The cryptocurrency market remains stable but cautious in view of the Federal Reserve meeting of 16-17 September. Investors are carefully attentive to signs on monetary policy, with many who ask the same question: what is the best cryptocurrency to buy in this environment?

Bitcoin Btc ▼ -0.97% It is mistaken about $ 115,700 after briefly immersing less than $ 115,000. On the daily graph, BTC has recovered the support of $ 112k and now faces a resistance near $ 120,000. A breakout above this level could reopen the route to $ 124,000, while the failure to maintain $ 112,000 risks of $ 108,000.

Ethereum And ▼ -2.99% It is in the balance greater than $ 4,600 after a small dip, while the altcoins remain under pressure.

The sector losses were guided by Gamefi (-3.03%), Defi (-2.21%) and meme coins (-2.85%).

Discover: Did Etf Dogecoin change everything for meme coins?

Best cryptocurrency to buy right now: Bitcoin contains $ 116k, altcoins awaits ETF catalysts

In addition to the price action, several macro and imminent regulatory events could shape the next great Crypto move. From the September meeting of the Federal Reserve to the critical ETF deadlines and the Stablecoin policy shifts, these decisions will determine whether the capital dates back to Bitcoin and Altcoin or remains on the sidelines:

- FOMC Meeting (16-17 set): market price in a probability of 88% of a rate of the 25 BPS rate. This cut could increase bitcoin and risk activities.

- ETF expiration of October: sec decisions

XRP ▼ -3.66%,

SOL ▼ -5.81%,

Ltc ▼ -3.06%AND

Ada ▼ -6.26% ETFs can validate altcoin as goods, potentially unleashing affluent similar to Bitcoin Boom Etf.

- Stollecoin and regulatory shifts: the application of the Circle Trust bank and the first launch of the Mica of Spain could remodel the liquidity and compliance in cryptocurrency markets.

The FOMC meeting remains the short -term spark that could give the tone to the next stage of the market.

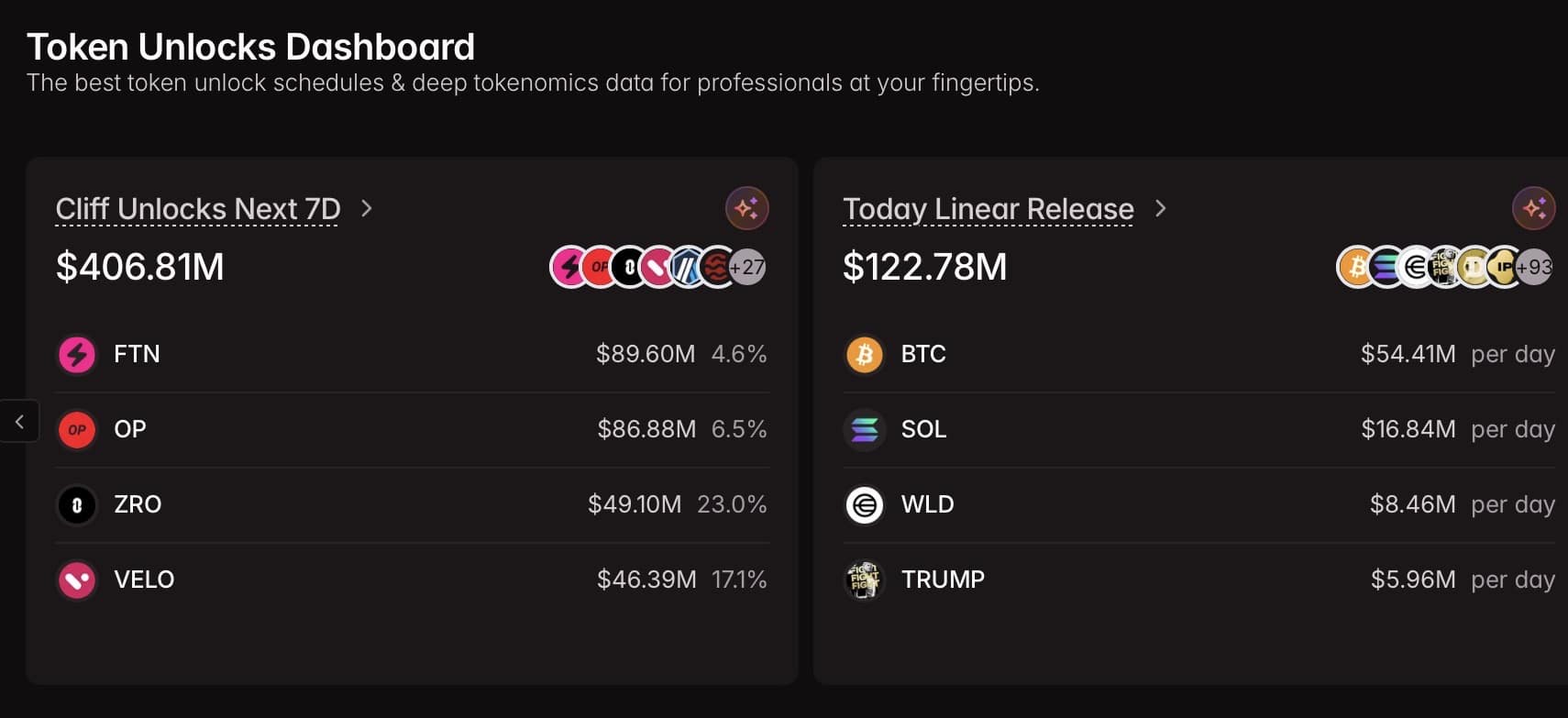

Token Unlocks for a value of over $ 790 million for release this week

According to Tokenomist, over 790 million dollars of token unlocking are programmed in the next seven days, placing a potential volatility for the cryptocurrency market. The main slopes of cliff above $ 5 million include op, ftn, zro, veil, arb, six, id, zk, kaito, ap, list and melania.

In the meantime, significant linear slaps that exceed $ 1 million per day involve Sol, Wld, Tia, Doge, Tao, Avax, Sul, Dot, IP, Morpho, Ethfi, JTO, Near and Ens.

Arthur Hayes: Bitcoin could break $ 200k, rejecting the four -year cycle

Arthur Hayes, Bitmex co-founder, says that Bitcoin’s trajectory will be more modeled by global liquidity than the traditional four-year cycle. In an interview with Kyle Chasse, Hayes claimed that banks and central governments all over the world will continue to print money and purchase of bonds, feeding activities at risk such as Bitcoin on actions such as the S&P 500.

He believes that the market underestimates this liquidity effect, which could drive BTC to $ 150k, $ 175k or even $ 200k by the end of 2020.

While the risks exist further in the cycle, Hayes insists that the real rise has not yet arrived.

Explore: Next 1000x Crypto: 10+ Crypto Token which can affect 1000x in 2025

The post [LIVE] Crypto News Today, September 15 – Why is encryption down? Bitcoin loses $ 116k while Altcoins late from Fomc: the best cryptocurrency to buy? He appeared first out of 99bitcoin.