The trend of Venture Capital (VC) tokens triggered both the attention and the criticisms after the launch of Bera and continues to fall into a cliff. These VC tokens are typical crypto startups that have obtained significant financing from venture capitalists even before the tokens are available to the public.

This path to the distribution of the token was both Dr.jeklyn and Mr.hyde in the eyes of the cryptographic community.

VC back coins such as $ Bera They are under fire while the recovery of the community grows on the distribution of travel. Is this the end of the inflated assessments? #Berabacklash #Cryptocommunity #TOKENCH ECONOMICS #Investsmart

– Pratap (@mr_pratap_singh) February 10, 2025

VC Tokens Dilemma: between equity and community in cryptographic space

Venture Capital Token are models in which a cryptographic project tries to build infrastructure or applications with initial funding. They assign many of their tokens to the first investors and pre-launch founders before the token hit the market.

This pre-alocation can vary from 20% to over 60% of the total offer. The idea is to use this capital to advance innovation before launch. This would interrupt the token economy from the beginning and damage the perception of the community.

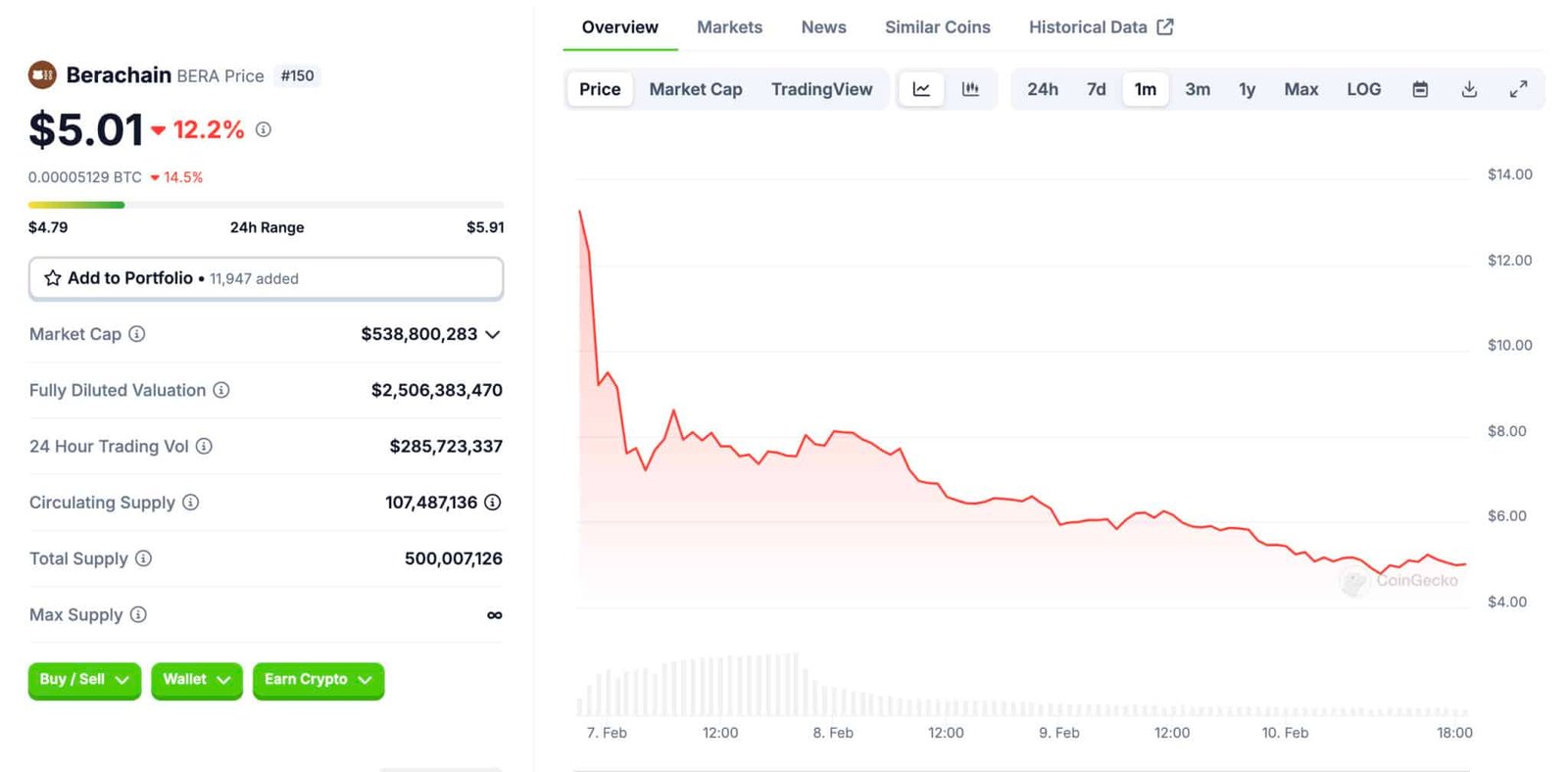

Berachain’s token Bera was launched with great expectations and a “liquidity test” mechanism. Bera quickly became a focal point of this controversy of the VC.

Its highly diluted high evaluation (FDV) shows that the distribution of the initial token has heavily favored the first supporters at the expense of the community. A recourse, with many in the cryptocurrency community that question the equity and its alignment with the decentralized principles of cryptocurrency.

(Berausd)

On the contrary, the tokens supported by the community offer a different narrative. Projects like Uniswap spread the concept of a “fair launch”. They distribute token directly to users who interact with the platform.

This approach actively promotes a sense of ownership among users. It builds a more inclined community to invest in long -term success of the project rather than looking for short -term earnings.

These tokens are often equipped with governance rights, allowing the community to guide the management of the project, leading to a more sustainable growth and a base of loyal users.

Uniswap itself has many owners and owners mainly hold a small part of the offer, with the larger cluster it holds only under 1% of the total offer. This creates stability on the token since the best large owners cannot manipulate the price.

(Source)

The market dynamics of the token VC compared to the tokens supported by the community are different. When Token VC are launched, the market can see great volatility. This is because the first investors sell their pre-entertained tokens and try to quickly make earnings.

This leads to a price dip before the usefulness of the project can prove to be. Marketing therefore plays a crucial role in maintaining or increasing the value of the token through hype rather than through the actual development of the project or the commitment of the community.

Before Bera: Token VC and their infamousness in cryptocurrency

Take some examples, such as brinos (lum) and quantumlink (qtl). Luminos, which was launched with enormous clamor and support by several high -profile VC companies, shows that the usefulness of the token has been suspended.

The team struggled with technical problems, including scalability problems that have not been resolved despite the significant funding. The feeling of the market became bad and the first investors began to sell their assignments. The value of Lum in a short time after its launch, a fatal bell from the beginning.

(Lumusd)

Another sign that he met with a similar fate is Quantumlink (QTL). With a vision to integrate the quantum calculation in cryptocurrency to improve safety and speed, QTL has attracted some big name VC investors.

However, the technology was far from practical and the team did not show progress in the integration of quantum mechanics in their blockchain.

The price of the token fell while the market realized that it was only another steam. This discrepancy between ambition and reality, combined with the pressure of VC investors to show quick returns, has condemned QTL to bankruptcy.

The launch of the token Bera of Berachain is arousing controversy in the cryptocurrency community. Critics are raising concerns that these “VC coins” really serve community interests or simply offer investors to the first investors a output strategy.

– Brief chain (@chainbrief) February 10, 2025

The VC tokens highlight a war between the need for capital to feed innovation and the principle of decentralization. Undoubtedly, VC financing accelerates technological development and provides the necessary resources for ambitious projects.

But the recourse against Token as well is a growing demand for launches that align more closely with the fundamental values of the transparency of the crypt, equity and involvement of the community.

EXPLORE: 15 new coinbase lists and arriving to be looked at in 2025

Join 99 bitcoins news discord here for the latest market updates

The Post Venture Capital Token and The Fall of Bera: Crypto New Gold Rush or Gilded Cage? He appeared first out of 99bitcoin.