Digitalx LimitedA manager of Australian digital investments made news with a new Bitcoin acquisition (BTC)reporting a renewed institutional trust in the market. The manager of the cryptographic fund listed in ASX has expanded his Bitcoin treasure with a huge 74.7 BTC, marking a significant addition to his already existing participations.

Digitalx Buy 74.7 BTC

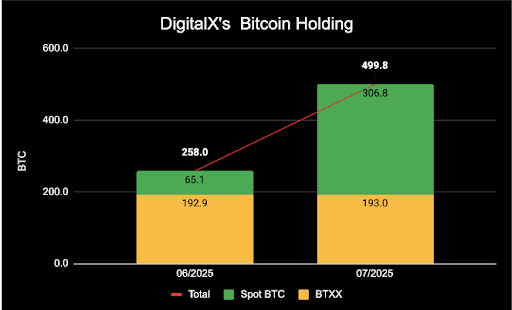

In a recent X Social Media send On July 23, Digitalx confirmed the addition of 74.7 BTC to its treasure. The acquisition, completed at an average price of $ 117,293 for BTC, reflects the constant commitment of the company for its strategy led by Bitcoin. This last purchase increased total Bitcoin investments of the Crypto Fund Manager at 499.8 BTC, worth about $ 91.3 million.

Reading Reading

In particular, also the company announced and expanded the details of this large -scale Bitcoin purchase in an official declaration on Investorhub. Of its total 499.8 BTC Holdings, 306.8 BTC are held directly by Digitalx, while the remaining 193 coins are indirectly kept through 881,000 units in its Etf Bitcoin listed in Asx, BTXX.

The recent addition of 74.7 bitcoins follows a previous acquisition of 57.5 BTC disclosed by the company on July 18, 2025. These back-to-back purchases demonstrate a continuous reallocation of the digital digital asset of Digitalx against Bitcoin. The total treasure of the company, excluding liquidity, now exceeds $ 104.4 million.

As part of its long -term cryptocurrency strategy, the target adaptation of Digitalx portfolio strengthens its role as an institutional level Bitcoin investment vehicle leader on the Exchange of Australian titles. The Crypto Fund Manager highlights its latest acquisition as a key step in its continuous effort to establish Bitcoin as cores Asset Reserve Treasury.

The focus of the shareholders is sharpened when the value of the Bitcoin treasure increases

According to its official declaration, the Digitalx strategy goes beyond the simple growth of its BTC reserve. It also aims to improve the value of shareholders through coherent and transparent reports. The Crypto Fund Manager now keeps track of its Bitcoin participations per action Satoshis (Sats)The smallest unit of BTC.

Reading Reading

Starting from the latest update, the BTC per action of Digitalx stands at 33.88 Sat, marking a 58% increase in its Bitcoin honey Value from 30 June 2025. This figure reflects the impact of recent acquisitions and provides a point of reference in some way measurable for investors that evaluate the exposure to the company’s remarkable portfolio.

Giving priority Bitcoin accumulation And optimizing its treasure structure, Digitalx continues to position itself as a prominent encryption company, one that sees the value of shareholders as directly linked to the strength and growth of its BTC participation. The company is also doubling its long -term vision to exploit the peak cryptocurrency as a strategic financial base.

Leigh Travers, former CEO and non -executive president of Digitalx, reaffirmed The company’s commitment to its digital resource objectives, stating that it aims to constantly grow its BTC portfolio throughout the year and up to the future.

First floor image from Pixabay, TradingView.com graphics