One of the city’s largest banks has reformulated the decline in ETHEREUM ETH USD from its highest level as a golden entry point. Jeffrey Kendrick, head of Standard Charterd’s assets, agents this week that ETH USD is still structurally existing, setting a goal at the end of the year with a value of $ 7,500 against the backdrop of the increasing institutional demand and a treasury wave.

The Kendrick note highlighted that the circulating boxes focused on ETHEREM and Corporate Treasury companies have accumulated 4.9 % of the offer circulating since June, a number that is expected to reach 10 % by the end of the year.

This fixed absorption of symbols was the decisive factor behind ETH to 4,953 dollars on Sunday, when the record was set in November 2021 before recovery -11 % in the following sessions.

Crypto Etfs and then the cabinet? What is the legal extent of the price of ETH or Or or Or or OR or OR or Ord.

What matters is that Standard Chartrered is not a correction but the structural offer. Kendrick wrote: “ETH and ETH companies are cheap on today’s levels,” stressing that the corporate wardrobe is gaining double benefits in rewards and opportunities for the ETF investors.

From his point of view, ETH wardrobes are more logical than Bitcoin bonds, which provide return options for negative Holding.

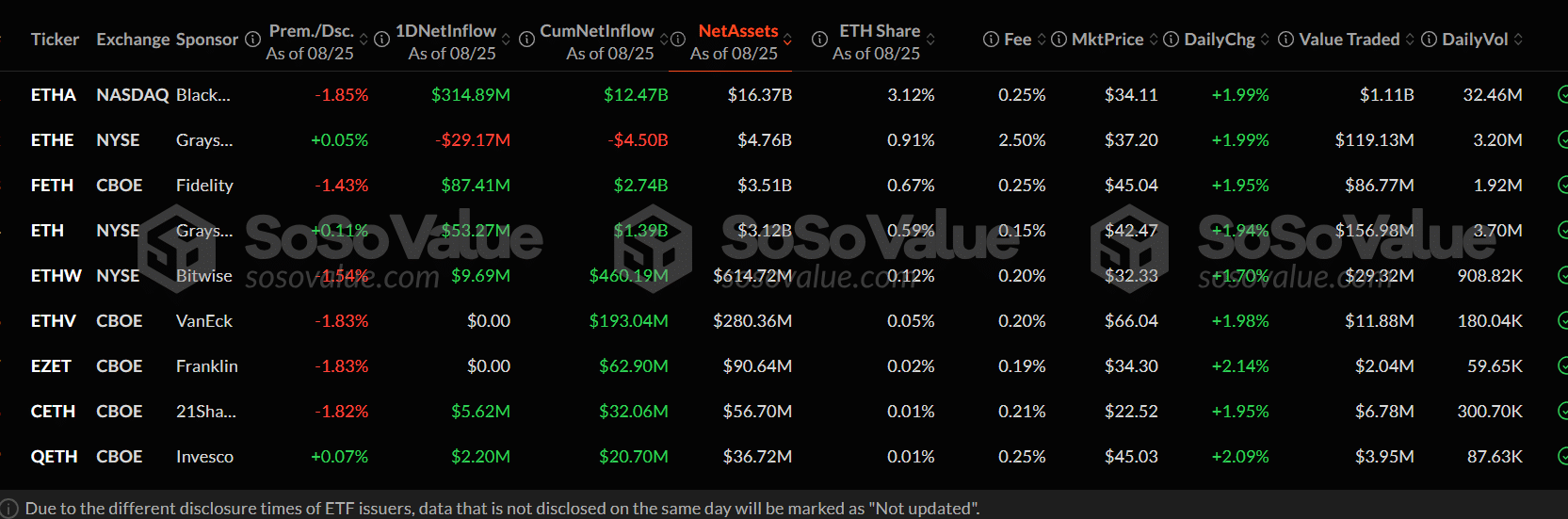

Flows confirm the thesis. Sosoperue data shows that Ethereum ETFS was withdrawn to $ 443.9 million on Monday alone, more than twice more than $ 219 million, which entered Bitcoin equations.

(Source – Ethereum Etf Dashboard, Sosovalue)

Through Thursday and Friday, the ETH boxes attracted $ 628 million in the new capital, while Bitcoin’s external products were registered. On a general basis, ETH USD +32.6 % increased, approximately Bitcoin +17.3 %.

The difference emphasizes the speed of traditional financing to reshape the encryption market. Since SEC approved the investment funds circulating in January 2024, Wall Street has become the largest marginal buyer of digital assets, as the formerly dominated driving price courses were retail speculation.

Now the exporters are pushing to expand the list outside Bitcoin and Ethereum

Discover: Best ICOS Mimi Investment in 2025

BitWise Tarkt growth rate with Spot Sainlink Crypto Etf

On Tuesday, BitWise Asset Management S-1 presented EtF Saftlink, with Coinbase Custody Trust called Custodian and Coinbase, Inc. Executive agent.

The product will reflect the immediate price of LINK but it excludes exhaustion, although SEC’s instructions in May show that exciting rewards do not constitute a stock deal.

The BitWise caution indicates that the two exporters have priority for the speed of organizational approval for potential potential improvements.

This step follows the Grayscale application to convert its confidence in Avalanche into Avax ETF, which is part of an escalating race to secure the medium -sized Altcoins championships associated with the adoption of the real world.

Cio Matt Hougan BitWise ChainLink was described as one of the “hygiene” plays in the direction of the distinctive symbol, with the infrastructure to reach DEFI and institutional pilots alike.

Discover: 9+ best high -risk encryption, highly bonus for purchase in 2025

What does this tradfi mean for retail traders?

Together, these developments highlight a decisive transformation: ETF pipeline is no longer confined to Bitcoin and Ether.

Instead, Trafi puts the wider ALTCOIN bars, with increasingly dictating liquidity flows by institutional asset managers instead of telegram groups or celebrity approvals.

For retail traders, the message is Stark. The market is making the financial speed. ETHEREUM path to $ 7500, if the Standard Charted Reclamation proves correct, it will not be driven by the noise covered in Mimi but by allocating the public budget and ETF flows.

Since one -traded investment funds for Chainlink, Avalanche and others come online, Altcoin’s next rotation may not be in Discord but on Wall Street trading offices.

The only remaining question is how quickly the retail sale with the market is now directed by Trafi Capital, and whether old fluctuations will remain from this structural change.

Discover: Top Solana Meme Coins to buy in 2025

The postforce flow to the investment funds circulated in Crypto, where the rented wardrobe appeared at $ 7500, the target for the first time on 99bitcoins.