Following a strong most weeks that dragged Bitcoin from over $ 100,000 less than $ 80,000, the recent bounce of prices has traders that discuss if the Bitcoin Bull market has really returned to the track or if this is only a beat market rally before the next highest macro leg.

The local Bitcoin bottom or the bull market break?

The last correction of Bitcoin was deep enough to shake the trust, but superficial enough to maintain the structure of the macro trends. The price seems to have set up a local fund between $ 76k and $ 77k and several reliable metrics are starting to consolidate local minimums and aim for further rise.

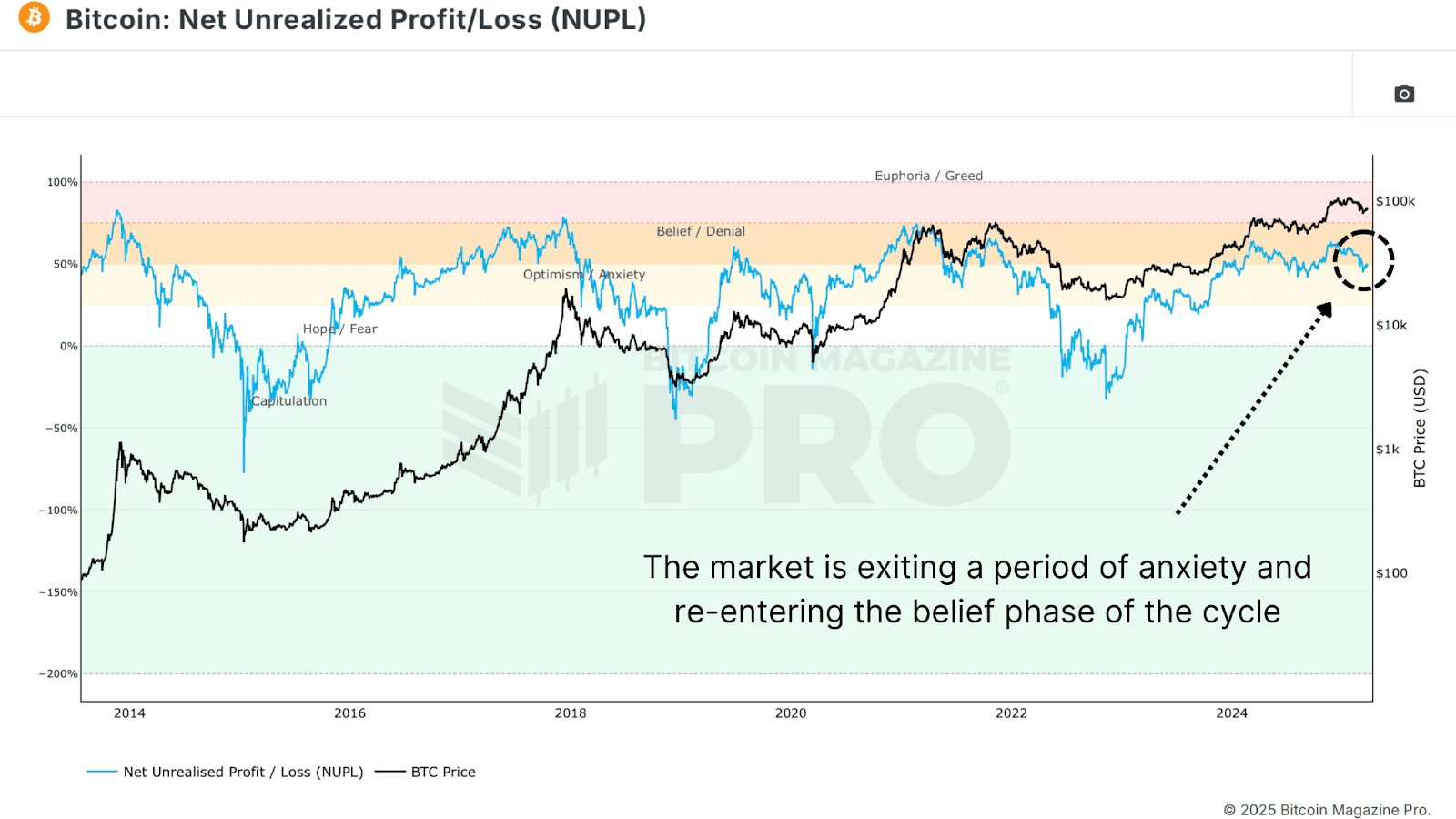

Profit and unrealized net loss (vacancies) is one of the calibers of most reliable feelings in Bitcoin cycles. When the price decreased, Durah went down to the “anxiety” territory, but following the rebound, Hungus has now recovered the “conviction” area, a transition of critical feeling historically seen in minimal macro higher.

The days of value destroyed (VDD) multiples weighs the BTC expenditure both for the age of the coin and for the size of the transactions and compare the data with a previous annual average, providing information on the behavior of the long -term owner. The current readings have remained at low levels, suggesting that large and aged coins are not moved. This is a clear signal of conviction from Smart Money. Similar dynamics preceded the main prices of prices both in the 2016/17 Toro cycles and 2020/21.

Long -term bitcoin owners increase the bull market

Now let’s also see the supply of long -term titles that starts to climb. After obtaining profits greater than $ 100k, long -term participants are now rushing to lower levels. Historically, these storage phases have fixed the foundations for the supply of supply and the subsequent parabolic prices of prices.

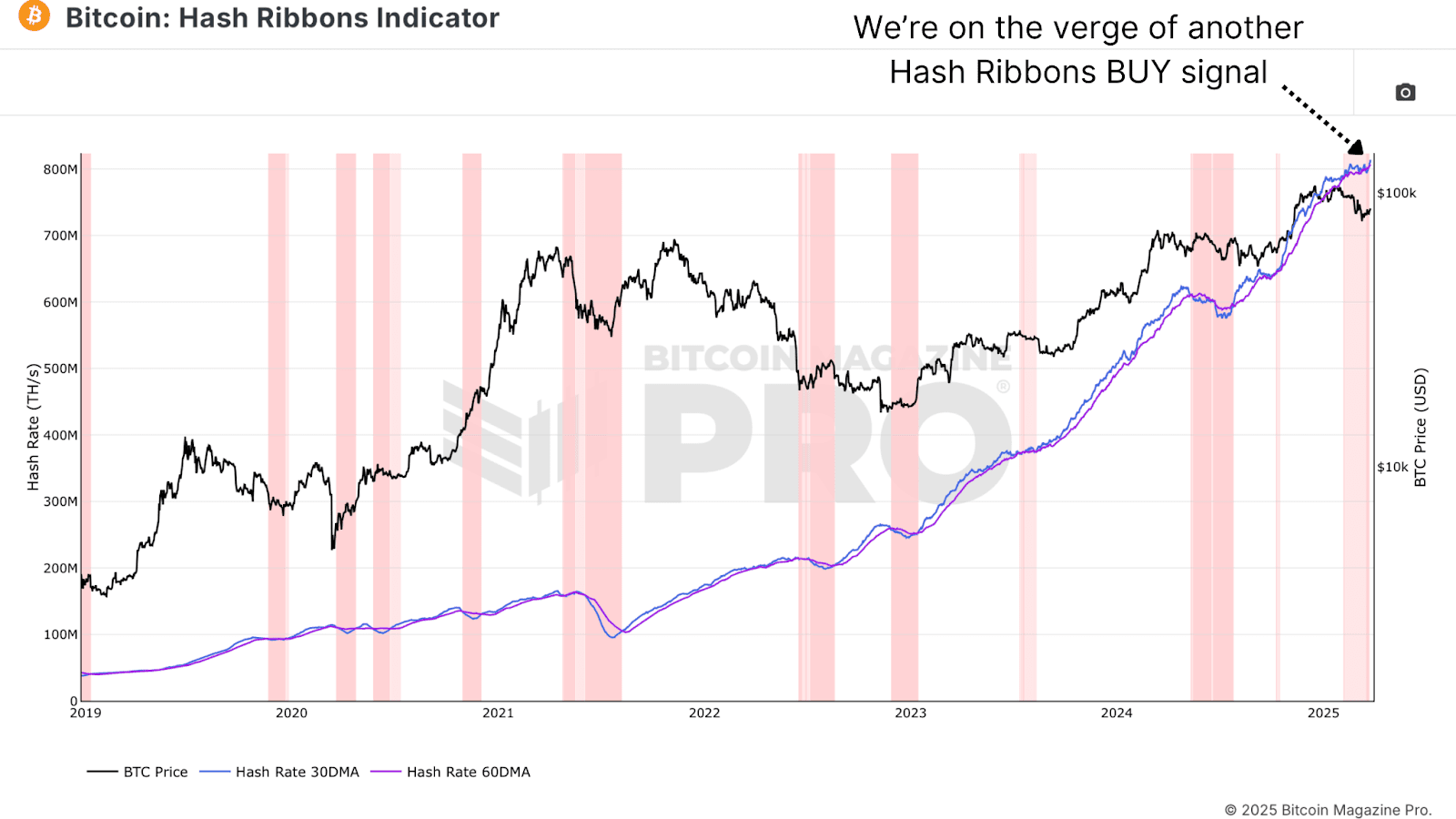

Bitcoin Hash Ribbons Signal Bull Market Cross

The Hash Nastri indicator has just completed a bullish crossover, in which the trend of short -term hash speeds moves above the long -term average. This signal has historically aligned with the bottom and the trendy inversions. Since the miner’s behavior tends to reflect profitability expectations, this cross suggests that miners are now confident in the highest prices.

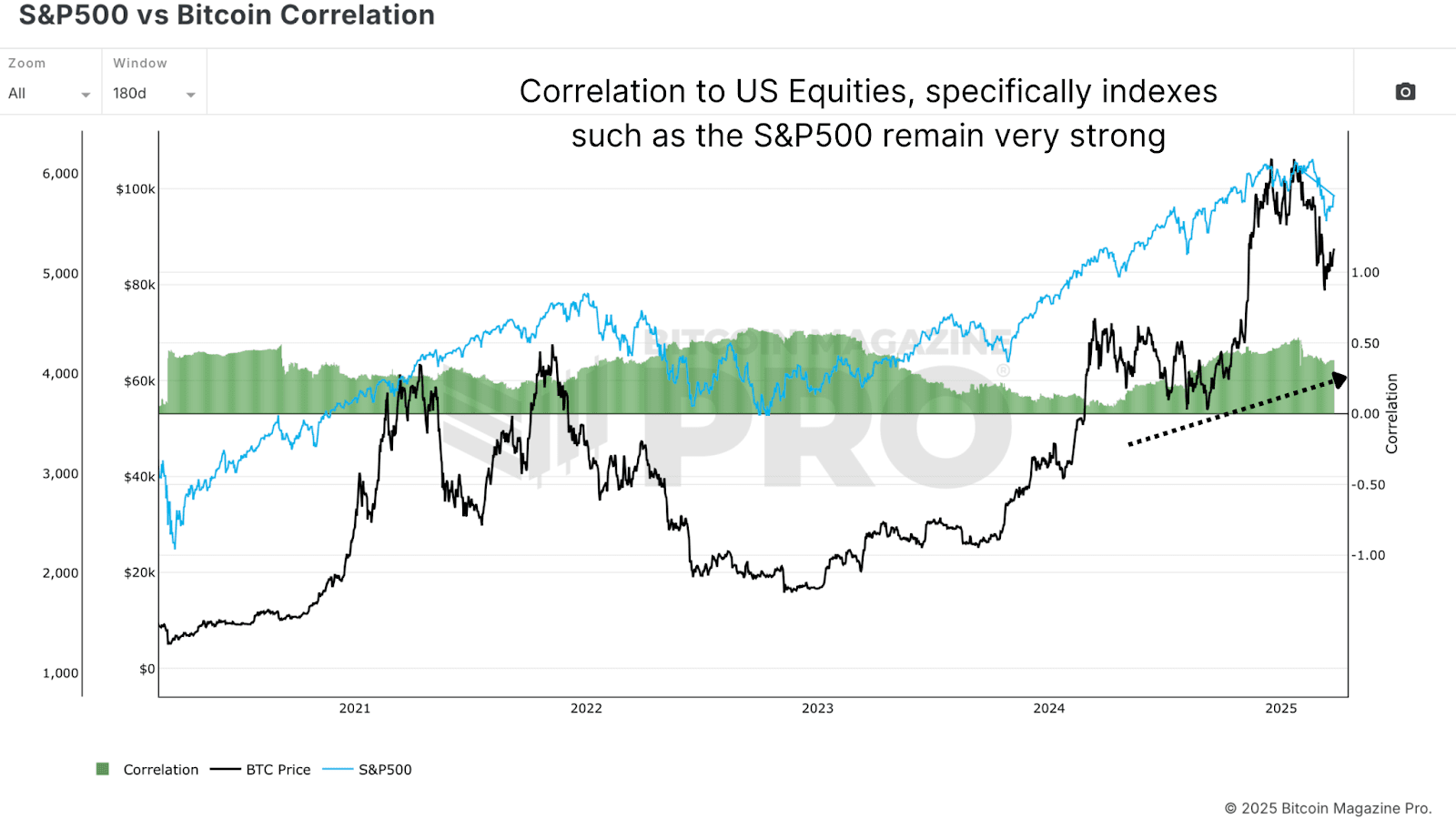

Bitcoin Bull Market linked to actions

Despite the upward data in the chain, Bitcoin remains closely linked to the macro liquidity trends and the share markets, in particular the S&P 500. Until this correlation holds, BTC will partially be at the mercy of global monetary policy, the feeling of risk and liquidity flows. While rates cutting expectations have contributed to bouncing activities at risk, any acute reversal could cause a renewed beat for Bitcoin.

Bitcoin Bull Market Outlook

From a data -based point of view, Bitcoin seems more and more well positioned for a supported continuation of its bull cycle. Chain metrics paint a compelling resilience image for the Bitcoin Bull Market. The profit and unrealized net loss (vacancies) moved from anxiety during the dive to the “conviction” area after the rebound, a transition often observed in minimal higher macro. Likewise, the destroyed days of value (VDD) are restored to the levels of reporting between the long -term owners, echoing the models before the Bitcoin gatherings in 2016/17 and 2020/21. These metrics indicate the structural resistance, strengthened by long -term owners that aggressively accumulate the offer of less than $ 80,000.

By further supporting this, the recent bullish crossover of the hash reburs indicator reflects the growing confidence of miners in Bitcoin’s profitability, a reliable sign of inversions of trend historically. This accumulation phase suggests that the Bitcoin Toro market may have prepared for a narrow, a dynamic that has fueled the parabolic moves previously. The data collectively highlight resilience, not weakness, since long -term holders captured the dip as an opportunity. However, this force depends on more than simple signs on chain: external factors will play a fundamental role in what will come later.

However, the Macro conditions still guarantee caution, since the Bitcoin Tori market does not work isolated. Toro markets take time to build momentum, often require constant accumulation and favorable conditions to turn on the next higher leg. While the local fund between $ 76k and $ 77k seems to hold up, the forward route will probably not yet present vertical candles of peak euphoria. Bitcoin’s link with S&P 500 and global liquidity tendencies means that volatility could emerge from changes in monetary policy or feeling at risk.

For example, while the rate of cutting of the rate have revoked the activities at risk, an abrupt inversion, perhaps from inflation peaks or geopolitical shocks, could test the stability of Bitcoin. Therefore, even with the chain data that report a robust configuration, the next phase of the Bitcoin bitcoin bull market will probably take place in the measured steps. Traders that anticipate a return to six -digit prices will need patience since the market builds its foundations.

If you are interested in a more in -depth analysis and given in real time, consider taking a look at Bitcoin Magazine Pro for precious insights on the Bitcoin market.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.