Michael Saylor returned to Bitcoin buffet and this time brought a larger dish. Strategy Inc. has expanded its favorite share increase from $ 500 million to $ 2 billion, doubling (or we should say quadruplication) on his Btc ▼ -1.69% accumulation campaign.

The favorite shares for the perpetual section of the Serie A are set on a price at $ 90 with a 9%dividend, according to Bloomberg.

“The company is ready to evaluate the shares at $ 90 each, the lower part of a marketed range”, – Source without name, Bloomberg

The move reflects both the persistent exposure demand linked to Bitcoin and the conviction during Saylor and BTC belongs to the center of the modern treasure strategy.

Michael Saylor: “Because this is important for Bitcoin and institutional investors”

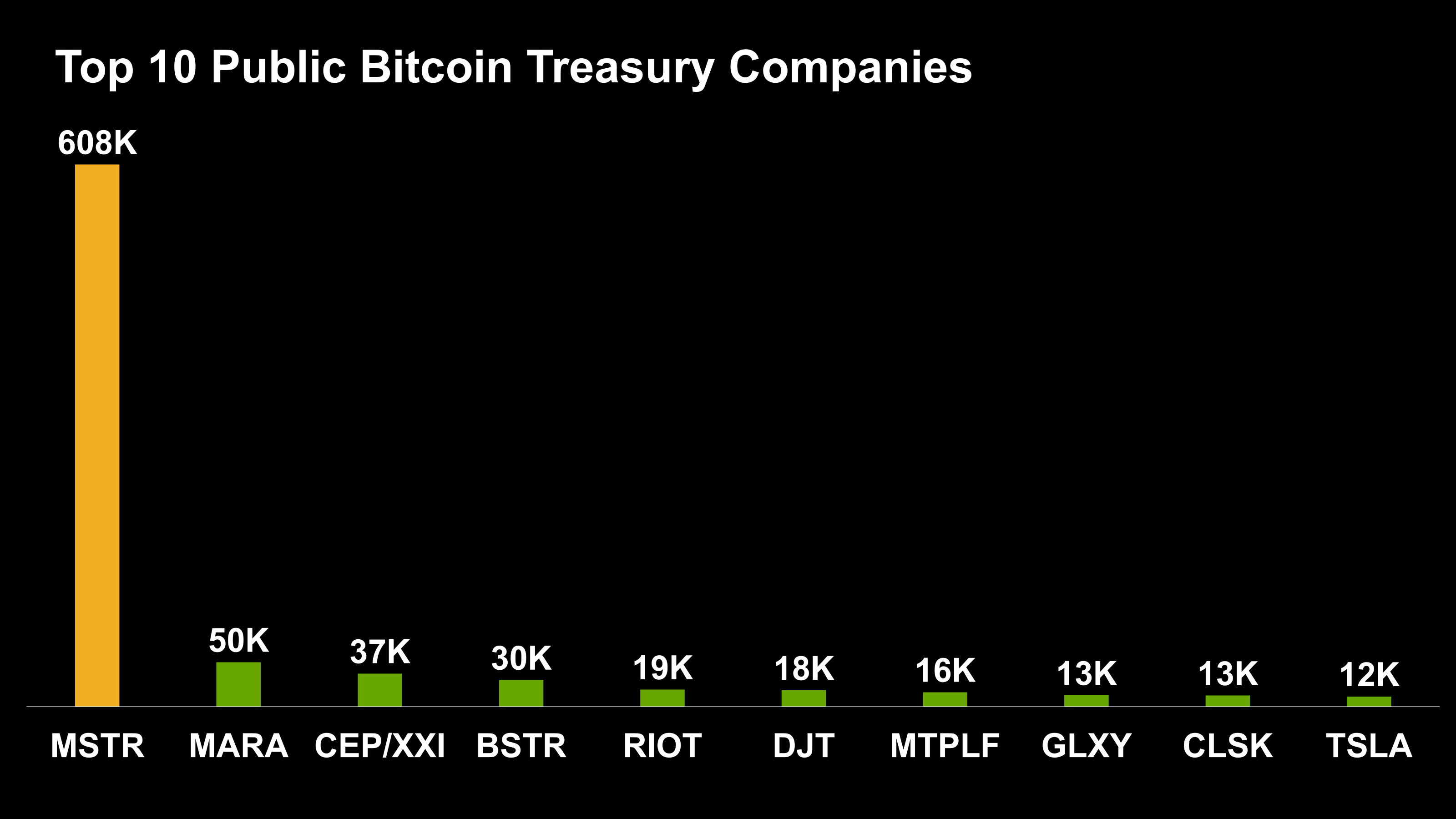

The strategy already contains 607,770 BTC, evaluated at approximately $ 72.4 billion, which represents over 3% of the total circulating supply of Bitcoin. The new 2 billion dollars in favorite equity could push that number even higher.

The offer is led by Morgan Stanley, Barclays, Moelis & Co. and TD Securities and includes 5 million actions that classify Senior with most of the existing privileged and ordinary actions of strategy, but remain junior to its convertible debt and the favorite class “strife”.

Michael Saylor described the strategy fundraising mechanism as an “square engineered tool that allows the company to buy Bitcoin at favorable prices using high -assessment capital.

The idea is simple: to raise funds through privileged actions or bonds when the strategy actions are at the top, therefore distribute that capital to accumulate Bitcoin, which can further increase the evaluation of the company. Rinse, repeat. Saylor is a crazy boy.

Reaction and prospects of the BTC market

At the time of writing writing, Bitcoin (BTC) exchanges near $ 115,300, slightly falling. The strategy shares also approached on Thursday session, but they slipped by 0.44% in the negotiations after the hours. Despite the dive, the momentum remains strong and the institutional sentiment continues to incline bullish.

If this approach continues to reward investors depends largely on a variable: the price of bitcoin. But in the world of cryptographic maximalism, Saylor is ready to become the next Warren Buffett.

Explore: the XRP price jumps 11% after the SEC Tease XRP Etf progress cryptographic unit

Discover: ICO of Might Meme Coin in which to invest today

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

Strategy Inc. has expanded its favorite share increase from $ 500 million to $ 2 billion, doubling its BTC bet.

-

Bitcoin (BTC) exchanges near $ 115,300, slightly the day. The strategy shares also approached on Thursday session, but they slipped by 0.44%.

The post strategy of Michael Saylor guarantees $ 2 billion to feed the accumulation of Bitcoin appeared first out of 99 bitcoins.