Bitcoin, ethereum and even the prices of Meme do not move quickly like She was Again in December. Bitcoin has gains in the back, while Ethereum remains less than $ 3,000.

Solana is under pressure, as it is circulated below a multiple multi -support levelwhile Met coins decreased to about 75 billion dollars from the maximum cumulative market.

Meme Coin Traders who separate them from time: Time for sale

Traders are concerned, and with a severe risk of correction that will expel speculators, their Glassnode analysts have male Another development.

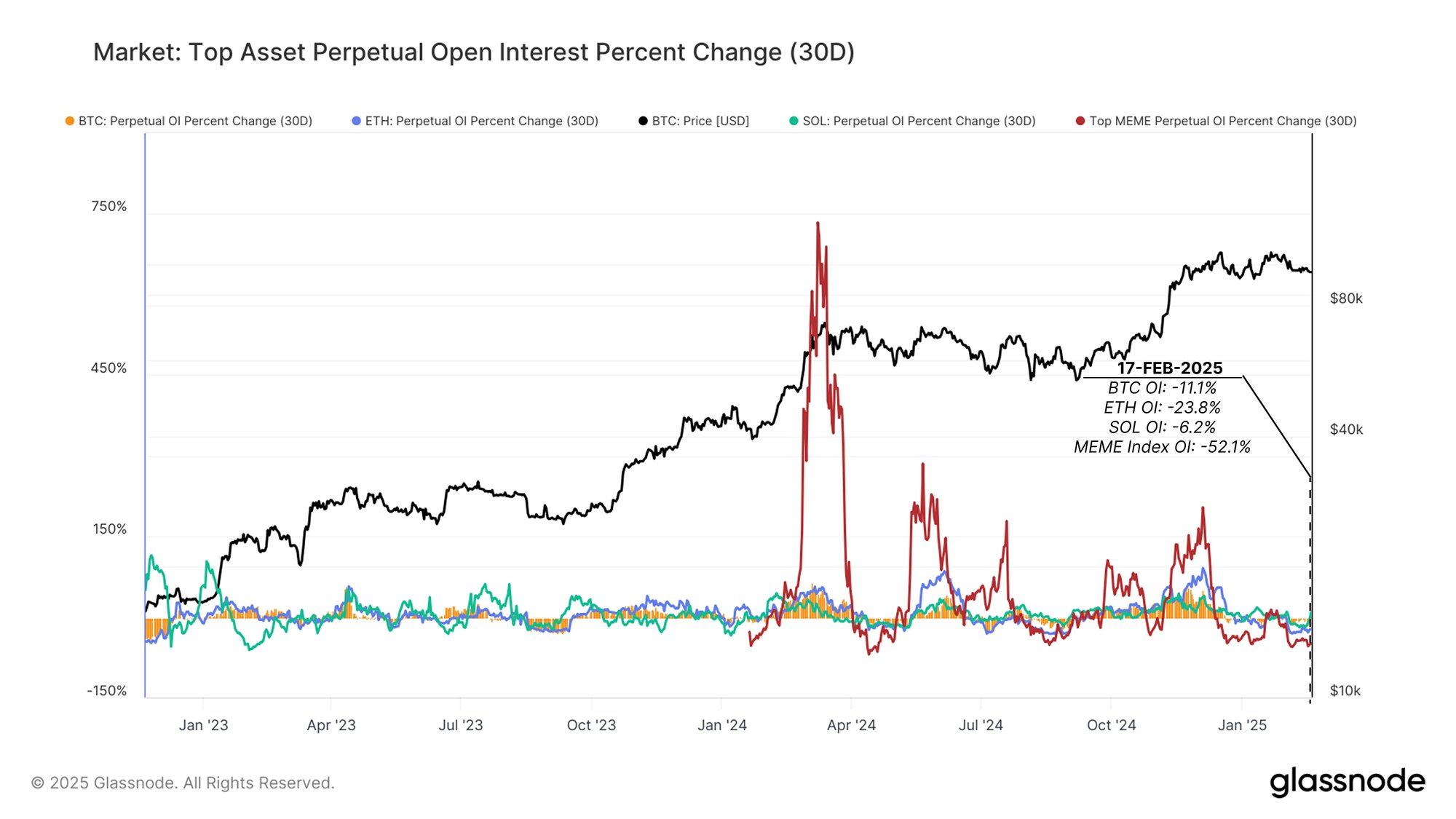

Stock stock positions such as Binance, OKX and Bybit are not suitable for traders, where traders can make trades with benefiting. Although this trend is widespread, there is a noticeable decrease in future open contracts between coins.

Last month alone, the open interest of the coin decreased by amazing 52 %And that The number can now rise after the prices of Dogecoin, Trump, Pepe and even WiFs decreased from double numbers last week alone.

(source)

The decrease in open interest indicates a shift in feelings. Since the encryption prices are sensitive to noise, the more traders choose to stay on the margin, the fastest prices tend to decline. More than 11.1 % of Bitcoin deals with benefiting from last month were closed through many stock exchanges.

Meanwhile, more than 23 % of the UTH positions have been closed, while Meme traders are scrambling to go out, with more than 52 % of positions closed since the launch of Meme. It is worth noting that traders quickly come out of Pepe, Bonk and Shiba Inu sites, as the open interest decreased by 70 % on average.

Interestingly, only 6.2 % of Solana’s positions were closed during this periodNevertheless Sol is one of the largest losers in the past thirty days.

Solana prices for encryption under pressure: What is the following for Sol

Open interest drops coincides with low prices. Bitcoin may be detained but trading less than $ 100,000. On the other hand, Ethereum was not after $ 3000, while Solana fell more than 40 % last month, as it decreased from $ 295 to about $ 175 – a major support level.

(Solusdt)

If Bitcoin prices are recovered, the lifting of Altcoins in this process, traders may flow and look forward to taking advantage of a possible appeal for the rising arrangement Q4 2024. However, after the collapse in February, the general fear – which was dismantled with the realization that the metal coins have turned head Money away from the best dictations – the trainees are likely to remain cautious.

ifand On the contraryPrices fell further, with Solana’s loss of $ 150 and bitcoin less than $ 90,000, could result in a widespread sale, which leads to the relaxation of billions of consequences.

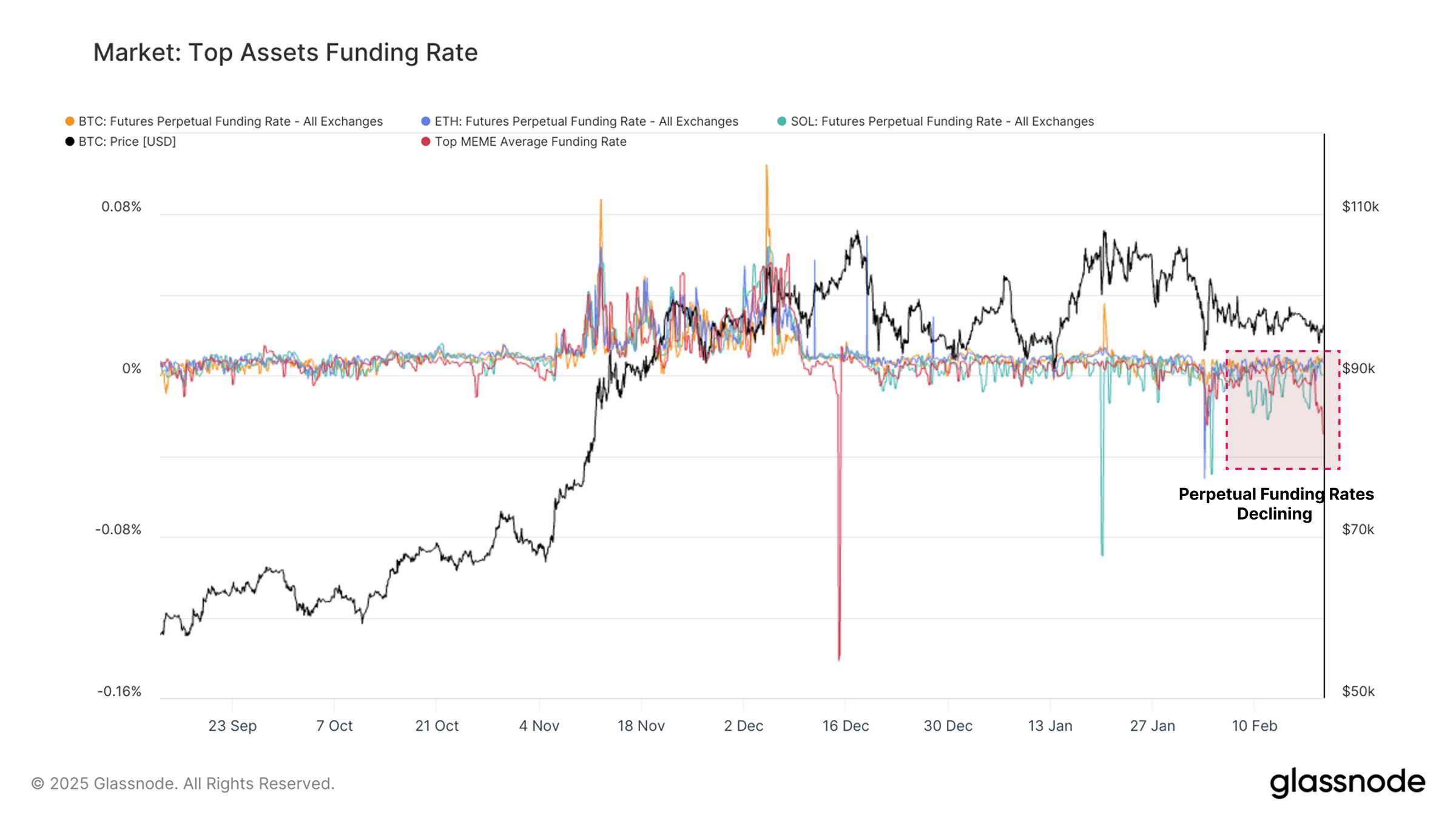

This trend reflects is low financing rates. Glassnode analysts Monitor While Ethereum and Bitcoin financing rates are somewhat negative, traders who take long sites on Solana are they It is pushedBecause the financing rate is also negative.

(source)

The shift from positivity to negativity indicates that more traders come out and penetrate their long sites. Since leaving from Longs means selling, this sale ExacerbationCreate domino effect.

Remains To see how Open attention will develop in the next few days. As of the writing of these lines, most merchants are neutral (42), according to Coinmarketcap Fear and greed indicator.

(source)

However, during the past month, the merchants were Mostly It is afraid, with the fear and anxiety that has been sweeping the market since early February.

Explore: 15 new Coinbase menus to watch in 2025

Join Discord 99bitcoins News here to get the latest market updates

The open benefit of the coin is more than 52 %

-

Farm momentum of encryption, Bitcoin, Altcoins, and Mimi currency

-

The open benefit of the coin has decreased by 52 % in one month

-

Funding rates also turn into negative on the permanent exchanges of pioneering encryption

Retail traders after they retracted the leverage with the benefit of the benefit: the open interest in Meme Coin appeared by 52 % on 99bitcoins.