This article is also available in Spanish.

Ondo Finance has faced significant challenges in recent weeks, with its price falling more than 30% from its all-time high of $2.14. Despite the recent downturn, many analysts remain optimistic about ONDO’s recovery potential, citing its strong performance earlier in this cycle as evidence of its resilience. As one of the best-performing altcoins, ONDO has consistently attracted investor attention, leading to speculation about its next move.

Related reading

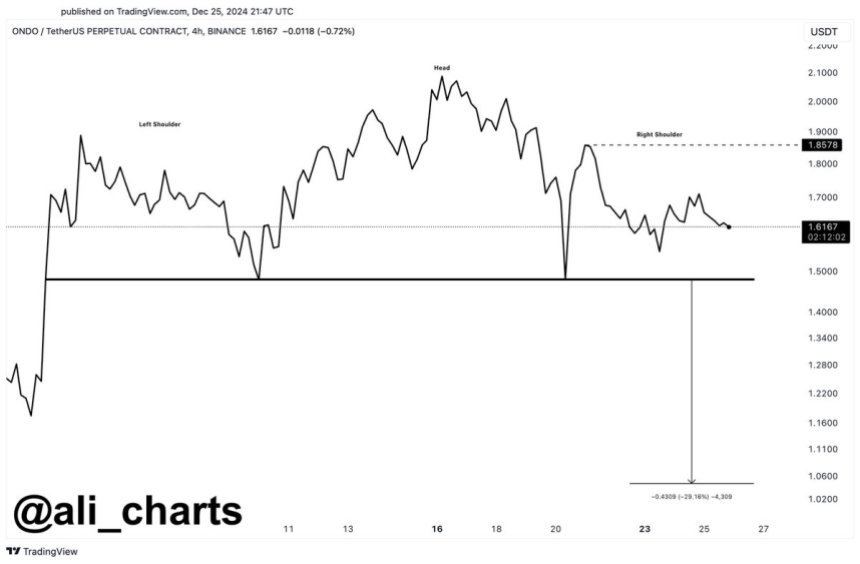

However, caution is required. Renowned analyst Ali Martinez recently shared a technical analysis warning that ONDO could be at risk of further correction. Martinez highlights the potential formation of a head and shoulders pattern on the price chart, a bearish signal often associated with trend reversals. If this pattern were to occur, it could lead to increased selling pressure and a deeper pullback.

The next few days will be crucial for Ondo Finance in dealing with this crucial moment. Investors will be watching carefully whether the token will be able to defy bearish signals and reignite bullish momentum or whether the feared pattern will bear out, leading to further declines. For now, ONDO’s future hangs in the balance, with market sentiment and technical indicators offering mixed signals about its near-term trajectory.

The ONDO tests the crucial question

Ondo Finance has faced a significant correction following its strong early-cycle rally, now testing crucial levels of demand at key price points. The token’s price stopped at its previous all-time high, around $1.50, which now serves as a key support level. If it holds above this level, bullish momentum could return, potentially setting the stage for a renewed uptrend.

However, lead analyst Ali Martinez has expressed concern with a technical analysis suggesting that ONDO could form a bearish head and shoulders pattern. This pattern, if confirmed, typically signals a trend reversal and could lead to increased selling pressure.

Martinez warns that a decisive close below the $1.48 level could trigger a sharp 30% correction, pushing ONDO price to around $1.05. Such a move would represent a significant setback for the token and its investors.

Related reading

To invalidate this bearish scenario, ONDO needs to reclaim the $1.86 level as support, a move that would signal strength and restore confidence in the asset’s upside potential. Until then, the market remains at a critical juncture, with traders closely monitoring the price action for clues as to ONDO’s next direction. The next few days will be decisive in determining whether ONDO can recover or face further downside risks.

Technical analysis: what to expect

Ondo Finance (ONDO) is currently trading at $1.49, after successfully testing the critical support level of $1.46 highlighted by lead analyst Ali Martinez. This level has proven to be an important line of defense for ONDO, reflecting strong buying interest at this price. For now the token appears stable, but market participants remain cautious, as broader market conditions could still influence ONDO’s trajectory.

The recent resilience to $1.46 is encouraging and suggests that ONDO may be laying the foundation for a potential recovery. However, a market-wide retracement could put further pressure on ONDO, possibly pushing its price lower and retesting critical demand levels. Investors are keeping an eye on key technical levels for confirmation of a bullish rebound.

Related reading

For ONDO to regain upside momentum, it is essential to recapture the $1.70 level in the coming days. A decisive move above this level would signal renewed strength, paving the way for a bullish recovery and potentially re-establishing previous highs. Until then, ONDO remains in a delicate position, with traders monitoring broader market sentiment and the asset’s ability to sustain current support levels. The next steps will be crucial in determining whether ONDO can resume its uptrend or face continued consolidation.

Featured image of Dall-E, TradingView chart