Tether, USDT, storing Bitcoin in 2025. Is this a strategic step to protect from Depeg Usdt? In 2021, USDC distinguished it and could not restore the wedge immediately because the banks were closed.

The largest Stablecoin in the world through the maximum market – has been accumulating bitcoin with the past few months.

Tether Stockpilt Bitcoin: Is this a strategic step?

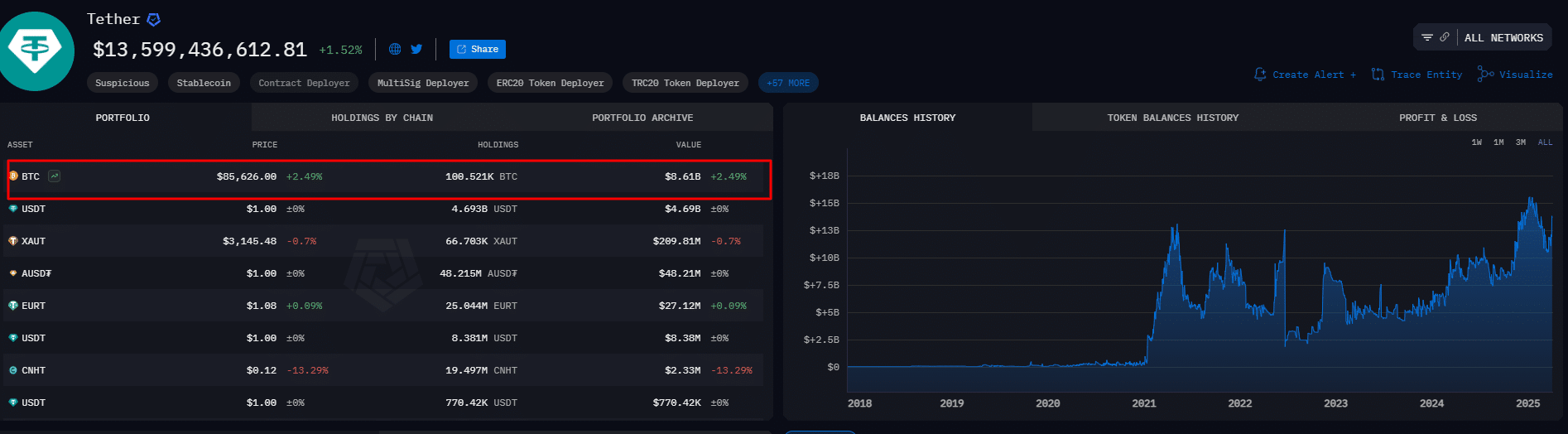

According to Arkham data, in the first quarter of 2025, Tether, which was also invested in Bitcoin Mining in Paraguay, 8,888 BTC, reached its total possession to 100,521 BTC.

(source)

At this pace, Tether, a private company whose shares are not traded in any exchange, is among the largest BTC holders, an overdose (formerly Microstrategy). However, it holds BTC more than Timing.

This massive accumulation of BTC is the reason why some on X believe that the step is strategic and can benefit greatly from the USDT source in the event of Depeg.

Will you sell Tether Bitcoin if it is USDT Depegs?

In a publication, an analyst said that Bitcoin storage is “something unspecified.”

Something not specified about Tether is that if USDT is temporarily out of PEG (such as what happened with USDC), they have 7.8 billion in BTC to immediate

While Circle has all its money in banks, the reinstalization may take longer (conversion delay)

0xngmi (@0xngmi) April 2, 2025

If Usdt, who currently has The maximum market Of more than 144 billion dollars, Depegs can sell Tether some BTC at immediate prices and restore the wedge without delay.

It cited USDC Depeg of March 2023, where Circle waited for two days to reopen banks before the equivalence.

Unlike its opponent, the analyst believes that Tether can sell part of Bitcoin’s bodies to restore Depeg without causing panic in the encryption trading community.

However, until the DEPEG event – such as the Terra collapse in 2022 when USDT decreased shortly to $ 0.96 or when FTX collapsed, forces USD to $ 0.971 – it remains unknown whether Tether will sell Bitcoin as a first line.

Bitcoin Tether Reserve

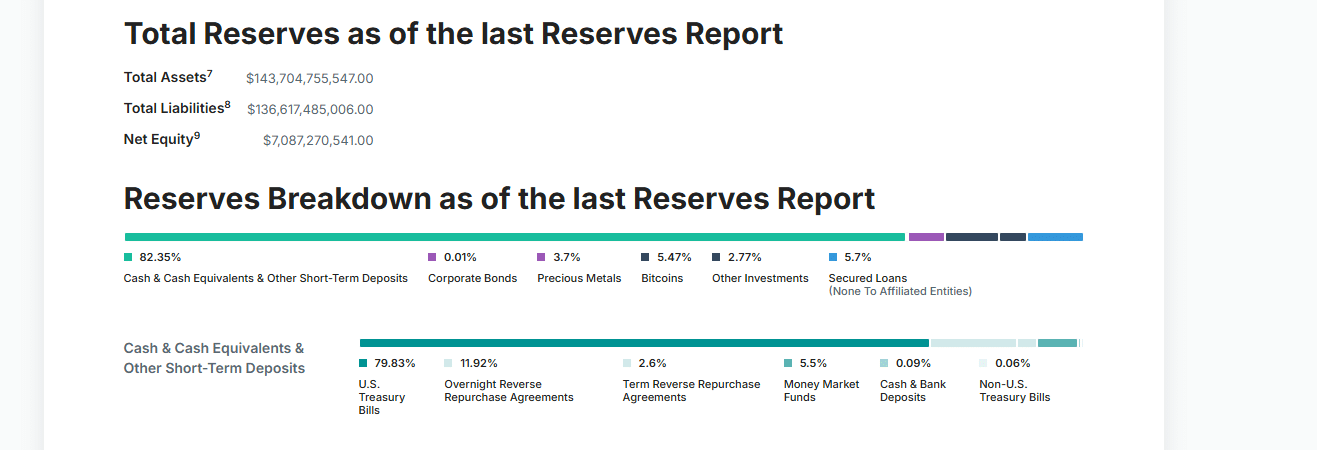

Tether claims that all USDT in trading is supported by criticism and other liquid equations, such as Holdings, US Treasury. However, no formal audit was confirmed in its reserves. If there is anything, there is no discount that they may carry some of the best metal currencies to invest in 2025.

from Cord transparency pageThe source holds 82.35 % cash and cash rewards, including short -term US Treasury bonds, as part of their reserves. Warmed loans make up 5.7 % of the total reserve, while Bitcoin constitutes 5.47 %.

(source)

Currently, if Usdt Depegs, Tether may filter the treasury bonds before unloading Bitcoin. This step will be because the cabinet is more liquid than BTC.

At the same time, the sale of bitcoin in a crisis may destabilize the market more, which exacerbates the problem and may cause more liquidity problems in the encryption market.

Is Bitcoin the way?

However, Tether is committed to BTC stacking, which is relatively liquid and more volatile than the cabinet. Bitcoin is likely to keep a long -term investment instead of emergency liquidity, which enhances its position as one of the best encryptions to buy.

It is also a strategy. While priority is given to the United States the creation of appropriate Stablecoin laws and the creation of an encrypted and bitcoin reserve, Tether corresponds to the main developments.

This approach will continue despite Jpmorgan Claim Some Tether reserves may include incompatible assets such as precious metals and corporate debts.

JPM analysts are salty because they do not own Bitcoin.

– Paulo Erdino

(Paoloardoino) February 13, 2025

In response, Tether rejected these concerns, saying that JP Morgan is “salty” and does not have enough BTC.

He discovers: 9 High -risk high risk encryptions for 2025

Tether Bitcoin Strategy: Will you sell BTC if it is USDT Depegs?

- Tether Bitcoin Holdings exceeds 100000 BTC

- Will you sell Tether Bitcoin if it is USDT Depegs?

- The USDT reserves are mainly consisted of liquid and cash bonds

- BTC is a strategic contract as the encryption adoption picks up momentum in the United States

The post is this the real reason behind the purchase of Tether Bitcoin? First appeared on 99bitcoins.