Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

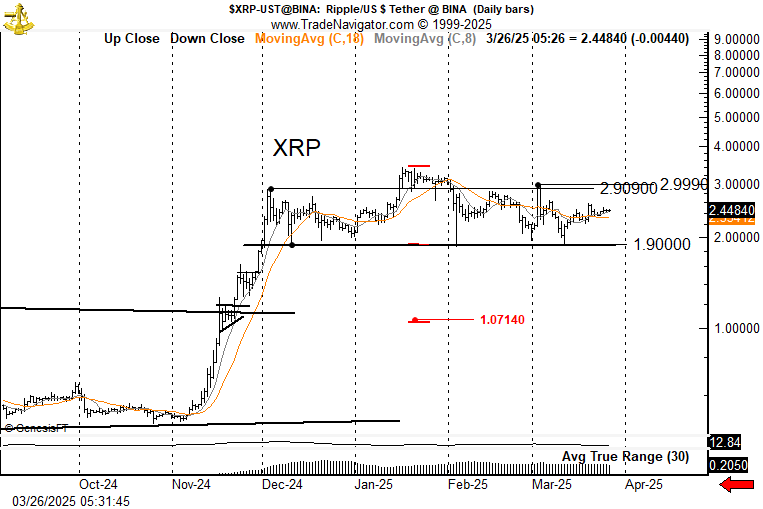

In an update published via X, the Analyst of the Veterans market Peter Brandt shared a surprising technical perspective for XRP/USDT, identifying a classic training of Head & Shoulders (H&S) in the daily graphication that indicates a possible retracement towards the region of $ 1.07.

Brandt’s graphic designer keeps track of the XRP daily bars from mid -October until the end of March on Binance. The XRP has increased from less than $ 0.50 to the end of October to over $ 1.00 in mid -November. After forming a flag of bull, the asset continued aggressively, building a local top of approximately $ 2.90 in early December before starting the last stage up to $ 3.40 in mid -January.

The 8 -day mobile averages (C, 8) and 18 days (C, 18) – respectively lived in orange and black – now hover around the sign of $ 2.44, where the price is currently sitting.

XRP could collapse if this happens

Two remarkable horizontal levels frame the current trading area. The first is the $ 1.90 floor, which acts as a approximate neckline for the H&S model and has repeatedly acted as a support. The second is the $ 2,90– $ 2.99 ceiling, a clear horizontal resistance band in which XRP fought to support the momentum upwards.

Brandt states that a decisive break below $ 1.90 “would not be ideal for Longs”, while any increase in the rise in $ 3.00 could force short sellers to reconsider their positions. On the graph, the left shoulder was formed close to the $ 2.90 handle, followed by a higher peak at $ 3.40, creating the “head”.

Subsequently, the right shoulder emerged closer to the $ 3.00 area. The neckline is about $ 1.90. If XRP breaks below that neckline with a sufficient volume, Brandt’s measured goal suggests a drop of about $ 1.07. Label this price goal with a red arrow, reporting the potential reduction risk inherent in the classic H&S models.

Mobile averages of 18 days and 18 days of Brandt converge about $ 2.44, indicating a silent moment at current levels. The average 30 -day interval (ATR) measure near $ 0.205, which implies that the oscillations of daily prices have been compressed with respect to the explosive action observed during the rise of XRP from the end of 2024 to the beginning of 2025. However, a break beyond $ 3.00 or less than $ 1.90 could arouse a renewed increase in volatility.

Brandt underlines his lack of a personal participation in XRP, explaining that he is simply transferring what he sees as a “textbook” bearish model: “I have no acquired interest on or down. XRP is forming a text H&M model. So, now we are limited. Above $ 3,000 I would not want to be short. Low $ 1.9 I would not want to have.

At the time of printing, XRP was exchanged at $ 2.35.

First floor image created with Dall.e, graphic designer by tradingview.com