The latest retirement push in Washington could send new 401(k) funds toward Bitcoin sooner than expected.

House Republicans filed on Tuesday retirement investment choice act, A bill that would turn an executive order issued by President Donald Trump in August into law.

The proposal officially opens the door for retirement plans to include “alternative assets,” such as funds that invest in digital currencies.

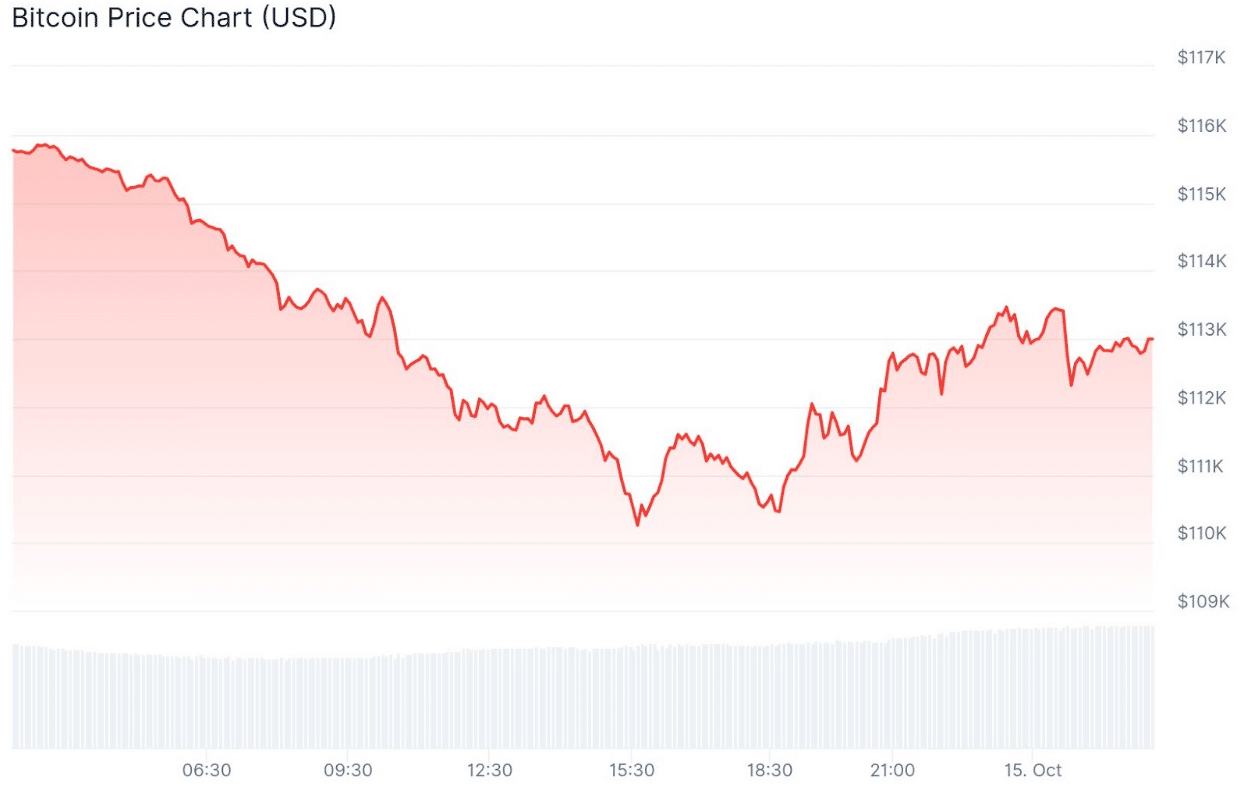

The move comes as regulators provide guidance on the issue, with Bitcoin trading near $113,000 in a volatile market.

If passed, the legislation would give Executive Order 14330 the full force of law. It directs the Department of Labor and the Securities and Exchange Commission to make room for a broader range of defined contribution investment options Plans like 401(k)s.

How will the 180-day deadline affect employers’ retirement plans?

Although the order does not require plans to offer cryptocurrencies, it specifically mentions “actively managed investment vehicles that invest in digital assets.”

It also sets a 180-day deadline for the Secretary of Labor to clarify fiduciary duties, including safe harbor protections for employers who choose to offer such options.

In May, the Department of Labor Cancel Its 2022 guidance urged plan sponsors to exercise “extreme caution” with cryptocurrency-related products.

This decline marked a shift to a neutral stance, neither favoring nor discouraging exposure to digital assets in retirement portfolios.

In September, the Labor Department said it plans to propose new rules clarifying when asset allocation funds that include alternatives can be provided. The agency also hinted at potential safe havens for fiduciaries handling such products.

“This advisory opinion provides much-needed clarity and certainty as the Department works to issue the proposed regulations,” said Deputy Secretary Keith Sonderling. He said at the time.

Bitcoin is trading at around $112,985, with intraday moves ranging between roughly $110,099 and $115,916.

(Source: Koenjiku)

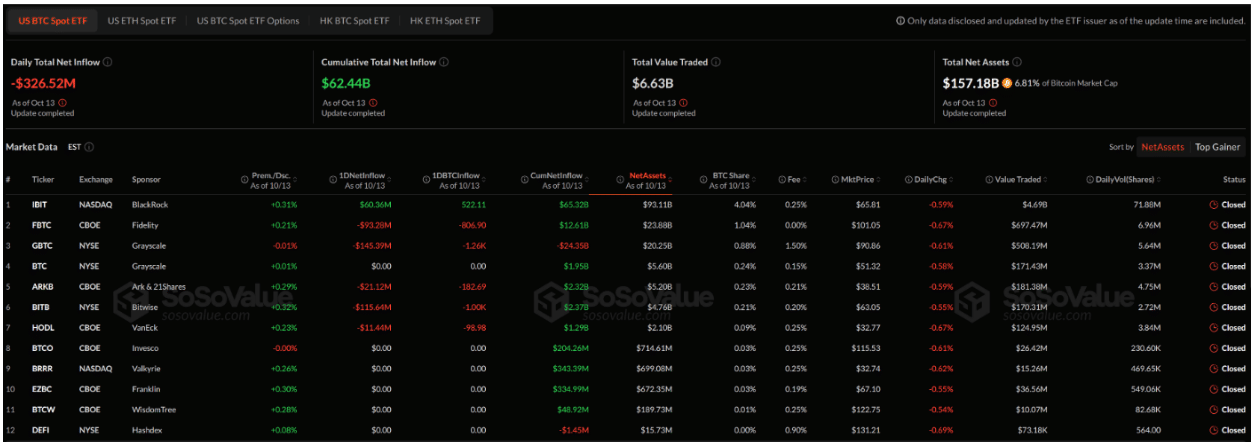

according to SoSoValue data, U.S.-traded bitcoin ETFs saw about $326.5 million in net outflows on Tuesday, as global markets weakened amid renewed trade tensions between the U.S. and China.

(Source: Soso Value)

(Source: Soso Value)

The new executive order directs regulators to coordinate how alternative assets fit into default options and managed retirement portfolios.

This is important because most savers rely on target date or professionally managed funds.

Discover: 9+ Best High-Risk-Reward Cryptocurrencies to Buy in October 2025

Why are BlackRock and KKR creating retirement-ready investment products?

Industry momentum is growing rapidly. Enable Supported order in August, saying they plan to expand access to private investments and cryptocurrencies along with lifetime income options.

Major asset managers, including BlackRock and KKR, are now developing retirement-friendly products.

Private market companies are looking at how to tailor their offerings to the daily rate structure of defined contribution plans.

Supporters in Congress say this flexibility could help diversify investment portfolios without weakening ERISA protections. A House Financial Services Committee letter last month praised the order and urged the Labor Department to create a formal “safe harbor” through rulemaking.

Not everyone agrees. Critics warn that adding alternatives, especially cryptocurrencies, could lead to higher fees, reduce liquidity, and bring more volatility to 401(k) plans.

Meanwhile, veteran trader Peter Brandt shared how he is preparing himself for retirement.

In a Last post At X, he said he plans to keep 5% of his Bitcoin holdings in his retirement portfolio.

I think my best bet is:

1. Switch my trading from daily charts to weekly charts as long as I can do it

2. Quality dividend stocks

3. Emerging markets

4. Gold and silver

5. 5% Bitcoin https://t.co/zPbHuVdwnH– Peter Brandt (@PeterLBrandt) October 13, 2025

This comment came as a follow-up to a question he had earlier asked his followers about investment strategies later in life.

Discover: Next 1000X Crypto: 10+ Crypto Tokens That Could Reach 1000X in 2025

Brandt’s approach goes beyond Bitcoin. It focuses on fixed income and lower risks. Brandt also chooses dividend-paying stocks for steady income. It also adds emerging market exposure to growth and investment in precious metals such as gold and silver as a hedge against inflation.

He also said he would downsize his business. He is moving from day trading to weekly trading to slow his pace as he approaches retirement.

This strategy represents a step towards stability and reliable returns.

However, the fact that he maintains 5% of his portfolio in Bitcoin, shows that he still believes in the long-term strength of the asset. This is true even after the recent market downturn.

For Brandt, bitcoin remains a hedge against inflation, his version of digital gold.

His approach reflects a simple message: As retirement approaches, balance and steady income become more important than noise.

Brandt also explained why real estate prices are not falling, saying that real estate prices are inflated and could see a major correction soon.

discovers: 20+ Cryptocurrencies That Will Explode in 2025

Join the 99Bitcoins News Discord here to get the latest market updates

The post Retirement Wallets Are About to Pump Your Cryptocurrency Pack: Here’s Why appeared first on 99Bitcoins.