Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

Solana is exchanging at critical levels after several days of attempt to definitely break the resistance key of $ 155- $ 160. The bulls are slowly building impetus, since the wider cryptocurrency market shows signs of strength and suggestions on the possibility of a prolonged event. However, global risks remain high, in particular because a clear resolution has not been achieved in the ongoing American commercial conflict in progress, which continues to model the macroeconomic feeling and the behavior of investors.

Reading Reading

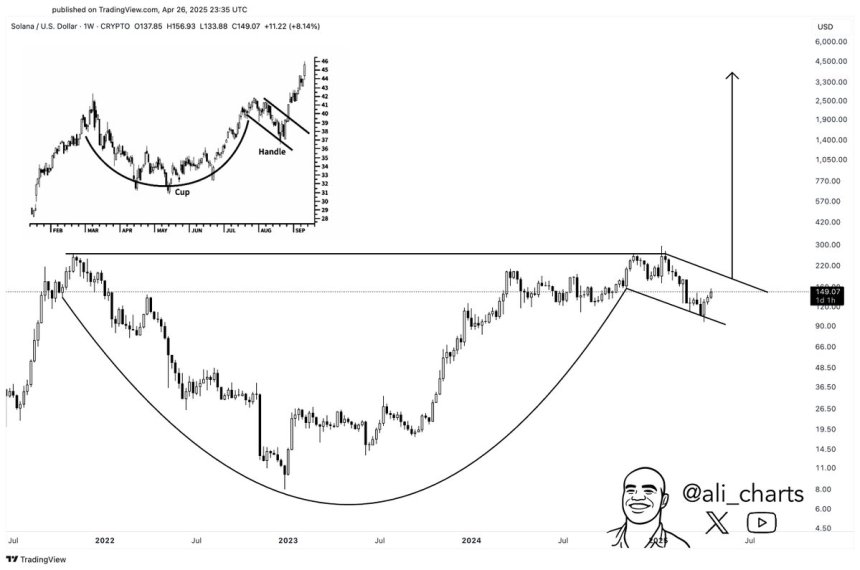

Despite the uncertain background, the technical indicators are starting to encourage a bullish perspective for Solana. The high-level analyst Ali Martinez has shared new intuitions, underlining that when zooming, Solana seems to form a cup and a handle model for a text-a classical technical configuration typically associated with important bullish breakfasts. If validated, this model could prepare the foundations for a strong rise in the coming weeks.

However, caution is guaranteed, since the volatility of the largest market and unresolved geopolitical tensions could stop the under development. The next few days will be fundamental for Solana’s tendency, since bulls will have to defend the key levels and build enough pressure to try a real breakout above the resistance.

Solana shows strength among the dynamics of the changing market

Solana has increased by 58% since the beginning of April, showing an impressive recovery impetus while market dynamics begin to change. After months of weakness and sales pressure, Solana is now emerging as one of the strongest artists among the main Altcoin. Analysts are observing the level of $ 160 closely, with many asking for a decisive breakout that could unlock further earnings. However, the risks remain high. The wider macroeconomic environment remains unstable, with global commercial conflicts and volatility of the financial market that weighs on the feeling of investors.

Solana was particularly sensitive to this uncertainty. Since January, Sol has lost over 65% of its value, highlighting the growing sales pressure and the speculative behavior that dominated the market during the first quarter of 2025. Despite this, the recent increase has moved short -term momentum to the bulls, offering hope for a wider recovery if the key levels are claimed.

Martinez’s analysis supports a bullish perspective for Solana. He underlines that the zoom zoom reveals that Solana is forming a cup and a handle model for a textbook. This classical technical structure often precedes strong movements upwards, especially if accompanied by a growing volume and macro support conditions. If confirmed, this configuration could mark the beginning of a great event per SOL in the weeks to come.

Reading Reading

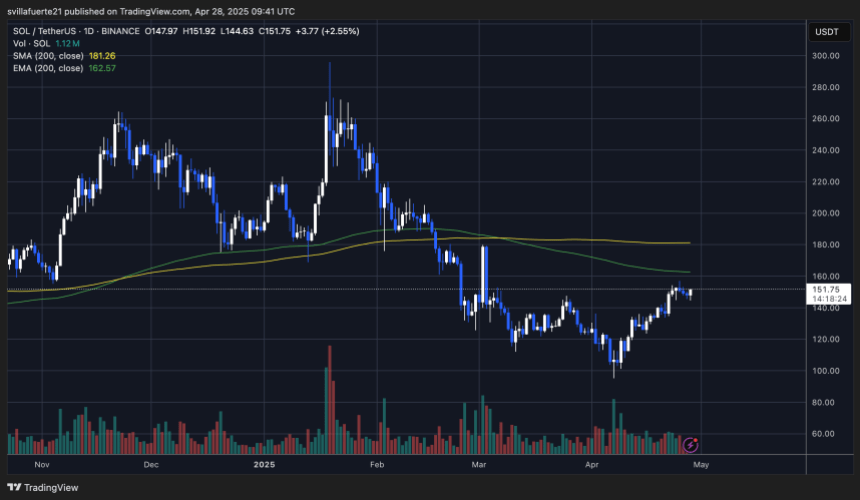

The action of the price Sol remains tight below the key resistance

Solana (Sol) is exchanged at $ 151 after several days of consolidation below the $ 160 crucial resistance area. The bulls have managed to defend recent earnings, but the momentum has slowed down while the prices fight to push higher. The recovery of the $ 160 level is essential for bulls to resume full control and continue recovery. A clean breakout greater than $ 160 could trigger a rally towards the sign of $ 180, which aligns with the 200-day mobile average (but)-a critical technical barrier which, if put in support, would confirm a strong turnaround.

However, the risks remain high if the bulls are unable to recover the resistance of $ 160 soon. A failure in this area could expose solos to a deeper correction, potentially dragging the price towards the support area of $ 120– $ 100. This would not only delete recent earnings, but could also damage the feeling of the market, slowing down the recovery efforts of Solana.

Reading Reading

For now, the consolidation just under the resistance suggests that buyers are trying to increase strength. However, the next few days will be fundamental to determine if Sol can break or enter another corrective phase. All eyes remain at the Breakout level of $ 160 while the battle between bulls and bears intensifies.

First floor image from Dall-E, TradingView chart