The price of Bitcoin currently seems to be on the verge of entering an euphoric phase of the price action after an already strong bull market. However, this cycle has been really impressive as the USD price graph suggests, or could it actually be subverting compared to other historical activities and cycles? This analysis digs in numbers, compares more cycles and examines Bitcoin performance not only with the US dollar, but also against activities such as Gold and US Tech stocks, to give a clearer picture of where we really find ourselves.

Previous price cycles of Bitcoin

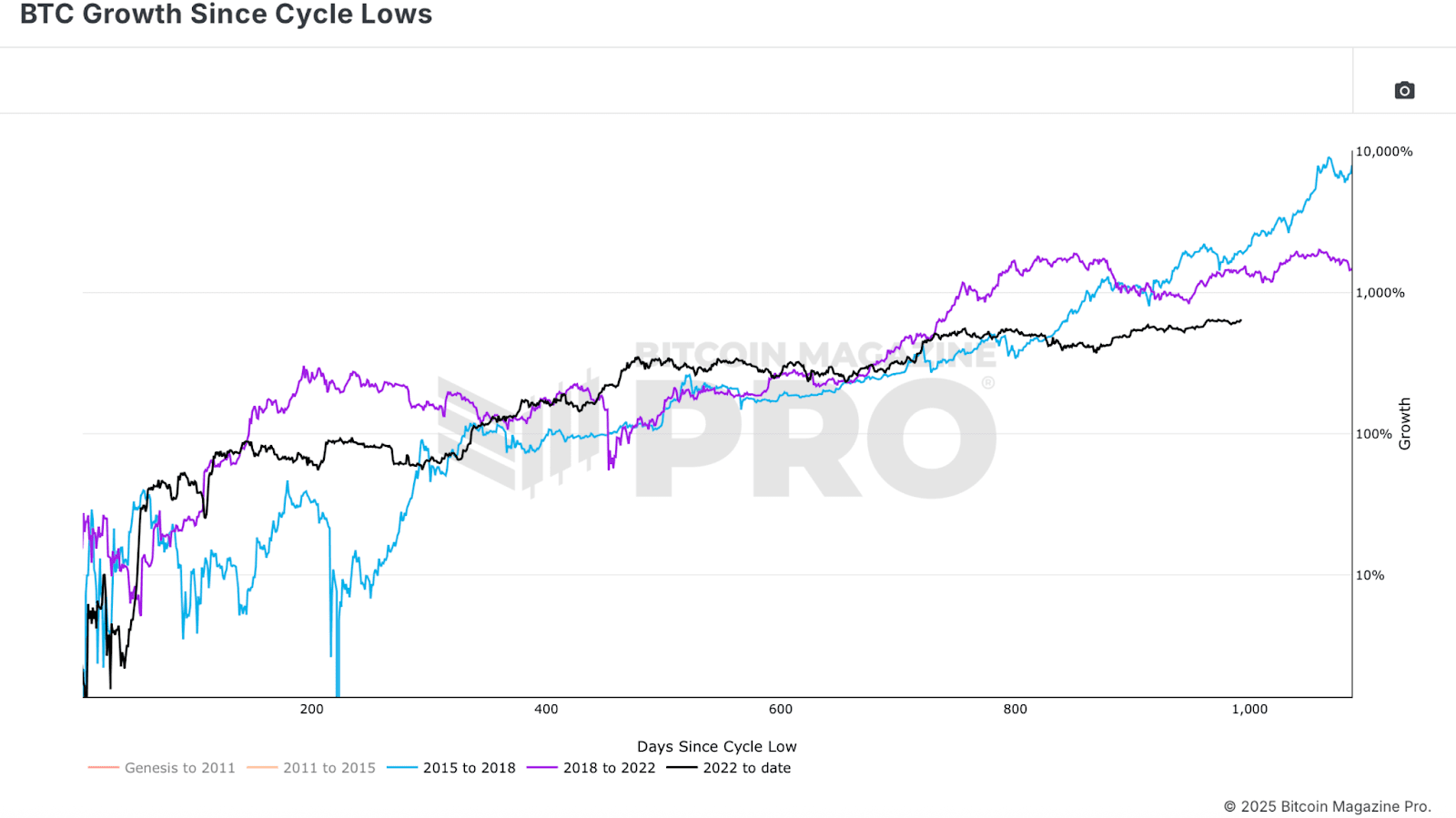

Observing the growth of bitcoins from the cycle whales table, the data initially seem promising. From the bass at the end of the last bears market, Bitcoin provided returns of about 634% at the time of drafting. These are significant earnings, supported not only by the action of prices but also by strong fundamental. The institutional accumulation via ETF and Holdings Treasury Bitcoin was robust and the data on chain show a large percentage of long -term owners who refuse to obtain profits. Historically, this is the type of background that precedes a strong phase of running late in the bull cycle, similar to what we have seen in previous cycles.

Current price cycle of Bitcoin

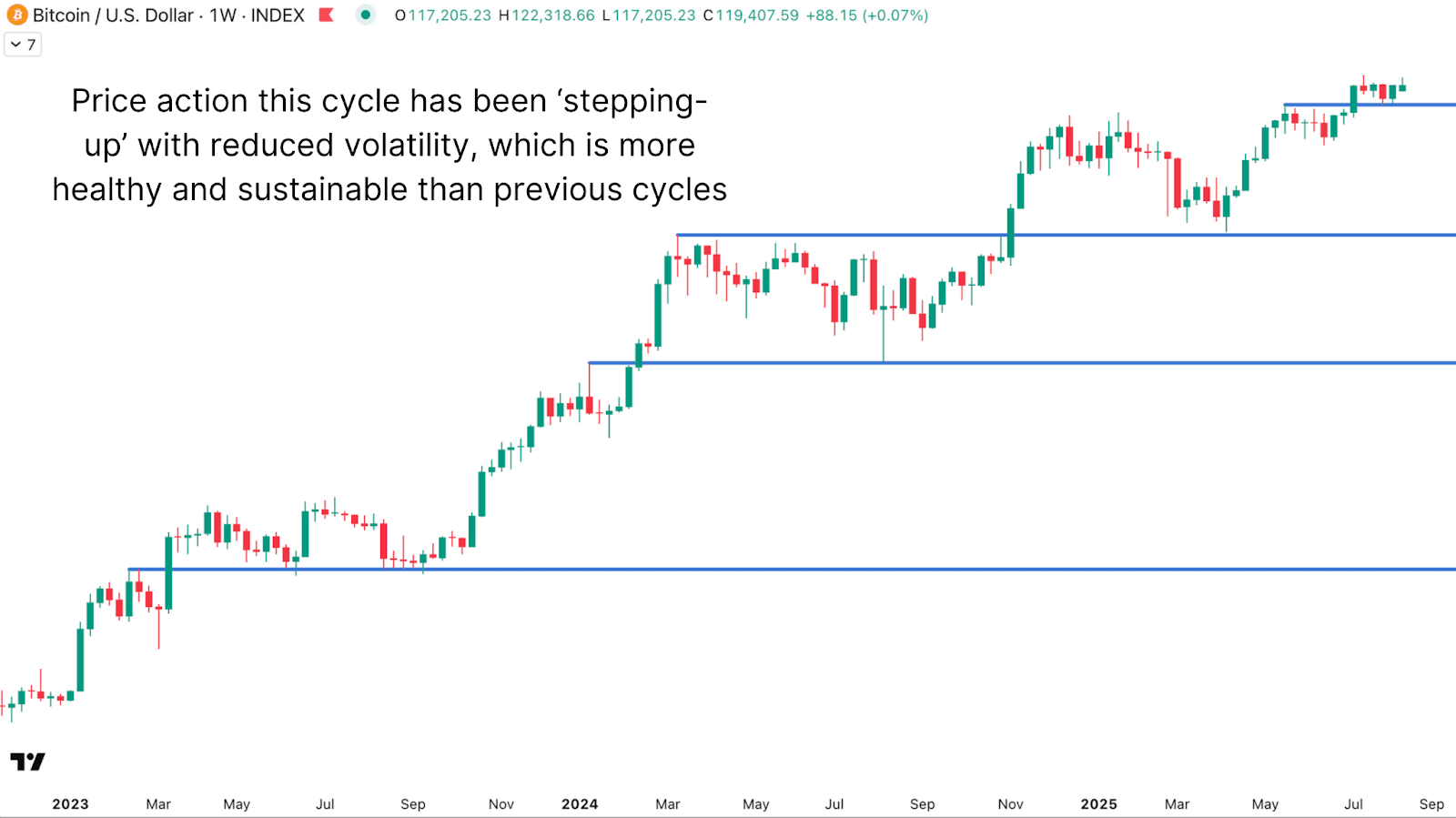

Turning to the USD price graph on TradingView, the current Bitcoin price cycle does not seem bad at all, especially in terms of stability. The deepest retracement of this cycle was about 32%, which occurred after exceeding $ 100,000 and pulled back to about $ 74,000 – $ 75,000. This is much lighter than 50% or greater than editorial offices observed in past cycles. Reduced volatility could mean a reduced rise potential, but it also makes the market less insidious for investors. The price structure followed a “step-up” model, acute rally followed by moved consolidation, then another event, repeatedly pushing towards new maximums of all time. From a fundamental point of view, the market remains strong.

Bitcoin price vs other activities

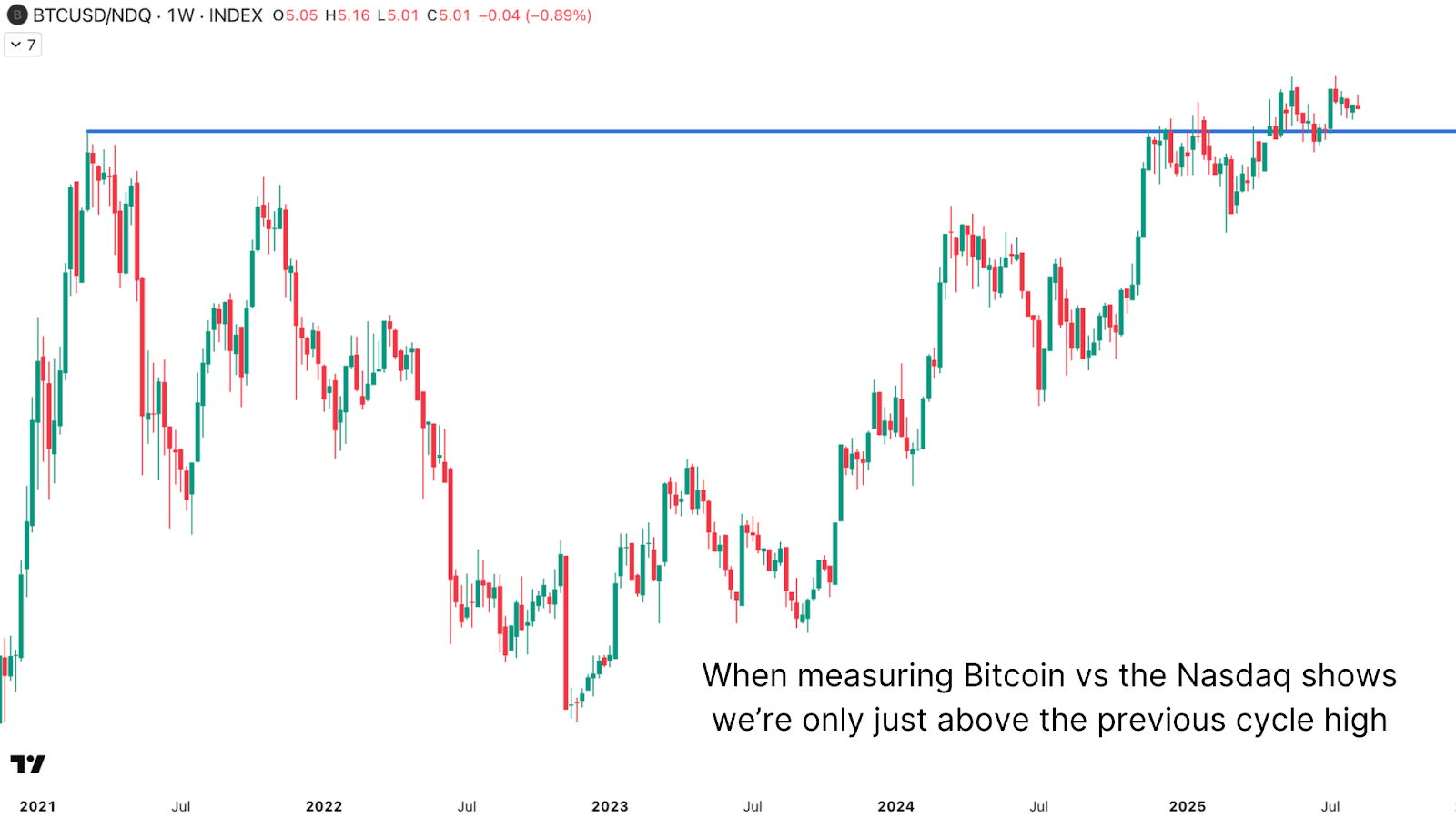

When measuring Bitcoin against something more stable than the US dollar, such as Nasdaq or other US technological titles, a different image emerges. US technological actions are also high -growing speculative activities, so this comparison is a more direct comparison of BTC vs USD. Here, Bitcoin performance seem less spectacular. In this current cycle, the climb beyond the previous maximum was minimal. However, the graphic designer shows that Bitcoin currently transforms the previous resistance to support, which can set the foundations for a more sustained move higher. What we can also see, looking at the previous double top cycle, is a second peak at a considerably lower level, suggesting that the second peak of Bitcoin in the last cycle may have been guided more by the expansion of global liquidity and by the tasting of the Fiat currency than with the real overprinting.

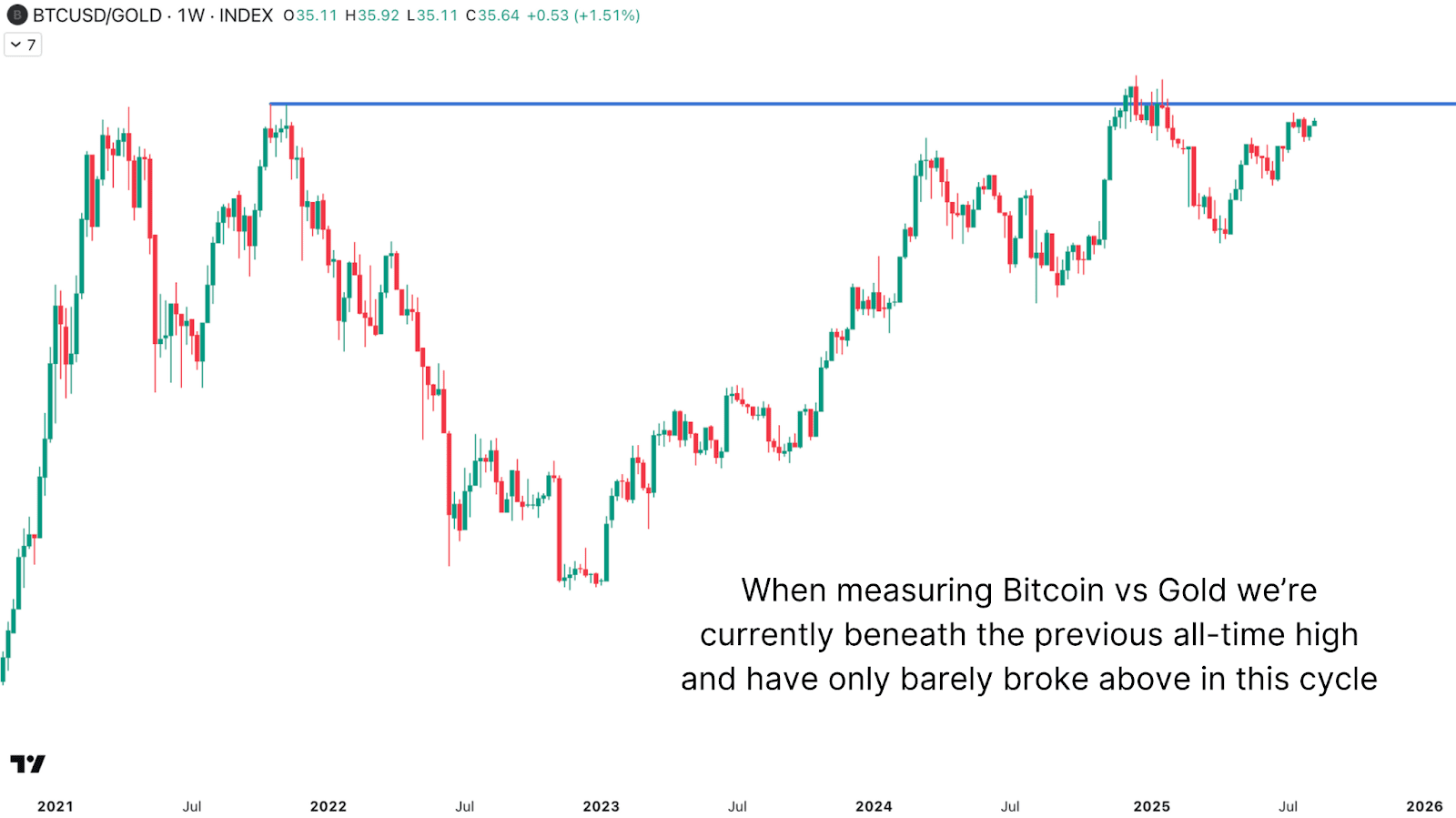

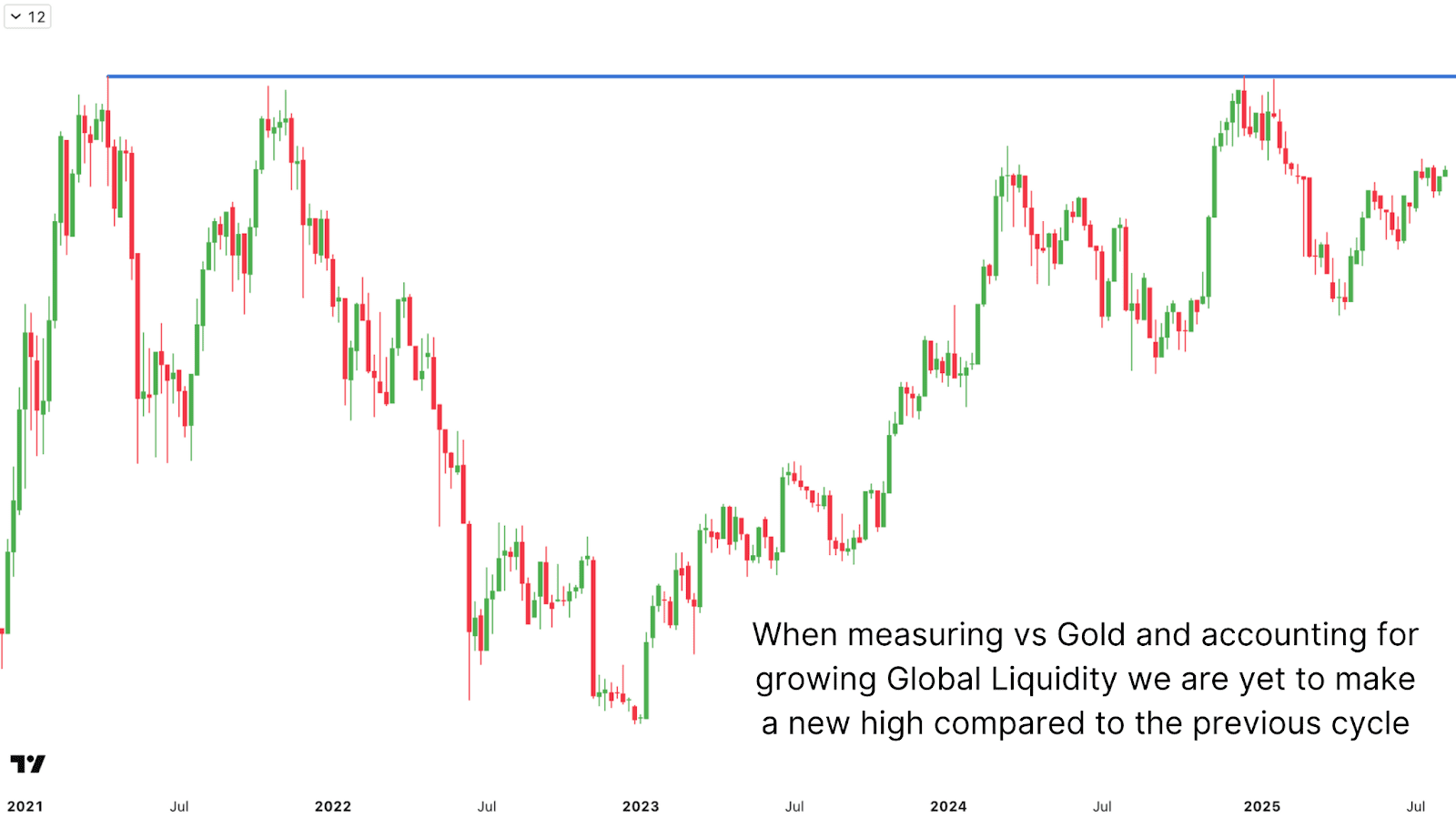

The “Digital Gold” narration invites another important comparison, looking BTC vs Gold. Bitcoin has not yet exceeded its maximum preceding all time from the 2021 peak when measured in gold. This means that an investor who purchased BTC at the peak of 2021 and kept so far would have been submitted compared to the simple possession of gold. Since the last cycle of the bass, Bitcoin vs Gold has returned over 300%, but the gold itself was in a powerful bull race. The measurement in terms of gold moves away the effects of degradation of Fiat and shows the “true” purchasing power of BTC.

Real purchasing power

To take a further step forward, adjust the Bitcoin VS Gold paper for the global expansion of the M2 money offer paints an even more reassuring image. When explaining the enormous liquidity injections in the global economy in recent years, the peak price of the Bitcoin cycle in terms of gold adequate to liquidity “is still below the previous peak. This helps to explain the lack of retail excitement, as there is no new maximum in terms of power of real purchases.

Conclusion

So far, the Bitcoin Taurus market has been impressive in terms of dollars, with over 600% of earnings from the minimum and a relatively low volatility climbing. However, if measured against activities as US or gold technological titles, and above all if regulated for the expansion of global liquidity, the performance is much less extraordinary. The data suggest that most of the rally of this cycle may have been powered by the Fiat tasting rather than by pure supert -computer. While there is still room for a significant advantage, especially if Bitcoin can break through the adequate resistance to liquidity and push even higher, investors should also pay close attention to these relationships of relationship. They offer a clearer perspective on the relative performance and could provide precious clues on where the price of Bitcoin could go.

Did I like this deep immersion in the dynamics of Bitcoin prices? Subscribe to Bitcoin Magazine Pro on YouTube for more experienced insights and market analysis!

For further immersion searches, technical indicators, real -time market notices and access to the analysis of experts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.