The cryptocurrency market was in tears in 2025 and the latest report on the 99 Bitcoins encryption state, written by Manisha Mishra and sponsored by Kcex, exposes everything. The quarter saw an increase in institutional demand, Bitcoin ($ BTC) hit a then $ 111,980 and Crypto by taking Spike by 753%.

Despite the event, the total market capitalization was still 12% below its $ 3.7 trillion peak, hinting at space to run. With the adoption of stablecoin in a strong expansion and long -term owners, Q2 may have been the real start of the breakout of this cycle.

Read the complete report here: State of Crypto Q2 2025 – 99 Bitcoins

A record quarter for bitcoin

Bitcoin illuminated Q2 with a gain of 25.66%, breaking the resistance beyond to hit a register $ 111,980 on May 22nd. This has put it in advance of the rise of 7.21% of gold and most shareholders, marking a strong reversal from the collection of the Q1.

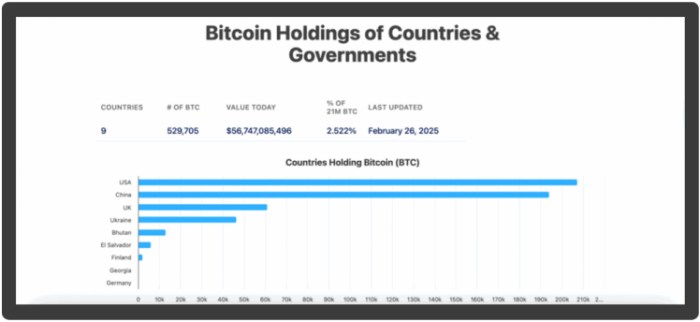

According to the Q2 report of 99 bitcoins, the event was led by institutional influences, the application of the ETF and growing sovereign interest, with the governments that now hold 2.5% of the total offer of Bitcoin. Meanwhile, spot Etf is constantly scrolls in the issue of miners, strengthening the demand just when the demand has increased.

Chris Wright by 21shares summarized him:

“We believe that Bitcoin Etfs will attract 50% more of affluent this year compared to last year. This would entail net influents of about $ 55 billion in 2025, representing an increase of about 20 billion dollars a year.”

A golden cross at the end of May confirmed the rise to rise, following a clean break from months of consolidation. It is a bullish structure of the textbook.

With the action of prices and the fundamentals in synchronization, Q2 has marked the clearest turn ever: Bitcoin has returned, but fueled by institutions, not retail.

The institutions took the steering wheel, the retail sale turned to Altcoin

According to the 99 Bitcoins ratio, this Toro race has a different driver behind the wheel. And it is not Reddit. 9 experts out of 10 interviewees in the Q2 report said that retail traders have shifted their attention to the best Altcoin, chasing faster earnings while the institutions have silently accumulated Bitcoin.

The chain data support it. Glassnode shows that 30% of the supply of $ BTC is now held by centralized entities, with great players who dominate the inflows. In the meantime, Google Trends reveals that the retail interest in “bitcoin” research has remained surprisingly low during the second quarter, even if $ BTC has affected new tops.

Trust between long -term owners has also risen. Utxo activity has decreased and the amount of BTC in long -term conservation has continued to increase. A sign that serious capital is not trying to sell soon.

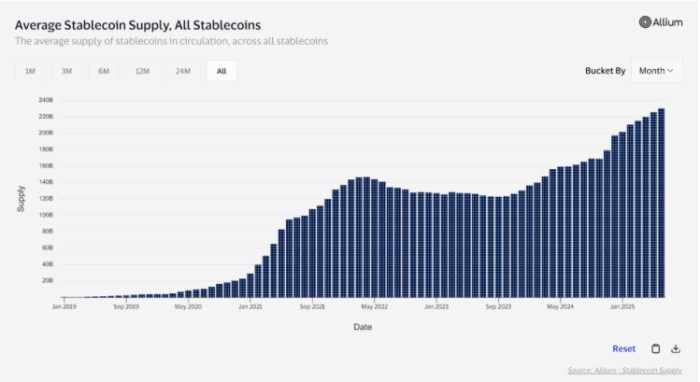

Stablecoins and Defi have collected steam

If Q2 has shown something, it is that Stablecoins are not only stable, they are also downsizing. The Circle IPO jumped to 168% on the first day, scoring the first Stablecoin broadcaster to become public and report the growth appetite of Tradfi for exposure to the cryptols without volatility.

According to 99 Bitcoins, 81% of SMEs with cryptocurrency now want to use Stablecoin for daily operations and the number of fortunes 500s that plan to integrate them has tripled since last year.

From a Defi point of view, Ethereum ($ ETH) held the L1 domain, Chainlink ($ Link) led the Dev and $ hype activity – the native token of the hyperliquid – saw a serious traction, fueled by the rise of dex to 70%+ of the entire volume Dex.

While others chased the memes, the hype gathered on real utility.

In short: Defi is still cooking and the Stablecoins are fueling the fire.

Memecoin Mayhem

After the tank in the first quarter, the Memecoin market bounced slightly in the second quarter, although volatility remained extreme and the price action has remained irregular.

Q2 saw the meme coins hit new heights, with over 5.9 million new token launched tokens and most of them has churned out via pump.fun. It was chaotic, noisy and pure energy degen. While more faded instantly, token like $ factcoin and $ spx continued to ride the wave.

Having said that, Token’s activity came with a dark side: the hacks of phishing and wallets climbed, especially among the memecoin holders.

Regulatory victories and macro shifts that guide trust

If Q2 had a theme, it was relief on both politics and economic fronts. The United States pulled the execution of cryptocurrencies, demolished the IRS reporting rules for Defi and reported a more constructive position in general.

In the meantime, the Fed has maintained the rates still for the fourth consecutive time, suggesting to a possible cut in July. With flat unemployment and the slowdown of growth, capital began to flow into activities for the cash and this time, Bitcoin was firmly in that list.

The result? Trust has increased. Bitcoin ETF accelerated affluent, eliminated volatility and the $ BTC narrative macro has strengthened. It is no longer just a resource at risk; It is becoming part of the defensive playbook.

Elsewhere, $ XRP has finally closed its long -standing legal battle with the century, potentially erasing the catwalk for a new ATH at the end of this year.

What is the next place for Q3?

In the second quarter, 99 bitcoins provided that if BTC could turn upside down $ 111k – $ 112k of resistance, the path to $ 120k would open, with $ 135k as an extension objective. Forward fast until now, and that forecast is aging well: Bitcoin is already mistaken to over $ 118k, moving towards that psychological milestone.

The report also observed that $ BTC organized a support of over $ 103k, forming a bullish structure supported by increasing miners portfolio sales, exchange reserves and growing IlLiquida-tutti supply the signs of trusted by long-term owners.

However, Q3 is not without risk. The affluent of the ETF could slow down and the macro winds, from the global conflict to the increases in sudden rates, remain on the radar.

But if the institutional flows remain hot and the Fed offers a rate of rate, $ 135k no longer looks like a ball. It’s just a part of the next leg.

Final thoughts: a bull market with depth

Manisha Mishra’s 99 bitcoins Q2 ratio paints a clear picture: this bull market is not built on retail hype.

The institutions, the regulatory tail winds and the traction of the real product are fueling it. From the affluent of the ETF to the adoption and the tightening on the side of the offer, the signals all indicate towards a more mature and resilient encryption cycle.

And with Bitcoin already pushes towards $ 120k, many of the Q2 projections are already playing. If the momentum is worth and the macro conditions do not launch a curved ball, Q4 could be the real breakout.

Read the complete report here: State of Crypto Q2 2025 – 99 Bitcoins

This article is only for information purposes and does not constitute financial advice. Always do your search (Dyor) before investing in cryptocurrency.