Is Blackrock to become the largest auditor in Ethereum? ETH USD is about to get up leverter app after recovering $ 4,300 for the fourth time in 48 hours. The collapse from here is the second number of digital assets to the highest new level ever, exceeding its highest level in November 2021 at $ 4,878.

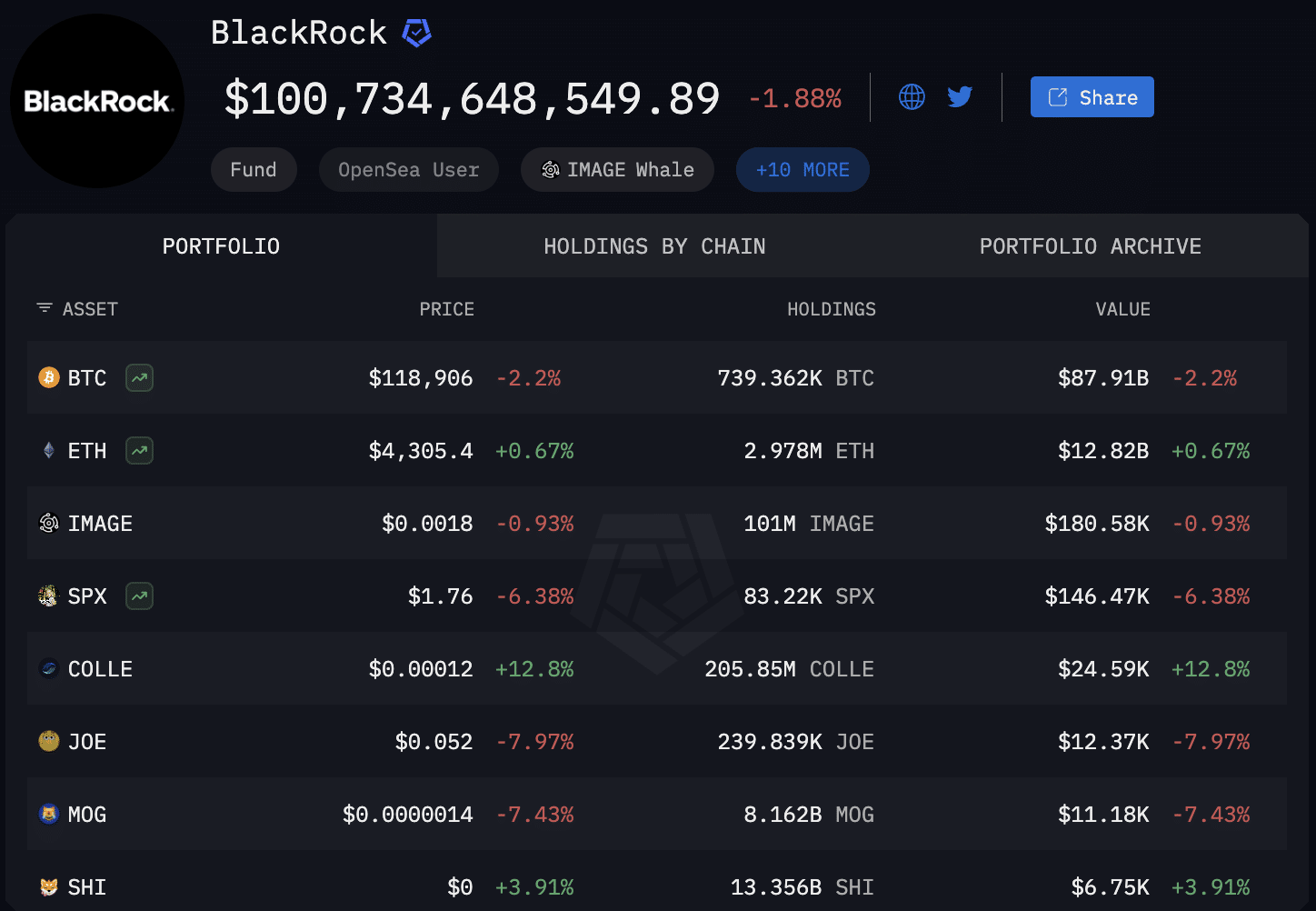

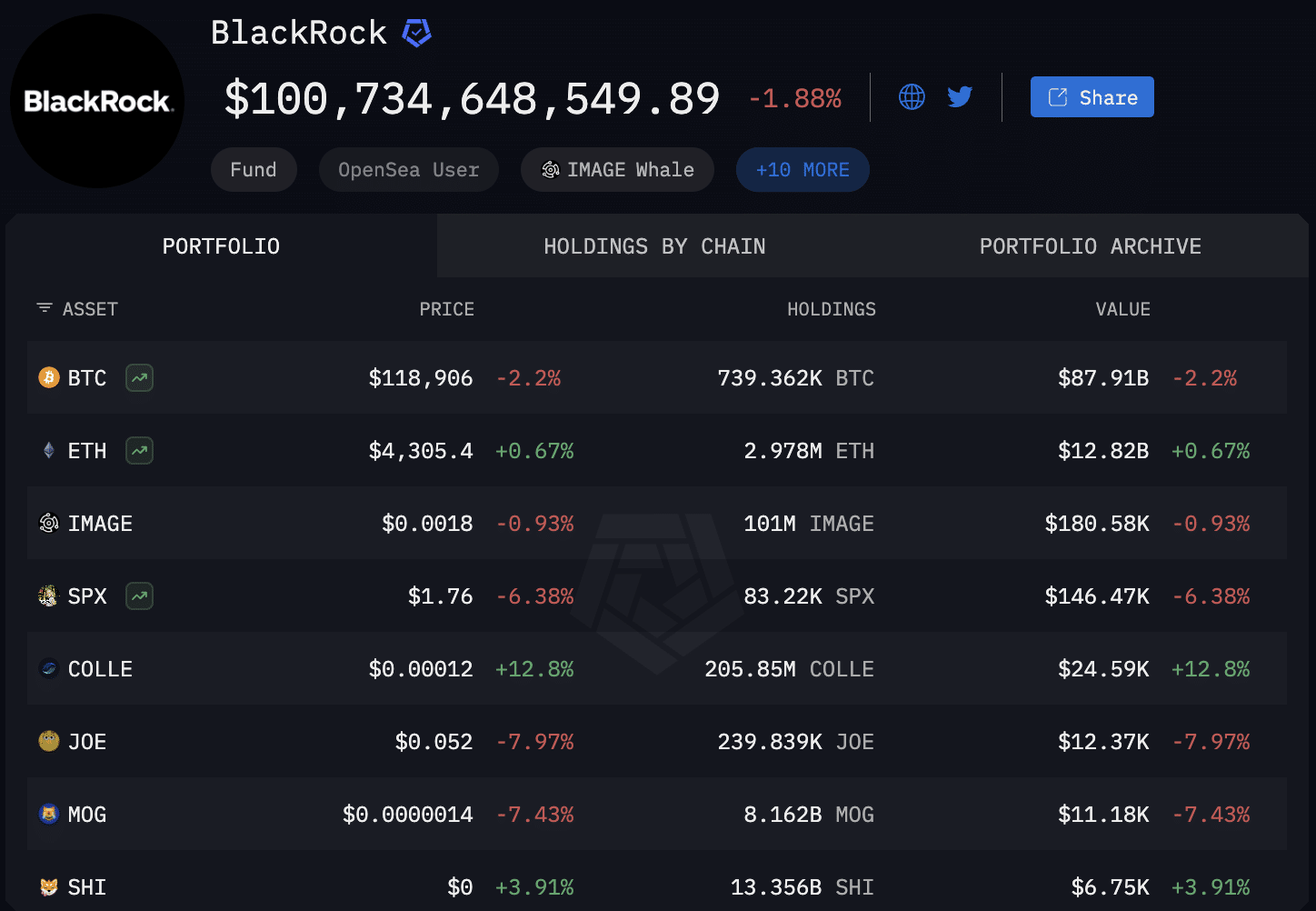

This last procedure of ETHEREUM prices coincides with Blackrock, who is doing one of the most important eths since I started accumulating, as he got 150,584.76 dollars for $ 639 million, with the director of Crypto Times Topings more than $ 100 billion for the first time, per Arkham.

(Arkham)

Discover: The 12 most important encryption for purchase now

Blackrock now holds $ 12 billion in ETH USD – what do they know?

Thanks to the latest purchase of nine ETH USD numbers, Blackrock now has more than $ 12.8 billion in ETHEREUM, its second largest contract behind Bitcoin ($ 87.91 billion).

Blackrock is the largest asset manager in the world, with more than $ 4.74 trillion of assets under management (AUM). For each hedge, the best reservation is the Apple Stock (AAPL), for $ 253.27 billion. Now, Crypto’s possessions exceeded $ 100 billion, making it the fifth largest Holding, and the superiority of Meta (Meta), which has a value of $ 95.89 billion in stocks.

Not talking about the importance of the world’s largest asset manager made Crypto the fifth largest detention. Its collective accumulation of ETH, while it is still more than 11 % of its high level ever.

For context, BTC rose about 90 % of its highest level in November 2021 at $ 67,617. He is currently trading for $ 118,600 and appears ready for another leg. It seems that Blackrock has monitored Ethereum Qadama. ETHEREUM is the second largest digital asset according to the maximum market and has not yet received a new level over the past four years.

Through the current ETH wives that make Blackrock the largest company holder in ETAREUM, it highlights demand and success in the Ethereum Etf Spot product. For all Coinglass data, yesterday, 1.02 billion dollars were seen in the positive flow of all ETHEREUM investment funds, with more than 639 million dollars from ETF from Blackrock.

Blackrock is now seeking to obtain approval from SEC to allow ETH assembly. If he is passed, this may see the asset manager earns more than 209 ETH in the return on ETHEREM Daily, This is the equivalent of about $ 867,000 in Eth Daily Orth rewards, which is an amazing amount for Blackrock and Etha investors.

Blackrock bought 12,065,478,744 dollars $ ETH.

You may want to check the amount of Ethereum you keep.

Do not leave without exposure. pic.twitter.com/pkm7eycsts

– TED (ettedpillows) August 11, 2025

Discover: Top Solana Meme Coins for purchase in August

Could Treasury Blackrock and Ethereum companies be the catalyst to send Ethereum to $ 15,000?

Not only does it buy Blackrock ETH in huge quantities, but the companies circulating publicly also take the Michael Saylor/Strategy approach and photographing ETHEREUM.

Sharplink Gaming (SBET), headed by the co -founder of Ethereum Joe Lubin, and BitMine (BMNR), is a pre -mining company Bitcoin led by Tom Lee, the most prominent. Both companies now have 1.67 million eth and are still buying.

The difference between the Bitcoin and ETHEREUM One Treasury strategy is the return displayed with eth stokeing. The current APR is about 2.6 % on average, which means that these companies can only gain great attention to find ethereum.

This opens the possibility of being a more profitable project than the same strategy with Bitcoin due to the displayed return. With the presence of ETH USD under the rise of 2021 at all, the continuous purchase of the giant ETHEREUM such as Blackrock and other asset managers, as well as ETH cabinet companies such as Sharplink and BitMine, makes the ability to hit ETHEREM 100,000 dollars+ this course is real.

Retail investors can now invest in Ethereum without the need to move in encryption exchanges, embarrassing user interface, and unforgettable operations. By simply investing in the Ietha Bloc in Blackrock or buying SBET/BMNR shares, investors can ease ETHEREUM treatment more easily than ever.

Then, if you add to the mix, the opportunity to reduce the price of 25 amputations per second in September in FOMC meetings in the Federal Reserve, sit 73 % of “yes” on the prediction platform, polymer polymers, and matters are formed for USD to five numbers in 2025.

Explore: Best ICOS Mimi Investment in 2025

Join Discord 99bitcoins News here to get the latest market updates

The post is to become Blackrock the largest auditor in Ethereum? Here is how ETH USD can reach $ 15,000 first appeared on 99bitcoins.