Este Artículo También Está available en español.

In a dramatic shift, the Hedge Fund seem to increase short positions in Ethereum at a rhythm not seen before, triggering questions about the fact that the second largest cryptocurrency by the market capitalization could face troubled waters or if it is at stake something ‘other.

According to the famous analysts of the letter Kobesi (@kobesileter), the short positioning in Ethereum “has now increased by +40% in a week and +500% from November 2024.” Their discoveries, shared on X, claim that “never in history the hedge fund of Wall Street have been so short of Ethereum, and it is not even close”, pushing the question: “What do they know that Hedge Fund know is coming? “

Massiccia Ethereum Short Squeeze coming?

The thread of Kobeissi’s letter highlights an extreme divergence between the action of Ethereum prices and the positioning of the future among the hedge fund. They indicate a particularly volatile period on February 2, when Ethereum fell by 37% in only 60 hours when the titles of the commercial war emerged, sweeping away more than a trillion of dollars from the cryptocurrency market “in hours”.

Reading Reading

Analysts note how ETH’s afflusted were robust in December 2024, even as Hedge Fund were increasing a short exposure. According to Kobiissi’s letter: “In just 3 weeks, Eth has seen +$ 2 billion of new funds with a weekly influx that Viola records of +$ 854 million. However, Hedge Fund are betting Eth’s wave and limit the breakouts. “

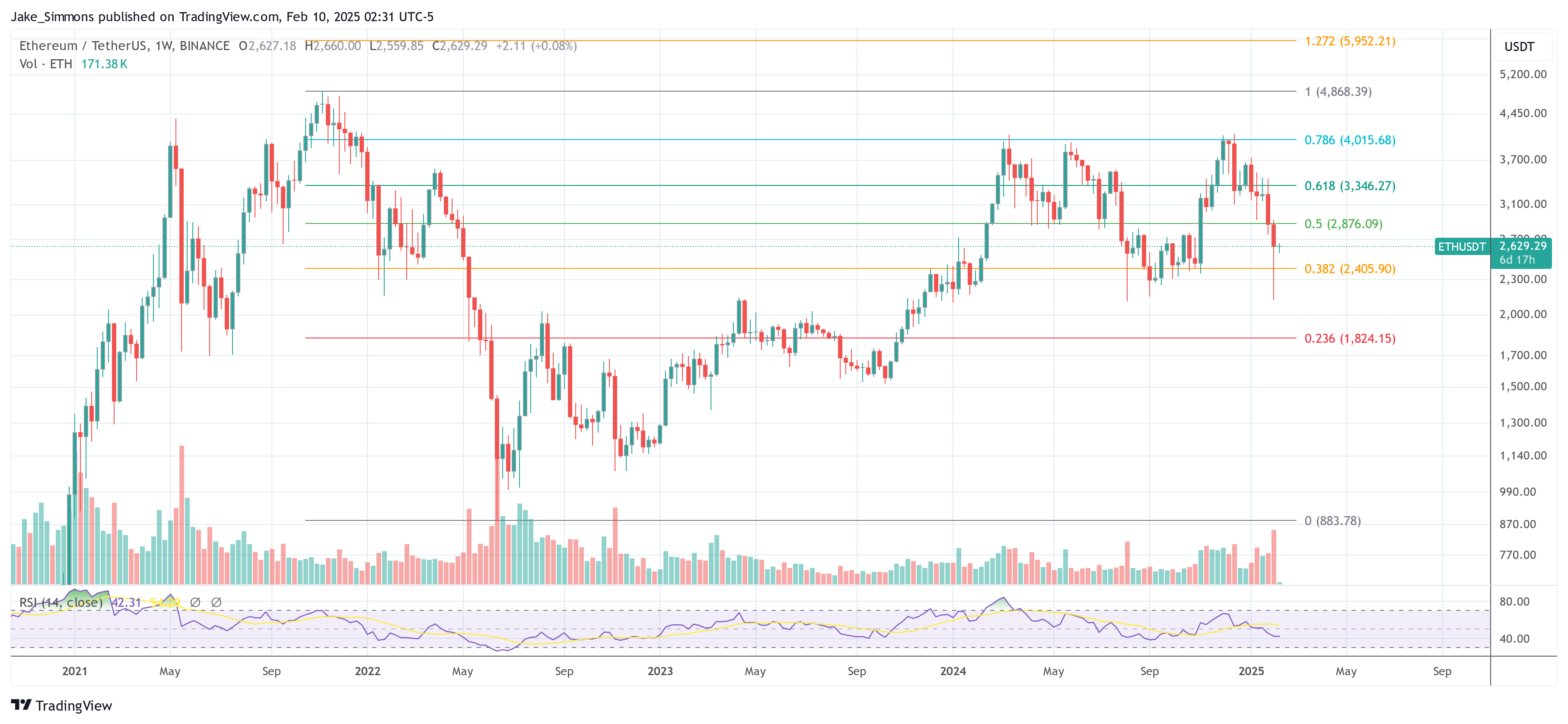

The peaks are also underlined in the trading volume of Ethereum, in particular on January 21 (inauguration day) and around the accident of 3 February. Despite the historically high afflusted, the price of Ethereum is not “failed to recover the lower gap even if a week has passed” and currently exchanges “~ 45% below the record set in November 2021”.

One of the greatest unknowns remains because the Hedge Fund are thus dedicated to Eth’s shorts. Analysts write: “The potential reasons range from the manipulation of the market, to the harmless cryptocurrency hedges, to the discounted prospects on Ethereum itself. However, this is rather strange since the Trump administration and the new regulators have favored Eth. Most of this extreme positioning, Ethereum has significantly submitted Bitcoin. “

Reading Reading

Kobiissi’s letter concludes its thread by attracting attention to Bitcoin’s superturformance and poses the question if a short narrow can be in preparation: could Ethereum be set for a short tightening? This extreme positioning means large oscillations like that on February 3 will be more common. Since the beginning of 2024, Bitcoin has increased ~ 12 times as much as Ethereum. Is a short narrow set to fill this gap? “

Cryptoviizart of Glassnode goes out

Not everyone in the Crypto Analytics sphere are convinced that the tide wave of Ethereum Short Positions reports a bearish perspective. Senior researcher of Glassnode, Cryptoviizart.₿ (@cryptoviizart), led to X to challenge the alarmist who circulates on social media: “Barchart is screaming,” the largest et in history! “And Crypto Twitter is around like headless chickens. Seriously, if you have fallen in love with this Clickbait title, it’s time to improve your game. We put the record record.”

In a detailed thread, Cryptoviizart stresses that the widely shared graphic designer on the short positions of Hedge Fund probably represents only a subset of the market (e.g. “Leva / Hedge Funds / CTA” funds) and does not take into account other participants in the significant market As asset manager, traders that cannot be reported and chain holders. They add that similar “huge shorts” were also seen in future bitcoins, but BTC has passed ETH during the same period.

In addition, Cryptoviizart stresses that future Ether CMEs are only a fragment of global cryptocurrencies derivatives. Liquidity on platforms such as binance, bybit, okx, as well as positions on chain and spot markets offer a wider view of what the data of any exchange could suggest. “The net short of a group ty the entire market is clear. Covering positions ☎ bets purely reiterate. “

Their last note: much of the positioning could be part of “non -directional strategies, such as Cassa and Carry”, which are neutral strategies used to block arbitrage earnings and are not simply a direct bet against ETH.

At the time of the press, Eth was exchanged at $ 2,629.

First floor image created with Dall.e, graphic designer by tradingview.com