In Q1 FY2025, metaplanet The most powerful financial results in its 20-year-old-year-old history have been published with a strategy for the Bitcoin Ministry, which is now widely operating.

Metaplanet not only in bitcoin. It doubles the value of the shareholders through it-using the infrastructure of the capital markets, the main performance indicators, and the frequent income strategies to increase the bitcoin per share systematically.

With 6,976 BTC in its public budget, BTC returns by 170 % from year to date, and an increasingly global space, metaplanet is no longer a signal-system.

A quarter of the outbreak of the cabinet leader in Japan Bitcoin

The results of the Metaplanet of Q1 FY2025 are distinguished by a turning point – not only in size, but in consistency. For the first time, it broke both the basic operating standards and the cabinet of the Ministry of Treasury.

The quarterly financial statements:

- profit: ¥ 877m (+8 % QOQ)

- Operating profit: ¥ 593M (+11 % QOQ)

- Total assets: ¥ 55.0B (+81 %)

- Net assets: ¥ 50.4B (+197 %)

- Unreasonable BTC gains (as of May 12): ¥ 13.5 b

While the company reported a 7.4B evaluation loss in its position in Bitcoin as of the end of March due to market prices, it indicated that these losses were completely reflected-after that-in mid-May.

This context is important: The evaluation is expected to fluctuate in the BTC’s capital model. What matters more BTC Growth Arrowand Operating profitabilityAnd Capital efficiency– All of this goes strongly to the top.

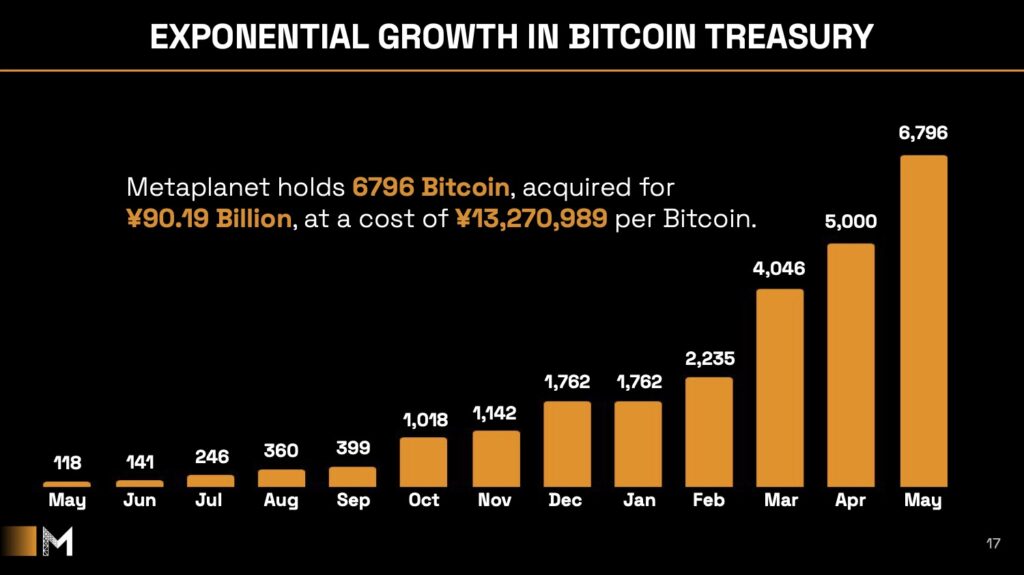

BTC Holdings rises to 6,976-Aut 3.9X years to date

Metaplanet added 5,034 BTC In the first quarter alone, Bitcoin’s possessions are increasing 6,976 btc3.9x increase since January 1.

Carrying now:

- ~ 68 % of its near term 10,000 BTC target

- The basis of cost is 13.27 meters per BTC

- The highest position in the world and #1 in Asia Among the public companies that held Bitcoin

This accumulation has been funded through the largest a notary program program in Japan, which allows the company to issue shares in the strength of the market without setting a fixed discount or strike. As of May 10:

- 87 % of the 210m share program was implemented

- 76.6B has been raised

- The program enabled the continuous BTC purchases without disrupting the stability of the stock prices

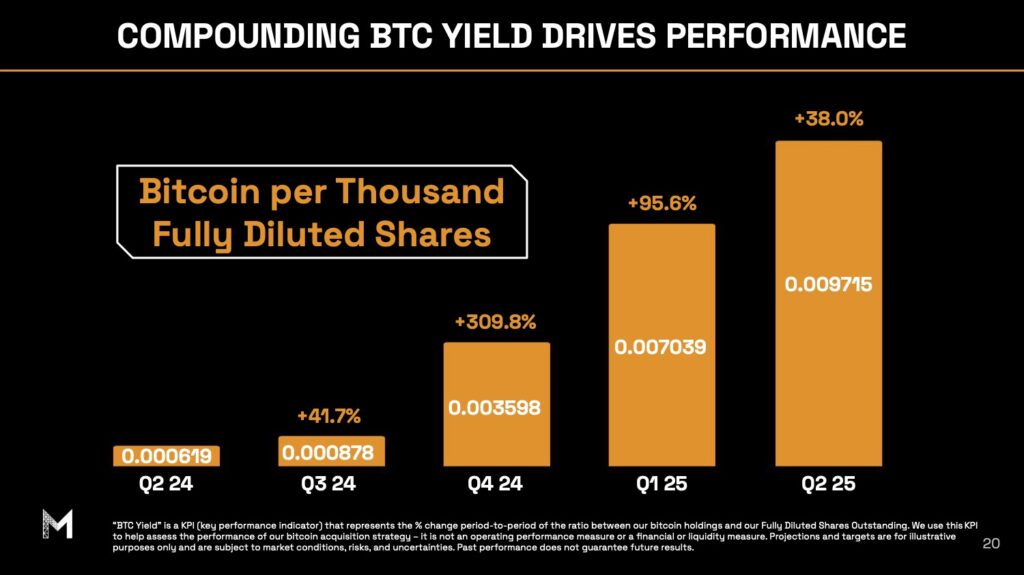

BTC Return reaches 170 % – KPI specific

Metaplanet KPI is a unique Bitcoin: BTC returnWhich measures growth in bitcoin for each reduced share. In the first quarter:

- BTC return: 170.0 %

- BTC profit: 2,996 btc

- BTC ¥ earning: 45.4b

This scale is essential for how to assess the Metaplanet Treasury – not on FIAT, but in The effectiveness of the BTC unit for each shareholder.

BTC’s return only reflects accumulation, however Capital Strategy. The arrows raised to the BTC that outperformed the mitigation. If this happens, the BTC return rises. If not, it falls. It is an accurate tool for cabinet discipline.

This reflects the leading innovations through the strategy (previously known as Microstrategy), but with the familiar capital market model in the Asia Pacific region.

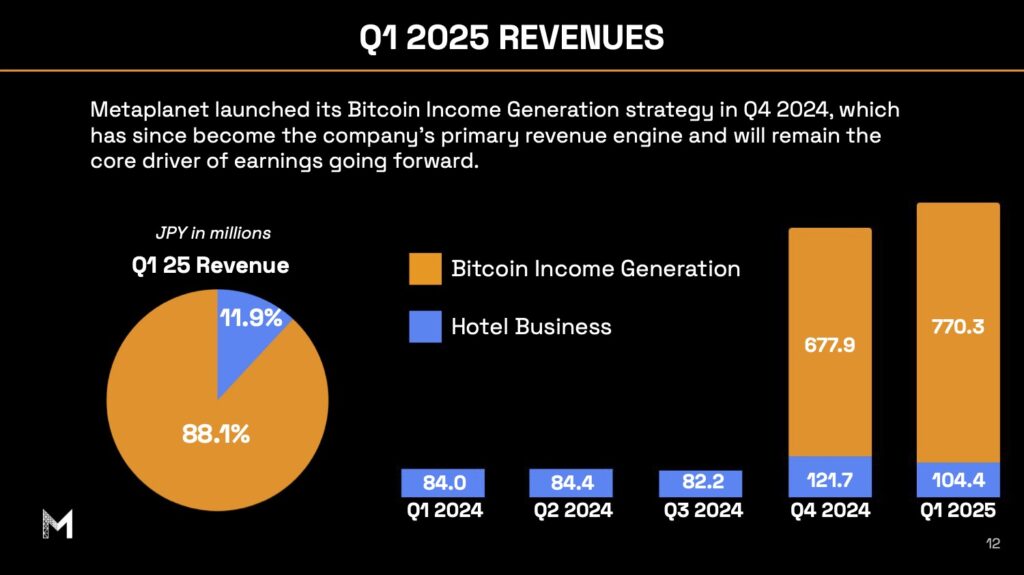

Operating profit reaches a new record – driven by Bitcoin

Unlike many companies that focus on Bitcoin, Metaplanet is not only capital collection and Bitcoin-it’s it also achieves frequent profits.

The q1 operating income was ¥ 592mRegister a new company.

separation:

- ¥ 770m from Bitcoin income generate (In the first place of BTC, the Written Criticism))

- ¥ 104 m Out of that Legacy Hotel works

- Operating margin: 67.6 %

Why does this income model Reduces dependence on shares ’issuance and It improves the flexibility of the capital. This also means that the new capital can go directly to BTC – not to finance operations. This enhances Metaplanet’s ability to grow BTC and BTC per share.

The company has now been liquefied 30 of 58 days In 2025 through BTC fluctuations strategies, while maintaining strict protection on the negative side. This transforms public budget fluctuations into a source of revenue.

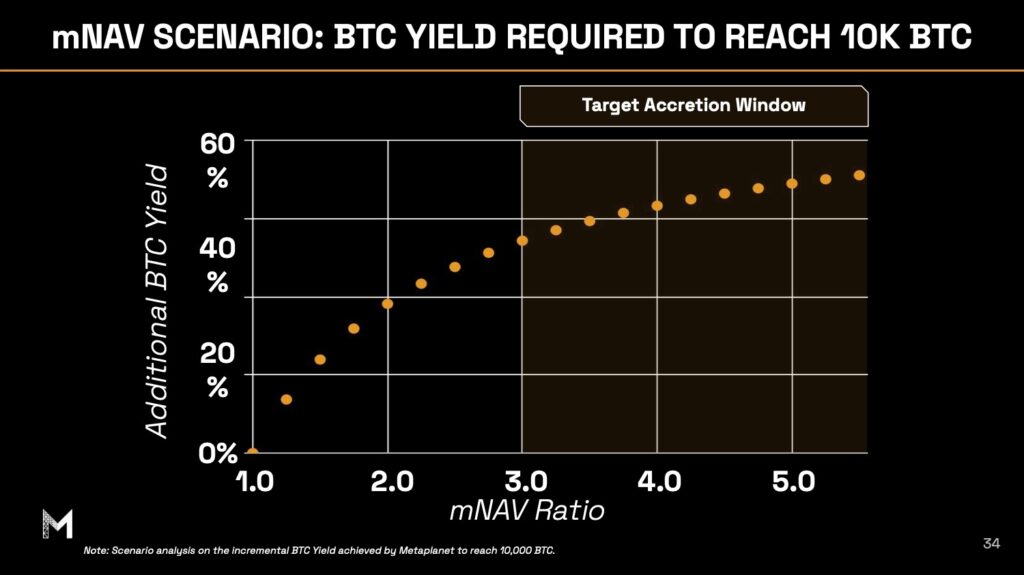

Metaplanet installment to NAV and Global Sival Edge

One of the specific features of the presence of the general market in metaplanet is its ability to maintain a Premium to navA rare achievement between the bitcoin.

At current levels, their property rights are circulating much higher than the value to the market to BTC, modified to mitigate. This installment is not a speculative interest – it is a reflection of how the company is In a structural position for Bitcoin’s superiority per shareAnd how global investors began understanding and price in that ability.

This installment drivers include:

- Continuous growth btc return This enhances a long -term value for each share

- Clean cover table with no favorite royal rights and debt

- Deep local liquidity on Tokyo Stock ExchangeWhere metaplanet became one The best 3 shares are active According to size in 2025

- wide ETF insert And the participation of the algorithm index, due to its high fluctuations, the impartiality of the sector, and trading

- Global exposure through mtplf (UTC List for us) and Dn3 (Germany), and providing access to retail and institutional capital across time areas

- Transparency, Treasury reports by BTC, which are in line with modern investor expectations

It also attracted metaplanet Border capital flows Among the Bitcoin investors are looking for judicial diversification and the growth of treasury, not only BTC. The positive return in the company BTC and the operating margin helped enhance this shareholder base, which led Issuing shares based on organic demand At accumulation prices.

Bitcoin Treasury Model is developing Asia

As a member of the first show in Bitcoin for companiesMetaplanet plays a vital role in the formation of the Bitcoin-especially within the Asia Pacific region.

While most of the treasury companies in Bitcoin so far have appeared from the United States, the Metaplanet model proves that the original capital strategy in Bitcoin can expand within the various regulatory frameworks, capital markets and investor cultures.

The company’s design is specifically designed to increase bitcoin per share to the maximum Without relying on fixed debt tools Or the opportunistic moments of “purchase”. Instead, it calls:

- Movement of striking stock programs Which allows it to issue shares only when the demand is supported by the market

- Vulnerable Treasury acquisition frameworkEnabling the daily BTC purchases without estimation of timing or manual trading

- BTC income generation strategies That turns fluctuation into operating profit

- Infrastructure of integrated liquidity that extends over three regions and currencies (JPY, USD, EUR)

As a first member of BFC, Metaplanet is involved in learning activity, standards and implementation visions with other public companies that explore the adoption of the Bitcoin Treasury. Its structure is not only repetitive, but it is exported.

For companies in Japan, Korea, Taiwan, Hong Kong and South Asia, Metapanet offers more than the concept. It provides a scheme.

As BFC continues to expand its international domain, the role of Metaplanet will be essential in how the PlayBook book is evolved to design the original capital of Bitcoin across the global markets.

Conclusion: Metaplanet moves from a signal to the system

Metaplanet is no longer the first company of the General Treasury in Japan. The first in Asia has become a operating model that proves that the Bitcoin Treasury Strategy can provide:

- High margins

- BTC accumulation is effective capital

- Standards of the performance of the successful and transparent shareholders

- The public market exceeds performance

With 6,976 BTC in the public budget, 170 % of the BTC return, and evaluating a premium supported by implementation – not the noise – Metaplanet sets a new standard.

It is not only the bitcoin contract. It shows what a Capital structure from Bitcoin It can really do.

Source: https://bitcoinmagazine.com/bitcoin-for-corports