Ai-Agent Token AIA has risen to a new record this week, crowned with an overnight one that jumped the new currency in the most trading market assets. This is AIA price prediction. Will you maintain its upper momentum?

Deagentai has placed itself as a project for the encryption infrastructure that focuses on bringing “artificial intelligence factors” directly on the series. that it White paper Framing the task as building a “reliable and independent intelligence network on the series”.

The project begins with the completion of the SUI and BNB series, and provides tools for the agent, memory, life and communications course to an agent.

Its road map includes alphax, a signal -based trading platform that the team says it already contains hundreds of thousands of daily users, along with Corrai, a creator of a non -symbol strategy, and Truesights, which is the next information financing product.

DEAGENTAI got support from Web3.com Ventures, Snz Capital, Kucoin Ventures, Vertex Capital and Valkyrie Fund.

Technical integration includes the support of Binance Wallet, OKX Wallet and Sui Network, which puts it in an increasing circle of the main encryption infrastructure players.

Discover: 9+ best highly risk blades, highly bonus for purchase in October 2012

What is the DEAGENTAI mission with the AIA symbol?

From Last updateThe AIA price changed the hands near $ 1.50, within a daily range ranging from $ 1.00 to $ 2.49. His highest level was ever recorded at $ 2.49 on October 2.

((Source: Coingecko))

The immediate trading volume was about 200.8 million dollars, with the maximum market about 149.7 million dollars and a fully diluted evaluation of $ 1.5 billion.

Coingecko Data Central exchanges Bitget, Gatec and Mexc were shown as major liquidity places

according to Panewlab, The size of the AIA Perpetual Futures jumped to approximately $ 2.04 billion, and over XRP for a short period. The height shows a strong demand for speculation and the benefit of the heavy market.

Binance AIA Spot pairs runway On alpha at 08:00 UAE time on September 18.

The Airdrop Alpha window accompanied 24 hours, a popular liquidity boost for new menus.

The distinctive symbol put new levels ever on October 2, while the high derivative rotation led to severe fluctuations inside the day to October 3. The fluctuations attracted both the methodology and the retail momentum.

The Binance Square Memorandum on Tokenomics said that investors carry 21 % and the team 18 %, with one cliff for a year followed by linear publications until 2028.

Discover: Crypto 1000X Next: 10+ encrypted codes that can reach 1000x in 2025

AIA Price PROCESSION: Are AIA signs of an explosive upper style?

Drawing the distinctive symbol of Deagentai, AIA, drew a heavy commercial benefit after high prices and rapid correction of the same level.

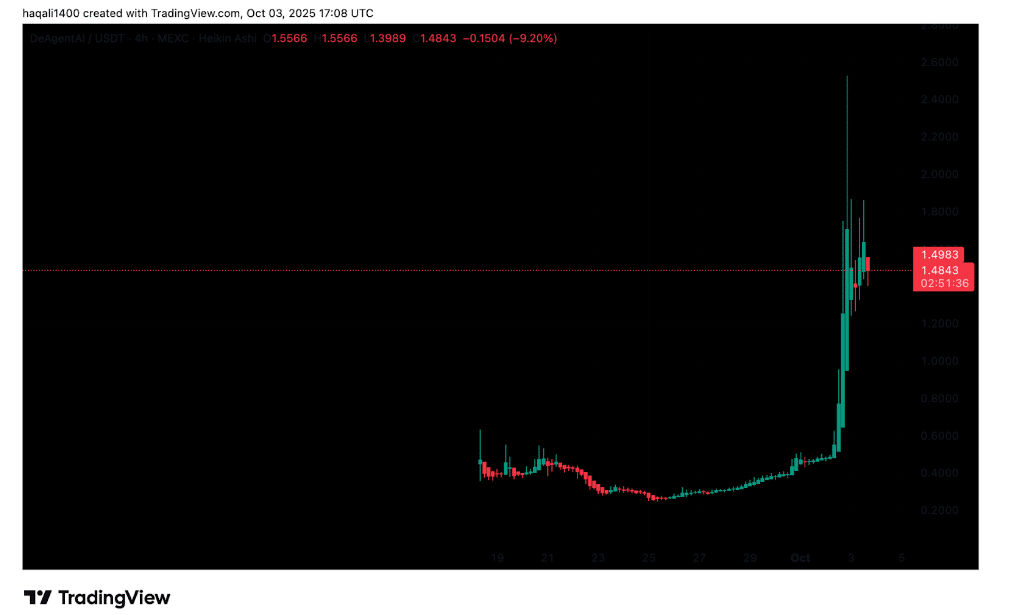

On Usdt scheme for 4 hours, AIA Erupted From a base between $ 0.20 and $ 0.40 in late September.

((Source: AIA USDT, Tradingview))

The move accelerated to October, raising the distinctive symbol over $ 1 and a climax with more than $ 2.60 on October 2. At its highest point, the highest level ever was printed at $ 2.49 before slipping.

Through the last update, AIA was changing hands near $ 1.48, a decrease of 9.2 % in the session.

The style on the classic “top explosion” chart. Heikin Ashi strong green candles showed excessive conditions in the peak during the previous period. The subsequent decrease to less than $ 1.50 signals for profit by first holders.

Even with withdrawal, the greater direction still looks upward. The purification of the long -term base is about $ 0.40 indicates that the symbol has turned into a higher domain.

The current resistance is located near $ 1.80 to $ 2.00, as sellers enter several times. Support formed about $ 1.20. Keeping this level can bring new buyers, while risk sliding below a deeper test of about $ 0.80 to $ 1.00.

Trading activity shows that momentum is still strong. Liquidity flows to both stain and derivative markets, although the fluctuations are high.

If the bulls are paid beyond $ 1.80, it is possible to re -test the $ 2.40 – 2.60 dollars. The sale continues, on the other hand, can pull the prices closer to one dollar.

He discovers: 20+ next to the explosion in 2025

Join Discord 99bitcoins News here to get the latest market updates

The post is Deaiaget? AIA PRICE Procality appeared after 190 % of the pump overnight first on 99bitcoins.