Brian Armstrong, CEO CEO, believes that our legislation for encryption finally has a shot. After several days of meeting with legislators in Washington, Armstrong said that the law of clarity of the digital assets market “has a good opportunity to accomplish it.”

In recent years, there is Coinbase where Blackrock BTC stores while other US exchange like Gemini or Kraken is literal.

The draft law seeks to clarify how to regulate digital assets, divide the control between SEC, CFTC and other agencies. It is especially focused on non -stylists like distinctive stocks.

“This is the way we guarantee that the encryption industry can be built here in America, leading innovation and consumer protection, and ensuring that there is no other Ginsler’s Gregrler trying to take your rights.” – Brian Armstrong, CEO of Coinbase

Coinbase and stand with Crypto: Is it about to send Bitcoin to $ 150,000?

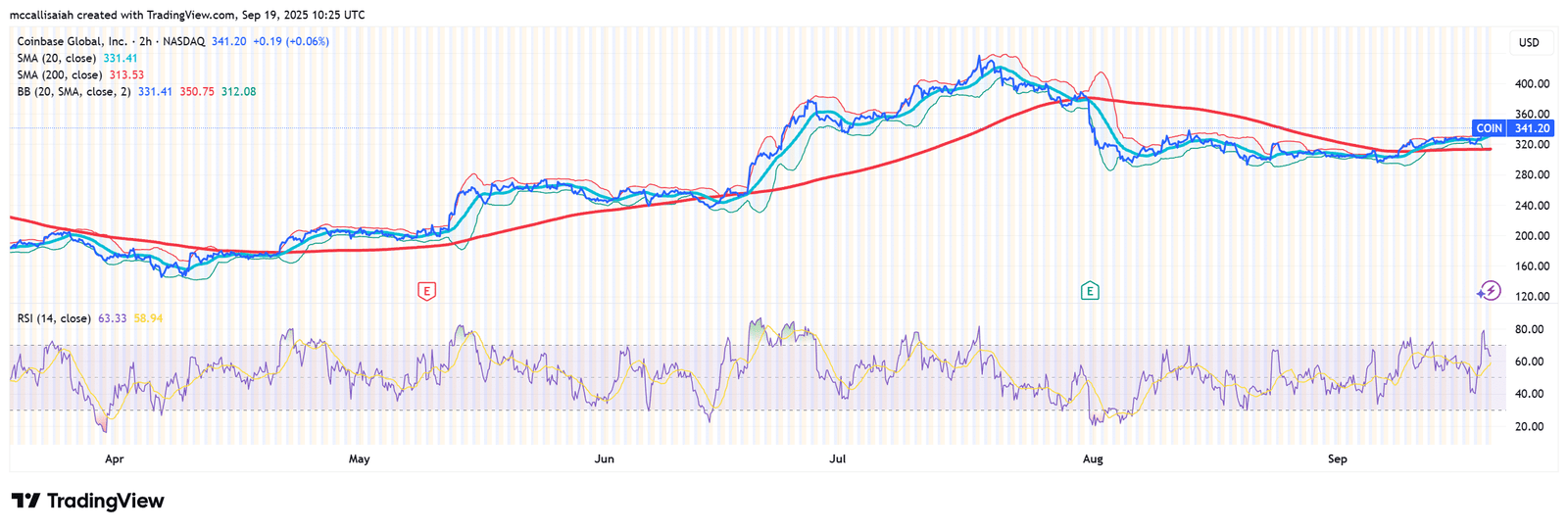

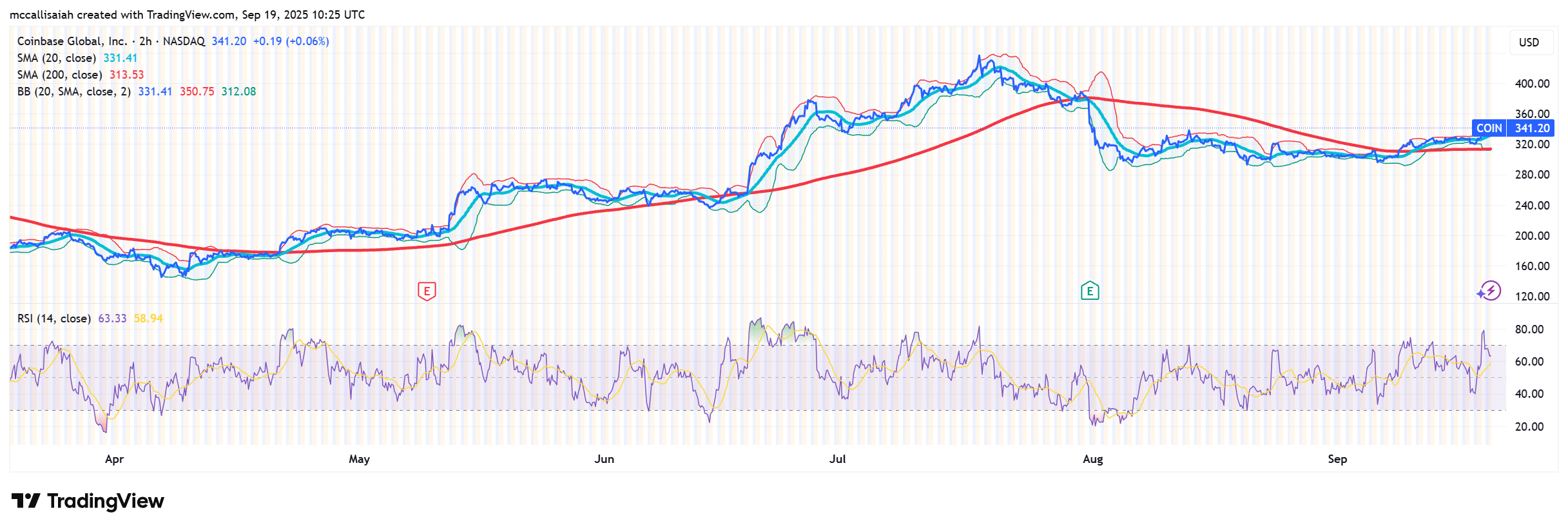

(Source: TradingView) Armstrong also urged retail investors to join Stand With Crypto Beariative, a popular platform that warns users when contacting actors. He framing it as a batch dependent on society, not just an effort for companies.

Icymi: SWC community director @512Mace I recently spoken with punchbowlnews On the real weight of the encryption voters. pic.twitter.com/ITDU7FRTAH

– Stand with encryption

(Standwithcrypto) September 8, 2025

He said that the active participation will indicate the legislators that the components, not only companies, want a clear organizational framework. Amen for that! Armstrong has argued that this is a pivotal moment of the encryption industry that could prevent another wave of “hostility” or unorganized fraud ranges such as Terra Luna.

He discovers: 1000x Crypto: 10+ encrypted codes that can reach 1000x in 2025

Stablecoin’s bank lobby reaction: Should you be worried?

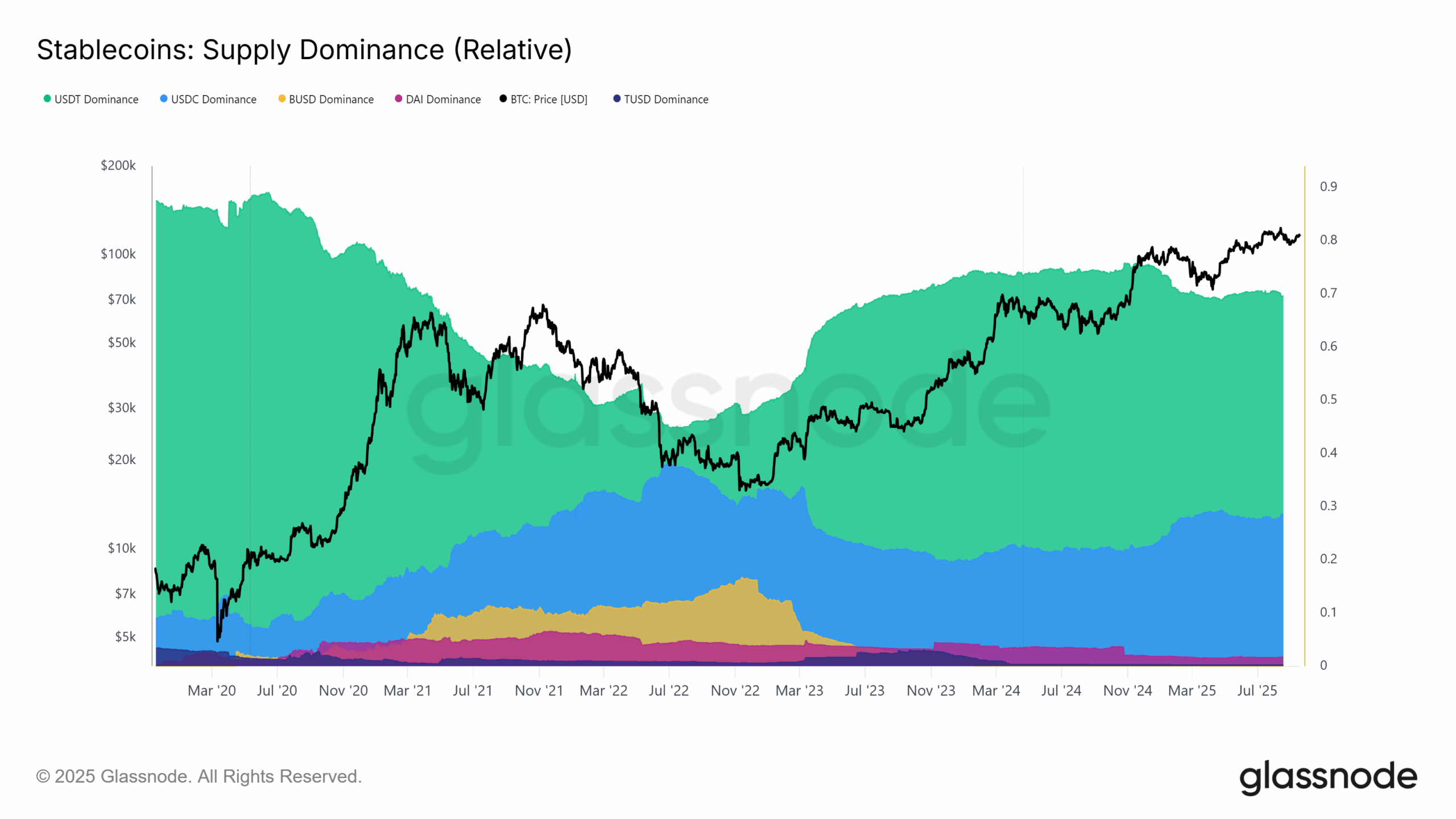

One of the sharp battles can involve stablecoins. Armstrong claimed that American banking groups tried to include the language in the genius law earlier this year, which would have prevented Stablecoins that carried the return. This attempt failed, but banking clicks are still pressing the legislators to reduce interest -based Stablecoin products.

Crypto was not only on Coinbase’s agenda. The legislators also met with 18 Bitcoin executives, including Michael Saylor of Strategy (previously Microstrategy), to discuss the Bitcoin Law sponsored by Senator Centum Lomes.

The suggestion perceives that the United States get a million Bitcoin over a five -year period using “budget neutral strategies” such as the reassessment of treasury gold certificates and re -customization of tariff revenues.

“This has a good chance to accomplish … It is a shipping train that leaves the station.” – Brian Armstrong

Discover: 20+ Cracking the next explosion in 2025

The ups of the ups and why the regulations could be the spark

Institutional data explains the reason for the importance of this legislation. According to Coinglass, the open interest in Crypto Futures has increased steadily until September, while Defillama reports more than $ 290 billion in the liquidity of Stablecoin sitting on the margin.

For Armstrong, the risks are high: seizing the momentum from the two parties and the age of the rules that balance consumer protection and innovation.

Explore: Singapore denies a $ 14 million repair money request on the “stolen” shed

Join Discord 99bitcoins News here to get the latest market updates

Main meals

-

Brian Armstrong, CEO CEO, believes that the United States’ legislation and clarity has finally a shot.

-

For Armstrong, the risks are to seize the momentum from the two parties and close the rules that balance consumer protection and innovation.

The post New Crypto Bill: CEO of Coinbase Brian Armstrong appeared to Washington, DC, first on 99bitcoins.