A coordinated group of whales, suspected of being supported by important cryptocurrency exchanges such as Binance and Okx, manipulated the price of the gelatin token on the hyperliquid (hype) Dex.

The portfolios linked to several important CEXs have opened a huge short jelly of hyperliquids and sent the cryptographic community in a frenzy, with the Hype token that crashes over 20% in a phase.

A huge whale with 124.6 m $ Jelly($ 4.85 million) is manipulating the price of $ Jelly(Jellyjelly) to make the hyperliquidity supplier (HLP) face a loss of $ 12 million!

First he downloaded $ Jellycrashing the price and leaving HLP with a passive short position of 398 m $ Jelly($ 15.3 million).

Then he bought … pic.twitter.com/kyckshv4rl

– Lookonchain (@lookonchain) March 26, 2025

The Lookonchain analysis platform discovered the manipulation of the gelatin market on the hyperliquid

According to Lookonchain, the first portfolio performed a huge short position of gelatin on hyperliquide, simultaneously acquiring gelatin tokens externally.

The trader was then identified by removing the margin, causing Hyperliquid’s HLP (his incorporated market protocol) to take the loss of 4.5 million dollars in the short position. In its worst point, this short position has exposed HLP to over $ 6 million losses.

While these Shenanigans were happening with the short position, another portfolio address on Hyperliquid has opened a long order on gelatin and at some point it has increased by over $ 12 million.

Subsequently, the whales proceeded to regain gelatin, guiding the losses in the original short position to over $ 12 million.

After the evidence of suspicious market activities, the validator set convened and voted to eliminate Jelly Perps.

In addition to the guidelines marked, all users will be made entire by the Hyper Foundation. This will be done automatically in the next few days based on the onchain data. There is not …

– Hyperliquid (@hyperliquidx) March 26, 2025

Due to the traders that caused a short narrow on the token, its market capitalization has increased by $ 10 million to over $ 50 million by more than 5 times. Jelly has now fallen to a market capitalization of $ 25 million, but if it had increased to $ 150 million, Hyperliquid would have had to face full liquidation.

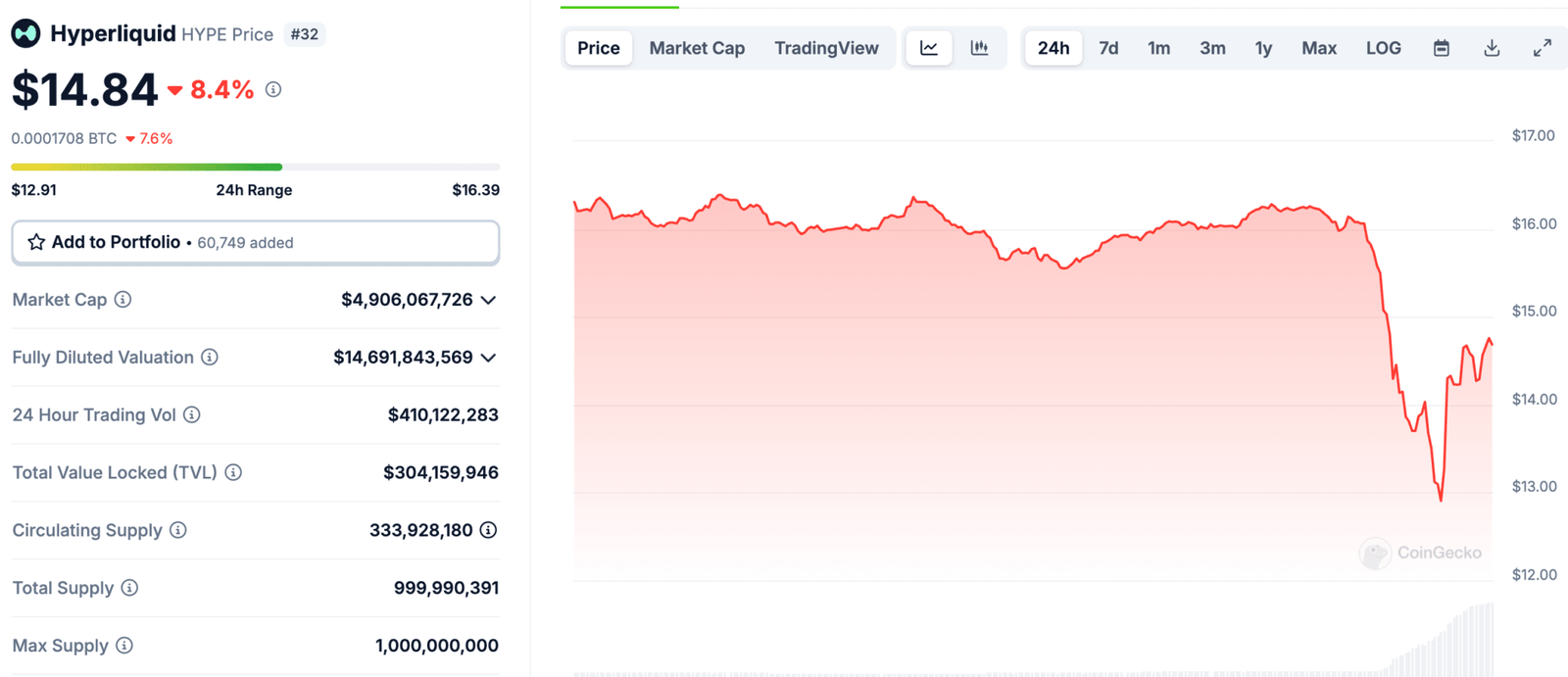

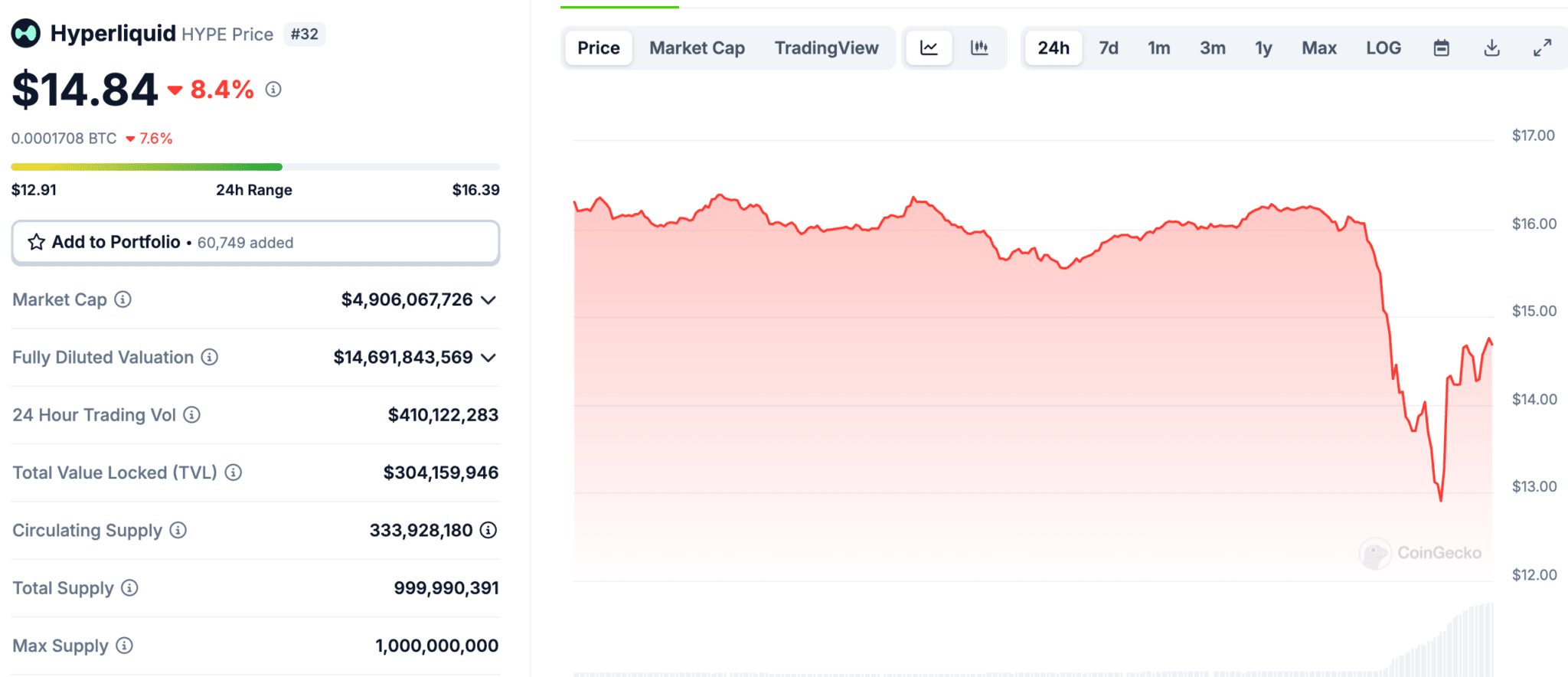

Following the manipulation of the prices of the jelly whale on its platform, the price of its native token, Hype has undergone a strong drop. Initially it dropped from over $ 16 to less than $ 13.

However, since then Hyperliquid has canceled the jelly and closed the short position, thus avoiding one of the enormous losses he was facing. Since illegal and avoiding liquidation, the hype is reciprocated at $ 14.84.

(Coingecko)

Find out: the two+ presales warmer crypt to buy right now

ZachxBt discovers a connection between a number of main exchanges and hyperliquid wallets

It would be even more fun if this result had happened due to both gelatin manipulators 0x20E8 and 0x67f were just financed via binance on arbitrum

0xf5C07EC0ACFC371C05A5DE9882C8C90BFA1C071FA9356E6710E3DB17D5ABDD48

0xf171D527B9A277B895A02CA4B7C5EE081CB94A8932A60EEADBDCB02A729B524 …– ZachxBt (@ZachxBt) March 26, 2025

While the danger and the immediate drama seem to have ended up for Hyperliquid, the Sleuth On-Chain preferred by everyone, ZachxBt, quickly deepened the matter.

He found that the two hyperliquid wallets involved in the manipulation of the prices of the jellies, 0x20E8 and 0x67f, have connections with centralized exchanges such as Okx, Mexc, Bibi and Binance. Both addresses demonstrate interactions and received funding from these exchanges before taking the attack on the hyperliquid.

Many within the cryptographic community believe that this attack on hyperliquid could be a coordinated attack by the main exchanges to close the highly successful hyperliquid.

This suspicion was improved as during the drama, both Okx and Binance announced that it would listed perpetual couples for the jelly meme coin.

It seems a great coincidence that both exchanges have chosen to list the same token who has almost caused the liquidation of the hyperliquid due to the manipulation of the market on its platform.

Discover: 9+ Best at high risk, high risk encryption to be purchased in March 2025

Join 99 bitcoins news discord here for the latest market updates

Multiple harmful actors have meant that the hyperliquide has almost liquidated through a manipulation of the prices of the jelly meme coin

-

Hyperliquid was at some point in the hook for $ 12 million, but since then he canceled the jelly and closed the position

-

Zachxbt found that the two harmful wallets on the hyperliquide were just financed by Binance and Okx

-

Many in the cryptocurrency community believe that the attack on the hyperliquid could be an attempt of important exchanges to kill the competition

-

Since Hyperliquid was facing the liquidation of his platform, both Okx and Binance decided to list the jelly, the same dreamy causing all the panic

What is the drama of gelatin? Is Binance trying to sabotage hyperliquids? He appeared first out of 99bitcoin.