Este Artículo También Está available en español.

Solana (Sol) is facing a serious sales pressure as it verifies the key levels of the application, with the bears that earn control after a failure of the maximums of all time. The price has fought to maintain the momentum and investors are now observing critical support levels that could determine Solana’s next move.

Reading Reading

After an explosive event at the beginning of this year, Sol is now at risk of lowering when the feeling of the market becomes uncertain. The high -level analyst Carl Runefelt has shared a technical analysis on X, revealing that Solana could repeat the test of a horizontal resistance if it breaks a reliable flag model. This key level will be crucial in determining if Sol can retain its soil or if it is dragged into a deeper correction.

If the bearish flag confirms a break, Sol could go down to test areas of lower demand, leading to further downward pressure. However, if the bulls manage to recover the key resistance levels, a potential recovery could be on the table. The next few days will be fundamental for Solana while the traders are looking for signs of a turnaround or a continuous moment of discount.

Solana enters a critical phase

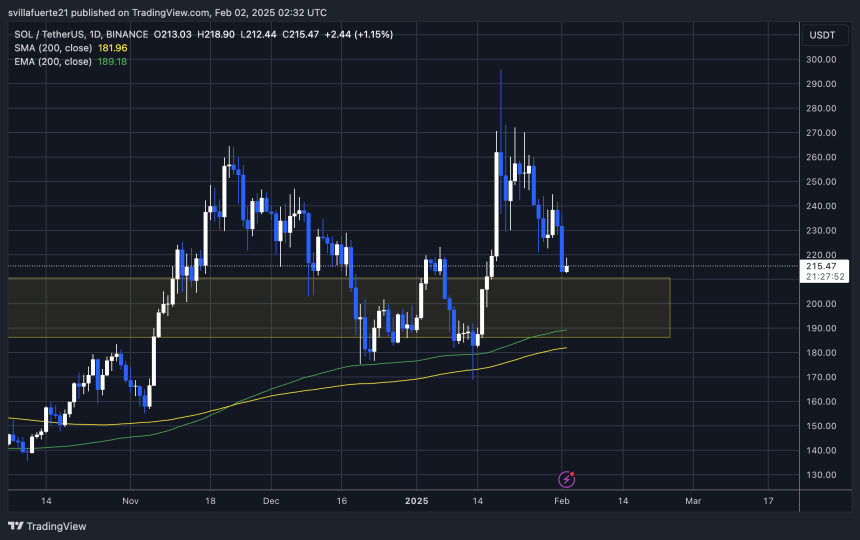

Solana is in a crucial phase, with the next few days destined to define whether it will continue its tendency to reduce or establish a structural variation of prices. After not having managed to support his bullish momentum above the tops of all time, the bears took control, pushing the SOL in the levels of key demand. The price has now fallen to $ 220 and analysts warn that the lowest levels could arrive in the following weeks.

The high -level analyst Carl Runefelt shared a technical analysis on X, highlighting that Solana could repeat the horizontal resistance test to about $ 222 if he breaks down a daily bearish flag. If this bearish model takes place, Sol could descend even more to test the level of $ 211, a large demand area that will probably decide the fate of the trend.

However, if the bulls manage to defend the current levels, a push above the supply areas could lead to a recovery of prices. The first step for a reversal would be to break over $ 222 and claim it as a support. If this happens, Solana could regain strength and challenge higher levels of resistance in the coming weeks.

Reading Reading

The next few days will be decisive, since Sol is at a turning point between a deeper correction or the beginning of a recovery phase.

Price struggles below the key level

Solana is exchanging $ 216 after losing the critical level of $ 220, a great support that the bulls had to hold. Now, bears have control and every moment Sol spends under this level increases the risk of a further disadvantage. If the price cannot recover quickly, the next significant demand area to test will be about $ 200, a level that could determine if Sol continues its correction or finds a strong rebound.

However, bulls are not yet out of the game. If Sol manages to recover $ 220 as a support, it could invalidate the bearish break and set for a potential reinvision of the trend. A strong move above this level would indicate a renewed purchase pressure and could allow Solana to challenge higher resistance areas in the next few days.

Reading Reading

For now, Sol remains in a fragile position and traders should look closely at the action of prices about $ 220 and $ 200. An $ 200 lower trend would confirm a deeper correction, while a quick recovery greater than $ 220 could rekindle the upward momentum. The next sessions will be crucial in determining Solana’s short -term direction.

First floor image from Dall-E, TradingView chart