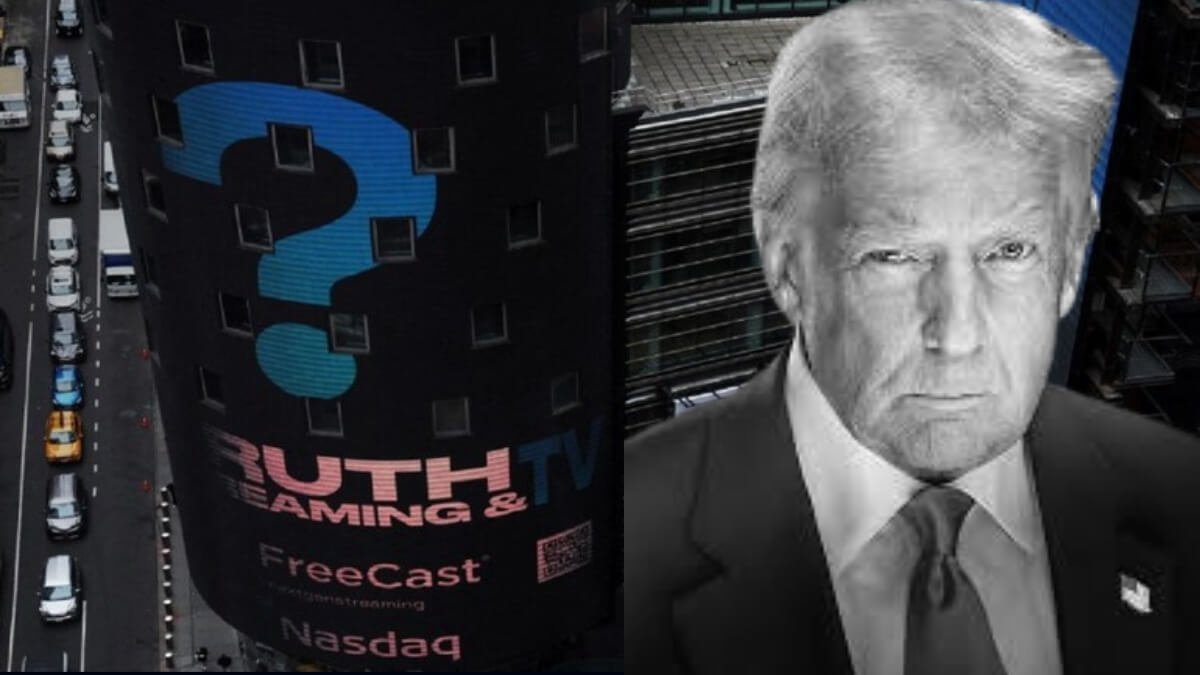

Trump Media & Technology Group Corp. has expanded beyond social media, setting views on financial service with a slate of investment products that reflect President Donald Trump’s priorities.

The company, which operates the conservative-leaning truth social platform, has applied to trademark six investment vehicles under the brand.FI brand, including an energy independence fund, a fund dedicated to US manufacturing, and an ETF dedicated to Bitcoin.

According to a statement released Thursday, the products – three ETFs and three separately managed accounts – will be part of reality.FI, a new financial platform subject to regulatory approval.

Pivot suggests a broader push for conservative businesses and investors to create successors of what they see as a financial industry governed by progressive values.

“We aim to give investors a way to invest in American energy, manufacturing, and other companies that provide a competitive alternative to woke funds and dedicated problems you find throughout the market,” Trump Media CEO Devin Nunes said in a statement.

Among the planned offerings, the truth.Fi bitcoin along with the ETF stands. If approved, it will mark the first investment vehicle tied to the US president.

Eric Balchunas, a senior Analyst of the ETF in Bloomberg, reacts to the transition to a post in X: “Trump will launch a Bitcoin plus ETF. It’s safe to say the first-ever Potus ETF issuer. What a country.”

He added that despite Trump’s brand, funds are likely to remain “microscopic in asset gathering” compared to industry heavyweights such as Blackrock’s Ishhares Bitcoin Trust (IBIT) or Wise Origin Bitcoin Trust (FBTC) of fidelity.

Trump Media’s financial service strategy includes a planned investment of up to $ 250 million, cared for by Charles Schwab. The company also cooperated with Yorkville Advisors, who will act as registered investment advisors for planned funds.

The move came in the middle of a growing financial political battle. Investing in the environment, social, and management (ESG) has become a flashpoint for conservative critics who have argued that Wall Street has prioritized political agendas at the value of the shareholder.

Republican-led states are pursuing major property managers such as Blackrock Inc. and State Street Corp., who accuse them of pushing ESG initiatives at the expense of traditional industries such as oil and gas. Trump has promised to remove many of these policies if re -elected.

The Trump Media’s Forest Media can test the flexibility of political investment products. The company’s stock has become a change of mind from going public through a spac merger, and the ability to attract significant ownership to these funds remains unsure.

However, the launch of Truth.fi strengthens the president’s efforts to shape the financial markets around his “America First” agenda – this time, through direct investment vehicles.

The announcement, however, failed to give a bullish boost to Bitcoin. BTC prices have slipped from its intraday of $ 99,070 to $ 96,590, according to CoinMarketCap data.

Trump owns a $ 3.5 billion stake on Trump Media, forming most of its net value, according to the Bloomberg Billionaires Index. The shares will be held with a confidence administered by his son Donald Trump Jr.

Denial: The information provided to Alexablockchain is for information purposes only and does not generate financial advice. Read the complete decline here.

Image credits: Unsplash, Shutterstock, Getty photos, Pixabay, Pexels, Canva