Bitcoin mining has made a long way since the times of the GPUs and the installations of the basement. At that time, the miners advanced in countless ways. For example, the asic are now the standard, not the GPUs. In addition, the company level players entered the field, opening new frontiers and bringing with them the dimensions and institutional recognition that opens the doors to otherwise unattainable places for smaller miners. Nowadays, the mining landscape is that in which network services, reduction strategies and energy market participation are no longer cases of margin but basic strategies. While the world around has gone on, is there a question that we continue to hear from the miners: can PPLN adapt?

Many miners, in particular those who work closely with energy suppliers or the integration of response mechanisms to the question, have come to see the PPLNs with suspicion. They fear that the times of inactivity penalizes and rewards only the uninterrupted hash, a bad deal for those who usually reduce machines to support the network or provide other services.

This fear is not without foundation. He returns to a fundamental moment in the recent past of the mining industry, which apparently has sealed the agreement for many on PPLNS -style payments: the repercussions between Riot and Braiins Pool.

At the time, Braiins was using the score payment system. Designed in 2011 by Slush himself, the score was designed to solve the problem of jumping in the pool, when miners jump between the pools to take advantage of the reward systems. There has also been a misunderstanding that the score is a PPLNS -style payment system, but as Rosenfeld’s Bible describes on the POL Payment systems, the score and the PPN are clearly different payment methods. The main difference is the way they represent the actions, in particular, the score has implemented a rolling window with the exponential decay function, this actually made the very short lookback window. On the other hand, Pplns is a family of payment systems with various types of fixed length looks windows.

As shown on this website archived how the score worked, you can see that after 90 minutes your hashrate no longer had presence in the pool. This means that the moment in which a miner begins to extract, their premium share reaches the fair value of the hashrate quite quickly. On the other hand, when a miner stops with extraction, it drops just as quickly, as shown on the GIF below.

This may have worked well in the cowboy and hacker era, but it has never been designed with today’s complex mining environments. Certainly not with the answer to the question, in which miners intentionally and profitably take offline machines to stabilize energy networks or make offers in the accessory markets. To score, that type of behavior does not seem different from a swimming pool, someone who tries to cheat the system.

So when Riot left the Braiins, citing concern for payment mechanics, he sent a shock wave through the mining world. Due to the aforementioned misunderstanding, the defects of the score system were unjustly projected on a wider category of payments, the PPLNs were captured in the fray, capturing a stray bullet in the process and the industry collectively thrown the child with the bathroom water.

But the mining world has changed and it is time for Phoenix to get up from its ashes.

Slice: a payment mechanism for the 21st century grid

Enter SLICEA modern payment system ready for the open-v2 layer created by the DMnd team. It is an improvement and evolution of the PPLNs, which rethink the way the miners are paid, the prizes are calculated and, above all, the respect of the inactivity time

score. Everything while preserving the miner’s right to build your block models with SV2.

In the center, Slice concerns equity and transparency. He preserves the fundamental idea of the PPLNs, paying the miners in proportion to their effective contribution to the resolution of the blocks, while modernizing it for today’s decentralized mining landscape.

Key innovation lies in the way slices structures reward the calculation and how the lookback window works. Instead of treating the entire pool like a monolith, the slice interrupts the time in smaller and more working dynamics to correctly distribute the commissions component. These slices represent lots of actions presented in a specific period, in which we check the amount of the commissions in the Methemeol and compare and mark different work models for the financial value they represent. When a block is found, Slice distributes the subsidy to the block and transaction commissions separately. The subsidy is allocated proportionally by hashrate, while the commissions are distributed according to the value of hash and financial.

This is particularly relevant in a world where miners can choose their transactions. Some miners can prioritize the MEV to high fee -style packages; Others can exclude some types of transactions for ideological, political or technical reasons. The slice guarantees that, within each slice, the miners are rewarded on the basis of the quantity and quality of their work, without punishing for the decisions of inactivity or strategic energy. For those who are curious to know more, this article can prove useful.

Request for response without penalty

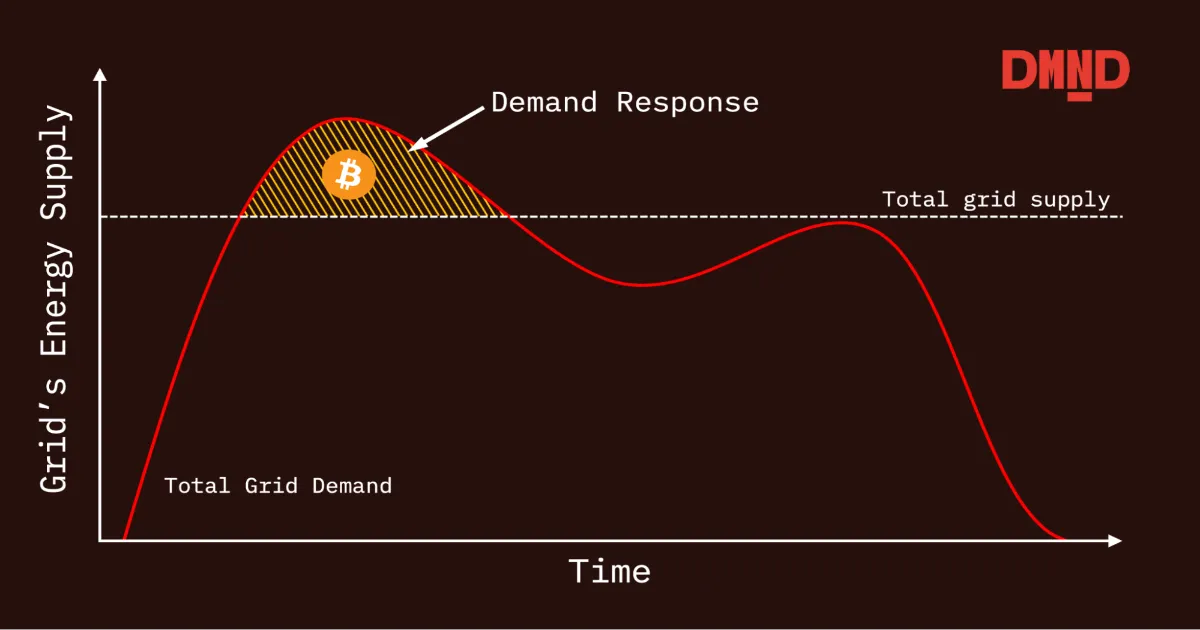

What makes the slice particularly attractive for miners who participate in the answer to the question or the reduction programs is that it does not penalize you to be offline.

This is because Slice does not decide your payment just because you made a break. Your actions remain in the PPLNS Window – the rolling window of the recent work which is suitable for payments – as long as they are recent enough. In this way, each fee is treated independently and should obtain 8 payments, since Slice uses a rolling window of 8 blocks, each valid fee remains suitable for payment in the next 8 blocks on average. This means that, regardless of how large or small the swimming pool is, you will never have the abysmal fortune to eat days of bad luck without a block, disconnect, find the pool and not be paid.

This means that miners can climb during the top hours, support their regional network and still collect their fair cut from the blocks found after having resumed the operations, above all, even if they are offline, if their actions are still in the window. In other words, if the pool has a strip of bad luck, and therefore the miner is called to carry out the answer to the question and turns off, even if the pool finds a block during their free time, that miner will be paid their right quota for as long as they were online. This is because each sharing generated during that period will be active and will be paid on average for 8 blocks.

This is not an alternative solution. This is the function. It makes the slice fully compatible with modern energy strategies that require flexibility, whether you are participating in the frequencies regulation markets, which is unleashed during the emergencies of the grid or simply by optimizing non -peak prices.

For example, suppose that a miner is extracting in a swimming pool and the swimming pool has not yet found the blockade of that day. This means that the swimming pool has not yet found the blockade, and therefore the miners have not yet been paid for that day. Now, the miner goes out to provide accessory services during the top summer load for a few hours, during that period, the swimming pool finds the block. In a pool -based pool, the miner would not see a single set of the one after 90 minutes, when the decay was full effect. But even if the swimming pool found a block 30 minutes later, due to the exponential decay, the miner would barely see something. On the other hand, the miner would have all the actions they extracted during the day received a payment, since each action receives on average 8 payments. Therefore, the miner would benefit in good times and would not be penalized in bad times.

Transparency and revision revision of the payment

Furthermore, Slice does not modernize only the equity of payment, it does so in order to minimize the trust in the operator of the pool. Each slice is completely controllable. Each action is monitored, indexed and publicly verified by any miner, so that miners can independently verify their share of the block reward. There is no black box, no “trusted my brother”.

And if the pool operator tries to cheat, for example, by injecting false actions to dilute payments, the miners can challenge the integrity of the slice. The extension of the declaration of work on Stratum V2, on which it is based, includes mechanisms for the publication of sharing data, verification of the Merkle roots and ensuring that any sharing corresponds to the real computational work.

For miners who care about decentralization, Slice is not just a payment scheme: it is a tool of responsibility.

From the defensive to strategic

The transition from the slice to slice represents more than a technical update. It is a mental change. The mining pools no longer have to defend themselves from bad actors penalizing everyone. Instead, they can structure payments in order to reflect reality: that the miners are sophisticated participants who work not only in the bitcoin blockchain, but also in the energy ecosystem.

With Slice, Pplns stops being a responsibility and becomes a strategic advantage. It allows a better acquisition of revenue, greater transparency and auditability and more fluid integration with network services.

And in a world where the up-time time is optional, but equity is not negotiable, this is exactly what the company’s miners need, a strategic partner in the pool that pushes forward and innovation, bringing the future today and allowing miners to make more money with the same hardware.

This is a post for the guests of General Kenobi. The opinions expressed are entirely proper and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.