The price of Bitcoin descends to $ 91,500 triggered the liquidations of mass cryptocurrencies through exchanges and best defi protocols as AAVE and composed – we take a late look.

After reaching the peak of about $ 106,000 on Friday, Bitcoin .CWP-Coin-Coin Svg Path {Wicke-Width: 0.65! IMPORTANT; }

Price

Volume in 24h

?

->

7D price

Abandoned during the New York session that day before extending the losses during the weekend. With the claims of possible market manipulations by the main market makers, Bitcoin went down more on Monday, going down to $ 91,500.

However, the unexpected dough in the previous hours of February 3 has been contained as prices constantly recovered, breaking $ 101,000 before backing up at the spots rates. In the midst of this wave of the price, billions of long lever positions were liquidated on Binance, Okx and Bybit.

Now it is emerging that Longs with lever and speculators 100x were not the only guilty. According to Santiment, the Fallout extended beyond trading to loans, where AAVE, compounds and other Difi protocols had to sell guarantees to protect the lenders. Their decision trembled Defi to the end, unleashing a sale in the best pro-defi platforms such as AAVE, INIECTIVE and even composed.

The collapse of the Bitcoin price recorded over $ 2.2 billion in defeat in the mass liquidation event

From the BTCUSDT graphic designer, the drop from January 31 to February 3 saw BTC lose 10%, pushing the losses from the maximums of all time to about 16%. Although prices are stable at the time of writing, the coin remains lower than $ 100,000.

(Btcusdt)

Over the past three days, the See-Swing and Range market has led to liquidation in the markets of perpetual futures.

According to Coneslass, over 481 million dollars of lever positions have been closed in the last 24 hours. Most of these have been long exploited, betting on Bitcoin and Ethereum to gather.

(Source)

Starting from February 3, this figure was over $ 2.2 billion, which means that many speculators have been eliminated, erasing excess lever.

The same liquidation has been extended to the DEFI loan protocols as aave and compound. On these platforms, users can borrow loans, using WBTC, ETH or any other resource supported as a guarantee.

To borrow, it is necessary to deposit a greater guarantee than the loan amount. For example, to obtain a loan of $ 1,000 in USDT, it is necessary to block a guarantee of $ 1,500 or higher to cover volatility.

It is a form of leverage because the prices provided continue to increase, the borrower must not worry about liquidation. Only once the prices begin cooling, the borrower can consider reimbursing the loan in order not to liquidate the protocol.

WBTC liquidations on AAVE and composed Defi

This is what happened precisely on February 3 when the prices found themselves throughout the line.

Users who had taken the locking loans in WBTC, a Stablecoin that monitors BTC prices, lost the resources on AAVE and composed after the protocol automatically paid these coins.

According to Santiment, over $ 782,000 WBTC have been liquidated on Aave V2, the highest since 1 August 2024.

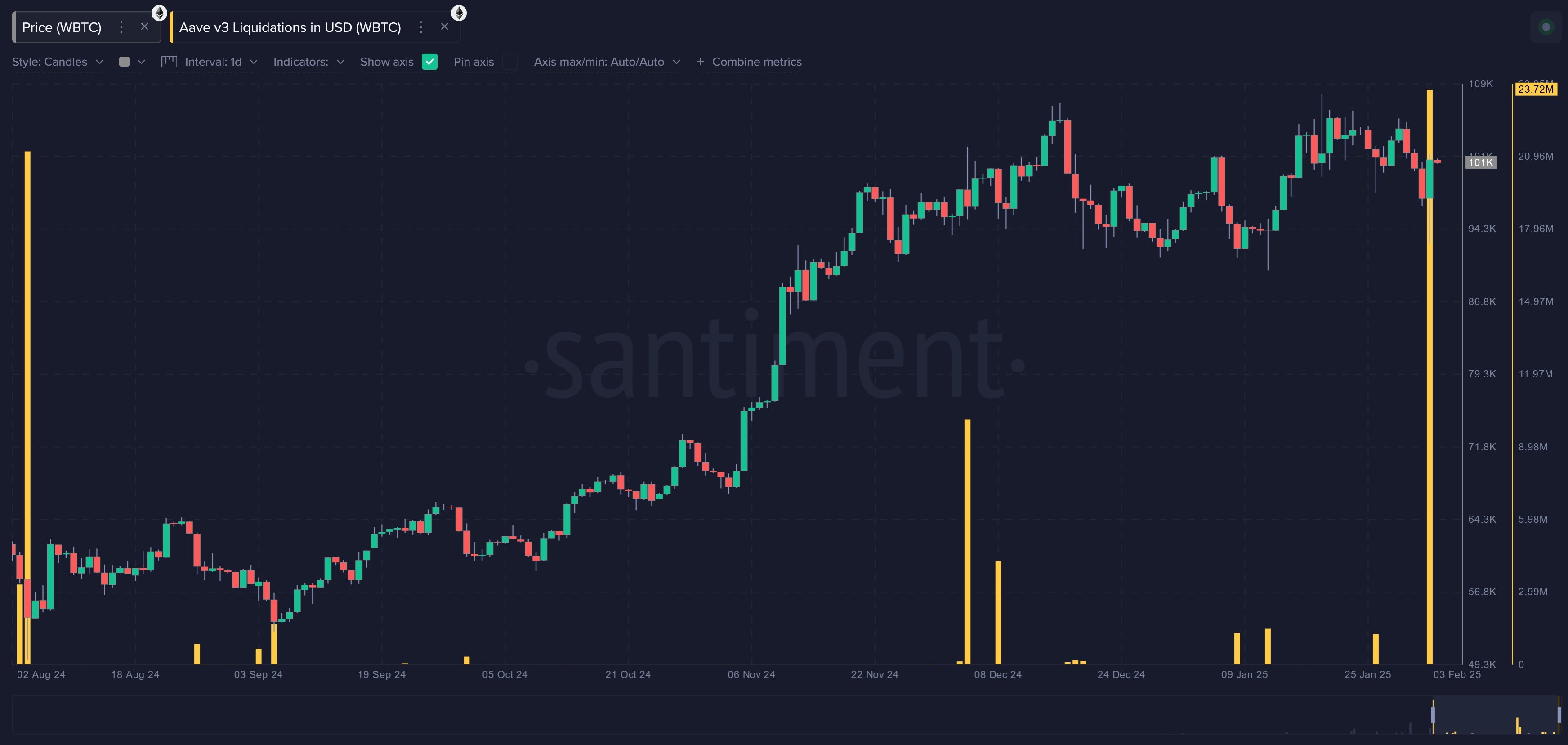

On Aave V3, which is known for its management of the risk and the improved risk skills, over $ 23.7 million WBTC, the highest day of liquidation ever, were sold.

(Source)

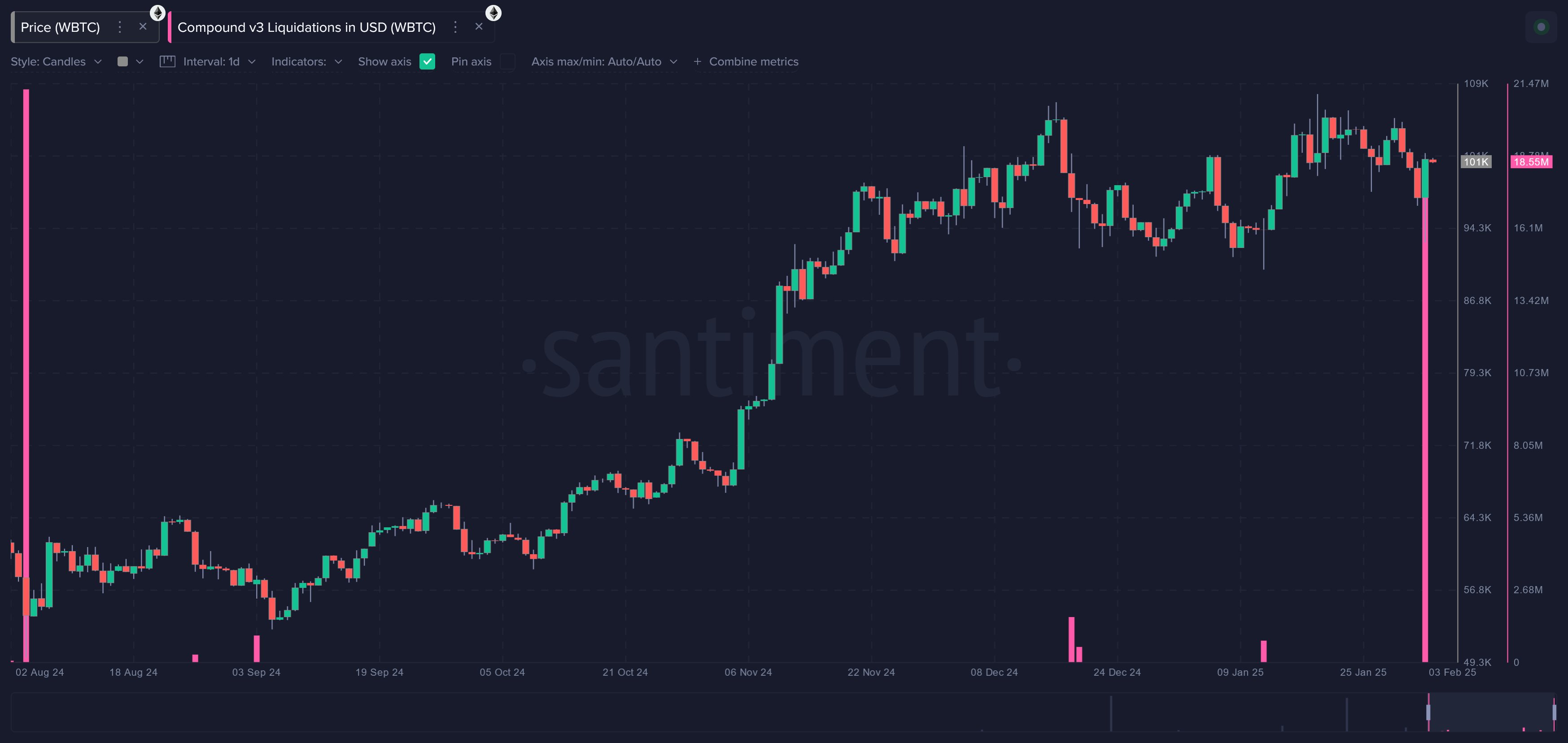

In the meantime, the borrowers on the mixture have not been spared. When the prices crashed to $ 91,500, over $ 467,000 WBTC were closed forcefully. On the V3 compound, over 18.5 million dollars of WBTC guarantees were to be sold to protect the lenders and stabilize the protocol.

(Source)

While mental health resumes after the delegation event, the total blocked value (TVL) of Aave and compound is respectively $ 16.8 billion and $ 2.3 billion, according to Defillama.

(Source)

On average, the underlying activities have reduced by almost 8% in the last week.

Explore: the victims of FTX desperate how parents call the president: will Trump free Sam Bankman-Fried?

Join 99 bitcoins news discord here for the latest market updates

The post of the Bitcoin Drop a $ 91,500 triggered an important Fluhout Defi appeared first out of 99 bitcoins.