The price of Bitcoin has returned more than 10% from the minimum of September and is once again observing $ 124,514 ATH.

Are the traders debating if this is the beginning of another leg or just another configuration for a trap for bulls?

Bitcoin Price: Why are Wall Street analysts becoming bullies on Bitcoin?

Citigroup exposed three scenarios for the SVG .CWP-Coin-Chart {Width: 0.65 path! IMPORTANT; }

1.83%

Bitcoin

Btc

Price

$ 122,774.48

1.83% /24 hours

Volume in 24h

$ 73.55b

?

->

7D price

// Make Svg Reactive JQuery (Document) .Redy (Function ($) {Var Svg = $ (‘. CWP-Graph-guitten Svg’). Last (); IF (Svg.length) {Var Originalwidth = SVG.Attare (‘Width’) || ‘160’; Var Originalheight = SFVG.Otrice (’40’ ‘; Svg.atr (‘Conservactratio’, ‘Xmidymid Meeting’);

Know more

In the next 12 months. Their basic case provides for a 50% rally at $ 181,000, while the Bull case projects an increase of $ 231,000, which represents a 93% increase compared to current levels.

“The prize grows as the institutional demand expands while the offer narrows on exchanges,” wrote Citi in his note to customers.

CITI introduces new 12 -month price objectives for digital activities:

Bull base bear

BTC $ 82k $ 181k $ 231k

Eth $ 2K $ 5.4k $ 7.3k pic.twitter.com/alpwpak2yw– Matthew Sigel, CFA recovery (@matthew_sigel) 2 October 2025

Blackrock has even gone further, suggesting that Bitcoin could possibly reach $ 700,000 in the long term. Catie Wood of Ark Invest reiterated his request for BTC above $ 2.4 million, citing his role of disruptive monetary technology.

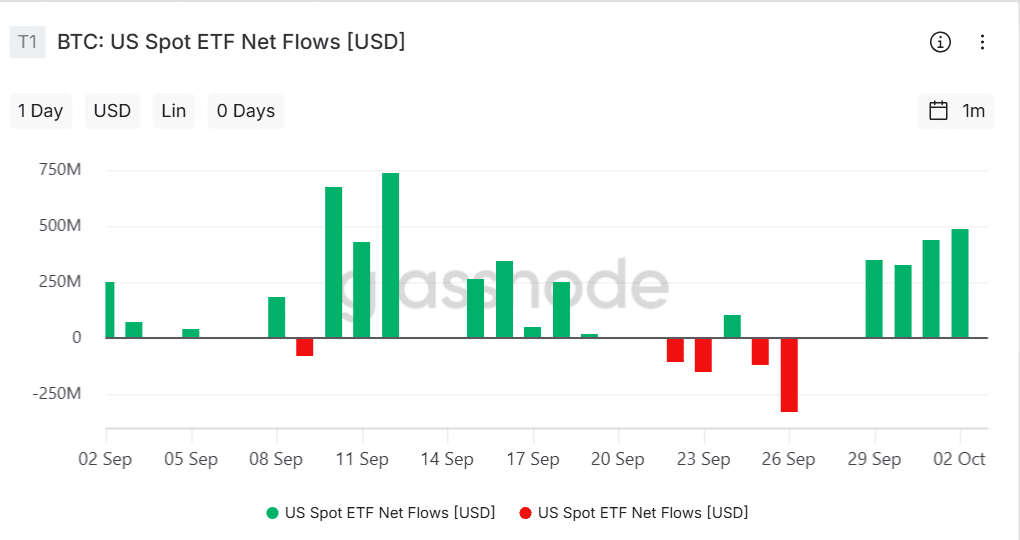

The Bitcoin Spot Etfs have attracted over $ 54 billion this year, while Glassnode indicates that the exchange sales are at the lowest point since 2017. The offer is being reduced just as the institutional demand continues to rise.

DISCOVER: Next 1000x Crypto: 10+ token crypt that can affect 1000x in 2025

Data points strengthening the case: can BTC break $ 150k in 2025?

The power supply is measurable for BTC. Glassnode reports that the miner’s difficulty is at the historic highs and that over 70% of Bitcoin’s circulating supply has remained unchanged for over a year. This IlLiquida offer amplifies the impact of new institutional influences.

In the meantime, Bitcoin correlation with S&P 500 and Nasdaq has decreased, according to Fred, strengthening its emerging role as “digital gold”. Blackrock observed in a White Paper that BTC has constantly exceeded traditional resources following a crisis, from the covidal accident to the war in Ukraine.

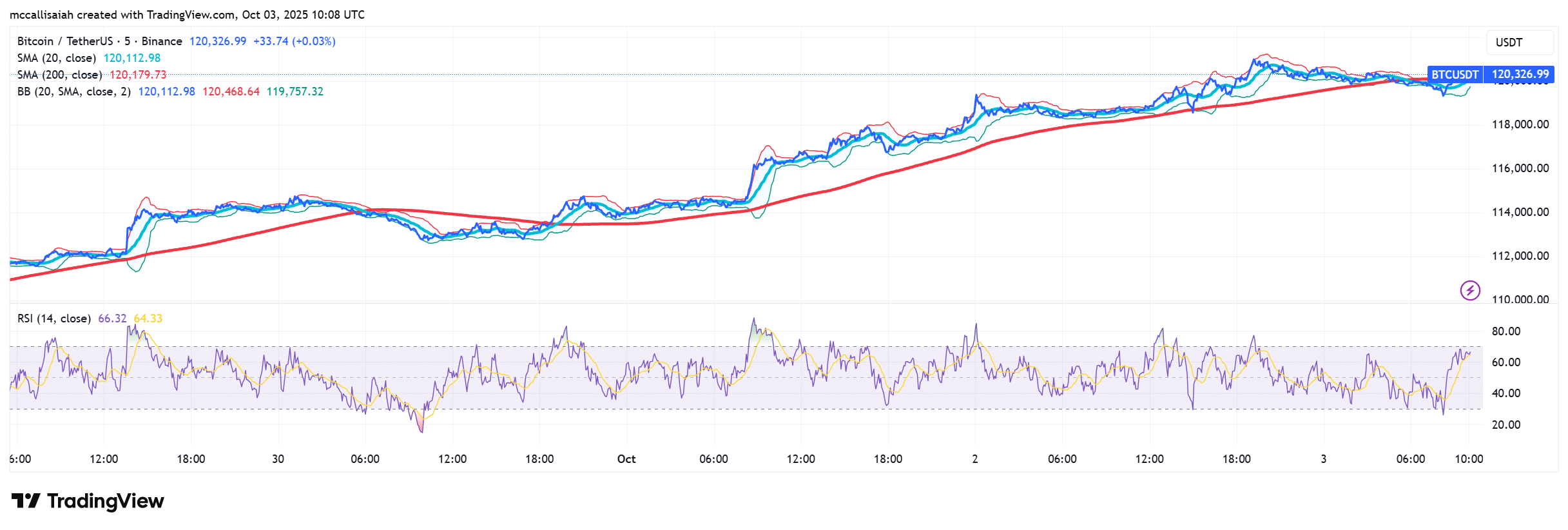

The graphs are equally convincing. BTC has recovered the EMA of 50 days at $ 113,830 and is now forming a bullish flag structure. Traders are observing the following milestones:

- First stop: $ 124,200, the maximum since the beginning of the year.

- Psychological barrier: $ 125,000.

- Offshoot target: $ 131,250, based on Murrey mathematics lines.

Discover: 20+ Next Crypto to be exploded in 2025

Macro Jolly

Ratorm cuts, inflation led by oil and the ETF question pushed Bitcoin to $ 120k, which is why Wall Street is bullish. The offer on exchanges continues to thin out, the institutions continue to buy and more trader are observing the goal of $ 231k in Citi for next year.

The route is bullish, but we will continue to see the turbulence along the journey.

Explore: Is Chartered Standard set to Pump Polygon? Pol price forecast for uptober

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

The price of Bitcoin has returned more than 10% from the minimum of September and is once again observing $ 124,514 ATH.

-

Bitcoin Etf Spots have obtained over 54 billion dollars this year, while Glassnode shows exchange sales in their lowest point since 2017.

The forecast of Post New Wall St. Bitcoin prices: can BTC push towards $ 231k? He appeared first out of 99bitcoin.