The analysis company Santiment in the chain has shown how the majority of the old coins are currently in a commercial zone.

Medium -term trade returns are extremely negative for most old coins

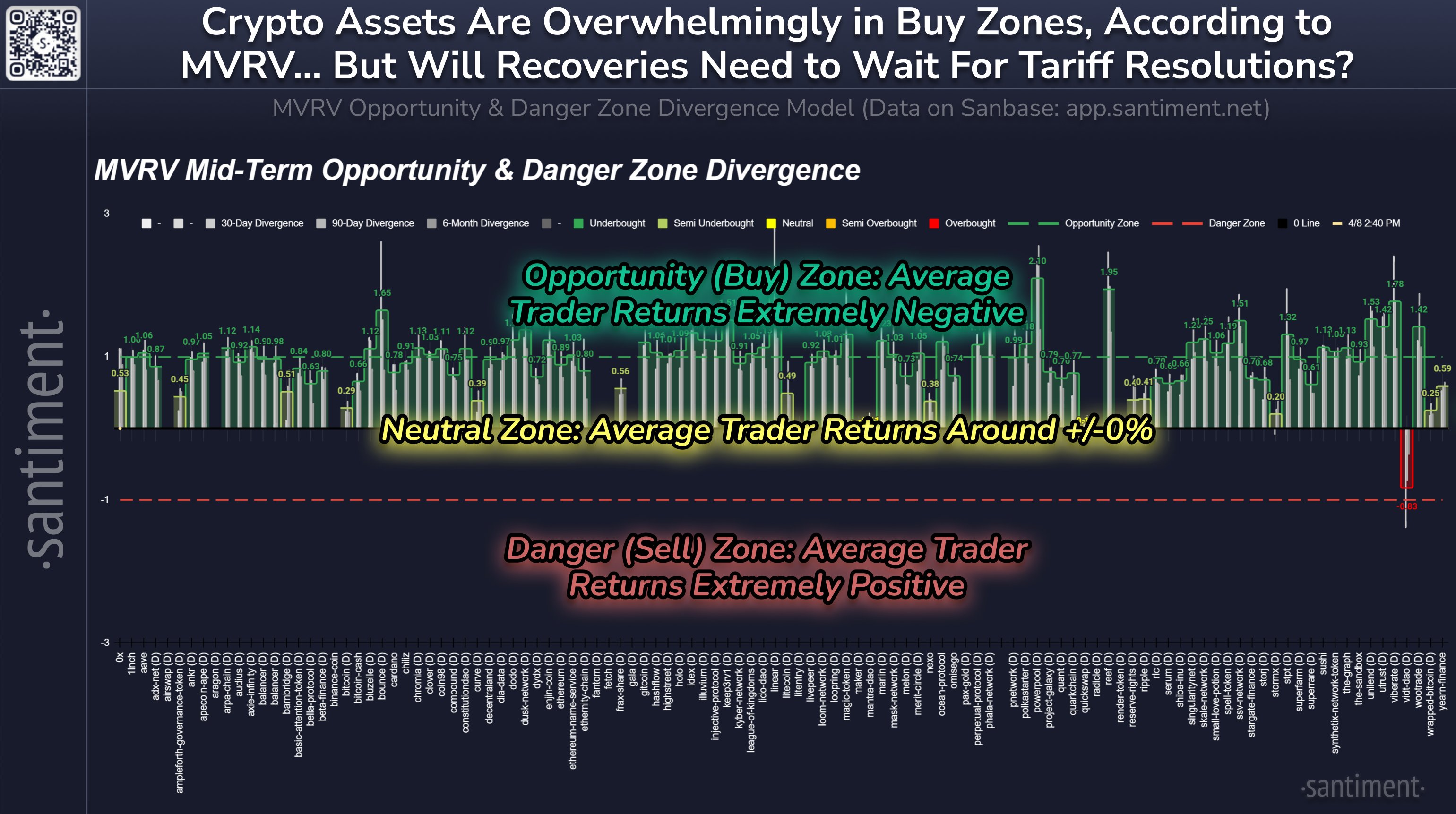

In a new contribution to X, Santiment shared an update for its MVRV Opportunity & Danger Zone Divergence model for the various old coins in this sector. The model is based on the popular “market value for realized value (MVRV)”.

The MVRV ratio is an indicator of on chains that basically tells us whether the investors of a cryptocurrency keep their coins with net profit or loss.

If the value of this metric is larger than 1, this means that the average investor keeps a profit. On the other hand, under this threshold it indicates the dominance of the loss.

In the past, the profitability of the owner has tended to affect the prices for digital assets. Whenever the investors are in big ones, they can be tried to sell their coins to make the stacked profits. This can hinder the bullish dynamics and lead to a tip for the price.

Similarly, the owner, who are significantly under water, leads to market conditions in which winners have expired and enable the cryptocurrency to reach a soil.

The MVRV Opportunity & Danger Zone Divergenice model from Santiment uses these facts to define purchase and sales zones for the old coins. The model calculates the divergence of the MVRV ratio on different time frames (30 days, 90 days and 6 months) to determine whether there is an asset in one of these zones or not.

Here is the diagram shared by the Analytics company, which shows how the various old coins are currently looking for based on this model:

Looks like most of the sector is currently in the buy region | Source: Santiment on X

In this model there is a value that is greater than zero, the average dealer returns for this time frame negative and that is positive. This is the opposite alignment of how it is in the MVRV ratio, with the zero mirror taking on the role of the 1 brand from the indicator.

It is visible from the diagram that almost all old coins have their MVRV divergence more than zero in the different time frames. Of these, most of them have their medium-term MVRV divergence of more than 1. The previously mentioned opportunity zone is beyond this brand. Therefore, the model currently shows a purchase signal for the majority of the old coins.

The average negative returns for these coins because the market was turmoil according to the news in connection with tariffs. While the model may show a purchase signal for the old coins, it is possible that this uncertainty will continue to pursue the market. As Santiment explains,

If and when a global tariff solution is achieved, it would undoubtedly trigger a very quick recovery in cryptocurrency “, this is currently a very large” if “that is based on the latest media reporting about what is quickly referred to as a full” trade war “between the USA and the majority of the world.

BTC price

At the time of writing, Bitcoin is floating by $ 76,900 in the past seven days, by more than 9%.

The price of the coin has already erased its attempt at recovery | Source: BTCUSDT on TradingView

Selected picture of Dall-E, santiment.net, diagram of tradingview.com

Editorial process Because Bitcoinist focuses on delivering thoroughly researched, accurate and impartial content. We comply with strict procurement standards and each page is diligently checked by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and the value of our content for our readers.