The hyperliquid blockchain, one of the fastest names in decentralized (Defi), is facing a growing safety crisis after a series of high profile accidents has questioned the safety of its monetary markets.

On September 27, Hyperdrive, a flagship protocol on Hyperliquid, was forced to pause all the markets following a confirmed exploit that emptied about $ 700,000 from two treasure positions of the treasure compromised.

What’s behind the Hyperdrive Hack?

The positions on two accounts on the Thbill market have been compromised.

Hyperdrive paused all monetary markets as a precaution while we investigate further.

This problem does not affect $ Hyped.

– Hyperdrive (@hyperdrivefi) September 27, 2025

The developers attributed the violation to a defect in the operator’s authorizations: users had designated the Hyperdrive router as an operator, effectively granting access to sweeping to call any Whiteled contract. The attackers took advantage of the escapade to manipulate positions and extract funds.

The hyperdrive insisted that the governance token of Thbill and Hyped were not affected directly, but the damage extended beyond the stolen funds.

The accident marked the second important attack in 48 hours on the Defi ecosystem of Hyperliquid. Just a day before, Hypervault, another performance protocol, saw 3.6 million dollars that have sprung up and recycled through Tornado Cash before its website was offline and social media accounts were eliminated, indicating a output scam.

DISCOVER: 9+ Best Memecoins to be purchased in 2025

Assembly exploitation pressure on Hyperliquid: network under siege?

The rapid sequence of losses has sharpened questions about the resilience of the hyperliquid. The feeling of the community has moved from the celebration of the speed and the composition of Hyperliquid to the anxiety that the network is becoming a magnet for the attackers.

Security researchers say that problems can be deeper than the individual false steps of the protocol. Hyperliquid, launched just last year with a 1.6 billion dollar Hype Airdrop, operates on a high performance chain built at the top of the referee.

Its design, giving priority to the ultra-welfic execution, has for some time raised concerns about centralization. The network works with only four validators, claim that concentration critics could make it highly vulnerable to coordinated violations.

Those warnings gained traction in December 2024 when Blockchain Sleuths connected the portfolios of the North Korean group to test transactions on the hyperliquide.

Taylor Monahan of Metamask warned at the time that the DPRK hackers were “calculating the tires” of the chain to identify the exploits.

While the hyperliquid workshops rejected the statements, the token hype fell by over 20% in one day while the investors fled.

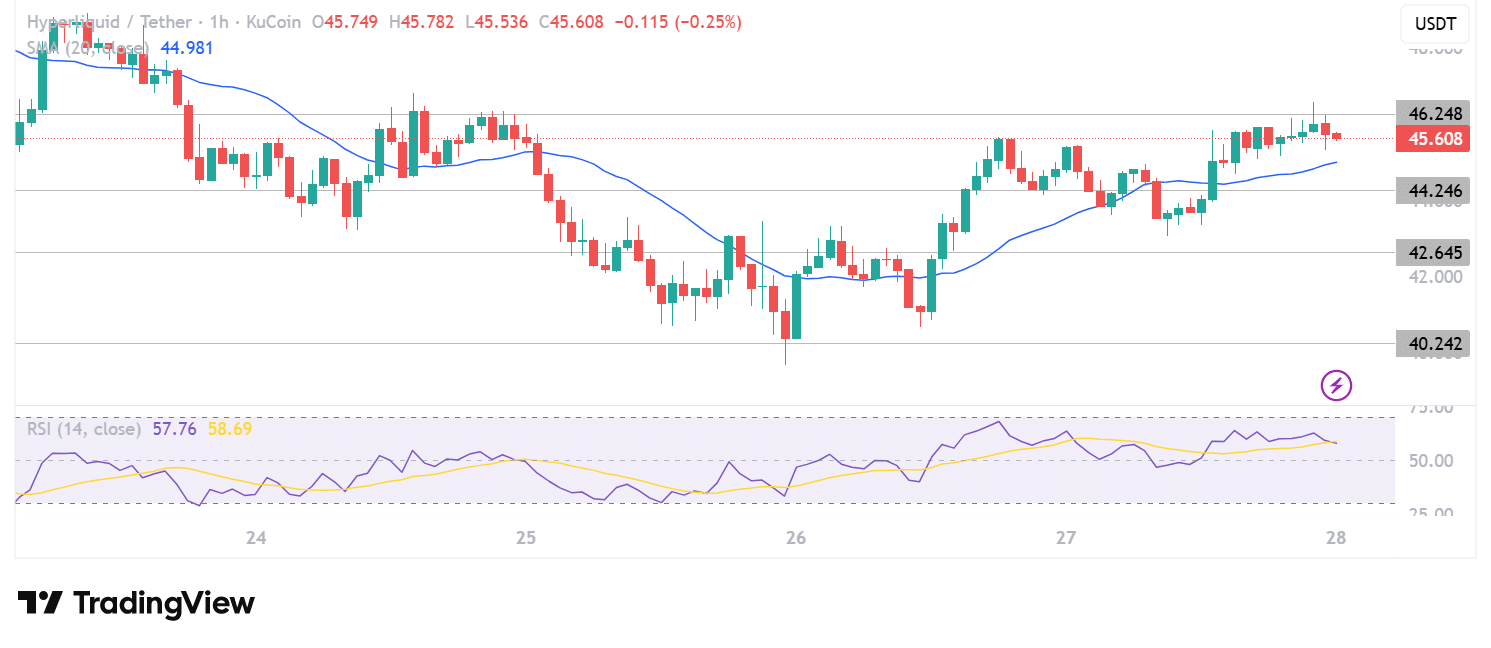

(Source – Hype USDT, TradingView)

DISCOVER: Over 16 lists of new and imminent binance in 2025

The latest violations seem to have rekindled those fears. The On-Chain analysis shows net deceased increasing from hyperliquid protocols from Friday, with over $ 200 million in USDC withdrawn in less than 24 hours.

The Token Hype, which has reached a market capitalization of higher than $ 11 billion at the beginning of this year, has lost two -digit percentages in the negotiations on the weekend.

Reputational success extends beyond the action of prices. The institutions that explore exposure to the hyperliquide are now evaluating whether its young ecosystem can support the level of safety required for downsizing.

The fact that both the users of retail retail of Iperdrive and Hypervault only aim to deepen the fact that Hyperliquid has become a fertile ground for opportunistic attackers.

Discover: 20+ Next Crypto to be exploded in 2025

Join 99 bitcoins news discord here for the latest market updates

Is the post a security crisis that heads for Hyperliquid? The hacked peak protocol appeared first out of 99bitcoin.