USDC BINANCE as a default setting for the Binance Pay while Trump pushes for deregulation. Stablecoin market capitalization increases to over $ 233 billion. Is tokenization the future?

Crypto, like any other sector, thrives in collaboration. Recently, Binance – the greatest exchange of cryptocurrencies in the world for commercial volume and customer counting –announced That usdc, the Stablecoin issued by Circle which keeps trace of the US dollar, would become the default currency for new Binance Pay users. Binance Pay is a payment solution that supports over 100 cryptocurrency activities, including some of the The best crypto -Cryptos to be purchased in 2025.

The era of tokenisation and stablecoins

This decision to support the USDC comes while the Donald Trump administration pushes for deregulation and gives priority to the creation of clear laws, in particular around Stablecoin.

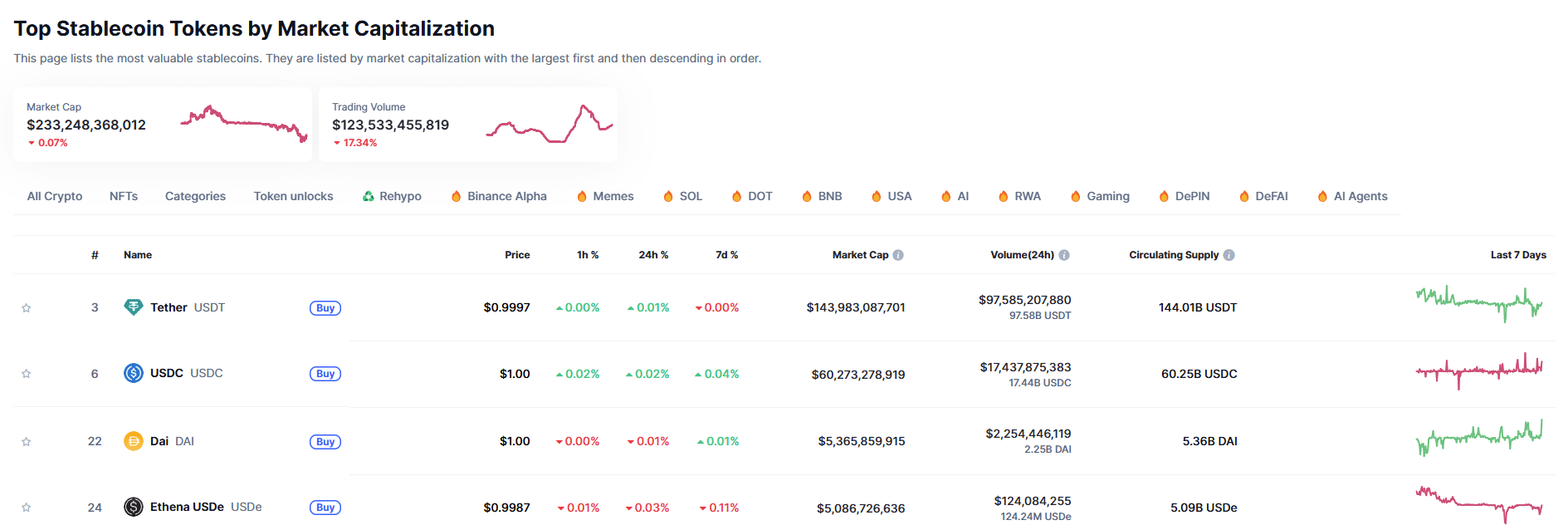

Starting from April 9, the total market capitalization of all Stablecoin, in particular those who monitor the USD, he was standing to over $ 233 billion. In recent years, multiple Stablecoins have been launched, stimulated in part by spikes of Tether’s profit and by the increase in the adoption of cryptocurrencies all over the world.

With this collaboration, questions are raised, especially now that World Liberty Financial, a Defi platform supported by the Trump family, is expanding in crypt WLFI security token with the USD1 Stablecoin.

The question remains: Is Binance silently preparing for the USDC as a future digital incarnation of the tokenized USD?

Binance pays for USDC pins: Details

Binance Pay is a popular payment platform that supports peer-to-peer cryptocurrency settlements and serves over 40 million monthly users.

With USDC as a default currency for the remuneration of the binance, it marks a significant departure on its previous dependence on Busc, the Stablecoin gradually eliminated at the beginning of 2024 due to regulatory pressures.

By adopting usdc as “Stablecoin in vital dollars” for its corporate treasure and promoting it through its ecosystem, Binance strengthens its position.

Circle Jeremy’s CEO Allaire greeted The integration as a great move for Binance, saying that it would allow millions of users to access the popular Stablecoin.

In addition, it highlighted its unique characteristics, including Multicichain support and almost zero transaction commissions on different chains, such as Solana and the BNB chain.

The Trump administration kills the CBDCS

The times of this integration are remarkable.

Coincides with the Trump administration that made key political changes aimed at making America the crypt capital of the world, possibly relaunching the wave of Taurus of 2024. Therefore, some of the Best Meme coins on Solana go up to new evaluations.

THE Emission The executive order of digital finance technology at the end of January actually killed all federal efforts to develop a digital currency of the central bank (CBDC).

Note that the order has revoked a 2022 biden directive, claiming that a CBDC would threaten the stability of the financial system.

Recently, another executive order has dissolved the National Cryptovace PropearcyRency Enforcement Team (NCET), stating that efforts should focus more on facing real crimes.

The Trump directive that has assumed the NCET has also affirmed that agencies should not act as regulators of digital resources, a role that the administration considers innovative suffocations.

Instead, attention is now on Stablecoin, a move intended to promote the sovereignty of the US dollar in the global panorama.

This move also aligns with the legislation envisaged by Stablecoin in the United States, such as the Genius act. The bill aims to provide a regulatory framework for Stablecoins such as the USDC.

Explore: 10 Best cryptocurrency coins to to invest in 2025

Focus on private Stablecoins

Analysts say that the increase in Stablecoin demand would bring capital to the United States titles. Currently, Tether is one of the major owners of US bonds, also overcoming France and Canada.

Leading the accusation, World Liberty Financial plans To launch a Stablecoin on Ethereum and the BNB chain. Stablecoin, USD1, is launched as a “credible and safe” option for institutional and sovereign investors.

However, he faces strong competition from the USDT, the largest in the world by market capitalization, for wave and many other stablecoins algorithmic, including USDS (previously from).

DISCOVER: Best new cryptocurrencies to invest in 2025 – Best new cryptocurrency coins

Binance supports usdc while Trump kills the CBDC, Towenization the Future?

- Binance Pay adopts usdc while Trump pushes for a cryptographic environment

- Trump wants to increase the development of private Stablecoins such as USDC and USD1

- Financial plans World Liberty World Brackd Trump to launch USD1

- Genius Act and Doj Ncet Showdown mark a deregulated future for the domain of the USDC

Is the post silently positioning USDC as the future of the US dollar? He appeared first out of 99bitcoin.