Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Tron (TRX) is currently browsing a prolonged consolidation phase that began in December 2024, with prices that oscillate between key levels and no clear direction of breakage in sight. Despite this action linked to the range, Tron remains firmly in the spotlight since fundamental developments capture the attention of the market.

The most significant news came two weeks ago, when the relationships revealed that Tron is preparing to become public through an inverse merger with the SRM entertainment listed in Nasdaq. This potential list could mark an important milestone for the Blockchain platform, potentially making it the first large cryptocurrency network to enter directly into the US public markets.

Reading Reading

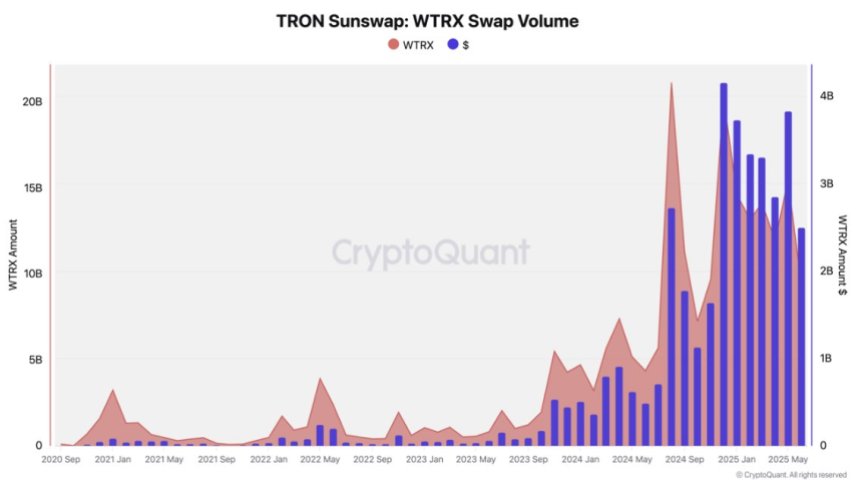

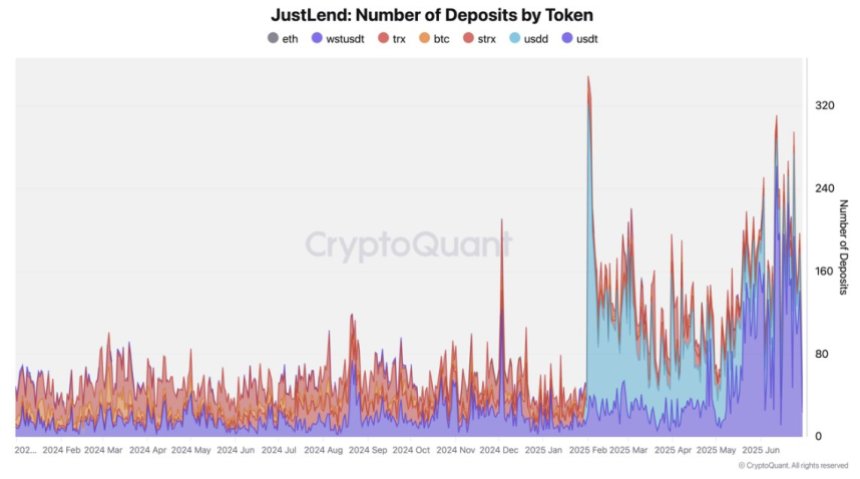

At the same time, the signals of data on chain that grows under the surface. According to the intuitions of CryptoQuant, the Defi activity on the Tron network has constantly expanded. The increase in transactions volumes, the increase in justlend deposits and the record exchange activity on Sunswap Punto to deepen the liquidity and involvement of users.

These developments highlight an ecosystem in maturity, but the market has yet to evaluate in a breakout move. While the consolidation continues, traders and investors are observing the next important catalyst closely. It remains to be seen whether the public list of Tron or the acceleration of Defi Traction triggers, but the momentum is silent.

Tron Defi Signals of growth at the basis of force

Tron is testing the levels of critical prices after months of lateral movement, consolidating between $ 0.211 and $ 0.295. This range has acted as a structural base since the end of 2024 and a clean break in both directions could determine Tron’s next main trend. A breakout above $ 0.295 would probably trigger a new momentum towards new local maximums, while the failure to maintain the support could expose the activity to deeper corrections.

While the largest cryptocurrency market anticipates the expansion upwards, supported by the event in US actions and a more stable macro background – Tron remains trapped in this narrow band. Volatility persists and without a decisive breakout, the market participants remain cautious. However, the underlying fundamentals suggest that Trx could silently collect strength.

According to cryptoqual data, the DIFI activity on the Tron network is increasing quickly. Sunswap has exceeded $ 3 billion in the volume of monthly swap constantly throughout 2025, with May that set up a record at $ 3.8 billion. In the meantime, Justlend’s deposits have more than tripled since the beginning of the year, reaching a peak of $ 740 million. These developments indicate the in -depth study of liquidity and the growing demand in Tron’s Defi ecosystem.

The affluent of Stablecoin and the increase in loan activity further strengthen the expanding usefulness of Tron, suggesting that the network is becoming a robust level of settlement. While the price remains for now, the foundations suggest a solid base for the future, once the technical breakout finally materializes.

Reading Reading

The TRX price consolidates near the resistance

TRX is currently mistaken about $ 0.2813, keeping its position near the upper border of the long -standing consolidation range started in December 2024. The activity showed resilience above the 50 -day mobile averages, 100 days and 200 days, all by tending upwards, supporting the prospects of Bullish. The 50 -day SMA at $ 0,2508 and the 100 -day SMA to $ 0.2289 provides dynamic support, indicating a strong interest in the buyer for the balls.

The action of prices throughout June remained laterally, with low volatility and volume consistent with a classic consolidation phase. Despite the multiple regions below the resistance of $ 0.295, Trx did not show any sign of structural weakness, with a firmly above $ 0.26- $ 0.27 and gradually building a pressure towards a breakout.

Reading Reading

The volume has remained stable, although it has not yet reported the type of break -up momentum which would confirm a transition to discover the highest prices. The traders are looking closely for a clean candle that closes over $ 0.295 to validate a bullish continuation. In case of success, TRX could gather towards the $ 0.32- $ 0.35 area, with a minimum air resistance.

First floor image from Dall-E, TradingView chart