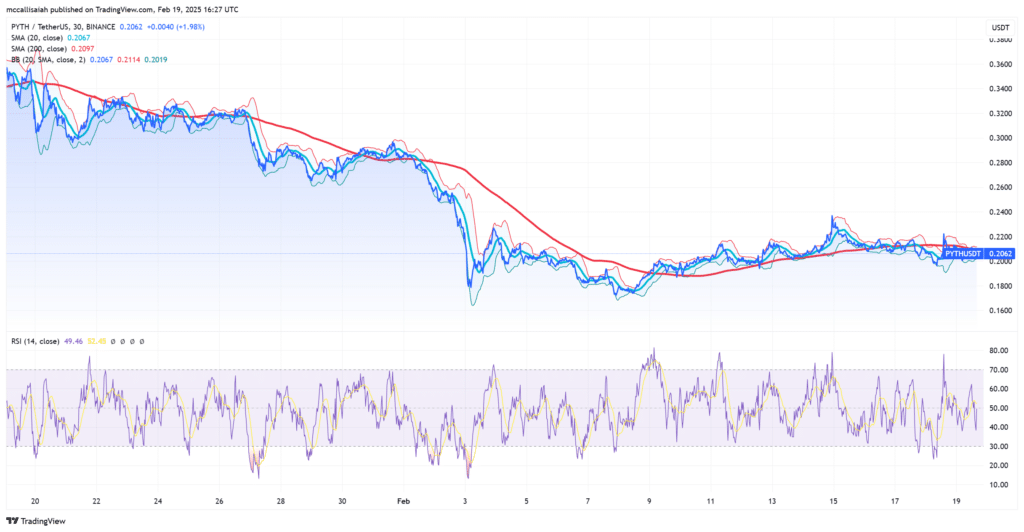

Solana’s market is in a bears market, showing poor performance compared to BTC, for example

The Solana ecosystem is an index made up of 11 cryptocurrencies: render, wif, jup, W, Bonk, Pyth, Bome, Gmt, Ray, Jto and TNSR.

Graphic: @Alphras pic.twitter.com/xrq4zsjbyp

– Joao Wedson (@jooo_wson) February 19, 2025

The Pyth Trust offers more than offering a new investment angle. Shows solana as a defii power, something criticized in recent weeks, with Pyth Like the line of salvation for most of its decentralized apps.

Squonding this Critical Oracle System and Chainlink’s competitor, Grayscale connects investors to the growth of the backbone of the Blockchain funding.

A promising step for the Altcoin ETF thrust

The Grayscale Pyth Trust underlines a change in cryptocurrency investments. It is no longer a question of accumulating coins but of digging into technology by fueling the next wave of finance. This launch offers investors a direct participation in decentralized innovation, drawing on a growing appetite for Blockchain potential.

The demand for far -sighted blockchain products continues to climb and the Pyth Trust adapts perfectly to the expanding formation of Grayscale.

Explore: the XRP price jumps 11% after the SEC Tease XRP Etf progress cryptographic unit

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

The Grayscale Pyth Trust marks a significant moment for both crypto infrastructures and investments.

-

Squonding a decentralized oracle like Pyth, the fund underlines the fundamental importance of the feed of reliable data in Blockchain ecosystems.

-

At the same time, it provides investors with a unique path in the rapid maturity network of Solana.

Is the post an Etf Pyth Crypto the next one? Grayscale has just launched a Pyth Trust appeared first out of 99 bitcoins.