A cash pillow of cash of 300 billion dollars just trained in cryptocurrency and traders ask when that “dry powder” will rotate in altcoin.

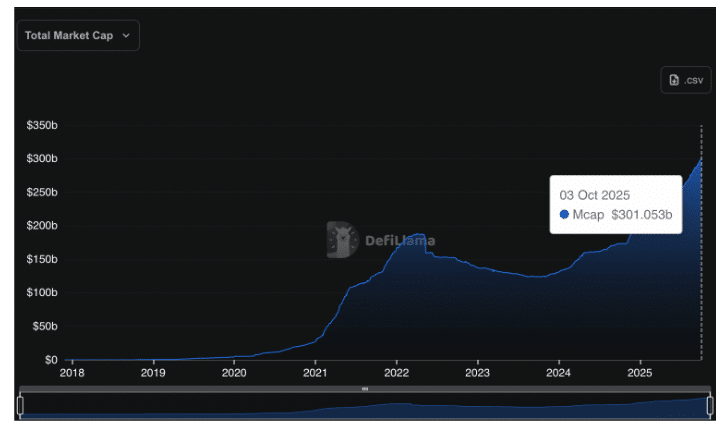

The value of the tokens with dollar combs in circulation has exceeded $ 300 billion for the first time, marking a milestone that often increases liquidity between digital activities.

Find out: Next 1000x Crypto: 10+ token crypt that can affect 1000x in 2025

What reveals the stablecoin supply report on market liquidity?

Data from Defillama It shows the capitalization of the total market of Stablecoin at around $ 301.6 billion today, a profit of +2% last week.

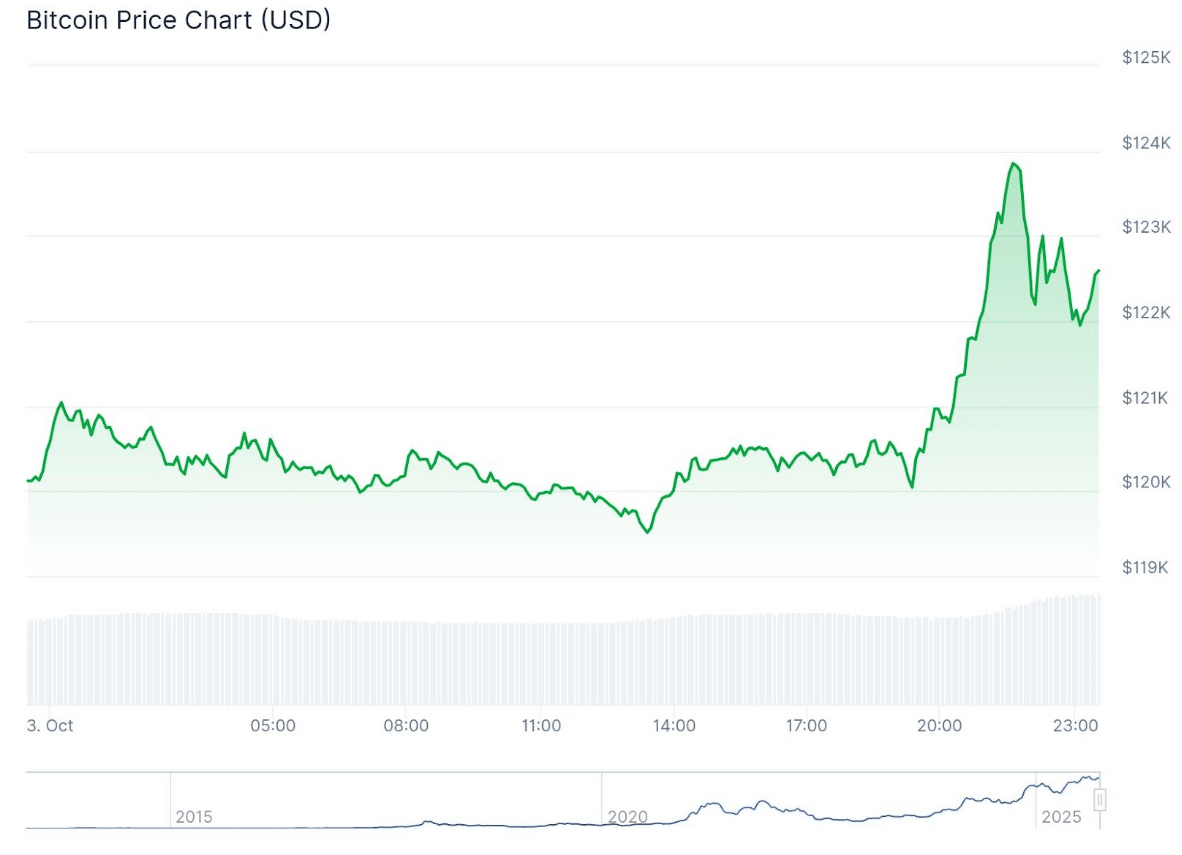

The increase is observed with Bitcoin Trading up to two months to about $ 120,000-123,000, which provides an atmosphere of appetite at a favorable risk in October.

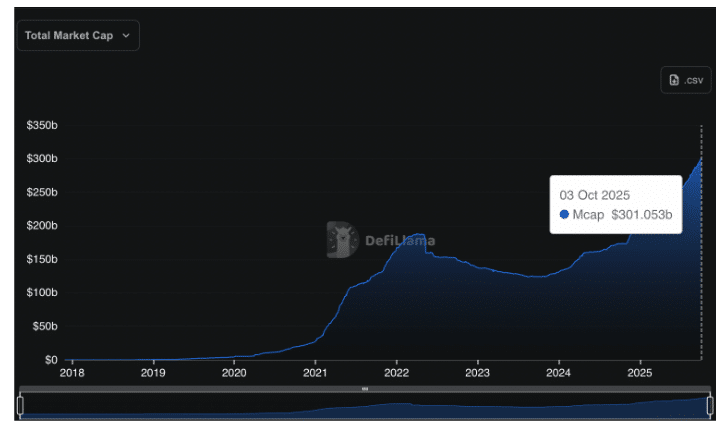

Tether (USDT) is the leader of the issuers and its market capitalization is almost $ 176 billion.

(Source: Corncko)

USD coin (USDC) Next class With an approximate $ 74- $ 75 billion and Syntetic Stablecoin Usde is close to the value of $ 14.8 billion. These three tokens constituted most of the 2025 net issuing.

The growth of this year marks the fastest Stablecoin expansion since the beginning of 2021. This is also the case, analysts say that the market has to further accelerate to meet long -term forecasts.

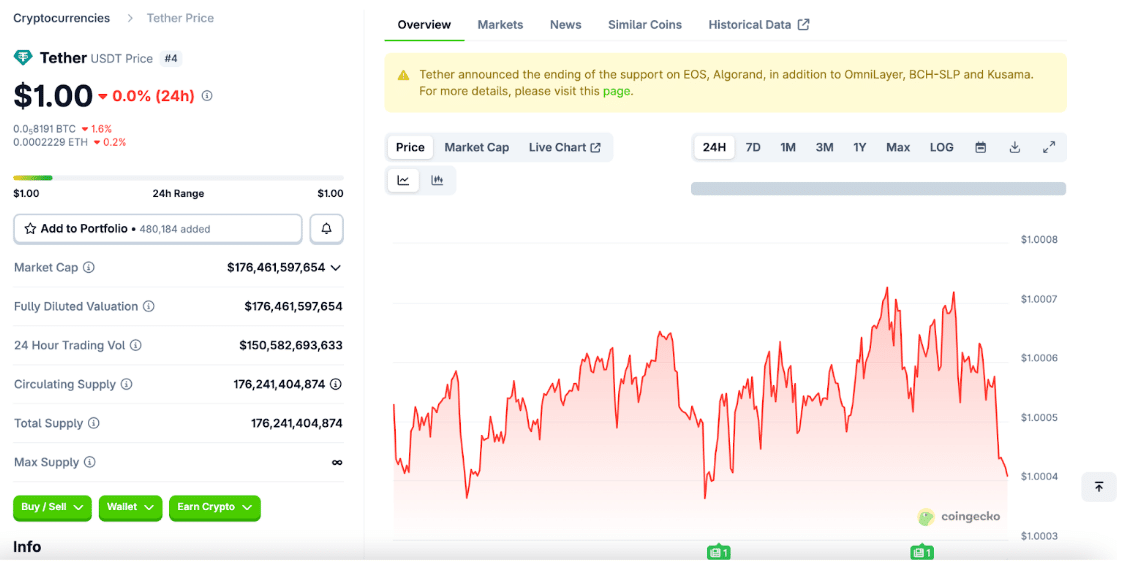

Coinbase projects $ 1.2 trillion supplies by 2028, while Standard Chartered sees $ 2 trillion and cites up to $ 4 trillion dollars by 2030.

(Source: Coinbase)

At the current rhythm of about $ 10 billion added every month, it would take more than five years to reach the lower range of these estimates.

Circle’s push to the public market and the relationships of a large tether financing round are seen as a key driver that could expand the role of the sector in global liquidity.

A key metric to look at is the stablecoin power ratio (SSR). Compare the supply of Bitcoin to that of Stablecoin, measured in BTC terms. A lower SSR means that there is more liquidity from Stablecoin, often described as “dry dust” ready to flow into cryptocurrency.

Second Glassnode dataA simple public proxy that uses Bitcoin market capitalization divided by the total market capitalization of Stablecoin is around 8.1.

About $ 2.45 Bitcoin trillion against $ 301.6 billion in Stablecoins. Methodologies can differ, but this relationship provides a directional view. A lower or constant reading tends to show a stronger purchasing power in the margin.

Find out: 9+ Best High Risk and High Senza Cryptocurrencies to Buy in October2025

How do Stablecoins act like a hedge before the Fed meeting?

The background seems to support. The issue of Stablecoin has expanded, with the market that recently crossed a new milestone for the number of rounds.

At the same time, the price of Bitcoin near $ 120,000 maintains attention on the wider cryptocurrency market. If the flows rotate beyond Bitcoin, the half -capitalization tokens are usually the first to benefit.

(Source: Corncko)

According to the Glassnode framework, a bass sustained SSR or a further decline in the proxy ratio would indicate that Stablecoins still maintain a significant purchasing power for the future moves of the market.

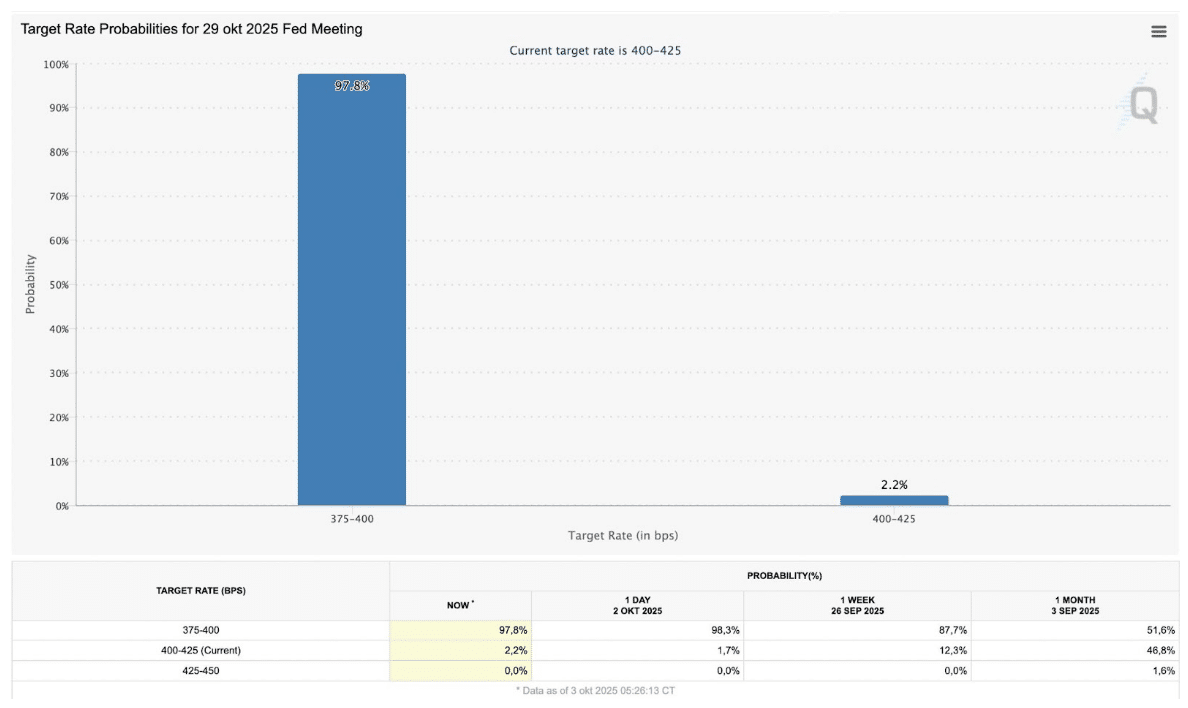

The latest Fedwatch data indicate that the markets are almost fully expected that Federal reserves cut the rates in the meeting of 29 October 2025.

(Source: x)

The current prices indicate a probability of 97.8% that rates will drop to the range of 375-400 base points, leaving only 2.2% probability that the Fed is stable at 400-425 BPS.

The expectations moved clearly compared to last month, when the traders had been almost divided.

The cryptographic analyst Ted has linked this movement to Stablecoin flows. He said that retail traders are accumulating with bullish bets, while institutional investors seem to cut positions.

Unpopular opinion: October rates cuts already have a price completely at prices.

The retail sale is accumulating with extreme rise.

The institutions are safely downloading.

Connect the points.

I could be wrong, but I’m managing with 70% in Stablecoins. pic.twitter.com/e7dkhndwh4

– TED (@Tedpillows) 3 October 2025

“The cuts in October rates already have a price completely at prices,” said Ted, and added that he moved 70% of his portfolio to Stablecoins as part of his risk management.

Fed’s decision could shape the liquidity between the markets and influence the appetite at risk.

For now, the traders are dealing with the ascatto as a certain certainty, with the Stablecoins acting as a favorite hedge before the political call.

DISCOVER: 20+ Next Crypto to be exploded in 2025

Join 99 bitcoins news discord here for the latest market updates

The post Stablecoins has reached $ 300 billion evaluation: when Altcoin markets appeared first out of 99 bitcoins.