Why is encryption going down today? On Friday 29 August, he marks a critical day for cryptocurrency markets while future binances suddenly offline, while a huge $ 15 billion of Bitcoin and Ethereum options expire. The Bitcoin options market shows a PUT/call ratio of 0.79, with the level of “maximum pain” at $ 116,000 and a heavier open interest at $ 140,000. Ethereum contracts show such a bullish momentum, with a PUT/call ratio of 0.76 and maximum pain at $ 3,800.

With traders already prepared for turbulence, the interruption adds further uncertainty – and has many who ask what could be the best cryptocurrency to buy now.

Breaking: Binance Futures Offline to disable the sale. On only it resumes shortly. https://t.co/cflqlrg5rk

– VikingxBt (@vikingxBt) August 29, 2025

Some traders are joking about the fact that since future binances are temporarily offline, perhaps the market can finally go up again. Well, that’s not what’s going on – at least for now. But not all cryptoros are going down.

Two possible countrymen for best cryptocurrency to buy now could be Chainlink (Link) and Pyth Network (Pyth): both have obtained high -profile roles in bringing the economic data of the United States government to the chain.

Chainlink has recently overlapped many Altcoin, fueled by strong fundamental: new government of the United States and institutional adoption, growing cases of use in the tokenization of activities in the real world and its growing role as a basic blockchain infrastructure. These drivers suggest that link may have more space to climb even when the largest markets face turbulence.

Explore: Top 20 Crypto to be purchased in 2025

Chainlink and Pyth Network gain momentum with the support of the United States government: the best cryptocurrency to buy now?

Both Chainlink and Pyth are gathering in revolutionary partnerships with the United States Department of Commerce. For the connection, the positive moment is powered by two main developments:

- Partnership of the United States Department of Commerce. The doc has announced that it will use Chainlink to bring vital macroeconomic data. This including GDP, PCE Inflation Index and consumer-cain consumption metrics from the Economic Analysis Office.

- First Public Company Link Treasury. Caliber, a real estate asset manager listed at Nasdaq, launched the first company connection treasure, by assigning funds to Chainlink.

These catalysts strengthen the position of Chainlink as a key infrastructure level for tokenized activities and global finance, giving investors new reasons to consider it the best cryptocurrency to be purchased now.

As for Pyth Network (Pyth): Pyth rose to the stars of 91% in 24 hours after being selected to distribute official GDP data on over 100 blockchain. The commercial volume of the token has increased over $ 2.1 billion, with a limit of $ 1.2 billion markets, since the momentum indicators such as MacD have reported a bullish divergence.

$ Pyth it is extremely not very expensive compared to $ Link And now that we are having data on the GDP on blockchain powered by @PythnetworkThe reproces begins and will be broadcast on television.

What if Pyth at the price of the link capitalization of the links …? pic.twitter.com/b5n2rd5857– Sectu ◎ US

(@sumptuosol) August 29, 2025

Pyth will publish historical GDP data for five years and expands in several macroeconomic indicators. Can Pyth really compete with links?

At the time of writing, Bitcoin exchanges near $ 110,300 and Ethereum around $ 4,390, while Chainlink’s momentum maintains its position. A high volatility is expected.

Stay tuned to our real -time updates below.

Etf Bitcoin and Ethereum see strong inflows despite the red market

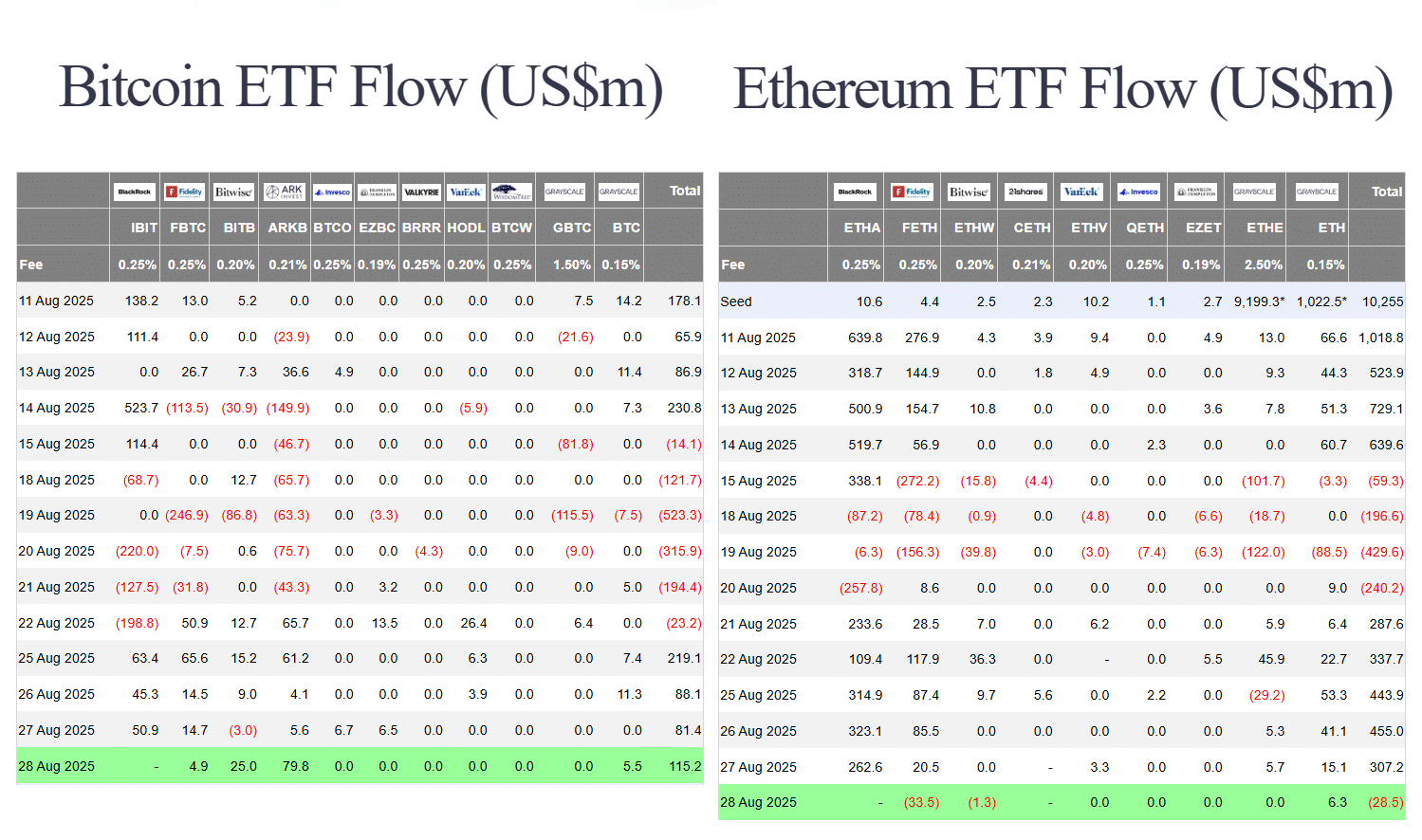

Despite the widest weakness of the market, both the Bitcoin Etfs and Ethereum recorded solid inflows on August 29. Bitcoin ETFs saw a net influx of 1,578 BTC, for a value of approximately $ 174.35 million. Blackrock Ishares opened the road with 568 BTC ($ 62.74 million) added, bringing its total participations to 746,584 BTC worth $ 82.5 billion.

Etfs Ethereum also recorded earnings, with a net influx of 12,489 ETH, for a value of $ 54.86 million. Blackrock has again dominated, ensuring 15,127 Eth ($ 66.45 million) and now holds 3,77,263 ETH worth $ 16.59 billion.

Tron cuts the 60% network commissions to increase the Stablecoin domain

Tron approved a 60% cut in network commissions, with the aim of strengthening his advantage in the Stablecoin transfer market. The proposal, supported by the super representatives of the network, comes after the transactions costs have doubled in the last year and has reached the maximum record in June.

The founder Justin Sun has recognized that the reduction of commissions will temporarily lower Tron’s profitability, since the network income depends directly on the commissions. However, long -term growth is expected since cheaper costs attract multiple users and increase transactions volumes. To maintain the balance, Tron will introduce quarterly reviews of the commissions.

The blockchain remains the best platform for Tether’s Stablecoin USDT, which houses almost $ 81 billion, according to Defillama. Trx, Tron’s native token, has increased by 126% in the last year despite the increase in costs.

Bitcoin Etfs see the inflows of $ 179 million, exceed Ethereum after a week’s break

Bitcoin Etfs staged a return, recording $ 179 million in affluent on August 28, in advance on $ 39.2 million Ethereum.

Arkb of Ark 21shares led with $ 80 million, followed by Blackrock Ibit ($ 63.7 million) and Bitb of Bitwise ($ 25 million). Other broadcasters, including Grayscale and Fidelity, have reported smaller flows, while several funds have not seen activities.

Etf Ethereum-Tracking Etf has published conflicting results. Blackrock’s ETHA brought $ 67.6 million and Grayscale’s Eth added $ 6.3 million, but withdrawals of $ 34.7 million from Fidelity and Betwise have weighed on net influences.

(Source: ETF BTC/ETH)

The move marks the first time in a week that the Bitcoin funds have surrepened Ethereum in daily flows. From 21 to 27 August, ETF ETHs have accumulated $ 1.83 billion, while the BTC ETF managed only $ 171 million. Despite the recent recovery, Bitcoin Etfs still dominate in scale, holding $ 145 billion of activity, compared to $ 29.5 billion of Ethereum.

Between a renewed focus on Bitcoin, the attention of investors is also transforming into Bitcoin Hyper (Hyper): a presale project that builds a bitcoin 2 level with speed at the level of sole and lower commissions. Designed to expand the usefulness of BTC in Dapps and picket, so far Hyper has collected almost $ 12.7 million.

Pre -presses buyers can use token hyper for transactions and governance commissions, with picket prizes offered up to 89% per year. The tokens currently have a price of $ 0.012825, with the next increase in prices expected soon.

Visit Hyper here

Petrochina explores the cross -border settlement based in Stablecoin in the regulatory change of Hong Kong

Petrochina has announced the intention of studying the feasibility of the use of Stablecoin for a cross -border regulation and payments, marking a big step towards financial innovation in the energy sector. The news comes when Hong Kong’s new regulatory framework of Stablecoin officially entered into force on 1 August, imposing on the broadcasters to obtain licenses and satisfy severe capital requirements.

According to Yahoo Finance, the CFO Wang Hua of Petrochina has confirmed the initiative during the briefing of the semester results of the company, observing that the company is monitoring the developments from the monetary authority of Hong Kong. This move positions Petrochina as one of the first energy giants to explore the settlement based on digital activities pursuant to the new rules of Hong Kong.

Sector analysts suggest that Stablecoins could reduce costs, reduce FX risks and increase efficiency in the global energy trade.

The cloak exceeds $ 4 billion in treasury activities, becomes the market leader

Mantle has announced that his treasure has exceeded $ 4 billion of activity, making him the largest in the cryptocurrency market. Next to this milestone, Mantle has highlighted his involvement in the recent Department of United States Trade and the integration of Chainlink, who aims to bring the key data of the United States to Chain government.

The post of today Crypto News, 29 August – $ 15 billion of bitcoin and Ethereum options expire, Binance Futures must be offline: Chainlink and Pyth compete for the best encryption to buy now has appeared first out of 99bitcoin.