Eter ETH in the American list has recorded five consecutive days of net external flows, adding pressure on ETHEREUM boxes and more soft signals than smaller investors.

Faris Data She appears 248.4 million dollars, left the products on Friday, which paid weekly recovers to 795.8 million dollars. The ether decreased by -10 % on the same extension.

It is the longest decline since the week ended on September 5, when the distinctive symbol was traded near $ 4,300.

One large question hanging on the market: Stokeing. Merchants are waiting to see if American organizers will allow roaming inside the investment funds circulating in the ether. On September 19, Reports Gaycale was preparing to share part of the large ETH staple, reading widely as a vote on confidence that the Supreme Education Council could allow it.

Fracture: Gray is preparing to participate $ ETH Property. $ Ethe $ ETH

They moved more than 40 thousand $ ETH In the last hour when applied (1.5 meters $ ETH) In favor of rewards.

They are the first Ethereum ETF in the American market to do so. pic.twitter.com/vsomr0vnhq

– Emmett Gallic (EMTGETGALIC) September 18, 2025

The timing is not clear. Feelings are not. “It is a sign of surrender because the sale of panic was very high.” He said From external flows.

$ ETH The investment funds are just circulating the largest weekly flow ever.

This is a sign of surrender because the sale of panic was very high.

Do you think $ 3,750 was the bottom of ETH? pic.twitter.com/drjlssokjc

– bitbull (@akabull_) September 27, 2025

Bitcoin products also felt cold. Spot BTC ETFS $ 897.6 million in net external flows during the same five days. Bitcoin -5.28 % decreased a week and changed at about 109551 dollars at the time of the press.

ETF analyst James Sevart He said In Podcast on Thursday, Bitcoin Etfs was not “completely hot over the past two months,” noting that they remain “the biggest launch of all time.”

Live Now – Rush Crypto ETF did not startjseyff Join us to appoint Boom Crypto Etf: What is real, what’s the next, and who already buys.

We are digging in how to open the investment funds circulating in Bitcoin and Ethereum in the flood gates, how advisers, hedge funds and even sovereign wealth funds … pic.twitter.com/jnafgnr7d0

Without Bank (banklesshq) September 25, 2025

Flows may depend on the position of the Supreme Education Council. Green light for straightening can be a fixed order on the ether boxes. Until then, price procedures and ETF data will set the tone.

Can the purchase of institutions pay ethereum until $ 4000?

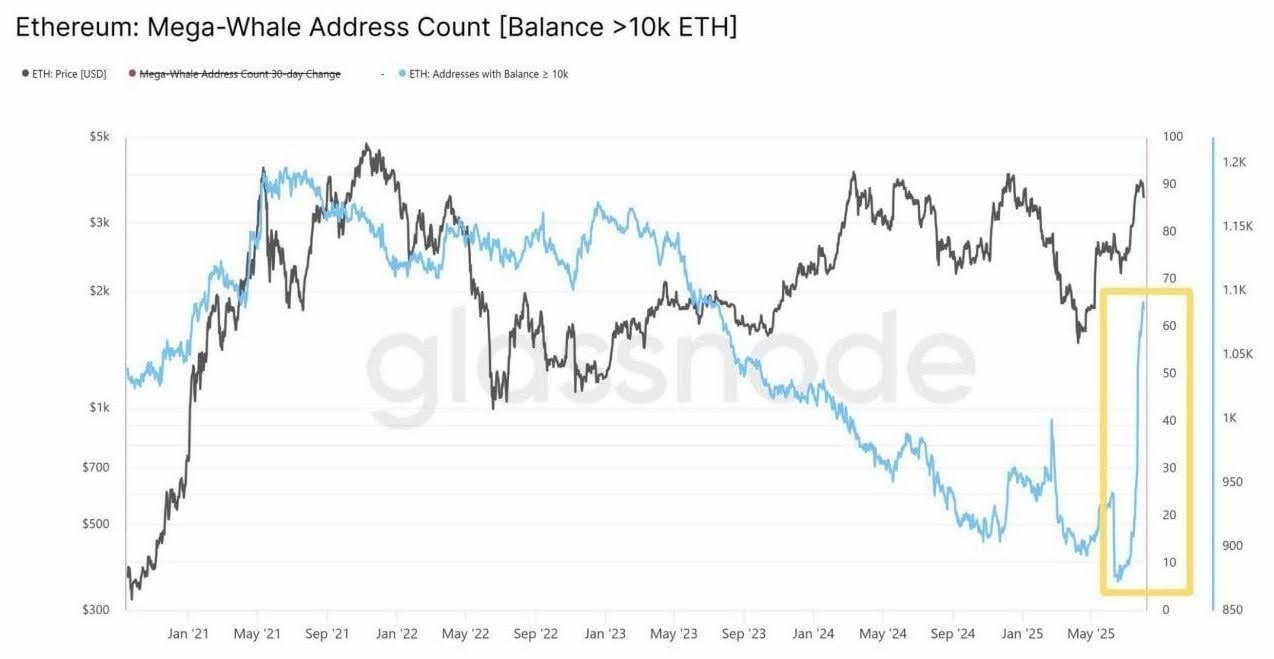

according to GlassnodeI return the largest Ethereum holders to the purchase mode. A wallet has grown with 10,000 ETH or more, often called huge whales, in one of the fastest sections in years.

((Source: Glassnode))

More than 60 of these titles have appeared in recent weeks, and the last time was seen in early 2021.

The shift came after the ETH was reclaimed a sign of $ 4000. It indicates the renewal of confidence from institutions and long -term holders who tend to buy when they see the value.

In previous sessions, an increasing share of metal currencies in large wallets lined up with the accumulation stages that preceded the main moves. These entities often include money, lymphists and high -value investors.

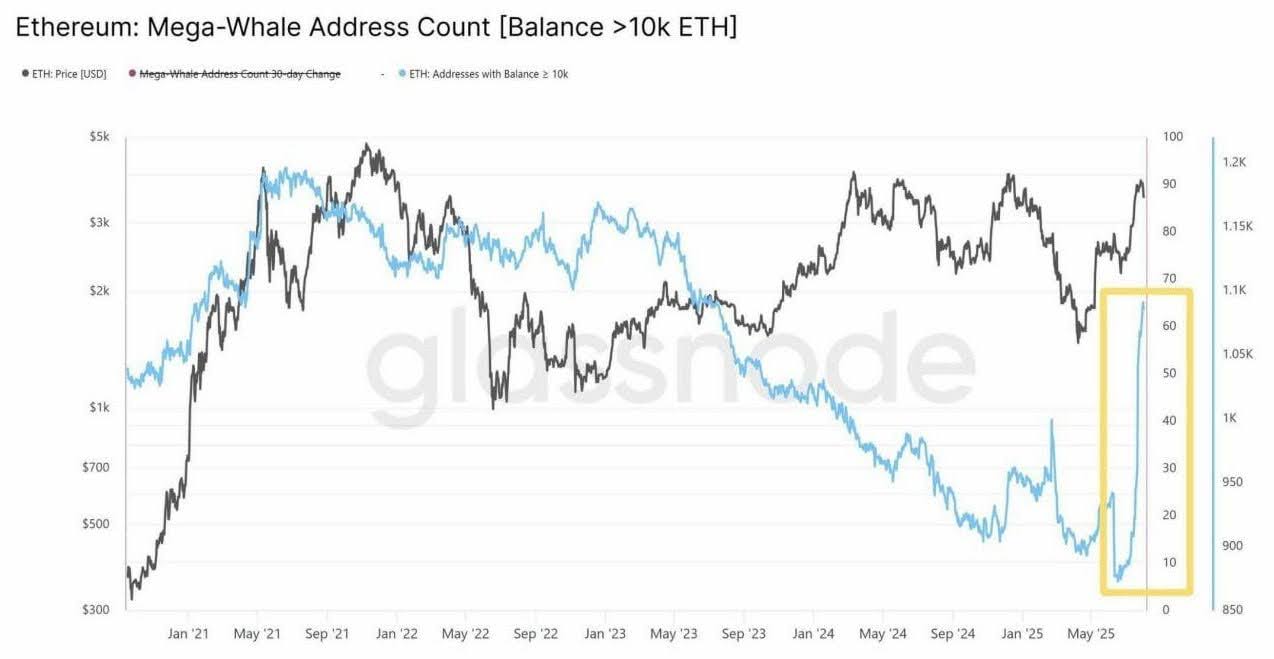

The derivatives add to the image. Future GPS is enlarged in addition to immediate purchase, which suggests that adult players are building exposure across the markets.

It can attract retail later but also makes fluctuations more clear if the functions are fluctuating.

Yes, the whales have a history of profit near the tops. However, the speed and size of modern additions looks like long -term sites of short -term trading.

Currently, the data indicates that deep buyers still see ETH as a basic origin tending to known stimuli such as using the broader wider and any progress in ETF plans.

Coinglass Data Ethereum Futures shows the open interest that approaches $ 70 billion, near the readings seen near the peak of 2021.

((Source: Coinglass))

Follow the jump to pay ETH above $ 4000 and new signals money entering the market through derivatives.

Open interest height tells us that more traders have active contracts. It does not say who will be right, just can follow a greater step.

When the location is crowded, financing and references are important. If you dominate the longs, the sharp retreat can a snowball. If the short pants are strongly inclined, the pressure can work quickly.

Discover: 20+ Cracking the next explosion in 2025

ETHEREUM price: Can Ethereum closed over the resistance of $ 4,300-4,400 dollars?

Merlijn merchant He says ETH is pressed against a long-term roof near $ 4,300 -4,400 dollars. His scheme shows repeated failures in that band since 2021.

$ ETH It is pressure against resistance.

You will follow a clean step and discover prices.

Goals: 10 thousand dollars+ and beyond.The gathering will not be great.

It will be legendary.Just hunting? You need steel balls to survive. pic.twitter.com/rbvjmvsn85

– Merlijn Trader (Merlijntrader) September 27, 2025

He argues that the clean daily closure above will push ETH to the discovery of prices, which opens a path to much higher levels.

((Source: x))

It is even called the “legendary” potential step, and put it as a structural break instead of slow grinding.

The danger is the noise around the penetration: the feelings can be turned quickly, and the crumbs are failed over the resistance. Simple preparation, holding below and domain; It can quickly expand with strength and momentum.

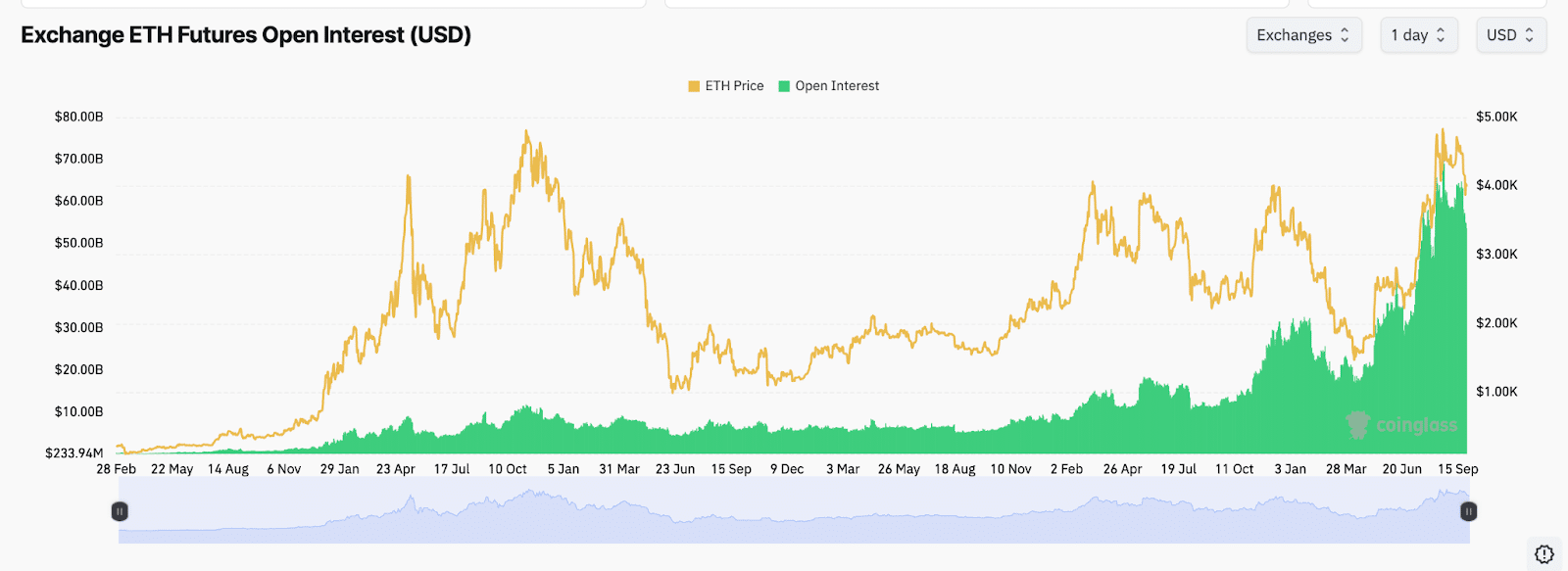

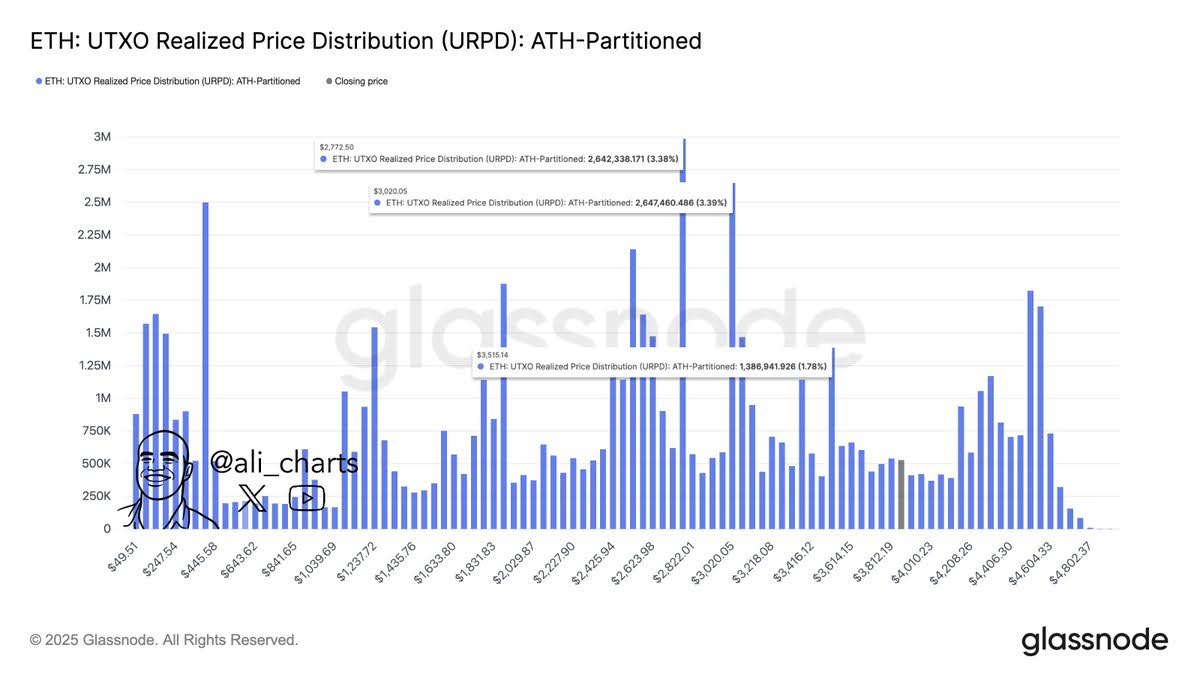

Analyst Ali Martinez Flags three areas to see On the way below: $ 3,515, $ 3,020, and $ 2,772.

Three support levels to watch ethereum $ ETH: $ 3,515, $ 3,020, and $ 2,772. pic.twitter.com/m6uitugvjz

Ali (ali_charts) September 27, 2025

His point of view depends on the distribution of the investigators, which is planning where you buy many titles eth last time.

These groups often behave like speed bumps for sale. The area of $ 3,020, due to the purchase of the heavy past there.

((Source: x))

Keeping this shelf would keep the trend based and limit the negative side after sharp moves. Check it, and the market can re -test deeper support layers in the late relaxation period.

In short: respect $ 3,515 to decline, treat $ 3,020 as a hub, and see $ 2,772 as FailSafe at the tension event.

He discovers: 16+ New Binance menus in 2025

Join Discord 99bitcoins News here to get the latest market updates

The post is ethereum to south? A week of flowing flows appeared to the eth USD first on 99bitcoins.