For most of this cycle, global liquidity was one of the most accurate indicators to anticipate the action of Bitcoin prices. The connection between the expansion of the offer of money and risk growth was well consolidated and Bitcoin followed that script considerably closely. Yet recently, we paid close attention to a couple of other databases that have been statistically even more accurate in predicting where Bitcoin is directed afterwards. Together, these metrics help to paint a clearer picture of the fact that Bitcoin’s recent stagnation represents a short -term break or the beginning of a longer consolidation phase.

Bitcoin price trends led by global liquidity changes

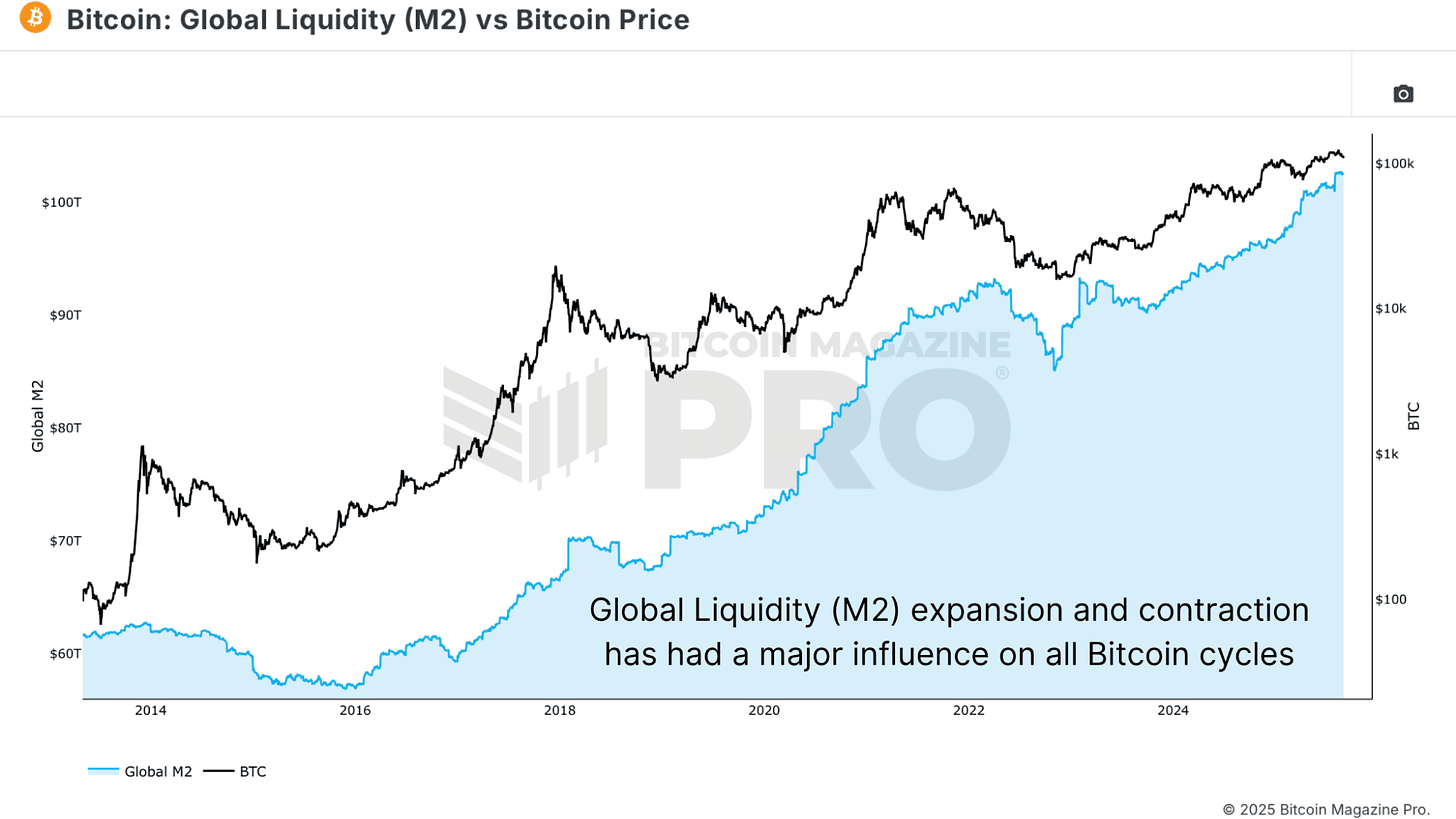

The relationship between Global liquidity, in particular the offer of M2 money and the price of Bitcoin It is difficult to ignore. When liquidity expands, Bitcoin tends to gather; When it contracts, Bitcoin fights.

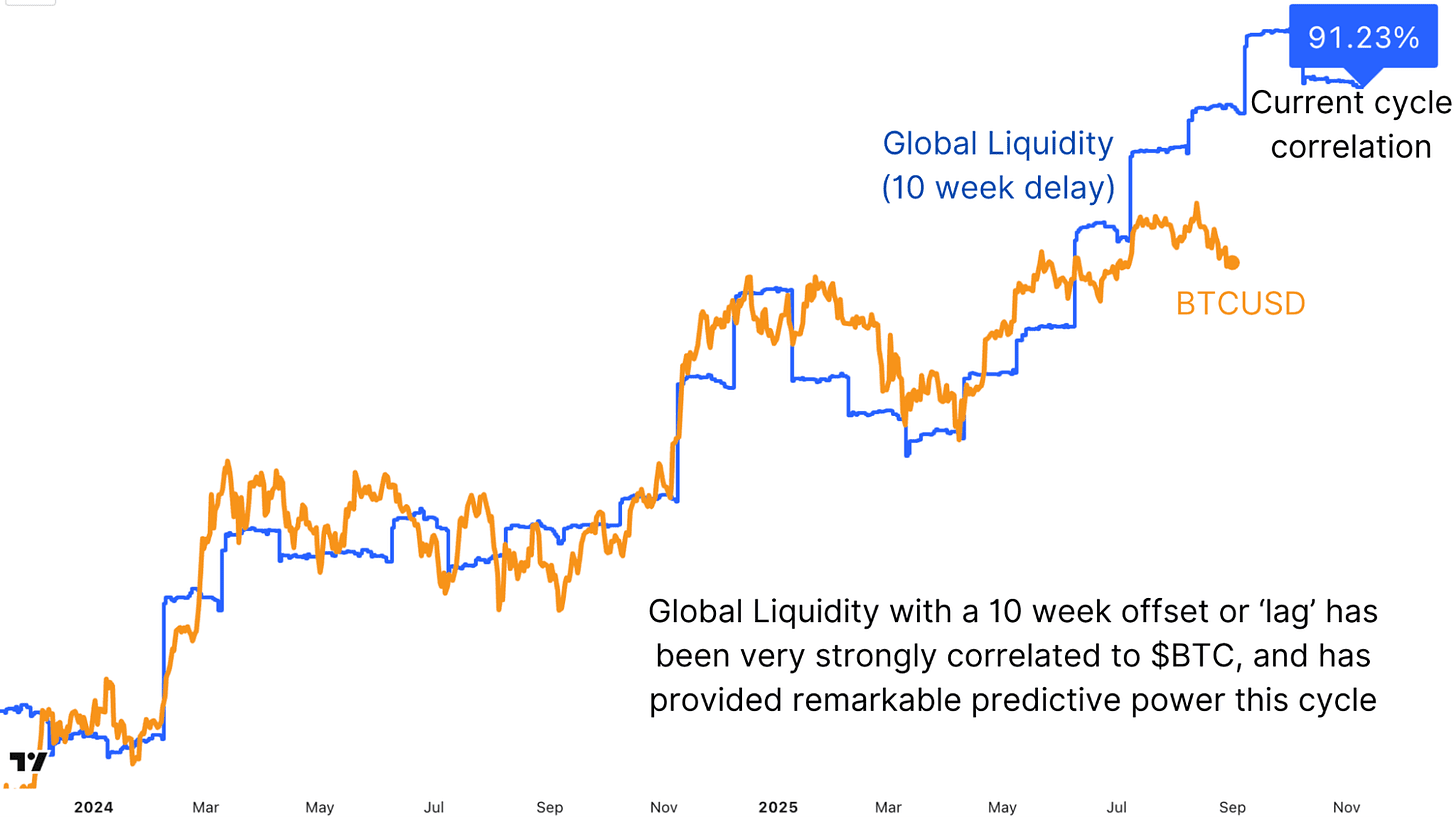

Measured through this current cycle, the correlation stands with an impressive 88.44%. The addition of an offset of 70 days pushes that correlation even higher than 91.23%, which means that liquidity changes often precede Bitcoin’s moves of just over two months. This picture proved to be considerably accurate in capturing the wide trend, with the drops of the cycle that have aligned themselves with the strengthening of global liquidity and subsequent recoveries that reflect the renewed expansion.

However, there was a remarkable divergence recently. The liquidity continues to increase, signaling the support for higher bitcoins prices, but Bitcoin himself has blocked after making new maximums of all time. This divergence is worth monitoring, but does not disable the broadest relationship. In fact, it may suggest that Bitcoin is simply late compared to liquidity conditions, as has done in other points of the cycle.

Stollecoin sopility of Bitcoin Segaization turns off

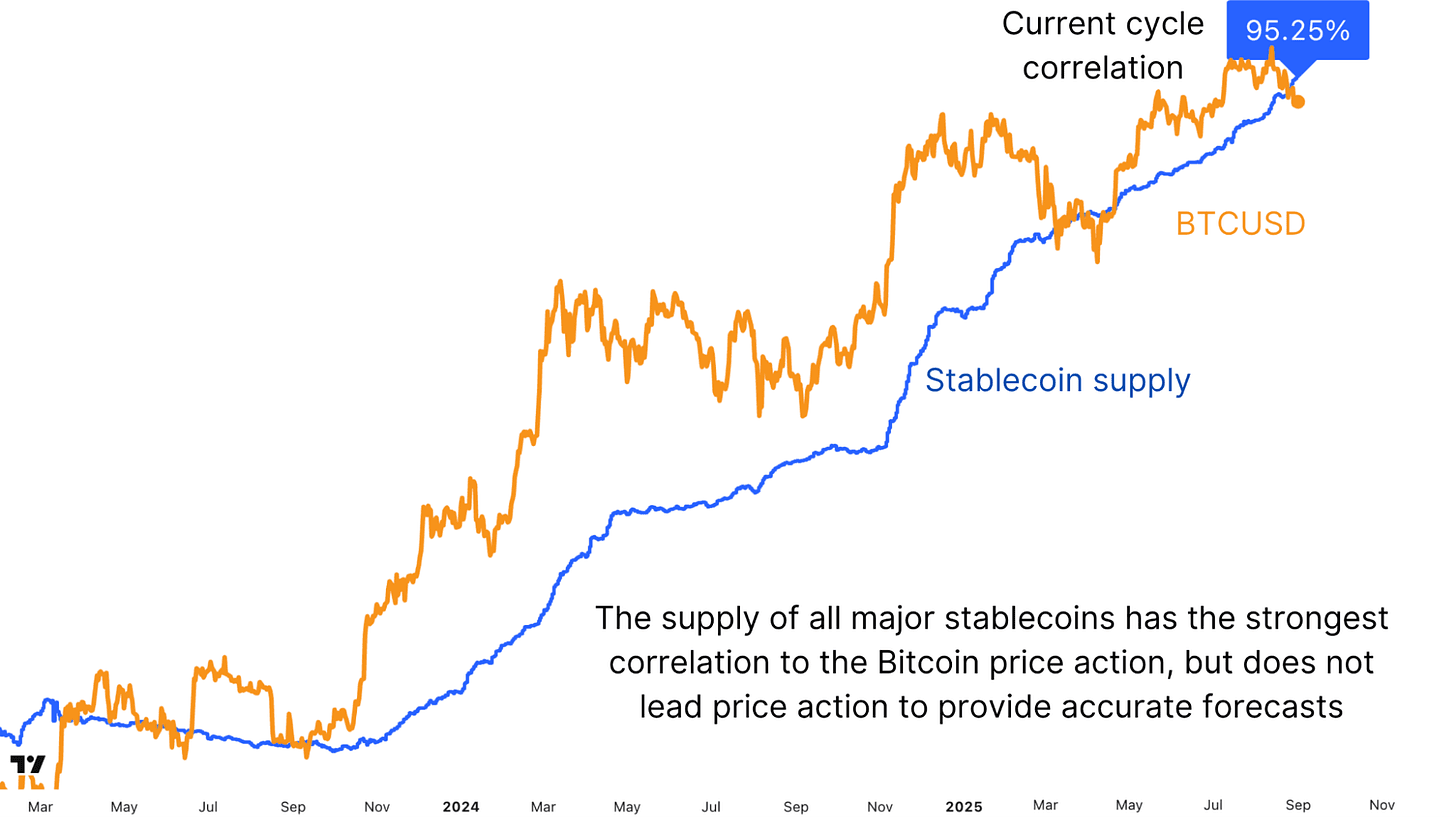

While global liquidity reflects the wider macro environment, Stablecoin Supply offers a more direct vision of the capital ready to insert digital activities. When USDT, USDC and other Stablecoins are coined in large quantities, this represents the “dry powder” waiting to rotate in Bitcoin and finally Altcoin more speculative. Surprisingly, the correlation here is even stronger than 95.24% M2 without any offset. Any important influx of liquidity of Stablecoin has preceded or accompanied an increase in the price of Bitcoin.

What makes this metric power is its specificity. Unlike global liquidity, which covers the entire financial system, the growth of Stablecoin is cryptographic. Represents the potential direct demand within this market. Yet here too we are seeing a divergence. Stablecoin Supply has expanded aggressively, making new maximums, while Bitcoin has consolidated. Historically, these divergences do not last long, since this capital eventually seeks returns and flow into risk activities. It remains to be seen if this suggests an imminent rise or a slower rotation, but the strength of the correlation makes it one of the most important metrics to be traced in a short and medium term.

Bitcoin predictive power of the high correlation of gold

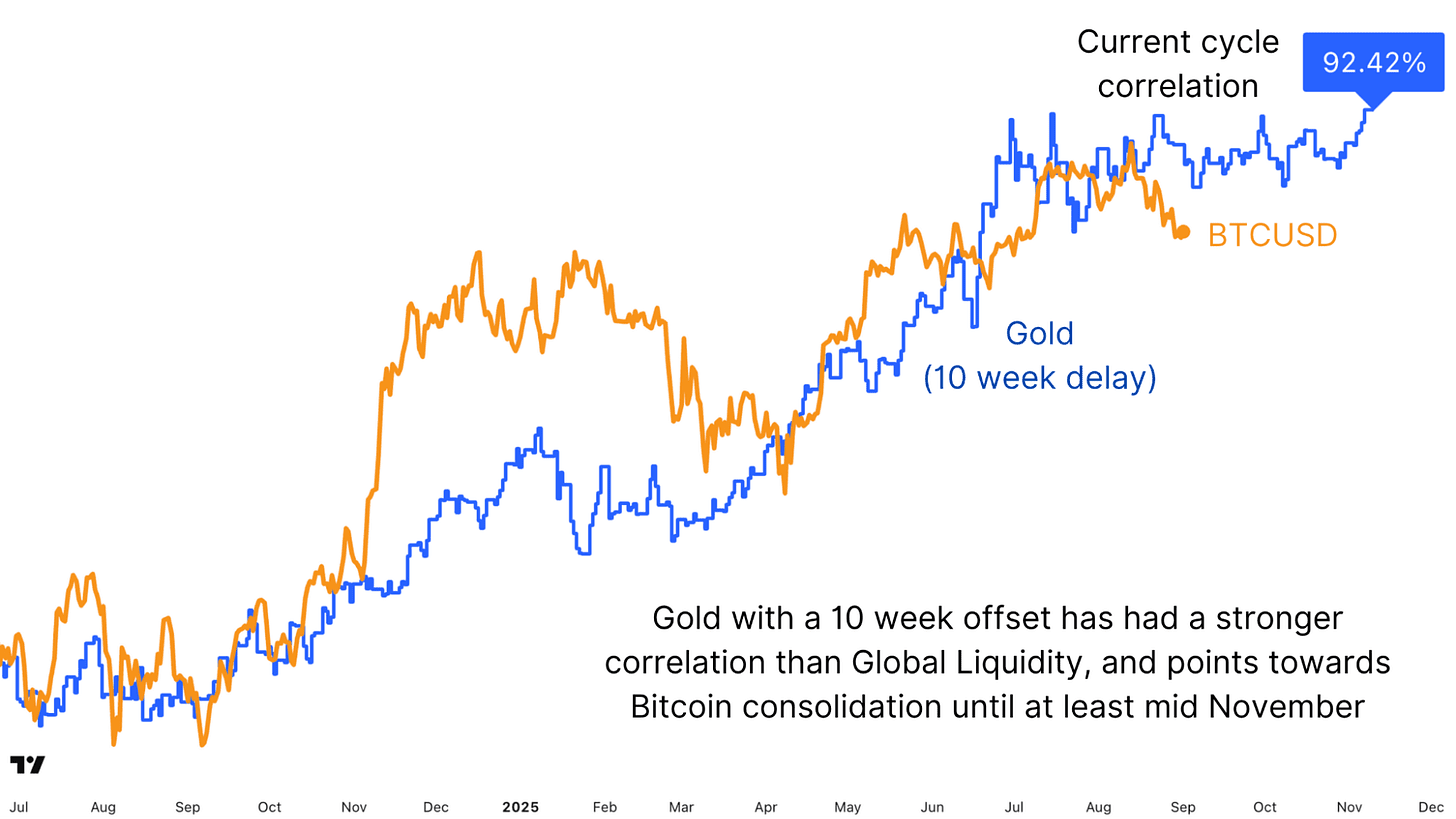

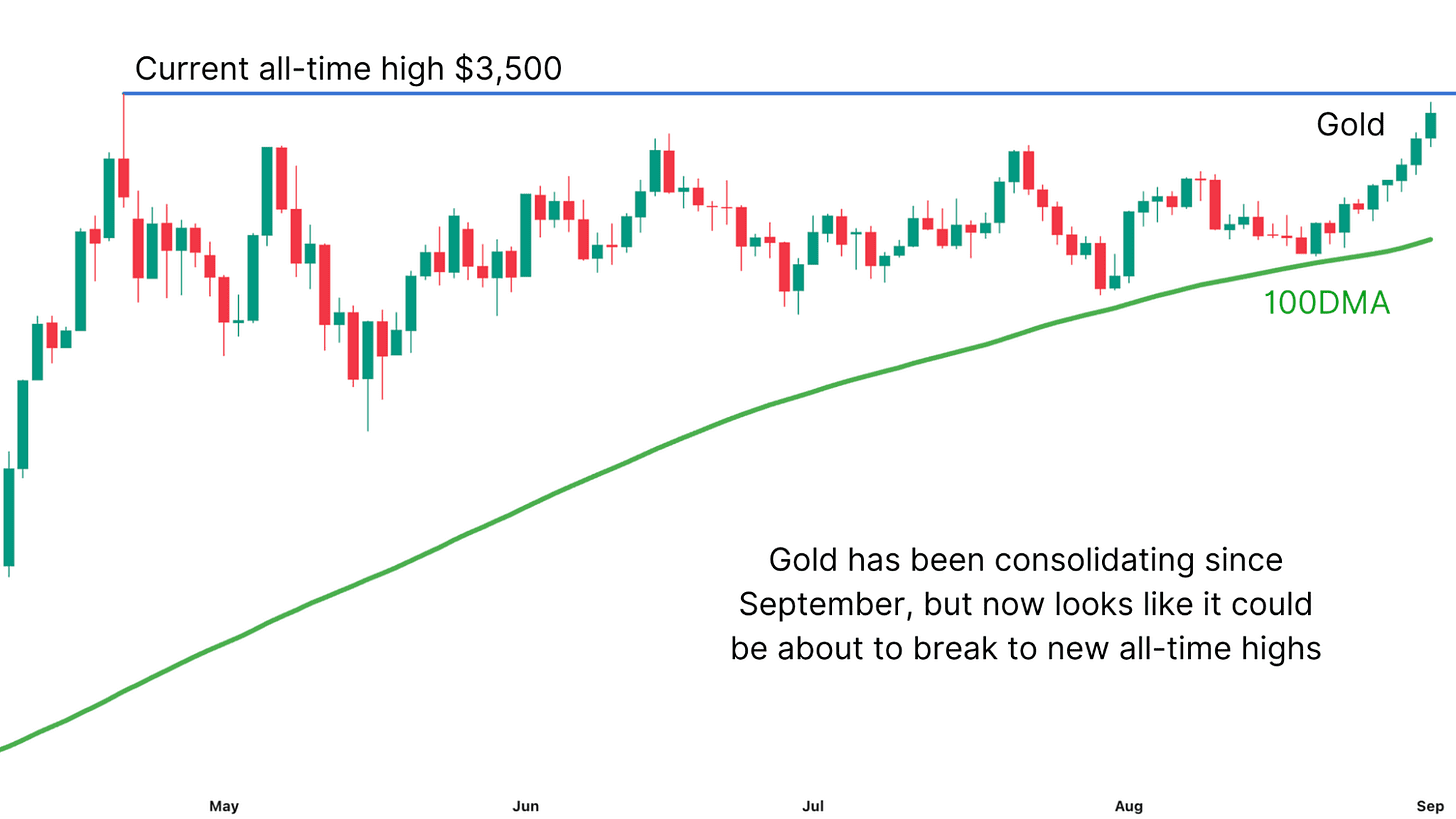

At first glance, Bitcoin and Gold do not share a constantly strong correlation. Their relationship is moved, sometimes moving together, other times divergent. However, when the same 10 weeks delay we applied to global liquidity data, a clearer picture emerges. In this cycle, gold with an offset of 70 days shows a correlation of 92.42% with Bitcoin, higher than the same global M2.

The alignment was surprising. Both activities have touched the same time and since then their main gatherings and consolidations have followed similar trajectories. More recently, gold has been blocked in a prolonged consolidation phase and Bitcoin seems to reflect this with its movement move. If this correlation is valid, Bitcoin can remain limited at least in mid -November, echoing Gold’s stagnant behavior. Yet, with gold that now seems technically strong and prepared for the new maximums of all time, Bitcoin could soon follow if the “Digital Gold” narration is reaffirmed.

The next Bitcoin move scheduled for the metrics of the key market

As a whole, these three metrics, the global liquidity, the supply of Stablecoin and the gold provide a powerful picture to predict Bitcoin’s next moves. Global M2 remained a reliable macro, in particular with a delay of 10 weeks. The growth of Stablecoin offers the clearest and most direct signal of the incoming cryptocurrency demand and its accelerated expansion suggests an assembly pressure at higher prices. In the meantime, Gold’s delayed correlation provides a surprising but precious predictive lens, indicating a consolidation period before a potential breakout later in the coming weeks.

In the short term, this confluence of signals suggests that Bitcoin can continue to cut laterally, reflecting Gold stagnation even when liquidity expands in the background. But if the gold breaks to the new maximums and the issue of Stablecoin continues at its current rhythm, Bitcoin could be established for a powerful end -of -year gathering. For now, patience is fundamental, but the data suggest that the conditions below remain in favor of the long -term trajectory of Bitcoin.

Did I like this deep immersion in the dynamics of Bitcoin prices? Subscribe to Bitcoin Magazine Pro on YouTube for more experienced insights and market analysis!

For further immersion searches, technical indicators, real -time market notices and access to the analysis of experts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.