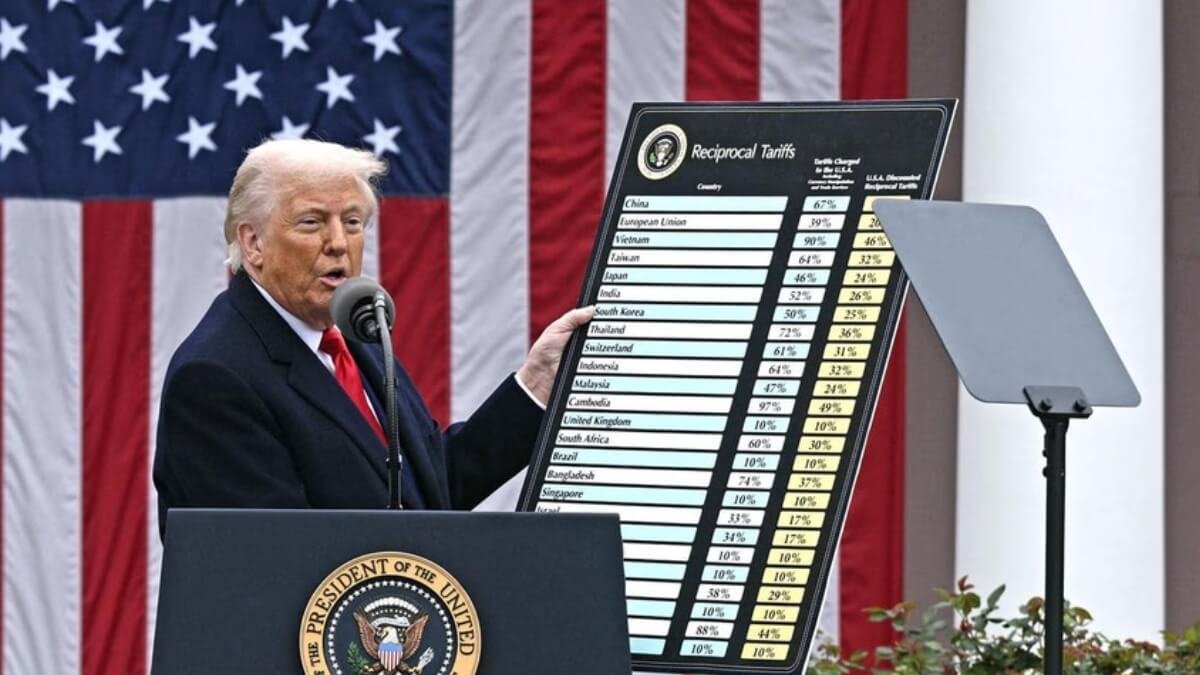

President Donald Trump announced on April 2, 2025, a comprehensive tariff regime that imposes a baseline 10% tariff on all imports, with a higher rate targeting specific countries. China faces a total tariff of 54%, the European Union 20%, Japan 24%, and other countries that vary between 20%to 50%.

The global leaders condemned tariffs, warnings in revenge

The global response is fast and serious. European Commission President Ursula Von der Leyen labeled tariffs of a “major blow to the world economy” and indicated the EU’s readiness to implement countermeasures. French President Emmanuel Macron urged European companies to stop investing in us, describing tariffs as “brutal and baseless.” Canada’s Prime Minister Mark Carney vowed to protect Canadian workers through countermeasures, while the Japanese government considered tariffs “very regret,” seeking exceptions and expression of concerns with the broader economic impact.

The US Stock Market suffers historical decline

The US Stock Market has responded with the most significant collapse of single days since the beginning of the Covid-19 Pandemic in 2020. On April 3, 2025, the Dow Jones industry average dropped 1,679 points (4%), the S&P 500 dropped 4.9%, eliminating $ 2.5 trillion in value, and the tech-heav-halo nasdaq composed composed composed. 6%.

Performance of major US stock indexes on April 3, 2025

- Dow Jones Industrial Average: Falling 1,679 points, marking 4% decline.

- S&P 500: fell 4.9%, deleted $ 2.5 trillion in market value.

- NASDAQ Composite: Rejected 6%, with significant losses in technology stocks.

Impact on the leading stock of technology

The major technology companies, which are highly dependent on the global supply chains, experienced sharp decline:

- Apple (AAPL): Shares have fallen by 10%, resulting in a market loss of approximately $ 290 billion.

- NVIDIA CORPORATION (NVDA): 13%drops, equivalent to a $ 183 billion reduction in market capitalization.

- Amazon.com Inc. (AMZN): Shares have been reduced by 12.2%, losing nearly $ 165 billion in market value.

Economists and analysts express concern

Economists and financial analysts have expressed significant concerns about the potential ramifications of tariffs. The Yale Budget Lab estimates that these tariffs can cost US households an average of $ 3,800 annually, increasing the average burden of import tax by 23%. The Peterson Institute for International Economics is warning possible deindustrialization of affected countries, while the Council on Foreign Relations features potential increases in energy prices due to tariffs on Canadian imports.

Global markets and money -changing money

The announcement of the tariff has immediate global repercussions. European and Asian stock markets have experienced significant declines, with indices such as Nikkei 225 and the German Dax dropping more than 3%. The US dollar index fell as investors demand safe currencies, reflecting concerns with increasing trade tensions and potential effects on the US economy.

Potential for retaliation and rising trade war

Many countries have indicated intentions to implement revenge tariffs. China’s commerce ministry has warned of countermeasures, emphasizing the historical failure of trade wars and protectionism. The European Union has prepared a two-phase retaliation on a plan targeting US goods, including iron products, aluminum, and agricultural products. Canada and Mexico also consider the appropriate responses to protect their interests in the economy.

Business Community and Mergers & Acquisitions Outlook

The business community expressed concern for the increase in economic uncertainty. Financial and legal advisers are warning that tariffs can significantly affect global integration and acquisition (M&A), which is discouraged by companies from joining major transactions due to potential eruptions -change in dealings with dealings and financing terms.

The administration’s bearing and future perspective

Despite market disturbance and international condemnation, President Trump remains stable in his belief that tariffs will benefit the US economy by responding to prolonged trade imbalance and encourages domestic manufacture. He dropped the reaction of the stock market, predicting a rebound and asserting that “the markets are going to the boom.”

However, the path forward remains unsure. The potential for a full -size trade war is huge, with the possibility of rising retaliation steps from affected countries. Economists are warning the risk of stagflation – a combination of inert economic growth and increased inflation – tariffs should stay in the area and motivate additional countermeasures.

The coming weeks will be critical to determining whether diplomatic negotiations can escalate tensions or whether the world is on the edge of a disgusting trade conflict with remote economic implications.

Also Read: The Sony-backed Soneium to re-invest the Astr token income

Denial: The information provided to Alexablockchain is for information purposes only and does not generate financial advice. Read the complete decline here.

Image credits: : Unsplash, Shutterstock, Getty photos, Pixabay, Pexels, Canva