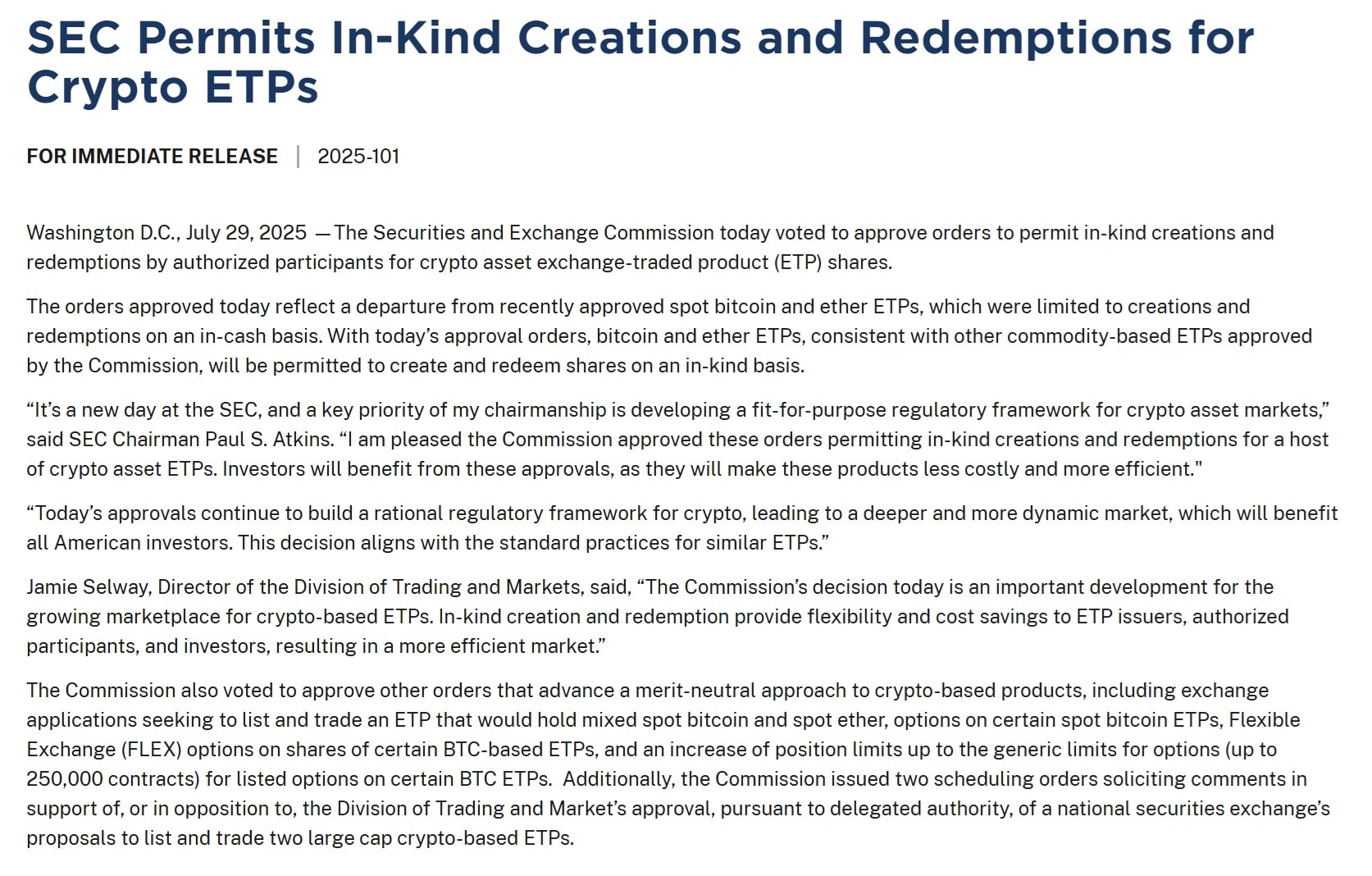

The US Securities and Stock Exchange Committee approved eye recovery for products circulating in the sales and the stock exchange. this It means that ETF exporters and credit participants can now deliver or receive Bitcoin or actual ether when creating or recovering stocks. So far, they had to use criticism. This is the changing of the base. It is dealt with.

Why the accurate issues of institutions?

For institutional traders, this update is simplified. Instead of selling Crypto in cash or converting FIAT to symbols during each ETF treatment, they can directly deal with the assets themselves. This saves time, reduces taxes and reduces unnecessary trading costs.

At the same time, SEC has raised the boundaries of the Bitcoin ETF options to 250,000 contracts. this A big leap from the previous limit and the institutions give more space for construction and management big Hedging positions. This also means more flexibility for advanced strategies without the need to divide deals through multiple money.

The organizational approach is transformed

this He is one of the first major It moves under the SEC Paul Atkins chair, and it stands out. Instead of fighting the structure of the investment funds circulating in encryption, the agency sets its bases to accommodate them. Not only does this include bitcoin and ethereum etf, but it is likely to be future products as well. Analysts believe that this can pave the way for the circulating investment funds based on Altcoin to enter the market with fewer obstacles.

Discover: 9+ best highly risk encryption, highly bonus for purchase in July 2012

Mechanics from behind the scenes you get an upgrade

From abroad, most investors wont Notice a lot of difference. ETF shares are still trading on the stock exchange as before. But the process behind the scenes to create and recover those shares has become more efficient. Instead of having to relax with monetary positions or go to third parties, accredited participants can transfer the encryption directly inside or outside the box.

this Reduces the operating burden on ETF exporters and makes the pleasure faster, which should help maintain the ETF price near the actual value of the basic coding assets.

The broader changes ETP reach the update

SEC also gave the green light to the Bitcoin and ETHEREUM money in one product. Agree on the options listed and flexible for that etps. this The current generation of investment funds in encryption makes it feel more complete and similar to the traditional product institutions that are used in dealing with them.

Companies such as Blackrock, Federation and Ark Invest were pushing for these changes since the passage of original approvals. the second The decision shows that it Listen and adapt to the maturity of the market.

Discover: Crypto 1000X Next: 10+ encrypted codes that can reach 1000x in 2025

Market reaction and institutional expectations

The reactions were mostly positive. Traders expect this change, but that no Make it less important. With normal salvation now, institutional players have less excuses to stay on the margin. New options border Also removal a major Registration on offices that want to increase exposure or manage the largest customer flows.

So, what comes after that?

With the infrastructure, ETF exporters may start exploring broader offers, perhaps including other encryption assets. Organizers will monitor how companies deal with these tools, especially in volatile markets. But at the present time, the structure is stronger, and this Good news for any institutional investor looking to take the encryption more seriously. By allowing direct transfers from Bitcoin and Eter, the ETF SEC base brings encryption products to traditional goods.

He discovers: 20+ next to the explosion in 2025

Join Discord 99bitcoins News here to get the latest market updates

Main meals

-

SEC now allows eye recovery for instant bitcoin and ethereum etfs, allowing exporters to transfer the encryption directly instead of using cash.

-

Founding investors benefit from fewer taxes and decreased friction, as they can now transport bitcoin and directly in ETF transactions.

-

The boundaries of the Bitcoin ETF options jumped to 250,000 contracts, giving large trading offices more space for strategies and hedges.

-

Change reflects a more flexible position on the Supreme Education Council and the door may open the door for investment funds circulating on the basis of other encryption assets such as Altcoins.

-

This step improves ETF pricing efficiency and reduces operating costs, while money that keeps both BTC and ETH also the SEC approval.

Post SEC opens the door for in -kind recovers in Crypto investment funds first appeared on 99bitcoins.