One of the dominant narratives in this cycle was that “this time it is different”. With the institutional adoption that remodes the bitcoin offer and offer dynamics, many claim that we will not see the type of euphoric blowing top that has defined the past cycles. Instead, the idea is that money and intelligent Etfs will smooth volatility, replacing the mania maturity. But is it really the case?

The sentiment guides the markets, also for the institutions

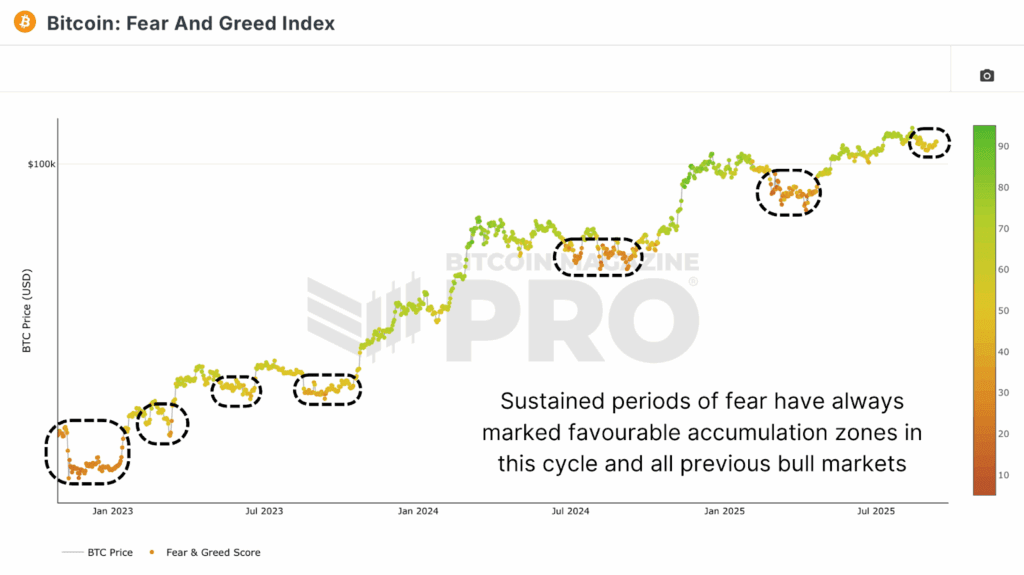

Skeptics often reject tools such as the index of fear and greed as too simplistic, claiming that they cannot capture the nuance of institutional flows. But erase the feeling ignores a fundamental truth that the institutions are still managed by people and people remain prone to the same cognitive and emotional prejudices that guide the market cycles, regardless of how deep their pockets are!

Although volatility has grown compared to previous cycles, the transition from $ 15,000 to over $ 120,000 is far from disappointing. And, basically, Bitcoin has reached this problem without the type of deep and extensive samples that have marked the bull markets. The Boom of the ETF and the accumulation of corporate treasures have moved the supply dynamics, but the basic feedback circuit of greed, fear and speculation remains intact.

Market bubbles are a timeless reality

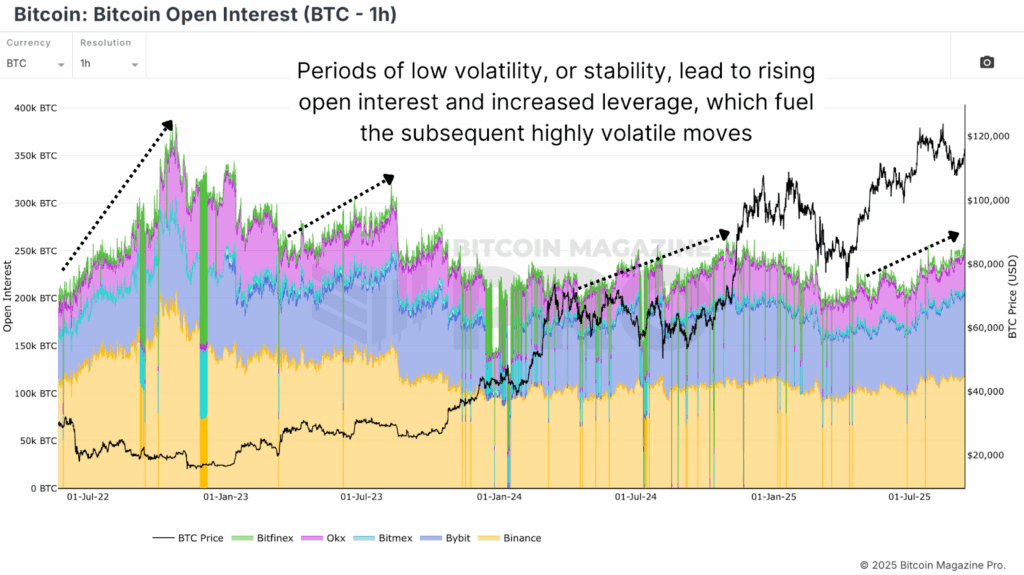

It is not only Bitcoin that is susceptible to parabolic races, the bubbles have been part of the markets for centuries. The prices of the activities have repeatedly increased beyond the foundations, fueled by human behavior. Studies constantly show that stability itself often generates instability and that periods of silence encourage lever, speculation and finally the action of the fleeing prices. Bitcoin followed the same rhythm. The low volatility periods see the ascent of open interest, the construction of financial leverage and speculative bets.

Contrary to the belief that “sophisticated” investors are immune, the search for the London School of Economics suggests the opposite. Professional capital can accelerate bubbles by accumulating late, chasing the momentum and amplifying the moves. The residential crisis of 2008 and the bust of the Dot-Coms have not been guided to detail, but led by institutions.

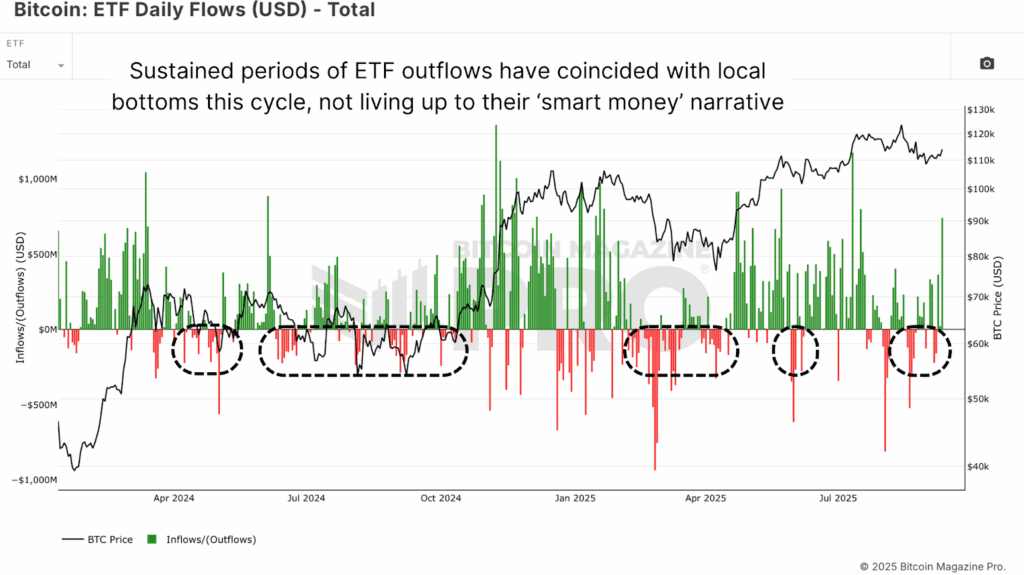

The ETF flows this cycle provides another powerful example. The periods of net deceased by the Etf Spots actually coincided with the funds of the local market. Instead of perfectly timing the cycle, these flows reveal that the “intelligent money” is equally inclined to behavior and tendency following investments as a detail trader.

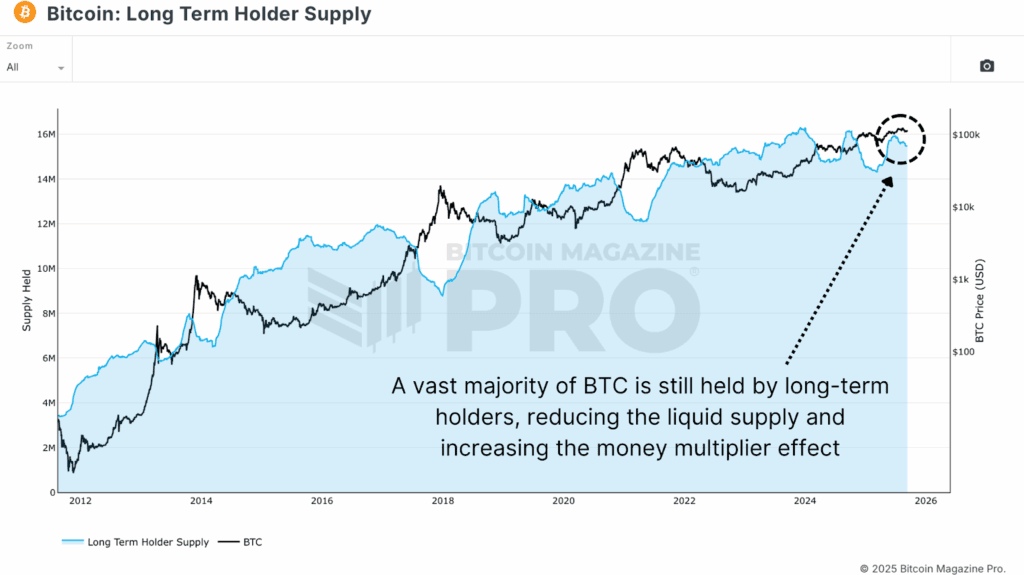

Capital flows could turn on the next Bitcoin jump

In the meantime, watching global markets shows how capital rotation could light another parabolic leg. Since January 2024, Gold’s capitalization has increased by over $ 10 trillion, $ 14 ta $ 24t. For Bitcoin, with a current market capitalization of about $ 2T, even a fraction of that type of influx could have an out -of -measure effect thanks to the multiplier of money. With about 77% of BTC held by long-term owners, only about 20-25% of the offer is promptly liquid, with consequent multiplier of 4x conservative money. This means that new $ 500 billion rushes, only 5% of Gold’s recent expansion, could translate into an increase of $ 2 trillions of dollars of the market capitalization of Bitcoin, implying prices well over $ 220,000.

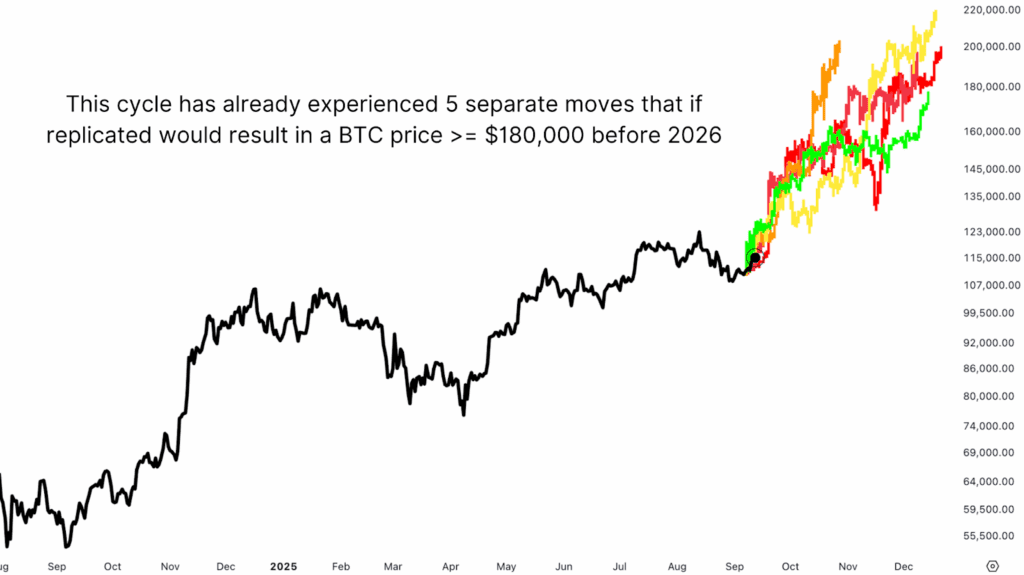

Perhaps the strongest case for a blowing top is that we have already seen parabolic events within this cycle. Since the whole 2022, Bitcoin has staged more 60-100%+ races in less than 100 days. Overlapping these frattals on the current price action provides realistic outline on how the price could reach $ 180,000 – $ 220,000 before the end of the year.

Bitcoin’s parabolic potential remains without shaking

The narrative that institutional adoption has eliminated the underestimated parabolic peaks both the Bitcoin structure and human psychology. Bubbles are not a retail speculation accident; They are a recurring feature of the markets in history, often accelerated by a sophisticated capital.

This does not mean certainty, the markets never work in this way. But rejecting the possibility of a parabolic top ignores centuries of market behavior and unique mechanics for the request for supply that make Bitcoin one of the most reflective activities in history. If anything, “this time it is different” can only mean that the event could be larger, faster and more dramatic than most expect.

For deeper data, graphic designers and professional insights on Bitcoin price trends, visit Bitcoinmagazinepro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more experienced insights and market analysis!

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.