The actions of the Crypto Treasury slipped on Thursday after the information reported that the Nasdaq is strengthening the supervision of the companies that increase the capital for the cryptocurrency.

We suspect that the main bet of the “Treasury Society” Larping was the hope of seeing “strategic reservations of cryptocurrencies” for relevant national states. Could you imagine Vietnam Hodling XRP or Ghana Bitcoin? This, of course, has not yet materialized and may not materialize soon.

In the meantime, Nasdaq is making treasure companies more difficult for cryptocurrencies, telling some listed companies that the approval of shareholders could be requested before issuing new actions to buy digital activities.

Crypt companies -Tesoro as $ Bmnr AND $ Mtplf Lately I have had difficult moments. pic.twitter.com/1onztvwd6s

– Cole Grinde (@grindeoptions) 4 September 2025

According to the documents and people who are familiar with the matter, the goal is to protect the shareholders existing from dilution, in particular when the cryptocurrency is the main use of the proceeds.

This move could slow down a business race. Architect Partners reports that 124 companies listed on the United States have announced their intention to collect $ 133 billion for cryptocurrency purchases this year and all this is now threatened.

Should you sell small companies of the cryptographer treasure? Market reaction: withdrawals of Bitcoin securities and treasure

The news aroused decrease in the whole sector:

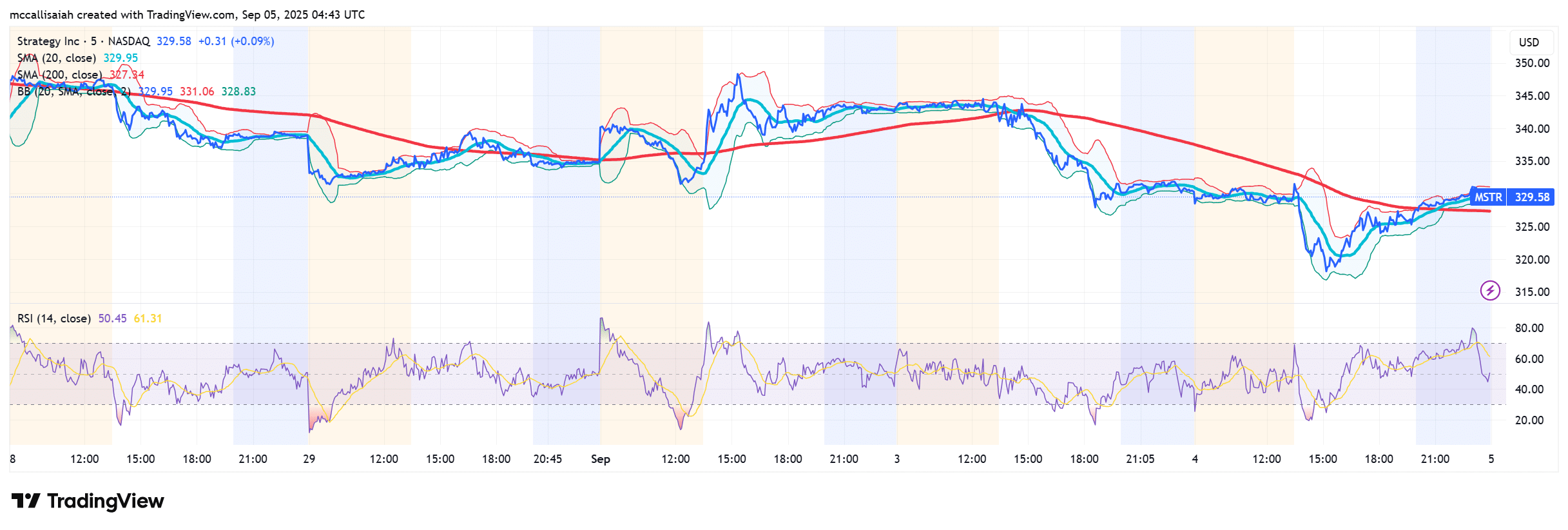

- The strategy (BTC Treasury Leader) decreased by 3% before closing 0.8%.

- Bitcoin dropped by 1.6% the day.

- Sharplink Gaming (ETH owner) slipped 8%.

- The development of Upexi and Defi (Sol holders) decreased by 4.5% and 7.6% respectively.

Heritage Distilling, which is introducing a “Bitcoin Bourbon”, is waiting for a vote for shareholders related to its Taken $ IP treasure, it fell by 0.3%.

Coinglass data show that treasury stocks have become highly correlated with the oscillations of USD BTC prices, the magnification of volatility while companies accumulate. Outside of Michael Saylor’s strategy, if you bet your company in cryptocurrency is proving to be a volatile lap.

DISCOVER: Next 1000x Crypto: 10+ token crypt that can affect 1000x in 2025

Can the strategy exceed the S&P 500 road blocks? Michael Saylor’s most recent bet

The spotlight remains on the strategy, the largest Bitcoin Treasury company in the world, with 636,505 BTC in participation. Analysts now see a 91% probability that the company qualifies for the inclusion in the’s & P 500, given its market capitalization of $ 92 billion+, the negotiation volume in millions of shares daily and a positive Gaap income of $ 5.3 billion in four quarters.

Yet the obstacles remain. Bloomberg notes that the S&P index committee can deny the inclusion even if the criteria are satisfied, citing “concerns about the sustainability” of a encryption model and volatility with an average of 96% in 30 -day prices oscillations.

This uncertainty could block the path of the strategy towards the S&P500, despite the financial metrics that exceed the requirements.

Find out: Top 20 Crypto to be purchased in 2025

Should you buy more strategy before the inclusion S&P 500?

An S&P 500 inclusion for the strategy would do more than raise his stock. The indexed funds that monitor the reference point would pay billions in crypto-diacentary shares, repeating the historical model of a pop of 8-10% for new competitors.

The crossover between Wall Street and Bitcoin would also be deepened. Treasury companies in the index would anchor the cryptographic exposure within the wallets of traditional investors, filling the gap between digital activities and traditional finance. Will it happen, though?

At present, Saylor and the company have the best probability, and this makes the prospect of loading more in Q4 quite tempting.

Explore: Trump Crypto Mowes has earned $ 5 billion in 2025: how to become rich in Trump -style cryptocurrencies?

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

Nasdaq is examining the crypto treasury stocks, sending the owners of Bitcoin and company lower. The strategy aims for the inclusion of S&P 500.

-

The indexed funds that monitor the reference point would pay billions in crypto-diacentary shares, repeating the historical model of a pop of 8-10% for new competitors.

The post Nasdaq plan to control treasure companies with cryptocurrencies appeared first out of 99 bitcoins.