Bitcoin’s 2025 journey did not give the explosive increase in the bull market that many expected. After reaching the peak of $ 100,000, the Bitcoin price of 2025 has abruptly relegated up to $ 75,000, unleashing the debate between investors and analysts on where we are in the Bitcoin cycle. In this analysis, we cut the noise, taking advantage of the indicators on chain and macro data to determine whether the Bitcoin bull market remains intact or if a deepest bitcoin correction looms in Q3 2025. Key metrics such as MVRV Z-Score, destroyed days (VDD) and Bitcoin capital flows provide critical news in the next market move.

Is the Bitcoin Pullback 2025 healthy or for the bull cycle?

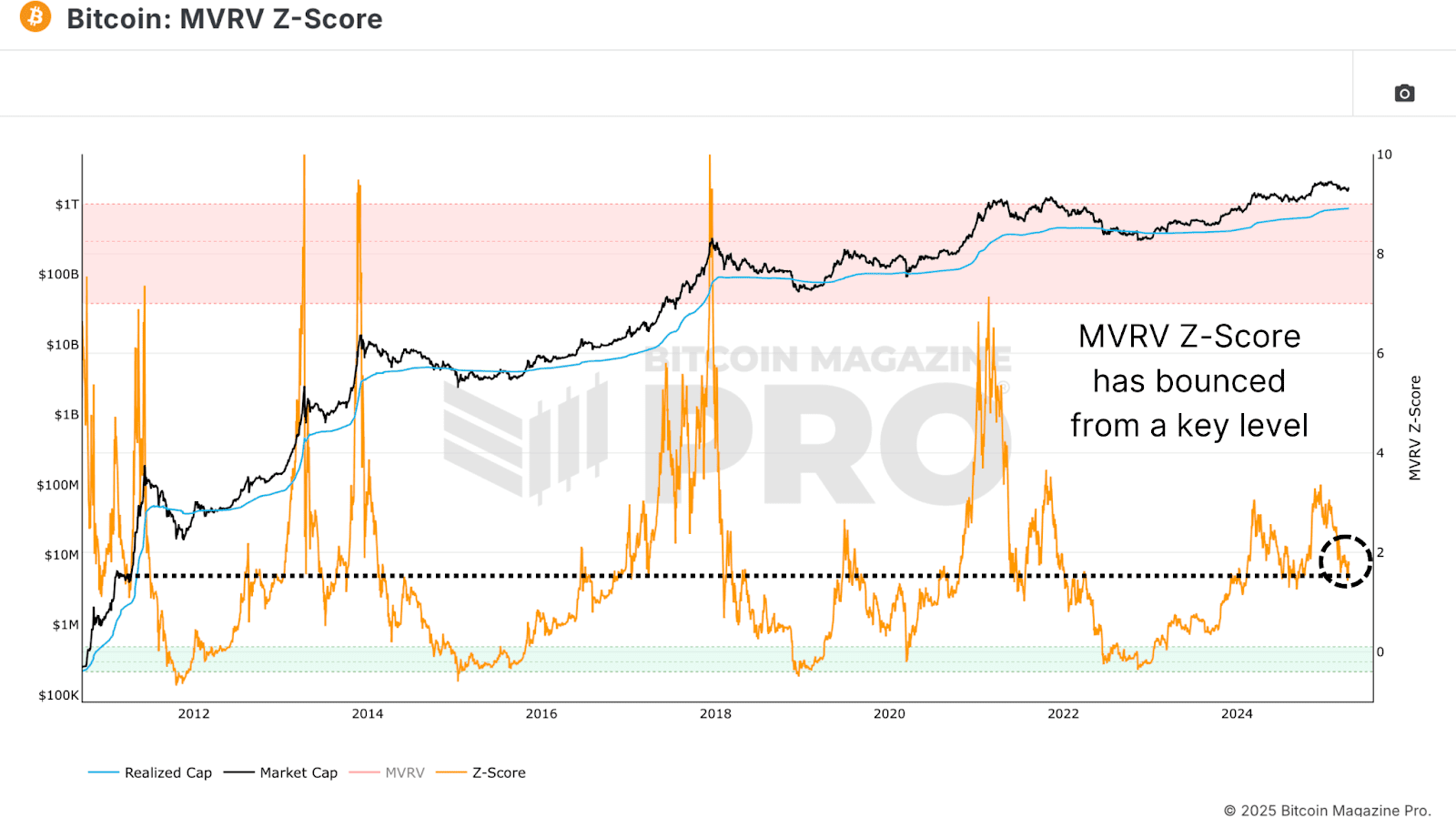

A strong starting point to evaluate the Bitcoin 2025 cycle is MVRV Z-Score, a trusted chain indicator that compares the market value to the value made. After hitting 3.36 at the $ 100,000 peak in Bitcoin, the Z MVRV score went down to 1.43, aligning with the drop in Prices Bitcoin 2025 from $ 100,000 to $ 75,000. This 30% bitcoin correction may seem alarming, but recent data show the rebound of the Z MVRV score from its minimum 2025 of 1.43.

Historically, MVRV’s Z score levels around 1.43 have marked the local fund, not peaks, in the previous bitcoin bitcoin markets (e.g. 2017 and 2021). These Bitcoin pullbacks often preceded raised trends, suggesting that the current correction aligns with a healthy dynamic of the bull cycle. While the trust of investors is shaken, this move adapts to the historical models of Bitcoin’s market cycles.

Like smart money model the Bitcoin 2025 bitcoin market

The days of value destroyed (VDD) multiples, another critical indicator on chain, keeps trace of the speed of BTC transactions, weighted by means of maintenance. The peaks in the VDD signal are useful by expert titles, while low levels indicate the accumulation of Bitcoin. Currently, VDD is located in the “green area”, the mirroring levels observed in the late Bear markets or in the first recoveries of the bull market.

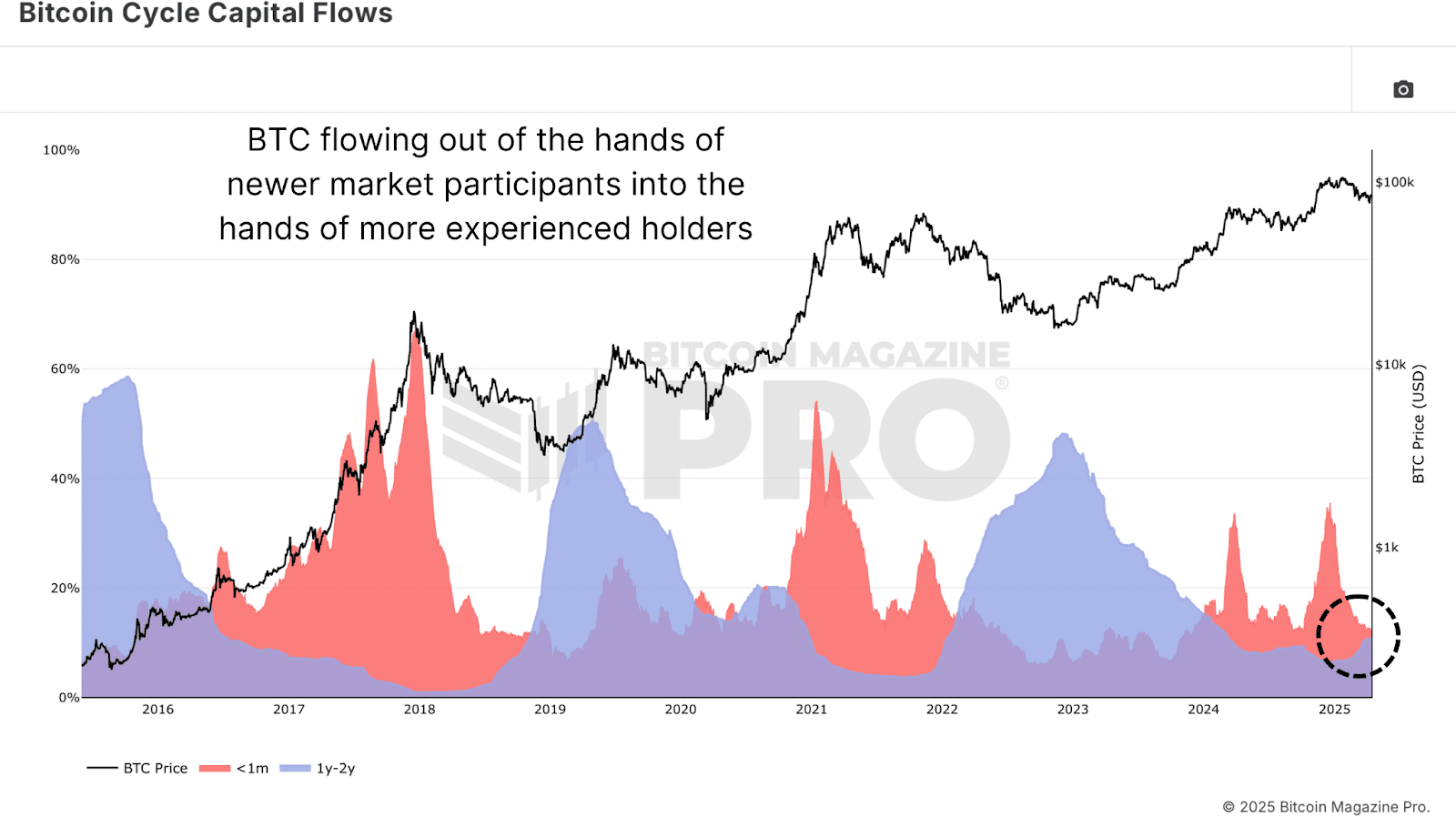

Following the inversion of Bitcoin from $ 100,000, the low VDD suggests the end of a phase of use, with long -term owners that accumulate in higher prices of Bitcoin 2025. The graphic of the capital of the Bitcoin cycle further illuminates this trend, breaking down the capital made by the age of coins. Near the peak of $ 106,000, the new market competitors (<1 month) have guided a peak of activity, reporting the faomobil purchases. From the moment of Bitcoin pullback, the activity of this group has cooled at typical levels of the medium -sized bull markets.

On the contrary, the 1-2-year-year cohort-special Macro-Experti Bitcoin Investors is increasing, which accumulates at lower prices. This shift reflects Bitcoin accumulation models from 2020 and 2021, in which long -term owners purchased during the tops, preparing the phases for the rallies of the bull cycle.

Where are we in the cycle of the Bitcoin 2025 market?

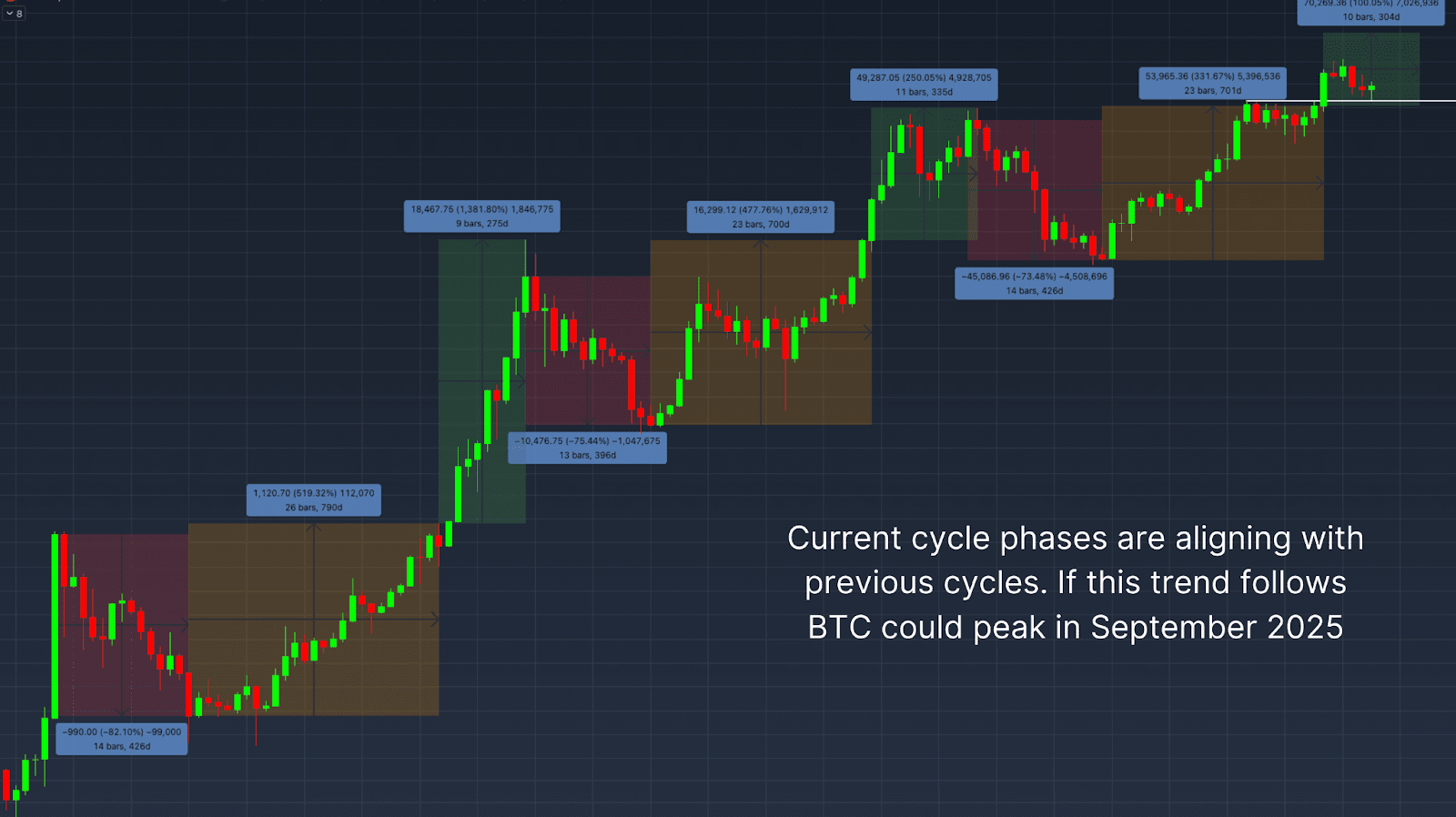

Zoom, the cycle of the Bitcoin market can be divided into three phases:

- Orsa phase: 70-90%deep bitcoin corrections.

- Recovery phase: claiming maximum previous of all time.

- Bull/exponential phase: progress of the price of parabolic bitcoin.

Past Bear Markets (2015, 2018) lasted 13-14 months and the most recent Bitcoin Bears market followed the example at 14 months. The recovery phases generally extend 23-26 months and the current cycle of Bitcoin 2025 is part of this interval. However, unlike the past market markets, the Bitcoin breakout above the previous maximums was followed by a pulback rather than an immediate wave.

This Bitcoin Pullback can report a higher minimum, setting the exponential phase of the 2025 bull market market. On the basis of the exponential phases of 9-11 months of past cycles, the price of Bitcoin could reach the peak around September 2025, assuming that the Taurus cycle resumes.

Macro risks that affect the price of Bitcoin in the third quarter 2025

Despite the upward indicators on chain, the macro winds are presented at the price of the Bitcoin of 2025. The correlation graphic graph of S&P 500 vs Bitcoin shows that Bitcoin remains closely connected to the US actions. With the fears of a growing global recession, weakness in traditional markets could limit the short -term Bitcoin rally potential.

The monitoring of these macro risks is crucial, since a deterioration of the equity market could trigger a deeper bitcoin correction in the third quarter of 2025, even if the chain data remain supporting.

Conclusion: Bitcoin’s q3 2025 Outlook

The key indicators on chain: MVRV Z score, the days of destroyed value and the flows of Bitcoin cycle capitals, point in healthy and consistent behavior with the cycle and long -term support accumulation in the Bitcoin 2025 cycle. Although slower and more irregular than the past bull markets, the current cycle aligns with the structures of the historic bitcoin cycle. If the macro conditions stabilize, Bitcoin appears in the balance for another leg, potentially reaching the peak in Q3 or Q4 2025.

However, the macro risks, including the volatility of the equity market and the fears of the recession, remain fundamental to look at. For a deeper immersion, watch this YouTube video: where we are in this Bitcoin cycle.

For further immersion searches, technical indicators, real -time market notices and access to a growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.