Https & Colon; & Sol; & Sol; x & period; Com & Sol; Guerillav2

Today at the Conference of Plan B in El Salvador, Tether made an announcement that has been underway. Usdt is back on Bitcoin using TAPROOT resources.

The next steps will be the asset for the mint legate, which will be initially available via Bitfinex.

Tether’s return to the Bitcoin ecosystem through Tupot’s resources is not just a simple return; It is a strategic pivot that could announce a new era both for Bitcoin’s Lightning Network (LN) and for the wider landscape of Stablecoin.

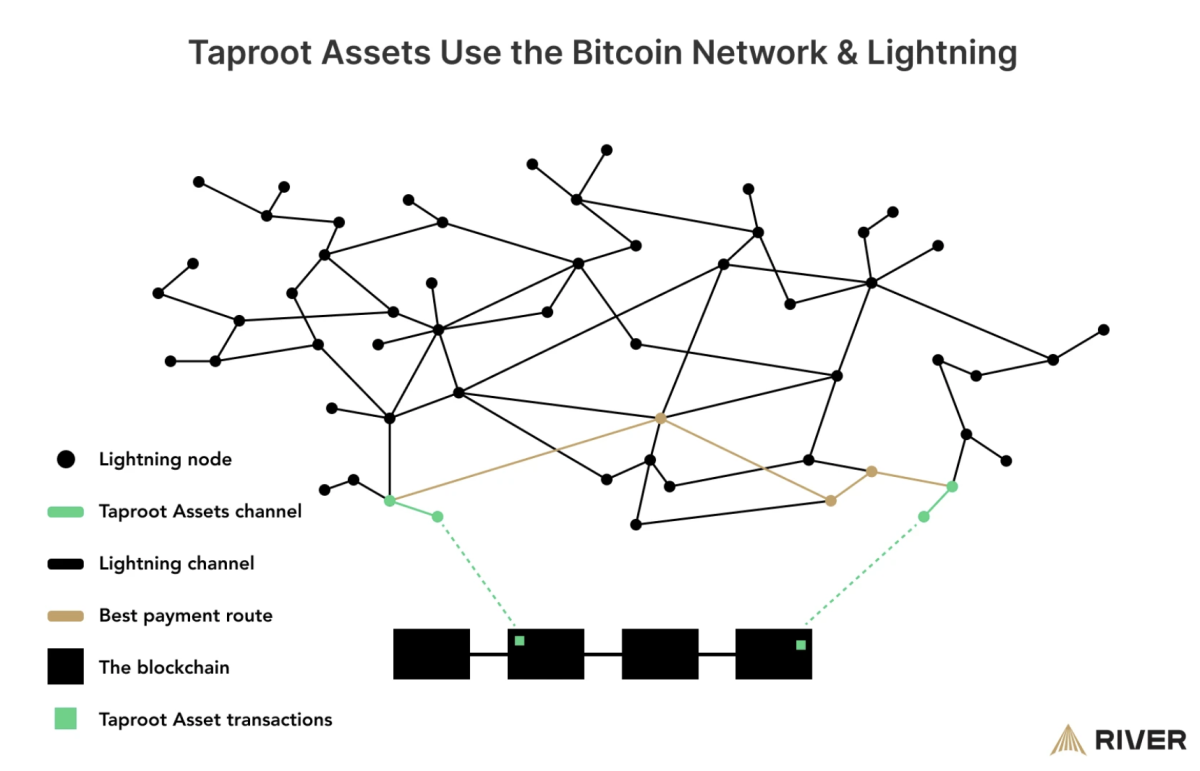

With the USDT that now returns to the Bitcoin network in a way that is also interoperable with Lightning (it has no direct impact on Bitcoin the asset-trannne for the fact that it is enormously upward), users can enjoy the advantages of almost transactions Instant and lows are fundamental for the practical use of Stablecoin in trade or in daily remittances. The integration is particularly advantageous in the regions in which financial infrastructures are lacking or prohibitive.

Having said that, the Lightning network is probably not able to manage the activity and flow of users who occur on competing chains such as Solana or Tron. There is also the question of how well the lightning network will manage the increase in the load of stablecoin transactions without degrading performance or lead to the centralization of the knot operations due to the need for greater liquidity.

The answer to this lies in a simple variable: Good infrastructure – And this is where Joltz comes into play.

Also presented at the Conference of Plan B, Joltz’s first bet on Taproot’s resources now seems to be prescient. Joltz introduces some significant progress in the ecosystem of Bitcoin infrastructure with its unique characteristics. It is one of the only self-aware mobile wallets that support TAPROOT resources, it allows users to manage multi-depth and swap payments directly on Bitcoin. In addition to the autonomous portfolio, Joltz offers a software development kit (SDK) that could be integrated by other developers, reducing the time and costs involved in the addition of the support for these resources, as well as on-chain and lighting bitcoin transactions. This could be advantageous for existing cryptographic wallets, activities of activity, Stablecoin platforms, Fintechs, payment apps and exchanges, offering them a path to improve their services with less development efforts. Developers who wish to access early SDK Joltz can register here.

Similar to how Trump promised to free Ross on the first day, we should ask that USDT be supported everywhere on day 1, with a good UX. Joltz will present it, hopefully it opens the way to others to see the scale of the opportunity that awaits us for Bitcoin.

Now: why should you even want Stablecoins on Bitcoin?

The recent increase in the activity of meme coins on Solana has led to a significant congestion of the network, pushing the transaction commissions to record the maximums. The daily revenues of Solana reached almost $ 78 million at the end of 2024, a direct result of the boom in the meme currency, but this has reached the cost of higher transaction commissions and occasional network congestion, challenging the experience of the user. Likewise, Tron faced his challenges with the transaction commissions. It has been reported that Tron’s daily revenues exceed $ 5 million, reflecting his significant role in the management of Stablecoin transactions, but also highlighting the pressure on his strongly centralized network. We want those commissions on Bitcoin, for miners and routing operators.

LN offers almost infinite scalability allowing the transactions to occur out of chain, sitting on Bitcoin only when necessary. This approach strongly contrasts with the scalability struggles of the single layer blockchains such as Solana and Tron.

In addition, with LN, there is the potential for new financial products. Blocking bitcoin inside Lightning channels can open opportunities for generation of yields such as the supply of liquidity (leasing) or even more complex financial instruments relating to routing, providing users with new ways to generate Bitcoin’s native returns not based on questionable practices. (See also mine Recent relationship On Bitcoin Stablecoins.)

The announcement today underlines a wider lesson in the cryptocurrency space: while specific chains such as Solana and Tron have made giant steps in terms of speed and costs, true scalability requires time and many investments in infrastructures to guarantee decentralization and L ‘Exit without trust: otherwise what is the point? The centralized chains guide on Stablecoins is temporary: Bitcoin is forever.

The return of Tether to Bitcoin through the TaProot resources indicates a vote of confidence in the evolution skills of Bitcoin. It is a testimony of innovation within the Bitcoin space and a reminder of how fundamental technologies such as Bitcoin can adapt and expand to meet new needs despite the high -quality ln high quality critics flyer focused on chasing distractions rather than on the real utility (meow).

This move could very well prepare the foundations for further innovations in decentralized finance (Defi) on Bitcoin (BTCFI), remodeling as we think Bitcoin as a final settlement level For all types of economic activity.

Welcome back tether! <3

This article is a Take. The opinions expressed are entirely those of the author and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Guillaume articles in particular can discuss topics or companies that are part of his company’s investment portfolio (Utxo management). The opinions expressed are only his and do not represent the opinions of his employer or his affiliates. Does not receive any financial compensation for these filming. Readers should not consider this content as a financial advice or approval of a particular company or investment. Always do your searches before making financial decisions.